Global DDI (DNS, DHCP, and IPAM) Market, By Component (Solutions, and Services), Organization Size (Large Enterprises, and Small and Medium Enterprises), Deployment Type (Cloud-Based, and On-Premise), Application (Network Automation, Virtualization and Cloud, Data Center Transformation, Network Security, and Others), Vertical (Telecom and IT, Banking, Financial Service and Insurance (BFSI), Government and Defense, Healthcare and Life Sciences, Education, Retail, Manufacturing, and Others), Version (IPv4, and IPv6) – Industry Trends and Forecast to 2031.

DDI (DNS, DHCP, and IPAM) Market Analysis and Size

DDI (DNS, DHCP, and IPAM) market is witnessing exponential growth, fueled by advancements in technology. The latest innovations are revolutionizing network management, enhancing efficiency, security, and scalability. From automated provisioning to AI-driven analytics, DDI solutions are evolving rapidly, catering to diverse enterprise needs. This growth trajectory reflects the critical role DDI plays in modern network infrastructures, driving businesses towards seamless connectivity and performance optimization.

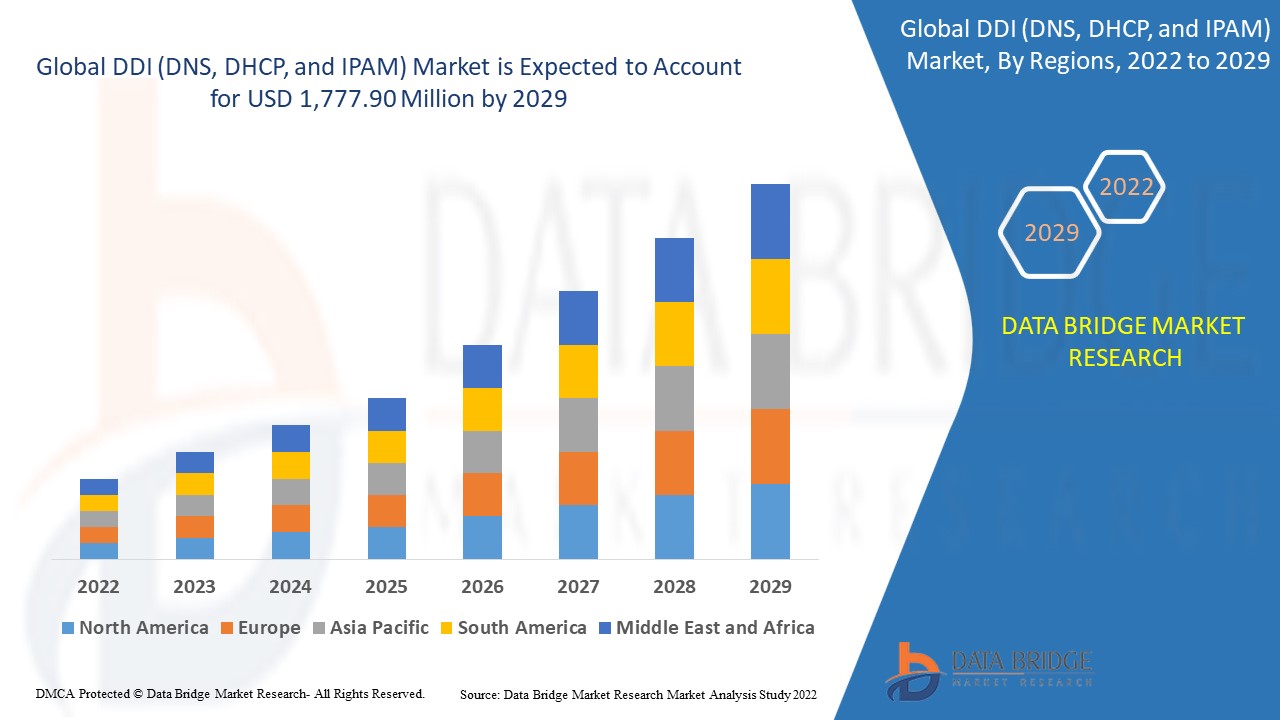

The global DDI (DNS, DHCP, and IPAM) market size was valued at USD 359.95 million in 2023, is projected to reach USD 3,027.81 million by 2031, with a CAGR of 30.50% during the forecast period 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Component (Solutions, and Services), Organization Size (Large Enterprises, and Small and Medium Enterprises), Deployment Type (Cloud-Based, and On-Premise), Application (Network Automation, Virtualization and Cloud, Data Center Transformation, Network Security, and Others), Vertical (Telecom and IT, Banking, Financial Service and Insurance (BFSI), Government and Defense, Healthcare and Life Sciences, Education, Retail, Manufacturing, and Others), Version (IPv4, and IPv6)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Cisco Systems, Inc. (U.S.), VMware, Inc. (U.S.), AT&T Intellectual Property. (U.S.), Microsoft (U.S.), Tech Mahindra Limited. (India), Honeywell International Inc. (U.S.), Capgemini (France), Oracle (U.S.), Accenture (Ireland), SAP (Germany), ALE International (France), Apperian (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Duo (U.S.), HCL Technologies Limited (India), BlackBerry Limited. (Canada), Infosys Limited (India), IBM (U.S.), Tata Consultancy Services Limited. (India)

|

|

Market Opportunities

|

|

Market Definition

DDI, standing for DNS, DHCP, and IPAM, is a suite of network services crucial for managing IP addresses and network infrastructure. DNS (Domain Name System) translates domain names into IP addresses, DHCP (Dynamic Host Configuration Protocol) assigns IP addresses dynamically to devices, and IPAM (IP Address Management) handles the allocation and tracking of IP addresses to ensure efficient network operation and security.

DDI (DNS, DHCP, and IPAM) Market Dynamics

Drivers

- Increasing Demand for Network Automation

The demand for DDI (DHCP, DNS, and IPAM) resolutions is propelled by organizations seeking efficiency and scalability through network automation. Through automating tasks such as IP address allocation and DNS provisioning, DDI solutions reduce manual intervention and error rates. For instance, a large enterprise deploying hundreds of new devices daily can automate IP address assignment, ensuring seamless connectivity and minimizing the risk of configuration errors, thus driving market growth for DDI solutions.

- Growing Complexity of Network Infrastructure

The increasing complexity of network infrastructure, fueled by the adoption of hybrid and multi-cloud environments, SDN, and IPv6, drives demand for DDI solutions. For instance, managing IP addresses across diverse cloud platforms, traditional data centers, and SDN-enabled networks poses challenges. DDI solutions offer centralized management, simplifying administration tasks such as IP address allocation and DNS configuration, thus enabling seamless operation in complex network environments.

Opportunities

- Rise in Need for High Availability and Disaster Recovery

The increasing need for high availability and disaster recovery in critical network services such as DNS and DHCP presents a significant market opportunity for DDI solutions. By offering features such as robust failover mechanisms, load balancing, and real-time replication, DDI vendors can ensure uninterrupted service delivery. For instance, solutions such as Infoblox provide geo-redundancy and real-time synchronization across data centers, ensuring seamless service continuity even during outages or disasters, thereby driving market growth.

- Growing Integration with DevOps Practices

The integration of DDI (DHCP, DNS, and IPAM) solutions with DevOps practices creates opportunities by enabling seamless automation and agility in infrastructure provisioning. By offering robust APIs and integration capabilities, DDI vendors facilitate the alignment of DNS, DHCP, and IPAM services with CI/CD pipelines. For instance, automated IP address allocation and DNS record management within CI/CD workflows ensure rapid deployment of applications, enhancing efficiency and scalability in dynamic DevOps environments.

Restraints/Challenges

- High Implementation Costs

High implementation costs hinder market growth as they pose significant financial barriers for organizations looking to adopt DDI technology. The substantial investments needed to build infrastructure deter potential users, limiting market expansion. Consequently, despite its potential benefits, the DDI market faces constraints in adoption and growth due to these cost-related challenges.

- Shortage of Skilled Labour

Skill shortages in network administration, security, and automation impede effective deployment and operation of DDI infrastructure. Lack of expertise hampers organizations from maximizing DDI capabilities, leading to suboptimal performance, security vulnerabilities, and operational inefficiencies. This skill deficit exacerbates challenges in managing complex network environments, constraining market growth and adoption of DDI solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In January 2023, EfficientIP, a specialist in DDI security and automation, launches its new DNS-based Data Exfiltration Application. Designed as a hands-on web tool, it enables organizations to conduct ethical hacks on their DNS systems, identifying potential vulnerabilities. This proactive approach helps prevent data breaches by strengthening network security defenses

- In June 2022, AmiViz, the Middle East's first enterprise B2B marketplace, partners with EfficientIP, granting Egyptian channel partners access to its DDI solutions. Available through AmiViz's online platforms, including its web portal and mobile app, EfficientIP's DNS, DHCP, and IP address management solutions enhance network infrastructure and security for Egyptian businesses

- In March 2022, EfficientIP unveils SOLIDserver 8.1, the latest version of its DDI suite, offering centralized DNS management and network security for hybrid cloud infrastructures. With features tailored for multi-cloud environments, SOLIDserver 8.1 empowers organizations to enhance agility and operational efficiency, crucial in today's rapidly evolving technological landscape

- In March 2022, EfficientIP announces a pan-European partnership with the Nomios Group, facilitating autonomous delivery of its DDI solutions across key European markets including Germany, Belgium, France, Poland, the Netherlands, and the U.K. This collaboration strengthens EfficientIP's presence and enables seamless access to its innovative DDI automation and security offerings throughout Europe

DDI (DNS, DHCP, and IPAM) Market Scope

The market is segmented on the basis of components, organization size, deployment type, application, vertical and version. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solutions

- Services

Organization Size

- Large Enterprises

- Small and Medium Enterprises

Deployment Type

- Cloud-Based

- On-Premise

Application

- Network Automation

- Virtualization and Cloud

- Data Center Transformation

- Network Security

- Others

Vertical

- Telecom and IT

- Banking

- Financial Service and Insurance (BFSI)

- Government and Defense

- Healthcare and Life Sciences

- Education

- Retail

- Manufacturing

- Others

Version

- IPv4

- IPv6

DDI (DNS, DHCP, and IPAM) Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, components, organization size, deployment type, application, vertical and version as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to witness significant growth in the DDI (DNS, DHCP, and IPAM) market due to the increasing urban population. Moreover, the proliferation of smart cities in developing economies including India, China, and Korea contributes significantly to regional market expansion, fostering technological infrastructure development.

North America is expected to dominate the DDI (DNS, DHCP, and IPAM) market, buoyed by robust adoption of big data analytics and increasing embrace of bring-your-own-device policies. These trends drive demand for efficient network management solutions, propelling the region's dominance in the sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and DDI (DNS, DHCP, and IPAM) Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Cisco Systems, Inc. (U.S.)

- VMware, Inc. (U.S.)

- AT&T Intellectual Property. (U.S.)

- Microsoft (U.S.)

- Tech Mahindra Limited. (India)

- Honeywell International Inc. (U.S.)

- Capgemini (France)

- Oracle (U.S.)

- Accenture (Ireland)

- SAP (Germany)

- ALE International (France)

- Apperian (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Duo (U.S.)

- HCL Technologies Limited (India)

- BlackBerry Limited. (Canada)

- Infosys Limited (India)

- IBM (U.S.)

- Tata Consultancy Services Limited. (India)

SKU-