Global Data Warehouse As A Service Market

Market Size in USD Billion

CAGR :

%

USD

11.37 Billion

USD

70.22 Billion

2024

2032

USD

11.37 Billion

USD

70.22 Billion

2024

2032

| 2025 –2032 | |

| USD 11.37 Billion | |

| USD 70.22 Billion | |

|

|

|

|

Data Warehouse as a Service Market Size

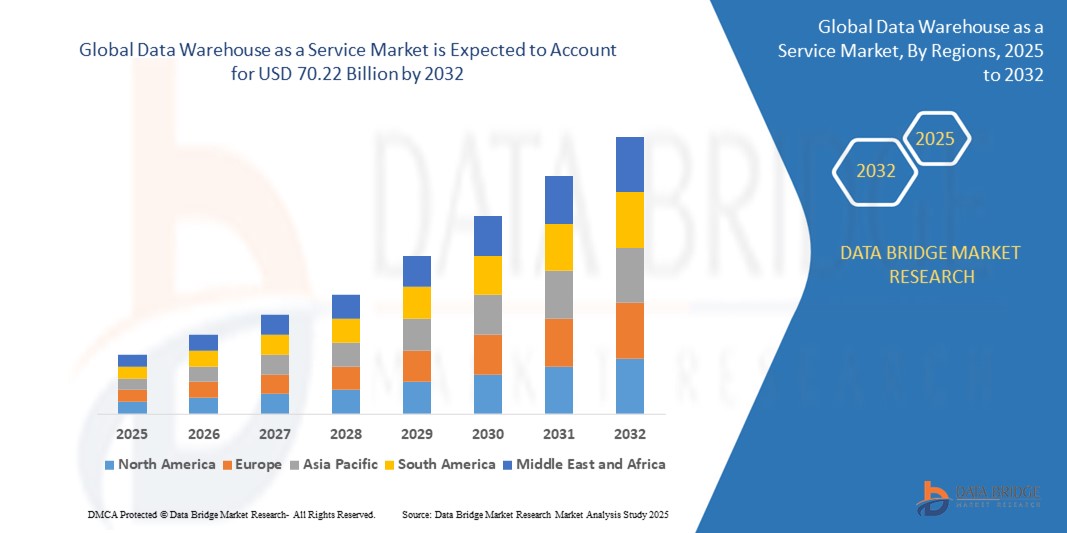

- The global data warehouse as a service market size was valued at USD 11.37 billion in 2024 and is expected to reach USD 70.22 billion by 2032, at a CAGR of 25.55% during the forecast period

- The market growth is largely fueled by the accelerating adoption of cloud computing, the exponential growth of big data, and the increasing demand for advanced analytics and business intelligence across diverse industries

- Furthermore, the rising need for scalable, cost-effective, and agile data management solutions that support data-driven decision-making is establishing DWaaS as a cornerstone of modern enterprise IT infrastructure, significantly boosting the industry's expansion

Data Warehouse as a Service Market Analysis

- Data warehouse as a service solutions provide cloud-based, scalable data warehousing capabilities, enabling organizations to store, manage, and analyze vast amounts of data without the complexities and overheads of on-premise infrastructure

- The escalating demand for data warehouse as a service solutions is primarily fueled by the rapid adoption of cloud computing models, the exponential growth of big data, the increasing need for advanced analytics and business intelligence

- North America is expected to dominate the data warehouse as a service market with the largest revenue share, characterized by early and widespread cloud adoption, a mature IT infrastructure, and a high concentration of enterprises investing heavily in data analytics and digital transformation initiatives

- Asia-Pacific is expected to be the fastest growing region in the data warehouse as a service market during the forecast period due to rapid digitalization across industries, increasing investments in cloud infrastructure

- The public cloud segment within the deployment model is expected to dominate the data warehouse as a service market with the largest market share of 39.7% in 2024, driven by its unparalleled scalability, cost-effectiveness, and ease of deployment, making it the preferred choice for organizations of all sizes seeking agile and flexible data warehousing solutions without significant upfront capital expenditure

Report Scope and Data Warehouse as a Service Market Segmentation

|

Attributes |

Data Warehouse as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Warehouse as a Service Market Trends

“Accelerated Adoption Driven by Cloud-Native Architectures and Real-time Analytics Needs”

- A prominent and rapidly expanding trend in the global data warehouse as a service market is the escalating adoption fueled by the pervasive shift towards cloud-native architectures and the growing imperative for real-time data analytics

- For instance, solutions such as Snowflake's Data Cloud seamlessly integrate with various cloud platforms (AWS, Azure, Google Cloud), allowing businesses to leverage its scalable architecture for diverse analytical workloads. Similarly, Google BigQuery provides a serverless and highly scalable data warehouse that supports real-time analytics for vast datasets

- The emphasis on real-time data analytics in data warehouse as a service market solutions enables features such as immediate ingestion and processing of streaming data, providing up-to-the-minute insights for operational decision-making

- The seamless integration of data warehouse as a service market with other cloud services, such as data lakes, machine learning platforms, and business intelligence tools, facilitates a comprehensive and agile data ecosystem

- This trend towards more agile, scalable, and interconnected data warehousing solutions is fundamentally reshaping how enterprises approach data management and business intelligence

- The demand for data warehouse as a service market solutions that offer seamless integration with cloud-native environments and cater to real-time analytics needs is growing rapidly across various industries, as organizations increasingly prioritize data-driven decision-making and operational efficiency

Data Warehouse as a Service Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The increasing prevalence of security concerns among homeowners and businesses, coupled with the accelerating adoption of smart home ecosystems, is a significant driver for the heightened demand for Data Warehouse as a Services

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced an advancement in IoT-based self-storage security, looking forward to integrating state-of-the-art sensors into the Passport locking solution. Such strategies by key companies are expected to drive the data warehouse as a services industry growth in the forecast period

- As consumers become more aware of potential security threats and seek enhanced protection for their properties, data warehouse as a services offer advanced features such as remote monitoring, activity logs, and tamper alerts, providing a compelling upgrade over traditional mechanical locks

- Furthermore, the growing popularity of smart home devices and the desire for interconnected living spaces are making data warehouse as a services an integral component of these systems, offering seamless integration with other smart devices and platforms

- The convenience of keyless entry, remote access control for family members or service providers, and the ability to manage access through smartphone applications are key factors propelling the adoption of data warehouse as a services in both residential and commercial sectors

Restraint/Challenge

“Data Security and Compliance Concerns, Alongside Vendor Lock-in Risks”

- Concerns surrounding data security, privacy, and compliance regulations, coupled with the potential for vendor lock-in, pose significant challenges to broader market penetration for data warehouse as a services

- For instance, high-profile data breaches in cloud environments have made some businesses hesitant to migrate their critical data to data warehouse as a services platforms, raising anxieties among potential consumers about data governance and control. Adhering to stringent compliance frameworks such as GDPR, HIPAA, or CCPA can also be complex when data resides with a third-party provider

- Addressing these data security and compliance concerns through robust encryption, comprehensive access controls, regular security audits, and clear service level agreements is crucial for building consumer trust. Data warehouse as a services providers often highlight their certifications and compliance features in their marketing to reassure potential buyers

- In addition, the challenge of vendor lock-in, where businesses become heavily reliant on a single data warehouse as a services provider's ecosystem, can be a barrier to adoption for organizations seeking flexibility and multi-cloud strategies

- Overcoming these challenges through enhanced data security measures, transparent compliance frameworks, consumer education on shared responsibility models, and the development of open standards or interoperable data warehouse as a services solutions will be vital for sustained market growth

Data Warehouse as a Service Market Scope

The market is segmented on the basis of type, usage, deployment model, organization size, end-user industry, and application.

- By Type

On the basis of type, the data warehouse as a service market is segmented into enterprise data warehouse as a service and operational data storage. The enterprise data warehouse as a service segment is expected to hold the largest market revenue share in 2024, driven by the increasing need for integrated, comprehensive data analytics across large organizations. This segment caters to complex analytical requirements, supporting strategic decision-making and leveraging diverse data sources. Enterprises prioritize this type for its ability to handle vast data volumes and provide a single source of truth for business intelligence.

The operational data storage segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for real-time data processing and analytics for operational insights. This segment focuses on supporting day-to-day business operations with immediate access to current data, enabling faster decision-making and improved operational efficiency, particularly in sectors requiring instant data feedback.

- By Usage

On the basis of usage, the data warehouse as a service market is segmented into analytics, reporting, and data mining. The analytics segment held the largest market revenue share in 2024, driven by the pervasive need for in-depth data analysis to uncover trends, predict outcomes, and support strategic business initiatives. Organizations are increasingly leveraging data warehouse as a service for advanced analytics to gain competitive advantages and enhance decision-making.

The data mining segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing interest in extracting valuable patterns and insights from large datasets. Data mining applications, often leveraging machine learning, are becoming critical for identifying hidden correlations and predictive models, making data warehouse as a service an ideal platform for these computationally intensive tasks.

- By Deployment Model

On the basis of deployment model, the data warehouse as a service market is segmented into public cloud, private cloud, and hybrid cloud. The public cloud segment held the largest market revenue share of 39.7% in 2024, driven by its scalability, cost-effectiveness, and ease of deployment. Public cloud data warehouse as a service solutions appeal to a broad range of businesses due to their flexibility and ability to handle varying data workloads without significant upfront infrastructure investments.

The hybrid cloud segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by organizations seeking a balance between public cloud flexibility and the control/security offered by private infrastructure. Hybrid models allow businesses to keep sensitive data on-premises while leveraging public cloud for analytical workloads, providing a tailored approach to data residency and performance.

- By Organization Size

On the basis of organization size, the data warehouse as a service market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The large enterprises segment held the largest market revenue share in 2024, driven by their extensive data generation, complex analytical needs, and significant budgets for advanced data management solutions. Large organizations require robust and scalable data warehouse as a service platforms to consolidate and analyze massive datasets for strategic insights.

The small and medium-sized enterprises segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing awareness among SMEs about the benefits of data analytics and the affordability of data warehouse as a service solutions. Data warehouse as a service provides SMEs with access to enterprise-grade data warehousing capabilities without the need for large capital expenditures or specialized IT staff, enabling them to compete more effectively with larger players.

- By End-user Industry

On the basis of end-user industry, the data warehouse as a service market is segmented into BFSI, IT & telecom, retail & e-commerce, manufacturing, government & public sector, healthcare & life sciences, media & entertainment, travel & hospitality, and others. The IT & telecom segment accounted for the largest market revenue share in 2024, driven by the massive volume of data generated by network operations, customer interactions, and service usage, necessitating advanced data warehouse as a service solutions for performance monitoring, customer analytics, and fraud detection.

The BFSI (Banking, Financial Services, and Insurance) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need for real-time fraud detection, risk management, regulatory compliance, and personalized customer experiences. Data warehouse as a service enables BFSI institutions to analyze vast transactional data efficiently and securely.

- By Application

On the basis of application, the data warehouse as a service market is segmented into customer analytics, risk and compliance management, asset management, supply chain management, fraud detection & threat management, business intelligence, predictive analytics, and data modernization. The business intelligence segment held the largest market revenue share in 2024, driven by the fundamental need across all industries to transform raw data into actionable insights for operational and strategic decision-making. Data warehouse as a service serves as the backbone for modern BI platforms.

The predictive analytics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing desire among organizations to forecast future trends, identify potential risks, and optimize strategies proactively. Data warehouse as a service provides the scalable infrastructure and processing power required for complex predictive modeling and machine learning applications.

Data Warehouse as a Service Market Regional Analysis

- North America dominates the data warehouse as a service market with the largest revenue share in 2024, driven by a high concentration of technology companies, early adoption of cloud-based solutions, and significant investments in digital transformation

- The region benefits from a mature IT infrastructure, a strong focus on data-driven decision-making across various industries, and the presence of major cloud service providers

- This widespread adoption is further supported by a skilled workforce, robust regulatory frameworks promoting data analytics, and the increasing preference for scalable and cost-effective data management solutions

U.S. Data Warehouse as a Service Market Insight

The U.S. data warehouse as a service (DWaaS) market is a dominant force within North America, projected to grow at a substantial CAGR from 2025 to 2032. This growth is primarily fueled by the rapid adoption of cloud-based solutions across various industries and the increasing demand for real-time data analytics. U.S. businesses are heavily investing in DWaaS to achieve faster, more precise outcomes, automate data preparation, and leverage AI and machine learning for enhanced data quality, regulatory adherence, and information security. The robust IT infrastructure, presence of major cloud providers (such as AWS, Microsoft Azure, and Google Cloud), and strong governmental support for digital transformation initiatives further propel the DWaaS industry. Companies are increasingly recognizing the cost-effectiveness and scalability benefits of DWaaS, leading to widespread migration from traditional on-premise data warehouses.

Europe Data Warehouse as a Service Market Insight

The Europe data warehouse as a service market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region's strong emphasis on digital transformation, increasing adoption of cloud technologies, and the growing need for sophisticated data management solutions across diverse sectors. Stringent data privacy regulations such as GDPR are also influencing the demand for DWaaS platforms that offer robust security and compliance features. European businesses are increasingly leveraging DWaaS for enhanced business intelligence, operational efficiency, and data-driven decision-making. The increase in cloud infrastructure investments and the desire for greater agility and flexibility in data processing are fostering the adoption of DWaaS in both established and emerging markets across Europe.

U.K. Data Warehouse as a Service Market Insight

The U.K. data warehouse as a service market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its mature IT sector, increasing adoption of cloud platforms, and the escalating need for agile data solutions. The U.K.'s robust digital economy and the continuous efforts to establish comprehensive data governance frameworks are supplementing the demand for DWaaS. Concerns regarding data security and compliance, especially post-Brexit, are encouraging businesses to adopt DWaaS solutions that offer enhanced audit trails, data masking, and breach prevention tools. The U.K.'s embrace of cloud-native architectures and machine learning-driven analytics further stimulates market growth, with a growing number of enterprises seeking to leverage DWaaS for advanced insights and competitive advantage.

Germany Data Warehouse as a Service Market Insight

The Germany data warehouse as a service market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of data-driven insights, a strong focus on industrial digitalization (Industry 4.0), and the demand for highly secure and compliant cloud solutions. Germany's well-developed infrastructure and its emphasis on innovation and data protection promote the adoption of DWaaS, particularly in manufacturing, automotive, and financial sectors. The integration of DWaaS with existing enterprise resource planning (ERP) systems and the strong preference for secure, privacy-focused solutions align with local consumer and business expectations. The market sees significant growth in applications such as customer analytics and business intelligence, driven by the need for deeper insights into operational efficiency and market trends.

Asia-Pacific Data Warehouse as a Service Market Insight

The Asia-Pacific data warehouse as a service market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing digitalization initiatives, rapid cloud adoption, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards data-driven decision-making, supported by government initiatives promoting smart cities and digital economies, is driving the adoption of DWaaS. Furthermore, as APAC emerges as a global hub for technological innovation and cloud infrastructure development, the affordability and accessibility of DWaaS solutions are expanding to a wider consumer and business base, from large enterprises to burgeoning SMEs.

Japan Data Warehouse as a Service Market Insight

The Japan data warehouse as a service market is gaining momentum due to the country’s high-tech culture, rapid digitalization, and increasing demand for efficient data management. The Japanese market places a significant emphasis on data quality, security, and the adoption of DWaaS is driven by the growing need for advanced analytics and business intelligence across industries such as manufacturing, healthcare, and finance. The integration of DWaaS with other IoT devices and AI platforms is fueling growth, enabling organizations to derive deeper insights from their vast datasets. Moreover, Japan's focus on digital transformation and optimizing operational efficiencies is such as demand for scalable, secure, and user-friendly DWaaS solutions in both large corporations and smaller businesses.

China Data Warehouse as a Service Market Insight

The China data warehouse as a service market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's rapid economic growth, massive data generation, and high rates of cloud technology adoption. China stands as one of the largest and fastest-growing markets for cloud services globally, and DWaaS is becoming increasingly popular across diverse sectors, including e-commerce, manufacturing, and telecommunications. The strong government push towards cloud-first strategies, coupled with the availability of robust and affordable DWaaS options from domestic and international providers, are key factors propelling the market in China. The demand for real-time analytics and big data processing capabilities further fuels the expansion of DWaaS in the country.

Data Warehouse as a Service Market Share

The data warehouse as a service industry is primarily led by well-established companies, including:

- Google (U.S.)

- IBM Corporation (U.S.)

- Amazon.com, Inc. (U.S.)

- Microsoft (U.S.)

- VMware, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc (U.S.)

- Huawei Technologies Co., Ltd. (China)

- FUJITSU (Japan)

- Nutanix (U.S.)

- NetApp (U.S.)

- Quantum Corporation (U.S.)

- Scale Computing (U.S.)

- DataCore Software (U.S.)

- Maxta (U.S.)

Latest Developments in Global Data Warehouse as a Service Market

- In October 2023, mParticle, Inc. introduced ComposeID, an identity resolution service designed for seamless integration with cloud data warehousing environments. Built upon IDSync, ComposeID enables teams to implement diverse identity strategies across various data architectures. Such as traditional identity solutions, ComposeID offers flexibility, transparency, and unlimited identity types while ensuring compliance with privacy regulations. By leveraging existing data warehouse investments, it enhances customer insights, personalization, and marketing strategies. This innovation empowers organizations to create unified customer views, optimize engagement, and improve regulatory adherence

- In July 2023, IBM unveiled significant enhancements to its Db2 Warehouse, introducing cloud object storage with advanced caching capabilities. This next-generation update enables organizations to achieve four times faster query performance while reducing storage costs by 34%. By leveraging cloud-native architecture, Db2 Warehouse optimizes data management, enhances analytics efficiency, and supports mission-critical workloads. The integration of advanced caching ensures seamless data retrieval, improving overall system responsiveness. These improvements empower businesses to maximize their data investments while maintaining cost-effectiveness

- In March 2023, SAP SE launched SAP Datasphere, a next-generation cloud-based data warehouse solution aimed at simplifying metadata management and organization. Built on SAP Business Technology Platform, it enhances data quality through efficient data modeling, lineage analysis, and impact assessment. SAP Datasphere enables businesses to access mission-critical data seamlessly while preserving business context and logic. By integrating data governance, cataloging, and virtualization, it supports advanced analytics and compliance needs. This innovation reflects SAP’s commitment to scalable, unified data management

- In May 2022, Dell Technologies partnered with Snowflake Inc. to enhance access to on-premises data by integrating Snowflake Data Cloud's tools with Dell's storage solutions. This collaboration enables organizations to leverage Snowflake’s advanced analytics and data-sharing capabilities while maintaining their data locally. By bridging on-premises object storage with cloud-based insights, businesses can optimize data management, improve compliance, and streamline operations in multi-cloud environments. The partnership aims to provide greater flexibility and efficiency in handling enterprise data

- In January 2022, Firebolt, a cloud data warehouse startup, secured $100 million in Series C funding, reaching a USD 1.4 billion valuation. The investment aimed to accelerate Firebolt’s technological advancements, expand business development, and strengthen its team to address growing demands in the data warehousing market. Firebolt focuses on delivering faster and more cost-effective analytics for large-scale data sets, competing with industry leaders such as Google’s BigQuery and Snowflake. The funding supports its mission to enhance performance, scalability, and efficiency in cloud-based data processing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.