Global Dental Infection Control Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

2.10 Billion

2024

2032

USD

1.37 Billion

USD

2.10 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 2.10 Billion | |

|

|

|

|

Dental Infection Control Market Size

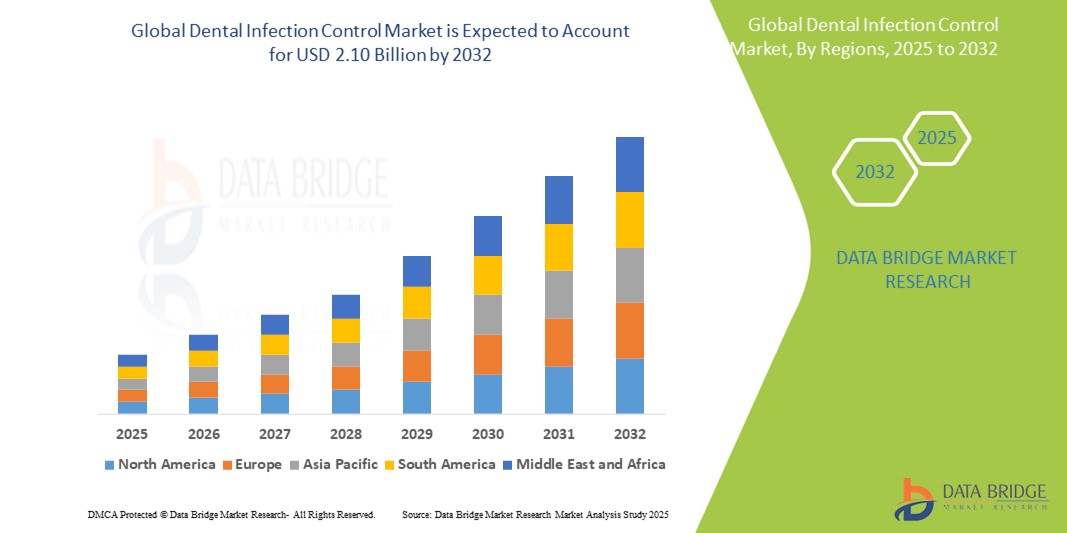

- The global dental infection control market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 2.10 billion by 2032, at a CAGR of 5.50% during the forecast period

- The dental infection control market growth is largely fueled by the increasing prevalence of dental disorders globally, coupled with the growing awareness of cross-contamination risks and the implementation of stringent regulatory guidelines. This has led to a heightened emphasis on patient safety and hygiene in both private clinics and large dental facilities

- Furthermore, rising consumer demand for safe, reliable, and efficient dental procedures is establishing advanced infection control solutions as an indispensable part of modern dental practice. Technological advancements, such as the integration of IoT in sterilization equipment and the development of eco-friendly disinfectants, are significantly boosting the industry's growth by offering enhanced safety and compliance. These converging factors are accelerating the uptake of dental infection control solutions, thereby significantly boosting the industry's growth

Dental Infection Control Market Analysis

- Dental infection control products, which include sterilization equipment, disinfectants, and personal protective equipment, are increasingly vital components of modern dental practice and healthcare systems. Their importance is driven by heightened awareness of cross-contamination risks, stringent regulatory frameworks, and technological advancements aimed at ensuring patient and practitioner safety

- The escalating demand for dental infection control solutions is primarily fueled by the rising prevalence of dental disorders, a growing number of dental procedures, and increasing global emphasis on hygiene and safety standards. The growing awareness among both dental professionals and patients about the prevention of healthcare-associated infections (HAIs) is also a key driver

- North America dominates the dental infection control market with the largest revenue share of 43.8% in 2024, characterized by early adoption of advanced dental technologies, high healthcare spending, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region in the dental infection control market during the forecast period with a CAGR of 6.9%. This growth is primarily due to increasing urbanization, rising disposable incomes, expanding dental tourism, and a growing emphasis on oral health and hygiene across emerging economies such as China and India

- The consumables segment dominates the dental infection control market with a market share of 56.98% in 2024, driven by the frequent use and single-use nature of products such as gloves, masks, surface disinfectants, and instrument cleaning solutions, which are essential for preventing cross-contamination in every dental procedure

Report Scope and Dental Infection Control Market Segmentation

|

Attributes |

Dental Infection Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Infection Control Market Trends

“Stringent Regulatory Landscape and Rising Patient Safety Concerns”

- A significant and accelerating trend in the global dental infection control market is the deepening impact of stringent regulatory frameworks and the heightened focus on patient and practitioner safety. This confluence of factors is significantly enhancing the demand for robust and compliant infection control solutions

- For instance, health organizations worldwide, such as the CDC, OSHA, and national dental associations, are continuously updating and enforcing guidelines for sterilization, disinfection, and waste management in dental settings. These regulations mandate specific protocols for instrument reprocessing, surface disinfection, and the use of personal protective equipment (PPE)

- The escalating demand for dental infection control solutions is primarily fueled by the imperative for dental clinics to avoid costly penalties for non-compliance and, more importantly, to ensure the well-being of both patients and staff. Advanced features in sterilization equipment, such as integrated validation systems and automated cleaning cycles, offer superior efficacy and traceability compared to manual methods

- This trend towards more compliant, safer, and integrated infection prevention systems is fundamentally reshaping user expectations for dental practice safety. Consequently, companies are developing innovative solutions, such as automated instrument reprocessing systems and eco-friendly disinfectants, with features such as intelligent cycle monitoring and broad-spectrum efficacy

- The demand for dental infection control solutions that offer seamless integration with regulatory requirements and enhanced safety features is growing rapidly across both private practices and large institutional settings, as dental professionals increasingly prioritize patient trust and comprehensive hygiene functionality

Dental Infection Control Market Dynamics

Driver

“Growing Need Due to Rising Regulatory Scrutiny and Increased Awareness”

- The increasing prevalence of dental conditions globally, coupled with stringent regulatory guidelines from health authorities and heightened awareness of cross-contamination risks, is a significant driver for the heightened demand for dental infection control products and solutions

- For instance, as of 2024, there are approximately 3.5 billion oral health disorders worldwide, according to market reports. This high incidence necessitates more dental procedures, directly increasing the demand for effective infection control.

- As dental professionals become more aware of potential transmission pathways and seek enhanced protection for their patients and staff, advanced infection control solutions offer features such as superior sterilization efficacy, automated cleaning processes, and a wide range of personal protective equipment (PPE). These provide a compelling upgrade over traditional, less regulated methods

- Furthermore, the growing popularity of cosmetic dentistry procedures and dental tourism is making infection control an integral component of these services, as maintaining impeccable hygiene standards is crucial for patient confidence and safety. The convenience of ready-to-use disinfectants, pre-sterilized instruments, and disposable options are key factors propelling the adoption of dental infection control solutions in both private clinics and large institutional settings. The trend towards integrated digital dentistry and the increasing availability of user-friendly infection control options further contributes to market growth

Restraint/Challenge

“High Initial Costs and Evolving Regulatory Compliance”

- The relatively high initial cost of advanced dental infection control equipment and the ongoing expenses associated with consumables pose a significant challenge to broader market penetration, particularly for smaller clinics or those in developing regions. Implementing comprehensive infection control protocols often requires substantial upfront investment in equipment such as autoclaves, ultrasonic cleaners, and specialized ventilation systems

- For instance, a high-end dental autoclave can cost upwards of several thousand USD, while disposable PPE and single-use instruments contribute to continuous operational expenses. This can be a barrier for price-sensitive dental practices or those with limited budgets

- Addressing these cost concerns through innovative financing options, tiered product offerings, and consumer education on the long-term benefits of robust infection control (for instance, reduced risk of litigation, enhanced patient trust) is crucial for building broader market adoption. Companies are exploring cost-effective solutions and offering bundled packages to make advanced infection control more accessible

- While prices for some basic infection control consumables are relatively stable, the perceived premium for advanced sterilization technologies and the need for ongoing investment in training and compliance can still hinder widespread adoption, especially for those who do not immediately see the return on investment in enhanced safety measures

Dental Infection Control Market Scope

The dental infection control market is segmented on the basis of end-user and product type.

- By End User

On the basis of end-user, the dental infection control market is segmented into hospitals, dental clinics, and dental academic and research institutes. The dental clinics segment held the largest market share in 2024, driven by the increasing number of patient visits for various procedures and the growing emphasis on infection prevention measures in private practices. Dental clinics are the primary point of care for most dental procedures, leading to a high volume of demand for infection control products and services.

The dental academic and research institutes segment is observed to grow at a rapid pace during the forecast period. This growth is fueled by continuous research and development in dental materials and procedures, necessitating advanced infection control protocols, and the training of future dental professionals who are educated on the latest hygiene standards.

- By Product Type

On the basis of product type, the dental infection control market is segmented into equipment and consumables. The consumables segment dominated the dental infection control market with a market share of 56.98% in 2024, driven by the recurrent need for single-use items such as gloves, masks, surface disinfectants, and sterilization pouches, which are crucial for preventing cross-contamination in every dental procedure. The single-use nature of these products ensures maximum safety and minimizes the risk of infection transmission between patients and healthcare providers.

The consumables segment is also anticipated to witness the fastest growth rate during the forecast period, fueled by the increasing awareness of infection control and stringent regulations mandating the use of disposable items. The ease of use and the time saved by not having to clean and re-sterilize reusable items further contribute to the growing popularity of consumables.

Dental Infection Control Market Regional Analysis

- North America dominates the dental infection control market with the largest revenue share of 43.8% in 2024, driven by a growing demand for advanced dental procedures and stringent regulatory frameworks

- Consumers and dental professionals in the region highly value the convenience, advanced safety features, and seamless integration offered by modern infection control products such as automated sterilizers and single-use disposables

- This widespread adoption is further supported by high healthcare expenditure, a technologically inclined dental community, and the growing preference for advanced patient safety protocols, establishing robust infection control as a favored solution for both private dental practices and large institutional settings

U.S. Dental Infection Control Market Insight

The U.S. dental infection control market captured the largest revenue share of 78.2% in 2024 within North America, fueled by the swift uptake of advanced sterilization technologies and the expanding trend of stringent hygiene protocols. Consumers and dental professionals are increasingly prioritizing the enhancement of patient safety through intelligent, effective infection prevention systems. The growing preference for robust compliance setups, combined with strong demand for automated sterilization processes and comprehensive personal protective equipment (PPE), further propels the dental infection control industry. Moreover, the increasing integration of cutting-edge solutions, such as IoT-enabled monitoring and advanced disinfection techniques, is significantly contributing to the market's expansion.

Europe Dental Infection Control Market Insight

The Europe dental infection control market is projected to expand at a substantial CAGR from 2025 to 2032, primarily driven by stringent security regulations and the escalating need for enhanced hygiene in dental practices and hospitals. The increase in urbanization, coupled with the demand for advanced dental services, is fostering the adoption of comprehensive infection control measures. European consumers are also drawn to the efficiency and reliability these devices offer. The region is experiencing significant growth across dental clinics, hospitals, and academic institutions, with infection control being incorporated into both new facility constructions and renovation projects.

U.K. Dental Infection Control Market Insight

The U.K. dental infection control market is anticipated to grow at a noteworthy CAGR from 2025 to 2032, driven by the escalating trend of heightened hygiene awareness and a desire for enhanced safety and compliance. In addition, concerns regarding cross-contamination and patient well-being are encouraging both dental professionals and healthcare facilities to choose advanced infection control solutions. The UK’s embrace of modern dental practices, alongside its robust healthcare infrastructure, is expected to continue to stimulate market growth.

Germany Dental Infection Control Market Insight

The Germany dental infection control market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of public health security and the demand for technologically advanced, eco-conscious solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on precision and patient safety, promotes the adoption of comprehensive infection control, particularly in dental clinics and hospitals. The integration of infection control systems with digital dental workflows is also becoming increasingly prevalent, with a strong preference for secure, high-standard solutions aligning with local consumer and regulatory expectations.

Asia-Pacific Dental Infection Control Market Insight

The Asia-Pacific dental infection control market is poised to grow at the fastest CAGR of 6.9% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards modern dental practices, supported by government initiatives promoting public health, is driving the adoption of advanced infection control solutions. Furthermore, as APAC emerges as a manufacturing hub for dental components and systems, the affordability and accessibility of infection control products are expanding to a wider consumer base.

Japan Dental Infection Control Market Insight

The Japan dental infection control market is gaining momentum due to the country’s high-tech healthcare culture, rapid urbanization, and demand for sophisticated hygiene. The Japanese market places a significant emphasis on patient safety, and the adoption of dental infection control is driven by the increasing number of dental clinics and the continuous advancements in sterilization and disinfection technologies. The integration of infection control with other dental equipment, such as automated instrument reprocessing systems and digital tracking, is fueling growth. Moreover, Japan's aging population is likely to spur demand for highly effective, safe, and easy-to-use infection control solutions in both dental clinics and hospitals.

India Dental Infection Control Market Insight

The India dental infection control market is anticipated to grow at a noteworthy CAGR of 10.19% from 2025 to 2032, driven by the escalating trend of oral health awareness and a desire for heightened patient safety and practitioner convenience. In addition, concerns regarding dental infections and cross-contamination are encouraging both dental professionals and healthcare facilities to choose advanced infection control solutions. India’s embrace of modern dental practices, alongside its robust healthcare infrastructure and a burgeoning medical tourism sector, is expected to continue to stimulate market growth.

Dental Infection Control Market Share

The dental infection control industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Young Innovations, Inc. (U.S.)

- Kerr Corporation (U.S.)

- Henry Schein, Inc. (U.S.)

- GC America Inc. (U.S.)

- A-dec Inc. (U.S.)

- Dentsply Sirona (U.S.)

- COLTENE Group (Switzerland)

- Medicom (Canada)

- Schulke & Mayr GmbH (U.K.)

- Hu-Friedy Mfg. Co., LLC (U.S.)

- Bio Hygiene (Australia)

- Ventyv (U.S.)

- Whiteley (Australia)

- Medivators Inc. (U.S.)

- Dispodent (India)

- Septodont Holding (India)

Latest Developments in Global Dental Infection Control Market

- In February 2024, Kerr Dental introduced its new SimpliCut line of pre-sterilized, single-patient use diamond burs. This launch aims to enhance clinical efficiency by eliminating the need for post-use cleaning and sterilization processes

- In November 2023, W&H expanded its hygiene portfolio in North America with the launch of the Lexa Plus Class B sterilizer and the Assistina One maintenance device. These innovations enhance infection prevention, offering faster sterilization cycles, improved traceability, and the fastest handpiece maintenance in its class

- In 2023, 3M acquired a company specializing in sterilization indicators and monitoring solutions to enhance its product portfolio in the dental market

- In February 2025, a leading European manufacturer introduced a compact, high-speed dental autoclave aimed at small clinics and mobile dental units. With faster cycle times and energy-efficient operation, it meets the growing demand for portable and eco-conscious sterilization tools

- In March 2025, a U.S.-based dental supply company announced a strategic partnership with software developers to integrate sterilization cycle monitoring into broader dental practice management systems. This aims to improve compliance tracking and maintenance scheduling

- In March 2025, Midmark Corporation unveiled a compact benchtop sterilization unit, “Sterili-Mini,” designed for small practices and mobile dental clinics. It offers a rapid sterilization cycle of under 10 minutes, aimed at increasing patient turnaround without compromising safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.