Global Data Colocation Market

Market Size in USD Billion

CAGR :

%

USD

63.92 Billion

USD

157.13 Billion

2024

2032

USD

63.92 Billion

USD

157.13 Billion

2024

2032

| 2025 –2032 | |

| USD 63.92 Billion | |

| USD 157.13 Billion | |

|

|

|

|

Data Colocation Market Size

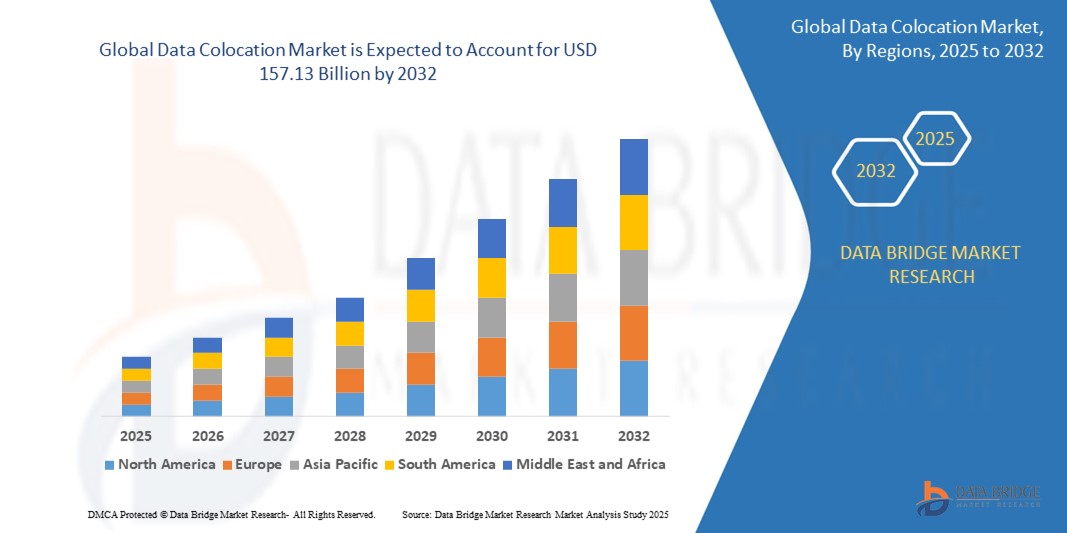

- The global data colocation market size was valued at USD 63.92 billion in 2024 and is expected to reach USD 157.13 billion by 2032, at a CAGR of 11.90% during the forecast period

- The market growth is primarily driven by the increasing demand for scalable, secure, and cost-effective data storage solutions, coupled with the rapid adoption of cloud computing and digital transformation across industries

- Rising concerns over data security, compliance with regulatory standards, and the need for reliable disaster recovery solutions are further propelling the demand for colocation services, making them a critical component of modern IT infrastructure

Data Colocation Market Analysis

- Data colocation services, which provide shared data center facilities for enterprises to house their servers and IT infrastructure, are becoming increasingly essential due to their ability to offer high reliability, robust connectivity, and reduced operational costs

- The surge in demand is fueled by the growing reliance on data-intensive technologies such as artificial intelligence, big data analytics, and IoT, alongside the need for businesses to ensure uptime and data accessibility

- North America dominated the data colocation market with the largest revenue share of 42.5% in 2024, driven by advanced IT infrastructure, widespread cloud adoption, and the presence of major colocation providers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing digitalization, and growing investments in IT infrastructure in countries such as China, India, and Singapore

- The large scale segment dominated the largest market revenue share of 62.5% in 2024, driven by the increasing demand from enterprises and hyperscalers for high-capacity, secure, and scalable data center solutions to support cloud computing, big data analytics, and AI workloads

Report Scope and Data Colocation Market Segmentation

|

Attributes |

Data Colocation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Colocation Market Trends

“Increasing Adoption of AI and Big Data Analytics”

- The global data colocation market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics to enhance data center operations

- These technologies enable advanced data processing, providing insights into server performance, energy efficiency, and predictive maintenance requirements

- AI-driven colocation solutions facilitate proactive issue resolution, identifying potential system failures before they result in costly downtime or inefficiencies

- For instances, colocation providers are leveraging AI platforms to optimize cooling systems based on real-time environmental data or to predict hardware failures by analyzing usage patterns

- This trend enhances the efficiency and reliability of colocation facilities, making them more appealing to enterprises seeking scalable and intelligent data management solutions

- AI algorithms can analyze extensive datasets, including network traffic, power consumption, and cooling efficiency, to improve resource allocation and reduce operational costs

Data Colocation Market Dynamics

Driver

“Rising Demand for Cloud Services and Edge Computing”

- The increasing adoption of cloud computing and edge computing is a major driver for the global data colocation market

- Colocation facilities provide the infrastructure needed for businesses to support cloud-based applications, offering scalability, high-speed connectivity, and robust security

- Government regulations, such as data sovereignty laws in regions such as Europe, are driving demand for localized colocation services to ensure compliance with data storage requirements

- The rise of IoT, 5G technology, and digital transformation initiatives is further expanding colocation applications, enabling faster data processing and lower latency for real-time services

- Enterprises are increasingly turning to colocation providers to access advanced infrastructure without the need for significant capital investment in building their own data centers

Restraint/Challenge

“High Initial Costs and Data Security Concerns”

- The high upfront costs of setting up and integrating colocation infrastructure, including network hardware, servers, storage, and cooling units, can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) in emerging markets

- Retrofitting existing facilities to meet colocation standards can be complex and expensive

- Data security and privacy concerns are a major challenge, as colocation facilities handle vast amounts of sensitive data for industries such as banking, healthcare, and government, raising risks of breaches or non-compliance with regulations such as GDPR

- The fragmented global regulatory landscape for data protection and privacy complicates operations for colocation providers operating across multiple regions

- These factors can deter potential clients, particularly in regions with high cost sensitivity or stringent data privacy awareness, limiting market growth

Data Colocation market Scope

The market is segmented on the basis of service type, components, and end-users.

- By Service Type

On the basis of service type, the global data colocation market is segmented into small scale and large scale. The large scale segment dominated the largest market revenue share of 62.5% in 2024, driven by the increasing demand from enterprises and hyperscalers for high-capacity, secure, and scalable data center solutions to support cloud computing, big data analytics, and AI workloads. Large-scale colocation facilities offer robust infrastructure and economies of scale, making them ideal for organizations with extensive data storage and processing needs.

The small scale segment is expected to witness the fastest growth rate of 14.2% from 2025 to 2032, driven by the rising adoption of colocation services among small and medium-sized enterprises (SMEs). These businesses seek cost-effective, flexible solutions to support digital transformation, cloud adoption, and data management without the high capital expenditure of building private data centers.

- By Components

On the basis of components, the global data colocation market is segmented into network hardware, server and storage, and cooling units. The server and storage segment is expected to hold the largest market revenue share of 58.7% in 2024, driven by the critical role of servers and storage systems in managing the exponential growth of data generated by businesses, IoT devices, and cloud applications. These components form the backbone of colocation facilities, enabling high-performance data processing and storage.

The cooling units segment is anticipated to experience the fastest growth rate of 13.8% from 2025 to 2032. The increasing density of computing equipment and the rising focus on energy efficiency are driving demand for advanced cooling solutions, such as liquid cooling and precision air conditioning, to maintain optimal operating conditions and reduce energy consumption in data centers.

- By End-Users

On the basis of end-users, the global data colocation market is segmented into banking, IT, healthcare, and government. The IT segment dominated the market revenue share of 38.4% in 2024, fueled by the sector’s heavy reliance on scalable, secure, and high-performance data center infrastructure to support cloud services, software development, and digital transformation initiatives. Major cloud providers such as AWS, Microsoft Azure, and Google Cloud drive significant demand for colocation services.

The healthcare segment is expected to witness the fastest growth rate of 15.1% from 2025 to 2032, driven by the rapid digital transformation in healthcare, including the adoption of electronic health records (EHRs), telemedicine, and AI-driven diagnostics. The need for secure, compliant, and scalable data storage solutions to manage sensitive patient data and ensure regulatory compliance is boosting the demand for colocation services in this sector.

Data Colocation Market Regional Analysis

- North America dominated the data colocation market with the largest revenue share of 42.5% in 2024, driven by advanced IT infrastructure, widespread cloud adoption, and the presence of major colocation providers

- Enterprises prioritize colocation services for scalability, cost-effectiveness, and enhanced security, particularly in regions with high data consumption and regulatory requirements

- Growth is supported by advancements in modular data centers, edge computing, and green infrastructure, alongside rising adoption in both hyperscale and enterprise segments

U.S. Data Colocation Market Insight

The U.S. data colocation market captured the largest revenue share of 80.9% in 2024 within North America, fueled by strong demand from hyperscalers and enterprises, as well as widespread digitalization. The trend towards hybrid cloud solutions and increasing regulations promoting data security and compliance further boost market expansion. The presence of major colocation hubs in states such as California, Texas, and Virginia complements enterprise demand, creating a robust ecosystem.

Europe Data Colocation Market Insight

The Europe data colocation market is expected to witness significant growth, supported by stringent data protection regulations such as GDPR and increasing demand for cloud and edge computing solutions. Enterprises seek colocation facilities that offer high uptime, scalability, and energy efficiency. Growth is prominent in both hyperscale and retail colocation, with countries such as Germany and the U.K. showing significant uptake due to rising digital transformation and sustainability initiatives.

U.K. Data Colocation Market Insight

The U.K. market for data colocation is expected to witness rapid growth, driven by demand for secure and scalable IT infrastructure in urban and financial hubs. Increased adoption of cloud services and rising awareness of data sovereignty benefits encourage colocation use. Evolving regulations balancing security and operational efficiency influence enterprise choices, supporting both retail and wholesale colocation growth.

Germany Data Colocation Market Insight

Germany is expected to witness rapid growth in the data colocation market, attributed to its advanced technological infrastructure and high enterprise focus on data security and efficiency. German enterprises prefer colocation facilities that offer low-latency processing and sustainable infrastructure. The integration of high-density colocation in hyperscale facilities and aftermarket solutions supports sustained market growth.

Asia-Pacific Data Colocation Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid digitalization, increasing internet penetration, and rising demand for cloud and virtualization technologies in countries such as China, India, and Japan. Growing awareness of scalability, cost efficiency, and data security boosts demand. Government initiatives promoting digital transformation and infrastructure investments further encourage the adoption of advanced colocation services.

Japan Data Colocation Market Insight

Japan’s data colocation market is expected to witness rapid growth due to strong enterprise preference for high-performance, secure colocation facilities that enhance operational reliability and compliance. The presence of major technology firms and integration of colocation in hyperscale data centers accelerate market penetration. Rising interest in edge computing and aftermarket solutions also contributes to growth.

China Data Colocation Market Insight

China holds the largest share of the Asia-Pacific data colocation market, propelled by rapid urbanization, increasing enterprise cloud adoption, and strong demand for scalable IT infrastructure. The country’s growing digital economy and focus on AI-driven workloads support the adoption of advanced colocation facilities. Robust domestic infrastructure investments and competitive service offerings enhance market accessibility.

Data Colocation Market Share

The data colocation industry is primarily led by well-established companies, including:

- NTT Communication Corporation (Japan)

- Digital Realty (U.S.)

- Cyxtera Technologies, Inc. (U.S.)

- CyrusOne (U.S.)

- Equinix (U.S.)

- AT&T (U.S.)

- CoreSite (U.S.)

- China Telecom Corporation Limited (China)

- Verizon (U.S.)

- NaviSite, Inc. (U.S.)

- Rackspace Technology (U.S.)

- DuPont (U.S.)

- TelecityGroup (U.K.)

- NTT DATA Corporation (Japan)

- KDDI Corporation (Japan)

- Lumen Technologies.(U.S.)

- Sungard Availability Services (U.S.)

What are the Recent Developments in Global Data Colocation Market?

- In September 2024, Equinix, Inc. secured a significant contract from the U.S. Department of Homeland Security (DHS) to deliver colocation services for the Homeland Security Enterprise Network (HSEN). The agreement covers power, connectivity, and operations and maintenance for HSEN’s East and West cloud access points. DHS selected Equinix based on its ability to provide direct network access to all major cloud service providers and zero-hop connectivity, ensuring high performance and minimal latency. This move underscores Equinix’s critical role in supporting secure, resilient infrastructure for national security operations

- In July 2024, Digital Realty Trust, Inc. completed the $200 million acquisition of a colocation data center campus in the Slough Trading Estate, UK. The site includes two data centers with a combined capacity of 15 megawatts, serving over 150 customers across technology, finance, and connectivity sectors. This strategic expansion strengthens Digital Realty’s presence in the West London submarket, complementing its existing facilities in the City and Docklands. The Slough campus will operate entirely on renewable energy, aligning with the company’s sustainability goals and enhancing its ability to support hyperscale and enterprise clients across Europe

- In May 2022, Cyxtera entered the Indian market through a strategic partnership with Sify Technologies Ltd., a leading ICT solutions provider. This collaboration enables Cyxtera to offer colocation services across five major Indian cities—Mumbai, Noida, Chennai, Hyderabad, and Kolkata—via Sify’s carrier-neutral data centers. In turn, Sify will resell Cyxtera’s full suite of solutions to its network of over 10,000 customers across North America, Europe, and Asia-Pacific. The partnership enhances Cyxtera’s global footprint and supports the rising demand for scalable, hybrid IT infrastructure in one of the world’s fastest-growing digital economies

- In February 2023, Google Cloud announced a strategic collaboration with StarHub, a leading Singapore-based telecom provider, to support its Cloud Infinity transformation program. The partnership integrates Google’s data management, AI, and machine learning tools with colocation services, enabling StarHub to build a secure, scalable, and energy-efficient cloud-native network. As part of the initiative, StarHub piloted Google Distributed Cloud Edge with Nokia’s 5G Standalone Core, creating a hybrid cloud-based 5G core network. This move enhances StarHub’s network operations and customer experience, while supporting industries such as manufacturing, retail, and transportation

- In February 2022, e& (formerly Etisalat Group) and G42 merged their data center businesses to form Khazna Data Centers, establishing the largest wholesale colocation provider in the Middle East. The joint venture consolidated twelve operational data centers, with plans for additional facilities to reach over 300 megawatts of capacity by the end of 2023. Khazna delivers secure, scalable, and energy-efficient infrastructure for enterprises, hyperscalers, and government clients, supporting the UAE’s digital transformation goal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.