Global Data Warehouse as a Service Market Segmentation, By Type (Enterprise Data Warehouse as a Service and Operational Data Storage), Usage (Analytics, Reporting, and Data Mining), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), Application (Customer Analytics, Risk and Compliance Management, Asset Management, Supply Chain Management, Fraud Detection and Threat Management, and Others), Industry Vertical (Banking, Financial Services, and Insurance, Retail and Ecommerce, Healthcare and Pharmaceuticals, Telecommunications and IT, Government and Public Sector, Manufacturing, Media and Entertainment, Travel and Hospitality, and Others) – Industry Trends and Forecast to 2031

Data Warehouse as a Service Market Analysis

The data warehouse as a service (DWaaS) market is experiencing significant growth, driven by advancements in cloud computing and data analytics technologies. Recent innovations include the integration of artificial intelligence (AI) and machine learning (ML) into DWaaS platforms, enabling businesses to derive actionable insights from large datasets more efficiently. These technologies enhance data processing speeds, automate data management tasks, and improve predictive analytics capabilities.

Furthermore, the adoption of serverless architecture allows organizations to scale resources dynamically, reducing costs and operational complexities. This flexibility supports varying workloads and fosters faster deployment of data solutions.

The increasing demand for real-time data analytics is also propelling the DWaaS market, as businesses seek to make informed decisions quickly. Industries such as e-commerce, finance, and healthcare are leveraging DWaaS for enhanced data storage, processing, and reporting capabilities, which drive competitive advantage.

In addition, concerns over data security and compliance are leading to the development of robust security measures within DWaaS offerings, further fueling market growth. Overall, the combination of advanced technologies and growing business needs is shaping the future of the DWaaS market.

Data Warehouse as a Service Market Size

The global data warehouse as a service market size was valued at USD 9.06 billion in 2023 and is projected to reach USD 55.96 billion by 2031, with a CAGR of 25.55% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Data Warehouse as a Service Market Trends

“Adoption of Cloud-Based Solutions”

One significant trend driving growth in the Data Warehouse as a Service (DWaaS) market is the increasing adoption of cloud-based solutions. Organizations are migrating their data management to the cloud for enhanced scalability, flexibility, and cost-effectiveness. For instance In March 2020, Google launched its AI cloud platform, designed to support the installation of machine learning product pipelines. This innovative architecture provides developers with the tools and resources needed to build, deploy, and manage machine learning models effectively. By offering robust infrastructure and integration capabilities, the Google AI cloud platform aims to empower businesses to leverage machine learning for enhanced insights and operational efficiencies across various applications.

Report Scope and Data Warehouse as a Service Market Segmentation

|

Attributes

|

Data Warehouse as a Service Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Google (U.S.), IBM Corporation (U.S.), Amazon (U.S.), Microsoft (U.S.), VMware, Inc. (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Dell Inc (U.S.), Huawei Technologies Co., Ltd.(China), FUJITSU (Japan), Nutanix (U.S.), Microsoft (U.S.), NetApp (U.S.), Quantum Corporation (U.S.), Scale Computing (U.S.), DataCore Software (U.S.), Maxta (U.S.), SANGFOR TECHNOLOGIES (China), SAP SE (Germany)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Data Warehouse as a Service Market Definition

Data Warehouse as a Service (DWaaS) is a cloud-based service model that provides organizations with the ability to store, manage, and analyze large volumes of data without the need for on-premises infrastructure. DWaaS allows businesses to scale their data warehousing capabilities based on demand, offering flexibility and cost-effectiveness. It typically includes features such as automated backups, data integration, and advanced analytics tools, enabling users to gain insights from their data quickly. By leveraging DWaaS, companies can focus on data analysis rather than infrastructure management, facilitating faster decision-making and improved operational efficiency.

Data Warehouse as a Service Market Dynamics

Drivers

- Growing Need for Real-Time Data Processing

The demand for real-time data processing is surging as organizations strive for quicker, data-driven decision-making. With the rise of e-commerce platforms such as Amazon, real-time analytics allows businesses to track customer behaviors and preferences instantly, enabling them to tailor offers and optimize inventory management on the fly. For instance, in September 2021, Vertica Systems introduced the Vertica Accelerator, an innovative software-as-a-service (SaaS) product aimed at providing scalable analytics. This new offering features high-performance, end-to-end analytics capabilities along with in-database machine learning functionalities. Set to be generally available in September 2021, Vertica Accelerator is expected to run on Amazon, enabling organizations to harness data insights more effectively and drive informed decision-making processes.

- Faster Time to Insights

The demand for quicker decision-making drives the Data Warehouse as a Service (DWaaS) market significantly. With DWaaS, organizations can rapidly deploy data warehouse solutions, integrating them seamlessly with existing systems, such as CRM and ERP platforms. For instance, in April 2022, Edgistify partnered with Eunimart, a leading eCommerce platform, to facilitate convenient hyper-local delivery services across India. This collaboration enables Eunimart to integrate Edgistify's extensive warehouse network into its operations, providing merchants access to efficient supply chain solutions. The partnership aims to enhance the delivery experience for consumers and improve operational efficiency for businesses, allowing them to meet rising demand for local deliveries.

Opportunities

- Disaster Recovery and Backup

Disaster recovery and backup capabilities within Data Warehouse as a Service (DWaaS) solutions are crucial for organizations aiming to safeguard their data. These features ensure that, in the event of hardware failure, cyberattacks, or natural disasters, critical data remains secure and recoverable. For instance, AWS Redshift offers automated backups and cross-region replication, enabling seamless data restoration. This not only enhances data safety but also strengthens business continuity planning, allowing companies to maintain operations without interruption. As businesses increasingly recognize the importance of data resilience, the demand for DWaaS solutions with robust disaster recovery features continues to grow, driving market expansion.

- Advanced Analytics and BI Integration

The surge in demand for Advanced Analytics and Business Intelligence (BI) capabilities significantly drives the Data Warehouse as a Service (DWaaS) market. Organizations increasingly rely on data-driven decision-making, and integrated analytics tools offered by DWaaS solutions facilitate this transition. For instance, in May 2023, GEODIS launched its new eLogistics platform in the UK, designed to assist e-retailers in outsourcing their logistical operations. The GEODIS eLogistics platform offers comprehensive logistics solutions, including order preparation and personalization, inventory optimization, transportation organization, and efficient returns administration. This initiative aims to enhance the operational efficiency of e-retailers by streamlining their logistics and delivery processes.

Restraints/Challenges

- Data Security Concerns

Data security concerns significantly hinder the Data Warehouse as a Service (DWaaS) market. Businesses are often reluctant to migrate sensitive information to third-party cloud environments due to fears of data breaches and loss of control over their data assets. The potential risks of unauthorized access, data leaks, and compliance violations create hesitancy among organizations. Furthermore, ensuring robust security measures and adherence to industry regulations is not only essential but also costly and complex. This complexity can overwhelm smaller organizations, leading to delays in adoption and limiting the overall growth of the DWaaS market as companies prioritize data protection over cloud migration.

- Complexity in Integration

Integration issues significantly hinder the Data Warehouse as a Service (DWaaS) market. Organizations often face challenges when attempting to integrate existing data sources and legacy systems with DWaaS solutions. These complexities can lead to increased costs and extended implementation timelines, making it difficult for companies to achieve a seamless transition. Furthermore, difficulties in integration may result in data silos, where critical information remains isolated and inaccessible. This fragmentation not only affects data analytics and decision-making capabilities but also discourages organizations from fully adopting DWaaS, ultimately impeding market growth and limiting the potential benefits of cloud-based data warehousing solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Data Warehouse as a Service Market Scope

The market is segmented on the basis of type, usage, deployment model, organization size, application and industry vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Enterprise Data Warehouse as a Service

- Operational Data Storage

Usage

- Analytics

- Reporting

- Data Mining

Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Application

- Customer Analytics

- Risk and Compliance Management

- Asset Management

- Supply Chain Management

- Fraud Detection

- Threat Management

- Others

Industry Vertical

- Banking, Financial Services, and Insurance

- Retail and Ecommerce

- Healthcare and Pharmaceuticals

- Telecommunications and IT

- Government and Public Sector

- Manufacturing

- Media and Entertainment

- Travel and Hospitality

- Others

Data Warehouse as a Service Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, usage, deployment model, organization size, application and industry vertical as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

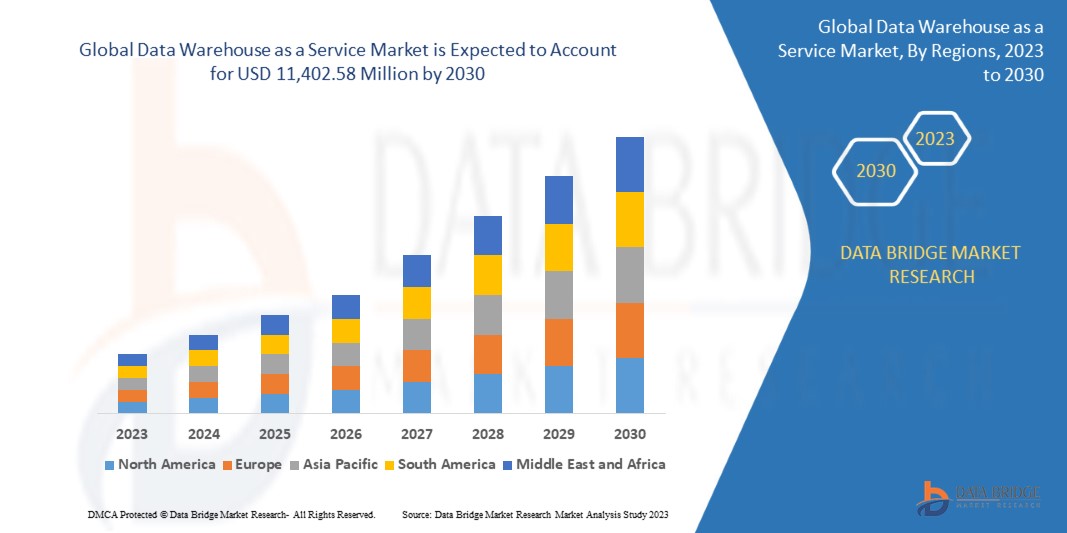

North America is expected to dominate the data warehouse as a service market due to the strong base of automotive facilities, strong presence of major players in the market.

Asia-Pacific is expected to witness significant growth during the forecast period due to the increase in government initiatives to promote awareness, rise in automotive facilities, growing research activities in the region, availability of massive untapped markets, large population pool.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Data Warehouse as a Service Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Data Warehouse as a Service Market Leaders Operating in the Market Are:

- Google (U.S.)

- IBM Corporation (U.S.)

- Amazon (U.S.)

- Microsoft (U.S.)

- VMware Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc (U.S.)

- Huawei Technologies Co. Ltd.(China)

- FUJITSU (Japan)

- Nutanix (U.S.)

- NetApp (U.S.)

- Quantum Corporation (U.S.)

- Scale Computing (U.S.)

- DataCore Software (U.S.)

- Maxta (U.S.)

- SANGFOR TECHNOLOGIES (China)

- SAP SE (Germany)

Latest Developments in Data Warehouse as a Service Market

- In March 2023, GXO Logistics, Inc. announced the global expansion of GXO Direct, enhancing its offerings in the logistics sector. By leveraging the capabilities, resources, and expertise gained from the acquisition of Clipper in 2022, GXO has developed a premier shared space option in the UK. This expansion is designed to optimize supply chain solutions and improve service delivery for its customers across various sectors

- In June 2022, HCL Technologies formed a strategic partnership with Amazon Web Services (AWS) to enhance its data warehousing solutions. By leveraging AWS’s capabilities, HCL aims to offer scalable, cost-effective, and secure Enterprise Data Warehouse solutions. Key features include the use of Amazon Redshift, which integrates advanced AI/ML capabilities, facilitating operational efficiency improvements, better decision-making, and faster time-to-market for HCL's clients across various industries

- In May 2022, Dell entered into a strategic agreement with Snowflake Inc. to enhance access to on-premises data. This collaboration focuses on integrating Snowflake's cloud-based solutions with Dell's on-site object storage systems. By doing so, the partnership aims to streamline data management processes, allowing businesses to leverage their existing data infrastructure while taking advantage of Snowflake's analytics capabilities for improved data insights and operational efficiency

- In January 2022, Firebolt raised USD 100 million at a valuation of USD 1.4 billion to enhance its data analytics capabilities. The funding is aimed at improving the speed and cost-effectiveness of analytics on large data sets. Firebolt plans to utilize the capital to refine its technology stack, expand its business development efforts, and grow its team, ultimately addressing the growing needs of the data warehousing market more effectively

- In May 2021, WPP and Microsoft announced a collaboration to create a cloud studio, significantly transforming content production processes. This partnership aims to leverage Microsoft's cloud technologies to enhance creative capabilities and streamline production workflows. By integrating advanced tools and resources, WPP seeks to improve efficiency and deliver innovative content solutions to clients, ultimately reshaping the future of digital marketing and content creation

SKU-