Global Data Management Advertising Software Market

Market Size in USD Billion

CAGR :

%

USD

2.38 Billion

USD

7.03 Billion

2024

2032

USD

2.38 Billion

USD

7.03 Billion

2024

2032

| 2025 –2032 | |

| USD 2.38 Billion | |

| USD 7.03 Billion | |

|

|

|

|

Data Management Advertising Software Market Size

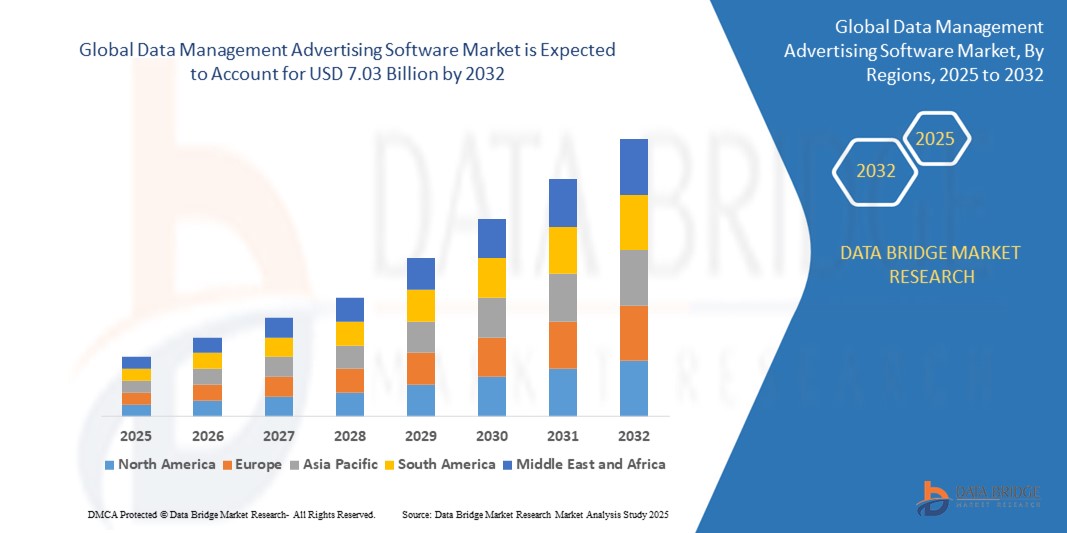

- The global data management advertising software market size was valued at USD 2.38 billion in 2024 and is expected to reach USD 7.03 billion by 2032, at a CAGR of 14.50% during the forecast period

- The market growth is largely fueled by the increasing use of customer data platforms and advancements in AI-driven analytics, enabling advertisers to derive actionable insights from large volumes of structured and unstructured data across channels

- Furthermore, the growing demand for personalized, performance-based marketing strategies is compelling businesses to adopt integrated data management advertising software, streamlining data collection, segmentation, and targeted campaign execution. These converging factors are accelerating the deployment of intelligent ad-tech solutions, thereby significantly boosting the industry's growth

Data Management Advertising Software Market Analysis

- Data management advertising software enables the collection, unification, and activation of customer data from various sources such as web analytics, CRM systems, mobile apps, and social media to support targeted advertising strategies

- The growing demand for these platforms is primarily driven by the decline of third-party cookies, increased regulatory pressure on data privacy, and the need for first-party data utilization to enhance customer engagement, improve ROI, and ensure compliance across digital advertising ecosystems

- North America dominated the data management advertising software market with a share of 32.5% in 2024, due to the high concentration of digital advertising spend, strong presence of tech-savvy enterprises, and widespread adoption of data-driven marketing strategies

- Asia-Pacific is expected to be the fastest growing region in the data management advertising software market during the forecast period due to rising digital ad spend, increasing mobile and internet penetration, and rapid business digitalization

- First party segment dominated the market with a market share of 48.1% in 2024, due to increasing emphasis on privacy regulations such as GDPR and CCPA, which compel advertisers and marketers to prioritize data collected directly from their own platforms. First-party data is valued for its accuracy, transparency, and relevance, offering advertisers enhanced control over customer information and deeper insights into audience behavior. This type of data also facilitates personalized marketing strategies with minimal compliance risks, making it highly sought after in industries focused on long-term customer engagement

Report Scope and Data Management Advertising Software Market Segmentation

|

Attributes |

Data Management Advertising Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Management Advertising Software Market Trends

“Growing Demand for Personalization and Targeted Advertising”

- A significant and accelerating trend in the data management advertising software market is the rising demand for highly personalized and targeted advertising, driven by the explosion of consumer data across digital channels and the need for more effective marketing strategies

- For instance, companies are increasingly adopting advanced data management platforms from providers such as Adobe, Oracle, and Salesforce to collect, analyze, and activate customer data from multiple sources—including websites, mobile apps, and social media—to deliver tailored ad experiences and maximize marketing ROI

- These platforms leverage artificial intelligence, machine learning, and predictive analytics to segment audiences, optimize ad placements, and automate campaign management, enabling marketers to reach the right consumers with the right message at the right time

- The shift toward omnichannel marketing and real-time analytics is further enhancing the value of data management advertising software, as businesses seek to unify customer insights and create seamless, cross-platform advertising journeys

- As privacy regulations and consumer expectations evolve, the ability to manage data securely and transparently is also becoming a key differentiator for software providers in this space

- Leading players are focusing on developing user-friendly interfaces and self-service tools that empower marketing teams to quickly launch and optimize campaigns, reducing reliance on IT departments and accelerating time-to-market for new advertising initiatives

Data Management Advertising Software Market Dynamics

Driver

“Rise of Omnichannel Marketing”

- The rapid rise of omnichannel marketing is a major driver for the data management advertising software market, as brands aim to engage customers consistently across multiple platforms and devices

- For instance, leading advertisers are utilizing data management solutions to integrate campaigns across social media, search, email, mobile, and offline channels, ensuring a unified customer experience and maximizing touchpoint effectiveness

- These tools enable marketers to track customer interactions in real time, attribute conversions accurately, and adjust messaging dynamically based on user behavior and preferences

- The ability to orchestrate seamless campaigns across diverse channels is critical for building brand loyalty and driving higher conversion rates in today’s fragmented digital landscape

- As consumer journeys become more complex, the demand for robust data management advertising software that supports true omnichannel execution continues to accelerate

Restraint/Challenge

“High Implementation Costs”

- High implementation costs remain a significant challenge in the data management advertising software market, particularly for small and mid-sized businesses with limited budgets

- For instance, deploying enterprise-grade solutions from top providers often requires substantial investments in software licensing, integration, staff training, and ongoing maintenance, which can be prohibitive for organizations without dedicated IT and marketing resources

- Customizing platforms to meet specific business needs, ensuring compliance with data privacy regulations, and integrating with existing marketing technology stacks can further drive up costs and extend deployment timelines

- The complexity and expense of implementation may slow adoption among cost-sensitive enterprises, despite the clear benefits of data-driven advertising

- Overcoming this challenge will require vendors to offer more scalable, modular solutions, flexible pricing models, and enhanced support services to make advanced data management advertising tools accessible to a broader range of organizations

Data Management Advertising Software Market Scope

The market is segmented on the basis of type, data source, and end-user.

- By Type

On the basis of type, the data management advertising software market is segmented into first party, second party, and third party. The first party segment dominated the largest market revenue share of 48.1% in 2024, owing to increasing emphasis on privacy regulations such as GDPR and CCPA, which compel advertisers and marketers to prioritize data collected directly from their own platforms. First-party data is valued for its accuracy, transparency, and relevance, offering advertisers enhanced control over customer information and deeper insights into audience behavior. This type of data also facilitates personalized marketing strategies with minimal compliance risks, making it highly sought after in industries focused on long-term customer engagement.

The second party data segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the growing trend of data collaboration between trusted partners. As organizations seek to expand their audience reach without relying on third-party cookies, second-party data offers a strategic middle ground—providing high-quality, consented data sets sourced from reputable partners. This trend is especially prominent in retail and travel sectors, where alliances allow brands to enrich customer profiles and optimize targeted advertising without violating consumer trust.

- By Data Source

On the basis of data source, the market is segmented into web analytics tools, mobile web, mobile apps, CRM data, POS data, and social network. The web analytics tools segment held the largest market revenue share in 2024, as businesses continue to invest in platforms that track user behavior, conversion rates, and traffic sources across websites. These tools offer real-time metrics and actionable insights that drive strategic advertising decisions, helping marketers measure ROI and optimize campaign effectiveness. Their compatibility with various ad tech solutions further enhances their utility in comprehensive digital marketing strategies.

The CRM data segment is anticipated to record the fastest CAGR from 2025 to 2032, fueled by the shift toward hyper-personalization and customer-centric advertising models. CRM systems provide structured, enriched datasets including demographics, purchase history, and engagement patterns—critical for designing tailored ad campaigns. As more organizations integrate CRM platforms with advertising software, the ability to deliver dynamic, context-aware messaging across channels is significantly enhanced, boosting engagement and conversion rates.

- By End Users

On the basis of end users, the data management advertising software market is segmented into ad agencies, marketers, and publishers. The ad agencies segment captured the largest revenue share in 2024, owing to their central role in managing multichannel campaigns, executing complex programmatic buys, and delivering measurable results for clients. Ad agencies heavily rely on data management software to segment audiences, manage budgets, and derive insights that support strategic decision-making. Their need for robust, scalable, and integrated data solutions makes them major adopters of advanced advertising platforms.

The marketers segment is expected to register the highest growth rate during the forecast period, driven by increasing demand for in-house marketing capabilities and data autonomy. As brands seek to reduce dependency on third parties and gain deeper control over their campaigns, marketers are leveraging data management software to unify customer data across platforms, automate campaign workflows, and enhance targeting precision. The adoption of AI-powered analytics and customer journey mapping further contributes to this segment's rapid expansion.

Data Management Advertising Software Market Regional Analysis

- North America dominated the data management advertising software market with the largest revenue share of 32.5% in 2024, driven by the high concentration of digital advertising spend, strong presence of tech-savvy enterprises, and widespread adoption of data-driven marketing strategies

- Organizations in the region emphasize leveraging first-party and behavioral data to drive personalized advertising and improve campaign ROI, while robust data privacy frameworks encourage responsible and compliant data practices

- The maturity of digital infrastructure, strong presence of global ad-tech firms, and increasing investments in AI-powered data analytics tools continue to reinforce North America’s leadership in the market

U.S. Data Management Advertising Software Market Insight

The U.S. data management advertising software market captured the largest revenue share in 2024 within North America, owing to the country’s dominant digital ad ecosystem and early adoption of programmatic advertising. Marketers are increasingly relying on unified data platforms to consolidate multichannel customer data and drive hyper-targeted campaigns. High demand from media agencies and direct-to-consumer brands, along with strong cloud adoption and integration of AI for customer analytics, are bolstering market growth.

Europe Data Management Advertising Software Market Insight

The Europe market is projected to register a strong CAGR during the forecast period, driven by increasing regulatory compliance requirements under GDPR and growing emphasis on data transparency in advertising. Companies across the region are actively shifting toward first-party and consented second-party data usage, fueling demand for compliant data management platforms. The surge in digital content consumption, particularly across e-commerce and OTT platforms, is also contributing to the increased adoption of advertising software integrated with data analytics capabilities.

U.K. Data Management Advertising Software Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, fueled by the growing adoption of digital and mobile advertising across industries such as retail, finance, and media. With businesses seeking greater control over customer engagement strategies, the demand for unified data management solutions continues to rise. The U.K.’s strong advertising technology infrastructure, combined with increasing investment in consumer insight platforms, is driving growth across enterprise and SME segments.

Germany Data Management Advertising Software Market Insight

The Germany market is expected to expand steadily during the forecast period, supported by the country’s emphasis on data privacy, enterprise digitization, and structured data integration. German companies are adopting advanced software solutions to manage omnichannel advertising campaigns with improved efficiency and compliance. The growing shift toward internal marketing operations and localized data processing solutions is reinforcing demand for customizable data platforms.

Asia-Pacific Data Management Advertising Software Market Insight

The Asia-Pacific market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising digital ad spend, increasing mobile and internet penetration, and rapid business digitalization across emerging economies such as India, China, and Southeast Asia. The growing focus on customer engagement, combined with evolving data protection laws, is prompting enterprises to invest in structured data management tools for personalized advertising. The expanding base of tech startups and ad tech vendors is also contributing to market acceleration.

Japan Data Management Advertising Software Market Insight

The Japan market is witnessing steady growth due to the high integration of digital tools in business operations and strong emphasis on customer experience. Enterprises in Japan are prioritizing data centralization to enable unified marketing strategies across traditional and digital channels. The adoption of privacy-compliant data platforms and increased investment in analytics solutions are supporting sustained demand across industries such as retail, finance, and telecommunications.

China Data Management Advertising Software Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, underpinned by the country’s massive digital consumer base, advanced e-commerce ecosystem, and aggressive digital advertising growth. Businesses are increasingly utilizing AI-powered data platforms to capture real-time customer insights and optimize ad performance. Government initiatives supporting digital transformation, coupled with the presence of leading tech giants, are major factors accelerating the market's expansion.

Data Management Advertising Software Market Share

The data management advertising software industry is primarily led by well-established companies, including:

- Actian Corporation (U.S.)

- BMC Software, Inc. (U.S.)

- Broadcom (U.S.)

- Hitachi, Ltd. (Japan)

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- Oracle (U.S.)

- Cloudera, Inc. (U.S.)

- InterSystems Corporation (U.S.)

- EMBARCADERO INC. (U.S.)

- Informatica (U.S.)

- MarkLogic Corporation (U.S.)

- SAP (Germany)

- Adobe -(U.S.)

- Wunderman Data Products (U.S.)

- Rocket Fuel (U.S.)

- Krux Digital (U.S.)

- Lotame Solutions, Inc. (U.S.)

- Turn (U.S.)

- Neustar, Inc. (U.S.)

Latest Developments in Global Data Management Advertising Software Market

- In August 2024, HCLTech’s subsidiary, HCL Software, announced the acquisition of French firm Zeenea SAS for €24 million in an all-cash deal, expected to close by September 2024. This move is poised to significantly impact the data management advertising software market by enhancing HCL's Actian Data Platform with Zeenea’s advanced capabilities in intelligent data discovery, metadata management, and governance. The integration strengthens HCL’s positioning in hybrid data environments and accelerates innovation in generative AI-powered data intelligence solutions, reinforcing its competitiveness in enterprise data platforms

- In August 2024, VerSe Innovation, parent company of Dailyhunt, acquired a majority stake in Valueleaf Group, a performance-driven digital marketing agency. This acquisition is expected to reshape the Indian advertising technology landscape by expanding VerSe’s reach across 90% of the Indian internet population and enhancing its retargeting and performance advertising capabilities. With a projected revenue boost of USD 100 million by FY25, the deal underscores VerSe’s aggressive expansion into ad-tech, equipping it to offer more integrated, scalable, and industry-focused marketing solutions across mobile platforms

- In 2020, HubSpot, Inc., a prominent US-based organization, introduced several updates to address pandemic-related challenges. They launched new callable contacts pricing models, enhancing the accessibility of contact interactions. In addition, they unveiled an enterprise sales CRM to support large-scale sales operations and expanded personalization features to better cater to advertising organizations and professional services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.