Global Data Center Ups Market

Market Size in USD Billion

CAGR :

%

USD

7.20 Billion

USD

11.83 Billion

2024

2032

USD

7.20 Billion

USD

11.83 Billion

2024

2032

| 2025 –2032 | |

| USD 7.20 Billion | |

| USD 11.83 Billion | |

|

|

|

|

Data Center Uninterruptable Power Supply (UPS) Market Size

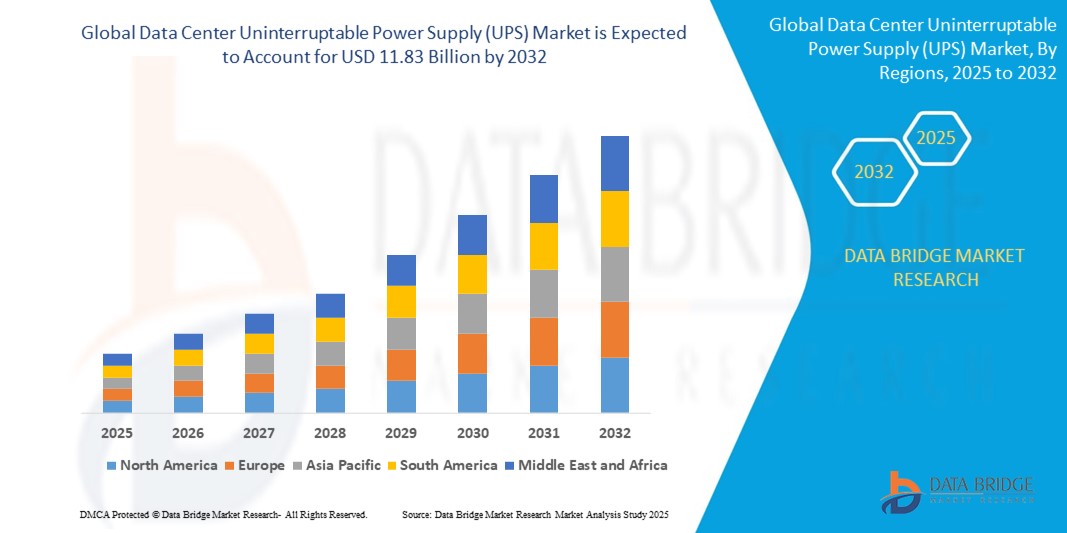

- The global data center uninterruptable power supply (UPS) market size was valued at USD 7.20 billion in 2024 and is expected to reach USD 11.83 billion by 2032, at a CAGR of 6.40% during the forecast period

- Market growth is primarily driven by the increasing number of data centers, rising adoption of cloud computing, and the surge in colocation facilities. As enterprises rely more heavily on digital services and uptime reliability, the demand for UPS systems to ensure continuous power supply has significantly escalated

- In addition, technological advancements in UPS systems, such as lithium-ion batteries, modular UPS architectures, and energy-efficient models, are fueling market expansion. Increasing investments in edge computing and hyperscale data centers, particularly across North America, Asia-Pacific, and Europe, are also contributing to market growth

Data Center Uninterruptable Power Supply (UPS) Market Analysis

- Data center UPS systems are essential for ensuring uninterrupted power supply in mission-critical environments, such as cloud infrastructure, financial services, healthcare IT systems, and hyperscale data centers, where even minimal downtime can lead to significant data loss and financial impact

- The escalating demand for data center UPS solutions is primarily driven by the exponential growth of digital services, rising cloud adoption, increasing deployment of edge computing infrastructure, and the need for 24/7 availability of online services

- Europe dominates the data center UPS market with the largest revenue share of approximately 39% in 2025, supported by the presence of a dense network of colocation and hyperscale data centers in countries such as Germany, the Netherlands, and the UK. Strict regulatory frameworks around data protection and energy efficiency, along with major investments in green data centers, are further accelerating market growth in the region

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid digital transformation, the surge in data center construction across countries such as India, China, and Singapore, and growing demand for reliable IT infrastructure from SMEs and large enterprises

- The On-Line Double-Conversion segment is expected to dominate the data center UPS market with a market share of around 45.5% in 2025, owing to its superior power protection capabilities, continuous voltage regulation, and suitability for sensitive IT equipment in high-density data center environments

Report Scope and Data Center Uninterruptable Power Supply (UPS) Market Segmentation

|

Attributes |

Data Center Uninterruptable Power Supply (UPS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Data Center Uninterruptable Power Supply (UPS) Market Trends

“Advancements in Lithium-Ion and Intelligent UPS Systems”

- A significant and accelerating trend in the global data center UPS market is the transition from traditional valve-regulated lead-acid (VRLA) batteries to lithium-ion-based UPS systems, driven by the need for higher efficiency, reduced footprint, longer lifespan, and lower total cost of ownership

- For instance, Vertiv and Eaton have introduced lithium-ion UPS systems specifically designed for edge and hyperscale data centers, offering faster recharge times, longer battery life (up to 10 years), and enhanced thermal performance compared to conventional batteries

- Intelligent UPS systems with built-in communication and monitoring capabilities are gaining traction. These systems provide real-time diagnostics, predictive maintenance alerts, and remote performance management, minimizing downtime and allowing proactive response to potential issues

- AI and machine learning integration in UPS systems is enabling automated load balancing, energy optimization, and anomaly detection. These smart systems can dynamically adjust power supply patterns based on usage trends and predictive analytics, improving reliability and operational efficiency

- The seamless integration of UPS systems with Data Center Infrastructure Management (DCIM) platforms is creating centralized control over power, thermal, and IT infrastructure, allowing for holistic monitoring and control. Companies such as Schneider Electric and ABB offer cloud-based DCIM solutions that sync with modular UPS units for unified facility management

- This trend towards modular, intelligent, and energy-efficient UPS solutions is reshaping expectations for data center infrastructure, encouraging key players to innovate with compact, scalable, and eco-friendly systems tailored for hybrid IT environments

- Demand for smart UPS solutions is rising rapidly across colocation, enterprise, and hyperscale data centers as operators prioritize efficiency, scalability, and 24/7 uptime, in response to the surging global demand for digital services and low-latency applications

Data Center Uninterruptable Power Supply (UPS) Market Dynamics

Driver

“Surging Data Center Demand and Emphasis on Power Continuity”

- The rapid growth in cloud computing, edge data centers, and hyperscale facilities globally is significantly driving demand for UPS systems that ensure uninterrupted power supply. With digital transformation accelerating across industries, the need for always-on infrastructure is higher than ever

- For instance, in February 2024, Eaton launched its new 93PR5 UPS, an energy-efficient, scalable solution for edge and enterprise data centers, optimized for low latency and maximum uptime—addressing rising enterprise demand for power continuity

- Increasing emphasis on zero-downtime service delivery by financial institutions, healthcare providers, and telecom companies is pushing data center operators to invest in high-reliability UPS systems as part of business continuity planning

- In addition, governments and regulatory bodies in regions such as Europe and North America are enforcing data center resilience and energy efficiency standards, which encourage the integration of modern, energy-optimized UPS systems

- Advances in modular UPS architectures, lithium-ion batteries, and intelligent monitoring features are enhancing system efficiency, lowering TCO, and improving uptime—further supporting market expansion globally

Restraint/Challenge

“High Initial Investment and Limited Scalability in Legacy Systems”

- The high upfront cost associated with deploying advanced UPS systems—especially modular or lithium-ion-based setups—poses a significant challenge for small- and medium-sized enterprises (SMEs) and data center operators in cost-sensitive regions

- For instance, many data centers in emerging markets continue to rely on outdated VRLA-based UPS systems due to budget constraints, which often lack the scalability and energy efficiency needed for modern IT environments

- Retrofitting legacy infrastructure to support new UPS technologies can also be complex and costly, involving changes to floor layout, cooling systems, and energy management platforms

- Furthermore, the need for specialized maintenance, skilled technicians, and safety certifications for newer UPS systems adds operational burdens for smaller players and regional colocation providers

- Overcoming these challenges will require cost-optimized, plug-and-play solutions and broader support for infrastructure upgrades—particularly in APAC, Latin America, and parts of the Middle East where digital infrastructure is expanding but funding is constrained

Data Center Uninterruptable Power Supply (UPS) Market Scope

The market is segmented on the basis of type, offering, capacity, battery type, data center type, data center size, application, and end user.

By Type

On the basis of type, the data center UPS market is segmented into on-line double-conversion, line interactive, and passive standby. The On-Line Double-Conversion segment dominates the largest market revenue share in 2025, driven by its high reliability, continuous power conditioning, and zero transfer time—ideal for mission-critical data center applications. Enterprises prioritize this UPS type for ensuring seamless operation during outages and voltage fluctuations, especially in hyperscale and cloud data centers

The Line Interactive segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by growing demand from edge and small to mid-sized data centers. These systems offer cost-effective power protection and moderate battery backup, making them suitable for less demanding IT infrastructure and regional facilities

• By Offering

On the basis of offering, the data center UPS market is segmented into solution and services. The Solution segment held the largest market revenue share in 2025, driven by widespread adoption of integrated UPS systems that combine power protection with battery management and monitoring solutions. Solutions are increasingly customized for large-scale deployments with modular and scalable configurations

The Services segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rising demand for maintenance, remote monitoring, and battery replacement services to enhance UPS performance and lifespan

• By Capacity

On the basis of capacity, the data center UPS market is segmented into Below 500 kVA, 500–1000 kVA, and Above 1000 kVA. The Above 1000 kVA segment accounted for the largest market revenue share in 2025, supported by increased deployment in hyperscale and colocation data centers that require high-capacity UPS systems to handle substantial IT loads

The Below 500 kVA segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the proliferation of edge data centers and distributed computing environments where compact UPS systems are preferred

• By Battery Type

On the basis of battery type, the data center UPS market is segmented into VRLA UPS, lithium-Ion UPS, flywheel UPS, and Others. The VRLA UPS segment held the largest market revenue share in 2025, attributed to its cost-effectiveness, proven reliability, and widespread legacy use in traditional data centers

The Lithium-Ion UPS segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advantages such as longer life cycles, reduced footprint, faster recharge, and increasing adoption in high-efficiency data center environments

• By Data Center Type

On the basis of data center type, the market is segmented into colocation data center, enterprise data center, cloud and edge data center, and managed data center. The colocation data center segment dominated the largest market revenue share in 2025, owing to the rapid growth of shared infrastructure demand and increased outsourcing of data hosting to third-party providers

The cloud and edge data center segment is projected to witness the fastest growth from 2025 to 2032, supported by the global push for low-latency digital services and the rise of 5G and IoT deployments

• By Data Center Size

On the basis of data center size, the market is segmented into small, medium, and large. The Large segment accounted for the largest revenue share in 2025, due to increasing hyperscale deployments and high-density computing requirements from global cloud providers

The Small segment is expected to register the fastest CAGR during the forecast period, driven by the emergence of micro and modular data centers supporting edge computing and localized data processing

• By Application

On the basis of application, the market is segmented into cloud storage, data warehouse, ERP System, file servers, application servers, CRM systems, and others. The Cloud Storage segment held the largest market revenue share in 2025, supported by exponential growth in digital content, enterprise cloud migration, and demand for scalable storage systems

The ERP System segment is expected to grow at the fastest rate from 2025 to 2032, as businesses increasingly rely on uninterrupted backend operations and data integrity in real-time enterprise management systems

• By End User

On the basis of end user, the data center UPS market is segmented into IT and ITeS, BFSI, telecommunications, manufacturing, government and public sector, healthcare and life sciences, media and entertainment, banking and financial services, and energy. The IT and ITeS segment accounted for the largest market revenue share in 2025, driven by the surge in digital infrastructure and the need for uninterrupted IT service delivery

The healthcare and life sciences segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing digitization of medical records, telehealth platforms, and data-heavy applications requiring robust uptime and power continuity

Data Center Uninterruptable Power Supply (UPS) Market Regional Analysis

- Europe dominates the global Data Center UPS market with the largest revenue share of approximately 39% in 2025, driven by stringent regulatory frameworks on data center energy efficiency and uptime, rapid digital transformation, and strong investments in cloud infrastructure and edge data centers across countries such as Germany, the UK, France, and the Nordics

- The region’s focus on sustainability and green data centers fuels demand for high-efficiency, eco-friendly UPS systems that comply with regulations such as the EU’s Energy Efficiency Directive and GDPR

- Enterprises and data center operators in Europe prioritize UPS solutions that integrate advanced battery technologies, renewable energy compatibility, and robust monitoring for power quality and reliability to maintain critical uptime and meet strict service level agreements (SLAs)

- Government incentives promoting clean energy adoption and investments in smart grids support the growth of modular and scalable UPS deployments

- In addition, increasing digitization across manufacturing, financial services, telecom, and healthcare sectors strengthens the need for uninterrupted power supply and reliable data protection

U.K. Data Center Uninterruptible Power Supply (UPS) Market Insight

The U.K. Data Center UPS market is expected to witness strong growth due to increasing investments in cloud infrastructure, edge computing facilities, and stringent regulations on data center uptime and energy efficiency. Heightened focus on reducing power outages and ensuring business continuity across financial services, telecommunications, and government sectors drives demand for advanced UPS solutions. Additionally, growing adoption of modular and scalable UPS systems integrated with renewable energy sources supports market expansion. The mature retail and e-commerce channels further facilitate accessibility to cutting-edge UPS technologies for small to large data center operators

Germany Data Center Uninterruptible Power Supply (UPS) Market Insight

Germany’s Data Center UPS market is projected to expand steadily, supported by the country’s robust industrial and IT sectors, as well as strict compliance requirements related to data security and power reliability. German data centers prioritize energy-efficient, eco-friendly UPS systems to align with the country’s commitment to sustainability and the EU’s Energy Efficiency Directive. The presence of numerous manufacturing hubs and large enterprises in Germany drives demand for reliable, high-capacity UPS infrastructure that safeguards critical operations. Innovations in battery technology and integration with smart grid solutions further bolster market growth

North America Data Center Uninterruptible Power Supply (UPS) Market Insight

The North American Data Center UPS market leads globally, fueled by widespread adoption of hyperscale cloud data centers and increasing digital transformation in enterprises. The U.S. and Canada see strong demand for cutting-edge UPS systems featuring lithium-ion batteries, modular design, and AI-enabled predictive maintenance. Regulatory frameworks emphasizing power availability and data security, such as NERC CIP and state-level mandates, push data center operators to invest in resilient and scalable UPS technologies. Additionally, the rapid growth of edge computing and telecom infrastructure expands the need for decentralized UPS deployments

U.S. Data Center Uninterruptible Power Supply (UPS) Market Insight

The U.S. market commands the largest share within North America, driven by the presence of major cloud providers, financial institutions, and government agencies requiring uninterrupted power supply for mission-critical data centers. High capital expenditure budgets enable adoption of premium UPS solutions that offer high efficiency, low total cost of ownership, and remote monitoring capabilities. The rise of data sovereignty laws and cybersecurity concerns also contribute to UPS investments. Increasing deployment of renewable energy-powered data centers accelerates demand for hybrid UPS systems capable of seamless integration with clean energy sources

Asia-Pacific Data Center Uninterruptible Power Supply (UPS) Market Insight

The Asia-Pacific region is the fastest-growing market globally for Data Center UPS systems, expanding at a CAGR exceeding 12% through 2030. Rapid urbanization, expanding IT infrastructure, and government-backed digital initiatives in countries such as China, India, Japan, and Australia fuel growth. Rising construction of hyperscale and colocation data centers to support growing cloud adoption and 5G rollout drives the demand for reliable and scalable UPS solutions. Power grid instability and frequent outages in certain APAC countries also make high-performance UPS systems critical for business continuity

Japan Data Center Uninterruptible Power Supply (UPS) Market Insight

Japan’s Data Center UPS market benefits from its advanced technology ecosystem and a high concentration of manufacturing and telecommunication industries. The demand for compact, efficient, and technologically sophisticated UPS systems is growing, especially those offering enhanced energy-saving features and predictive diagnostics. Japan’s aging workforce and emphasis on automation increase the need for reliable power backup solutions in both commercial and industrial data centers. Environmental regulations also promote adoption of green UPS technologies

China Data Center Uninterruptible Power Supply (UPS) Market Insight

China commands the largest revenue share in the Asia-Pacific Data Center UPS market in 2025, driven by rapid expansion of data center infrastructure, cloud computing, and government mandates on energy efficiency and uptime. The booming manufacturing, e-commerce, and telecom sectors contribute to strong UPS demand. Domestic UPS manufacturers are increasingly innovating to offer cost-effective, high-performance systems tailored to local requirements. National initiatives aimed at strengthening data security and reducing carbon emissions further support market growth

Data Center Uninterruptable Power Supply (UPS) Market Share

The data center uninterruptable power supply (UPS) industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Schneider Electric (France)

- Eaton (Ireland)

- Vertiv Group Corp (U.S.)

- Mitsubishi Electric Corporation (Japan)

- N1 Critical Technologies (U.S.)

- Legrand (France)

- Delta Electronics, Inc. (Taiwan)

- Huawei Digital Power Technologies Co., Ltd. (China)

- Toshiba Corporation. (Japan)

- LITE-ON Technology Corporation. (Taiwan)

- Power Innovations International, Inc. (U.S.)

- SOCOMEC (France)

- Borri S.p.A. (Italy)

- Fuji Electric Co., Ltd. (Japan)

- Hitachi Hi-Rel Power Electronics Private Limited (India)

- KOHLER Uninterruptible Power Limited (U.S.)

Latest Developments in Global Ear Muffs Market

- In December 2024, Vertiv acquired BiXin Energy, a Chinese company specializing in centrifugal chiller technology, through its subsidiary. This acquisition strengthens Vertiv’s portfolio, enhancing its ability to provide advanced cooling and power solutions for AI-driven data centers and high-performance computing. BiXin Energy’s expertise in water-cooled and air-cooled systems supports Vertiv’s global infrastructure expansion, addressing the growing demand for integrated solutions

- In June 2024, ABM Industries acquired Quality Uptime Services for $119 million, expanding its presence in the UPS market. Quality Uptime, a leader in uninterrupted power supply system maintenance, will integrate into ABM’s Mission Critical Solutions group. This acquisition enhances ABM’s capabilities in data center infrastructure, including electrical testing, UPS service, and battery maintenance, supporting mission-critical environments

- In July 2023, Fuji Electric launched the 7500WX series, a high-capacity uninterruptible power supply (UPS) system tailored for hyperscale data centers and semiconductor facilities. The latest model boasts a single-unit capacity of 2,400 kVA, one of the highest in the industry, addressing the growing demand for 20,000 kVA or more in modern data infrastructures. With 98.5% power conversion efficiency, it significantly reduces CO₂ emissions and operating costs

- In May 2023, Schneider Electric secured a five-year, $3 billion contract with Compass Datacenters to provide prefabricated modular data center solutions. This agreement expands their existing partnership, integrating supply chains to streamline manufacturing and deployment. The collaboration supports the growing demand for scalable, energy-efficient infrastructure, driven by AI and cloud computing advancements

- In November 2022, Huawei introduced FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a compact power supply system integrated into its Smart Modular Data Center series. These innovations enhance data efficiency at the edge, offering cost-effective and green digitization solutions for businesses. The FusionModule2000 6.0 features optimized cooling efficiency, a small footprint, and intelligent management, while UPS2000-H provides high reliability and energy savings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES MODEL

5.2 REGULATORY STANDARDS

5.3 CASE STUDIES

5.4 TECHNOLOGY LANDSCAPE

5.5 PRICING ANALYSIS

5.6 VALUE CHAIN ANALYSIS

6 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY TYPE

6.1 OVERVIEW

6.2 ON–LINE DOUBLE-CONVERSION

6.3 LINE INTERACTIVE

6.4 PASSIVE STANDBY

7 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOLUTION

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.2 MANAGED SERVICES

8 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY CAPACITY

8.1 OVERVIEW

8.2 BELOW 500 KVA

8.3 500−1,000 KVA

8.4 ABOVE 1,000 KVA

9 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY BATTERY SIZE

9.1 OVERVIEW

9.2 VRLA UPS

9.3 FLYWHEEL UPS

9.4 LITHIUM-ION UPS

9.5 OTHERS

10 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY DATA CENTER TYPE

10.1 OVERVIEW

10.2 COLOCATION DATA CENTER

10.2.1 BY CAPACITY

10.2.1.1. BELOW 500 KVA

10.2.1.2. 500−1,000 KVA

10.2.1.3. ABOVE 1,000 KVA

10.3 CLOUD AND EDGE DATA CENTER

10.3.1 BY CAPACITY

10.3.1.1. BELOW 500 KVA

10.3.1.2. 500−1,000 KVA

10.3.1.3. ABOVE 1,000 KVA

10.4 ENTERPRISE DATA CENTER

10.4.1 BY CAPACITY

10.4.1.1. BELOW 500 KVA

10.4.1.2. 500−1,000 KVA

10.4.1.3. ABOVE 1,000 KVA

10.5 MANAGED DATA CENTER

10.5.1 BY CAPACITY

10.5.1.1. BELOW 500 KVA

10.5.1.2. 500−1,000 KVA

10.5.1.3. ABOVE 1,000 KVA

11 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY DATA CENTER SIZE

11.1 SMALL

11.2 MEDIUM

11.3 LARGE

12 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY APPLICATION

12.1 CLOUD STORAGE

12.2 ERP SYSTEM

12.3 DATA WAREHOUSE

12.4 FILE SERVERS

12.5 APPLICATION SERVERS

12.6 CRM SYSTEMS

12.7 OTHERS

13 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY END USER

13.1 IT & ITES

13.1.1 BY TYPE

13.1.1.1. PASSIVE STANDBY

13.1.1.2. LINE INTERACTIVE

13.1.1.3. ON-LINE DOUBLE-CONVERSION

13.2 BFSI

13.2.1 BY TYPE

13.2.1.1. PASSIVE STANDBY

13.2.1.2. LINE INTERACTIVE

13.2.1.3. ON-LINE DOUBLE-CONVERSION

13.3 TELECOMMUNICATIONS

13.3.1 BY TYPE

13.3.1.1. PASSIVE STANDBY

13.3.1.2. LINE INTERACTIVE

13.3.1.3. ON-LINE DOUBLE-CONVERSION

13.4 GOVERNMENT AND PUBLIC SECTOR

13.4.1 BY TYPE

13.4.1.1. PASSIVE STANDBY

13.4.1.2. LINE INTERACTIVE

13.4.1.3. ON-LINE DOUBLE-CONVERSION

13.5 MANUFACTURING

13.5.1 BY TYPE

13.5.1.1. PASSIVE STANDBY

13.5.1.2. LINE INTERACTIVE

13.5.1.3. ON-LINE DOUBLE-CONVERSION

13.6 HEALTHCARE AND LIFE SCIENCES

13.6.1 BY TYPE

13.6.1.1. PASSIVE STANDBY

13.6.1.2. LINE INTERACTIVE

13.6.1.3. ON-LINE DOUBLE-CONVERSION

13.7 MEDIA AND ENTERTAINMENT

13.7.1 BY TYPE

13.7.1.1. PASSIVE STANDBY

13.7.1.2. LINE INTERACTIVE

13.7.1.3. ON-LINE DOUBLE-CONVERSION

14 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, BY REGION

GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 FRANCE

14.2.4 ITALY

14.2.5 SPAIN

14.2.6 THE NETHERLANDS

14.2.7 SWITZERLAND

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 RUSSIA

14.2.11 SWEDEN

14.2.12 FINLAND

14.2.13 DENMARK

14.2.14 NORWAY

14.2.15 POLAND

14.2.16 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 CHINA

14.3.2 JAPAN

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 AUSTRALIA AND NEW ZEALAND

14.3.7 MALAYSIA

14.3.8 PHILIPPINES

14.3.9 THAILAND

14.3.10 INDONESIA

14.3.11 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 U.A.E

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AFRICA

14.5.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL DATA CENTER UNINTERRUPTED POWER SUPPLY (UPS) MARKET, COMPANY PROFILE

17.1 ABB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 SCHNEIDER ELECTRIC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 EATON

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 VERTIV GROUP CORP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 MITSUBISHI ELECTRIC POWER PRODUCTS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 GENERAL ELECTRIC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 LEGRAND GROUP

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 DELTA ELECTRONICS, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 TOSHIBA INTERNATIONAL CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 POWER INNOVATIONS INTERNATIONAL, INC

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 SOCOMEC

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 BORRI S.P.A.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 RPS SPA

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 AEG POWER SOLUTIONS

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 FUJI ELECTRIC CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 HITACHI, LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 KOHLER CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 SOLAREDGE TECHNOLOGIES, INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 PILLER POWER SYSTEMS (LANGLEY HOLDINGS PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 CYBER POWER SYSTEMS

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

17.22 KEHUA DATA CO., LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 GEOGRAPHIC PRESENCE

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENTS

17.23 CLARY CORPORATION

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 GEOGRAPHIC PRESENCE

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENTS

17.24 SHENZHEN KSTAR SCIENCE&TECHNOLOGY CO., LTD.

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 GEOGRAPHIC PRESENCE

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENTS

17.25 ENERSYS

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 GEOGRAPHIC PRESENCE

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENTS

17.26 PANDUIT CORP.

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 GEOGRAPHIC PRESENCE

17.26.4 PRODUCT PORTFOLIO

17.26.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Data Center Ups Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Center Ups Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Center Ups Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.