Global Ddi Dns Dhcp And Ipam Market

Market Size in USD Million

CAGR :

%

USD

469.73 Million

USD

3,951.27 Million

2024

2032

USD

469.73 Million

USD

3,951.27 Million

2024

2032

| 2025 –2032 | |

| USD 469.73 Million | |

| USD 3,951.27 Million | |

|

|

|

|

DDI (DNS, DHCP, and IPAM) Market Size

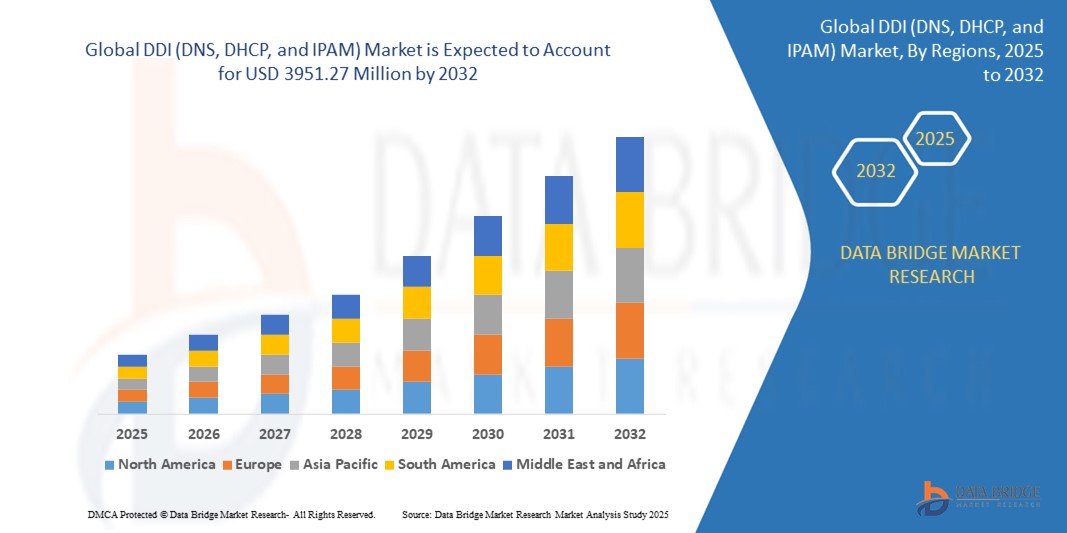

- The global DDI (DNS, DHCP, and IPAM) market size was valued at USD 469.73 million in 2024 and is expected to reach USD 3951.27 million by 2032, at a CAGR of 30.50% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud computing, IoT, and 5G technologies, which demand efficient and scalable IP address management solutions

- The rise in cyber threats and the need for improved DNS security and automated network services also play a pivotal role in accelerating DDI deployment across industries

DDI (DNS, DHCP, and IPAM) Market Analysis

- The surge in connected devices and enterprise mobility has driven the need for centralized IP address management, positioning DDI solutions as a strategic asset in modern network infrastructures

- Key industries such as BFSI, telecom, IT & ITeS, and healthcare are actively investing in DDI platforms to streamline network performance, ensure compliance, and mitigate operational risks

- North America dominated the DDI (DNS, DHCP, and IPAM) market with the largest revenue share of 41.25% in 2024, driven by the growing demand for advanced network management solutions and the widespread adoption of cloud-based services across large enterprises and telecom providers

- Asia-Pacific region is expected to witness the highest growth rate in the global DDI (DNS, DHCP, and IPAM) market, driven by the rapid expansion of digital infrastructure, increasing mobile and internet penetration, and rising demand for automated network management.

- The solutions segment dominated the market with the largest revenue share in 2024, driven by the rising need for integrated network management systems that provide centralized control over DNS, DHCP, and IP address management. Enterprises are increasingly adopting DDI solutions to ensure network efficiency, reduce manual configuration errors, and enhance visibility across IP infrastructures. These solutions are particularly critical in supporting digital transformation and scalable IT infrastructure

Report Scope and DDI (DNS, DHCP, and IPAM) Market Segmentation

|

Attributes |

DDI (DNS, DHCP, and IPAM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

DDI (DNS, DHCP, and IPAM) Market Trends

“Rising Demand for Automated Network Management in Hybrid Environments”

- Enterprises are increasingly adopting hybrid and multi-cloud infrastructures, making manual DDI management inefficient and error-prone

- Automated DDI tools enable centralized control and dynamic configuration of IP addresses, DNS, and DHCP services

- These solutions minimize human error, reduce downtime, and improve overall network reliability and scalability

- Integration of AI/ML in DDI platforms helps predict and prevent issues such as IP conflicts and outages

- Vendors are launching platforms optimized for hybrid environments

- For instance, Infoblox’s BloxOne DDI provides seamless automation and visibility across cloud and on-premise networks

DDI (DNS, DHCP, and IPAM) Market Dynamics

Driver

“Surge in Network Traffic from IoT and 5G Rollouts Driving IP Address Management Demand”

- The explosive growth in IoT devices and 5G connectivity increases the demand for efficient IP address management

- DDI solutions provide dynamic provisioning, real-time visibility, and centralized control over network resources

- Telecom and smart device ecosystems benefit from enhanced reliability and rapid scaling using IPAM tools

- Network slicing in 5G requires robust DDI infrastructure to allocate and manage IP resources across distributed nodes

- For instance, AT&T’s 5G expansion efforts include deploying advanced DDI systems to support dynamic network services for millions of connected devices

Restraint/Challenge

“High Cost of Deployment and Integration in Legacy Systems”

- The initial cost of implementing advanced DDI solutions is high, deterring adoption by SMEs and budget-constrained organizations

- Many enterprises operate on outdated DNS/DHCP systems that require costly overhauls to integrate modern DDI platforms

- Deployment often involves significant time, skilled personnel, and potential disruptions to network operations

- Compatibility issues and steep learning curves during migration from manual IP management increase resistance from IT teams

- For instance, a mid-sized healthcare network in Europe faced delays and budget overruns while integrating a new IPAM solution due to legacy infrastructure constraints

DDI (DNS, DHCP, and IPAM) Market Scope

The DDI (DNS, DHCP, and IPAM) market is segmented into six notable segments based on component, organization size, deployment type, application, vertical, and version.

• By Component

On the basis of component, the DDI market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share in 2024, driven by the rising need for integrated network management systems that provide centralized control over DNS, DHCP, and IP address management. Enterprises are increasingly adopting DDI solutions to ensure network efficiency, reduce manual configuration errors, and enhance visibility across IP infrastructures. These solutions are particularly critical in supporting digital transformation and scalable IT infrastructure.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the growing demand for managed services, consulting, and support across enterprises migrating to cloud environments. These services play a vital role in helping businesses deploy, integrate, and maintain DDI systems effectively, especially for organizations lacking in-house technical expertise.

• By Organization Size

On the basis of organization size, the DDI market is segmented into large enterprises and small and medium enterprises. Large enterprises held the largest revenue share in 2024, attributed to their extensive networks and the critical need for advanced IP address management and network control. These organizations require robust DDI systems to support global operations, ensure network uptime, and maintain compliance.

The small and medium enterprises (SMEs) segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising adoption of cloud-based DDI solutions that offer cost-effective scalability and simplified network operations for growing businesses.

• By Deployment Type

On the basis of deployment type, the DDI market is segmented into cloud-based and on-premise. The on-premise segment captured the largest market revenue share in 2024, primarily driven by data-sensitive industries that prefer internal control over their network infrastructure. On-premise deployments offer higher customization, better data sovereignty, and meet strict compliance requirements.

The cloud-based segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing shift toward flexible, scalable, and cost-efficient network management. Cloud-based DDI solutions are particularly advantageous for supporting remote work, hybrid IT models, and multi-site connectivity.

• By Application

On the basis of application, the market is segmented into network automation, virtualization and cloud, data center transformation, network security, and others. The network automation segment led the market with the largest revenue share in 2024, as enterprises aim to reduce manual interventions, enhance network reliability, and streamline operations.

The virtualization and cloud segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid adoption of cloud-native applications and virtual infrastructures that require seamless DDI integration for optimal performance and scalability.

• By Vertical

On the basis of vertical, the DDI market is segmented into telecom and IT, banking, financial service and insurance (BFSI), government and defense, healthcare and life sciences, education, retail, manufacturing, and others. The telecom and IT segment dominated the market in 2024, owing to the sector's high reliance on dynamic and complex networks requiring continuous IP address management and automation.

The healthcare and life sciences segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising digitalization of healthcare records, growing number of connected medical devices, and the increasing demand for secure and reliable network management.

• By Version

On the basis of version, the DDI market is segmented into IPv4 and IPv6. The IPv4 segment accounted for the largest revenue share in 2024 due to its widespread usage across legacy systems and compatibility with existing infrastructures.

Conversely, the IPv6 segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the depletion of IPv4 addresses, the rise in internet-connected devices, and the need for greater address space to accommodate growing digital ecosystems.

DDI (DNS, DHCP, and IPAM) Market Regional Analysis

- North America dominated the DDI (DNS, DHCP, and IPAM) market with the largest revenue share of 41.25% in 2024, driven by the growing demand for advanced network management solutions and the widespread adoption of cloud-based services across large enterprises and telecom providers

- Organizations in the region are emphasizing efficient IP address management and network automation to support complex IT infrastructures and hybrid working environments

- The proliferation of IoT devices, increasing data center construction, and strong emphasis on network security compliance further support the growth of DDI solutions, especially in the U.S. and Canada

U.S. DDI (DNS, DHCP, and IPAM) Market Insight

The U.S. DDI market captured the largest revenue share of 79.8% within North America in 2024, driven by rapid digital transformation initiatives and increased adoption of IPv6 addressing. Enterprises and government institutions are integrating DDI platforms to enhance control over their growing networks and reduce manual errors. The need for centralized, automated network management has led to widespread implementation across cloud service providers and data centers. In addition, the increasing need for cyber resilience and compliance with data protection standards is pushing organizations to upgrade legacy DNS and DHCP infrastructure with robust DDI solutions.

Europe DDI (DNS, DHCP, and IPAM) Market Insight

The Europe DDI market is expected to witness the fastest growth rate from 2025 to 2032, propelled by strict regulatory frameworks such as GDPR and increasing investments in digital infrastructure. With rapid expansion of 5G networks and cloud computing services, enterprises across Germany, the U.K., and France are leveraging DDI solutions to manage IP resources more effectively. The growing reliance on hybrid IT environments and the need for streamlined network visibility are also contributing to the market growth across European countries.

U.K. DDI (DNS, DHCP, and IPAM) Market Insight

The U.K. DDI market is expected to witness the fastest growth rate from 2025 to 2032, supported by accelerated adoption of digital services and expanding telecom infrastructure. Enterprises are focusing on automation of IP address management to meet rising demand for connectivity and secure network access. The surge in enterprise mobility, along with cloud-native developments in the financial and retail sectors, is further bolstering the demand for reliable and scalable DDI platforms in the country.

Germany DDI (DNS, DHCP, and IPAM) Market Insight

The Germany’s DDI market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by the country’s robust industrial and IT landscape. The emphasis on secure digital transformation and adoption of edge computing are fueling investments in automated network management solutions. German companies are prioritizing network optimization and compliance with data protection laws, leading to increased deployment of DDI systems across sectors such as automotive, manufacturing, and healthcare.

Asia-Pacific DDI (DNS, DHCP, and IPAM) Market Insight

The Asia-Pacific DDI market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing internet penetration, and widespread adoption of cloud and virtualization technologies in countries such as China, India, and Japan. Government-led digitalization initiatives, coupled with the growing number of connected devices, are accelerating the demand for DDI solutions. The region's expanding SME base and cost-effective adoption of cloud-based platforms are making DDI increasingly accessible and scalable for all business sizes.

Japan DDI (DNS, DHCP, and IPAM) Market Insight

The Japan’s DDI market is expanding due to the rising need for efficient network management across large-scale enterprises and public institutions. With the growing deployment of IPv6 and digital infrastructure upgrades, organizations are investing in advanced IPAM and DNS-DHCP automation tools. In addition, Japan’s focus on smart cities and increasing use of connected systems in sectors such as manufacturing and healthcare are contributing to steady demand for integrated DDI platforms.

China DDI (DNS, DHCP, and IPAM) Market Insight

The China held the largest revenue share in the Asia-Pacific DDI market in 2024, supported by strong government initiatives around digital transformation and expanding 5G infrastructure. With the country’s vast network of cloud providers, telecom operators, and internet enterprises, the adoption of automated and scalable DDI systems has gained significant traction. Moreover, the push towards data localization and secure networking is compelling organizations to modernize their DNS and DHCP frameworks.

DDI (DNS, DHCP, and IPAM) Market Share

The DDI (DNS, DHCP, and IPAM) industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- VMware, Inc. (U.S.)

- AT&T Intellectual Property. (U.S.)

- Microsoft (U.S.)

- Tech Mahindra Limited. (India)

- Honeywell International Inc. (U.S.)

- Capgemini (France)

- Oracle (U.S.)

- Accenture (Ireland)

- SAP (Germany)

- ALE International (France)

- Apperian (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Duo (U.S.)

- HCL Technologies Limited (India)

- BlackBerry Limited. (Canada)

- Infosys Limited (India)

- IBM (U.S.)

- Tata Consultancy Services Limited. (India)

Latest Developments in Global DDI (DNS, DHCP, and IPAM) Market

- In January 2023, EfficientIP, a specialist in DDI security and automation, launches its new DNS-based Data Exfiltration Application. Designed as a hands-on web tool, it enables organizations to conduct ethical hacks on their DNS systems, identifying potential vulnerabilities. This proactive approach helps prevent data breaches by strengthening network security defenses

- In June 2022, AmiViz, the Middle East's first enterprise B2B marketplace, partners with EfficientIP, granting Egyptian channel partners access to its DDI solutions. Available through AmiViz's online platforms, including its web portal and mobile app, EfficientIP's DNS, DHCP, and IP address management solutions enhance network infrastructure and security for Egyptian businesses

- In March 2022, EfficientIP unveils SOLIDserver 8.1, the latest version of its DDI suite, offering centralized DNS management and network security for hybrid cloud infrastructures. With features tailored for multi-cloud environments, SOLIDserver 8.1 empowers organizations to enhance agility and operational efficiency, crucial in today's rapidly evolving technological landscape

- In March 2022, EfficientIP announces a pan-European partnership with the Nomios Group, facilitating autonomous delivery of its DDI solutions across key European markets including Germany, Belgium, France, Poland, the Netherlands, and the U.K. This collaboration strengthens EfficientIP's presence and enables seamless access to its innovative DDI automation and security offerings throughout Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 MULTIVARIATE MODELLING

2.2.5 TOP TO BOTTOM ANALYSIS

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 VENDOR SHARE ANALYSIS

2.2.8 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.9 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 VALUE CHAIN ANALYSIS

5.5 COMPANY COMPARITIVE ANALYSIS

5.6 PATENT ANALYSIS

5.7 CONSUMER BEHAVIOUR ANALYSIS

6 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1. TRAINING AND CONSULTING

6.3.2.2. IMPLEMENTATION AND INTEGRATION

6.3.2.3. SUPPORT AND MAINTENANCE

7 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 CLOUD

7.3 ON PREMISES

8 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 SMALL AND MEDIUM SIZED ENTERPRISE

8.2.1 BY DEPLOYMENT MODE

8.2.1.1. CLOUD

8.2.1.2. ON PREMISE

8.3 LARGE ENTERPRISE

8.3.1 BY DEPLOYMENT MODE

8.3.1.1. CLOUD

8.3.1.2. ON PREMISE

9 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY VERSION

9.1 OVERVIEW

9.2 IPV4

9.3 IPV6

10 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DATA CENTER TRANSFORMATION

10.3 NETWORK SECURITY

10.4 NETWORK AUTOMATION

10.5 VIRTUALIZATION AND CLOUD

10.6 UNIFIED MANAGEMENT

10.7 OTHERS

11 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY END USER

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 BY APPLICATION

11.2.1.1. DATA CENTER TRANSFORMATION

11.2.1.2. NETWORK SECURITY

11.2.1.3. NETWORK AUTOMATION

11.2.1.4. VIRTUALIZATION AND CLOUD

11.2.1.5. UNIFIED MANAGEMENT

11.2.1.6. OTHERS

11.3 IT AND TELECOMMUNICATION

11.3.1 BY APPLICATION

11.3.1.1. DATA CENTER TRANSFORMATION

11.3.1.2. NETWORK SECURITY

11.3.1.3. NETWORK AUTOMATION

11.3.1.4. VIRTUALIZATION AND CLOUD

11.3.1.5. UNIFIED MANAGEMENT

11.3.1.6. OTHERS

11.4 GOVERNMENT AND DEFENSE

11.4.1 BY APPLICATION

11.4.1.1. DATA CENTER TRANSFORMATION

11.4.1.2. NETWORK SECURITY

11.4.1.3. NETWORK AUTOMATION

11.4.1.4. VIRTUALIZATION AND CLOUD

11.4.1.5. UNIFIED MANAGEMENT

11.4.1.6. OTHERS

11.5 MANUFACTURING

11.5.1 BY APPLICATION

11.5.1.1. DATA CENTER TRANSFORMATION

11.5.1.2. NETWORK SECURITY

11.5.1.3. NETWORK AUTOMATION

11.5.1.4. VIRTUALIZATION AND CLOUD

11.5.1.5. UNIFIED MANAGEMENT

11.5.1.6. OTHERS

11.6 HEALTHCARE AND LIFE SCIENCES

11.6.1 BY APPLICATION

11.6.1.1. DATA CENTER TRANSFORMATION

11.6.1.2. NETWORK SECURITY

11.6.1.3. NETWORK AUTOMATION

11.6.1.4. VIRTUALIZATION AND CLOUD

11.6.1.5. UNIFIED MANAGEMENT

11.6.1.6. OTHERS

11.7 RETAIL

11.7.1 BY APPLICATION

11.7.1.1. DATA CENTER TRANSFORMATION

11.7.1.2. NETWORK SECURITY

11.7.1.3. NETWORK AUTOMATION

11.7.1.4. VIRTUALIZATION AND CLOUD

11.7.1.5. UNIFIED MANAGEMENT

11.7.1.6. OTHERS

11.8 EDUCATION

11.8.1 BY APPLICATION

11.8.1.1. DATA CENTER TRANSFORMATION

11.8.1.2. NETWORK SECURITY

11.8.1.3. NETWORK AUTOMATION

11.8.1.4. VIRTUALIZATION AND CLOUD

11.8.1.5. UNIFIED MANAGEMENT

11.8.1.6. OTHERS

11.9 OTHERS

12 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, BY REGION

12.1 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. FRANCE

12.1.2.3. U.K.

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. RUSSIA

12.1.2.7. TURKEY

12.1.2.8. BELGIUM

12.1.2.9. NETHERLANDS

12.1.2.10. SWITZERLAND

12.1.2.11. SWEDEN

12.1.2.12. DENMARK

12.1.2.13. POLAND

12.1.2.14. REST OF EUROPE

12.1.3 ASIA PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA AND NEW ZEALAND

12.1.3.6. SINGAPORE

12.1.3.7. THAILAND

12.1.3.8. MALAYSIA

12.1.3.9. INDONESIA

12.1.3.10. PHILIPPINES

12.1.3.11. TAIWAN

12.1.3.12. VIETNAM

12.1.3.13. REST OF ASIA PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. EGYPT

12.1.5.3. SAUDI ARABIA

12.1.5.4. U.A.E

12.1.5.5. ISRAEL

12.1.5.6. KUWAIT

12.1.5.7. QATAR

12.1.5.8. REST OF MIDDLE EAST AND AFRICA

12.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL ULTRAVIOLET (UV) CURING SYSTEMS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, SWOT ANALYSIS

15 GLOBAL DDI (DNS, DHCP, AND IPAM) MARKET, COMPANY PROFILE

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 NOKIA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 CISCO

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 BLUECAT NETWORKS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 BT DIAMOND IP (CYGNA LABS CORP.)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 INFOBLOX

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 TCPWAVE INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 MEN & MICE

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 FUSIONLAYER

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 SOLARWINDS, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 EFFICIENTIP

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 APPLIANSYS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 6CONNECT INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NEXNET SOLUTIONS

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 ZEBRA TECHNOLOGIES

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 HUAWEI TECHNOLOGIES CO., LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.