Global Data Integration Market, By Offering (Tools, Services), Business Application (Sales, Marketing, Finance, Operations, Human Resources), Enterprise Size (Small Enterprise, Medium Enterprise, Large Enterprise), Deployment Mode (On-Premise, Cloud), Vertical (Manufacturing, Healthcare & Life Sciences, IT & Telecom, Media & Entertainment, Retail & Consumer Goods, BFSI, Energy & Utilities, Government & Defence, and Others) - Industry Trends and Forecast to 2029.

Market Analysis and Insights

Data integration compliance program is a set of regulations or rules that a financial institution, companies such as large enterprises, small enterprises and medium enterprises must follow to prevent data loss. The various issues related to data integration are compelling the government and various authorities to increase the regulation due to data threats involved in data transfer. While data integration is increasing the use of hybrid data integration, also the increasing stringent regulations and compliance related to data integration are increasing the demand for data integration in the market. However, high data integration software cost hamper the growth of the market.

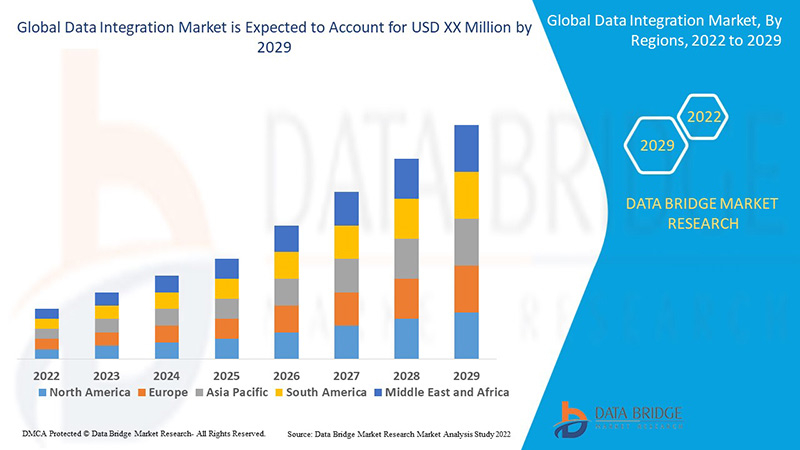

Data Bridge Market Research analyzes that the data integration market will grow at a CAGR of 14.3% during the forecast period of 2022 to 2029.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Pricing in USD

|

|

Segments Covered

|

By Offering (Tools, Services), Business Application (Sales, Marketing, Finance, Operations, Human Resources), Enterprise Size (Small Enterprise, Medium Enterprise, Large Enterprise), Deployment Mode (On-Premise, Cloud), Vertical (Manufacturing, Healthcare & Life Sciences, IT & Telecom, Media & Entertainment, Retail & Consumer Goods, BFSI, Energy & Utilities, Government & Defence, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico U.A.E, Saudi Arabia, Israel, South Africa, Egypt, rest of Middle East and Africa, U.K., Germany, France, Spain, Italy, Russia, Turkey, Netherlands, Switzerland, Belgium, rest of Europe, China, India, Japan, South Korea, Singapore, Australia, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific

|

|

Market Players Covered

|

Microsoft, Amazon Web Services, Inc. Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation ( Subsidiary of Hitachi, Ltd.), Salesforce, Inc. , Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLogic. among others

|

Market Definition

Data integration is the process of combining data from different sources into a single, unified view. Integration begins with the ingestion process, and includes steps such as cleansing, ETL mapping, and transformation. Data integration ultimately enables analytics tools to produce effective, actionable business intelligence. Organizations are moving to become more data-driven, yet data sources are more distributed and fragmented than ever before. By connecting systems that contain valuable data and integrating them across departments and locations, organizations are able to achieve one-point data storage and access, data availability, and data quality.

Data Integration Market Dynamics

Drivers

- Increasing use of hybrid data integration

Hybrid data integration has been in use lately due to its ability to connect applications, data files, and business partners across cloud and on-premises systems. The purpose of using hybrid data for data integration is because hybrid data integration primarily focuses on deployment model element. Data integration has become a major network and data transfer solution from source to destination. Every year billions of dollars are being transferred and those data are being protected with data integration software implemented in systems.

- Increasing stringent regulations and compliance related to data integration

Data integration compliance program is a set of regulations or rules that a financial institution, companies such as large enterprises, small enterprises and medium enterprises must follow to prevent data loss. The various issues related to data integration are compelling the government and various authorities to increase the regulation due to data threats involved in data transfer.

- Growing demand for data integration tools and software

Financial institution, information technology, hospitals, telecom, military and defence industries deal with day-to-day data transfer which requires more protection due to privacy, sensitivity and confidentiality of data. Data integration tools used in financial institutions leverage the power of data in motion to drive personalized customer experiences, proactively mitigate cyber risks and drive regulatory compliances.

Tools such as data lakes are used in data integration for real-time analytics and fraud detection. Data are integrated into modern cloud-based services for data visualization and reporting. These tools also helps in analysis of transaction in real-time to detect fraudulent transaction and send notifications.

- Growing demand for application based integration

Application based integration has become an important part of data integration systems. Industry such as banking, medical, IT & Telecom, manufacturing, retail & consumer goods, media and entertainment prefer application based integration methods in order to keep an eye out for any suspicious transactions, financial crimes from customers. Application integration software combines and enhances data flows between two separate software’s applications. Businesses often use application integration software’s to create a bridge between a new cloud application and older application hosted on-premise, enabling a wide range of independently designed application to work together.

Opportunities

-

Increasing adoption of data integration by various departments such as Operations, Finance

Data integration is the autonomous or semi-autonomous system that analyse data or content using sophisticated techniques and tools which is quite different from the traditional business intelligence. These analytics gives a deeper analysis with which the system predicts and generate recommendations. Advanced analytics in data integration solutions can play vital role in detecting transaction activities, data storage from different sources, among others. Moreover, advanced analytics can play a vital role in advanced transaction monitoring.

-

Integration of AI, ML in developing data integration solutions

Data integration has become a very important data transferring method for analysis of data by companies to derive meaningful analysis from historic raw data. According to the survey, data integration is estimated to be used by 65% of companies globally. There are various other issues such as data loss, signal distortion, storage capacity of platforms used for data integration.

Restraint/Challenge

- High data integration software cost

Data integration related to software solution should ensure that a device installed with different integration software is able to detect suspicious activities associated with transferring virus involving data, fraud, and terrorist funding and report to the appropriate authorities. A data integration software solution should not only focus on the effectiveness of internal systems but also needs focus on detection capabilities. The key components of data integration systems are data mitigation, enterprise application integration, master data management, and data aggregation. Designing data integration systems can be a challenging task as the complexity involved in designing multiple modules is very high.

COVID-19 Impact on Data Integration Market

The confinement and lockdown period during the COVID-19 crisis has shown the importance of good, reliable internet connectivity at large industry. A high-speed connection at large industry has opened up the possibility of efficient teleworking, maintaining entertainment habits and keeping close contacts. Data traffic in all networks has increased significantly during the pandemic period. COVID-19 has increased the demand of data integration in the market. Fixed broadband networks have gained immense popularity for keeping the world connected. Traffic grew 30-40% overnight, driven primarily by working from large industry (video conferencing and collaboration, VPNs), learning from large industry (video conferencing and collaboration, e-learning platforms) and entertainment (online gaming, video streaming, social media). Moreover, limited supply and shortage of software has significantly affected data integration in the market. The flow of new equipments, such as computers, servers, switches, and Customer Premise Equipment (CPE) has either fully stopped or is delayed, with lead times of up to 12 months for different items.

Manufacturers are making various strategic decisions to bounce back post COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the data integration. With this, the companies will bring advanced data integration to the market.

For instance,

- In June 2022, salesforce expands mulesoft, a unified solution for automation, integration and APIs to easily automate workflow. This solution was expanded in order to integrate complex systems and data. This solution expansion took place for easy to standardize automation and integration process

Thus, COVID-19 has increased the demand of data integration in the market but limited supply and shortage of software has significantly affected data integration process in the market.

Recent Developments

- In June 2022, TIBCO Software Inc., relaunched its platform TIBCO Analytics Forum (TAF) for their consumer base. The platform will help the enterprises to connect, unify and confidently predict business outcomes. The platform will help in data integration and expansion of their solution portfolio. This will attract more new customers for the company

- In May 2022, Informatica Inc launched platform Intelligent Data Management Cloud (IDMC) for Financial Services to boost data life cycle of enterprises. The solution was launched by the company to enhance customer experience in terms of data. The company will be able to expand its solution portfolio for new customers

Global Data Integration Market Scope

The data integration market is segmented on the basis of offering (tools, services), business application (sales, marketing, finance, operations, human resources), enterprise size (small enterprise, medium enterprise, large enterprise), deployment mode (on-premise, cloud), vertical (manufacturing, healthcare & life sciences, IT & telecom, media & entertainment, retail & consumer goods, BFSI, energy & utilities, government & defence, and others).

Offering

- Tools

- Services

On the basis of offering, the global data integration market is segmented into tools and services.

Business Application

- Sales

- Marketing

- Operations

- Finance

- Human Resources

On the basis of business application, the global data integration market is segmented into sales, marketing, operations, finance and human resources.

Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

On the basis of enterprise size, the global data integration market is segmented into large enterprises, medium enterprises and small enterprises.

Deployment Mode

- Cloud

- On-Premises

On the basis of deployment model, the global data integration market is segmented into cloud and on-premises.

Vertical

- IT& Telecom

- Healthcare & Life Sciences

- Retail & Consumer Goods, Media & Entertainment

- BFSI, Energy & Utilities

- Government & Defense

- Others

On the basis of vertical, the global data integration market is segmented into IT & telecom, healthcare & life sciences, retail & consumer goods, media & entertainment, BFSI, energy & utilities, government & defense, and others.

Global Data Integration Market

The data integration market is analyzed and market insights and trends are provided on the basis of offering, business application, enterprise size, deployment mode, vertical deployment mode and vertical as referenced above.

Global data integration market covers regions such as U.S., Canada, Mexico U.A.E, Saudi Arabia, Israel, South Africa, Egypt, rest of Middle East and Africa, U.K., Germany, France, Spain, Italy, Russia, Turkey, Netherlands, Switzerland, Belgium, rest of Europe, China, India, Japan, South Korea, Singapore, Australia, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific .

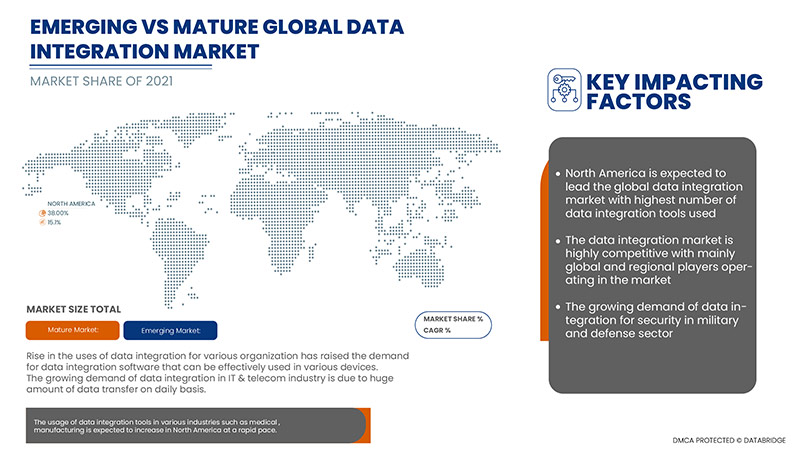

North America is expected to dominate the global data integration market as hybrid data integration has been in use lately due to its ability to connect applications, data files and business partners across cloud and on-premises systems and also data integration compliance program is a set of regulations or rules that a financial institution, companies such as large enterprises, small enterprises and medium enterprises must follow to prevent data loss and the growth of the country in the global data integration market.

The country section of the data integration market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Data Integration Market Share Analysis

The data integration market competitive landscape provides details of the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the data integration market.

Some of the major players operating in the global data integration market are Microsoft, Amazon Web Services, Inc. Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation ( Subsidiary of Hitachi, Ltd.), Salesforce, Inc. , Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLogic. among others.

SKU-