Global Data Center Rack Server Market

Market Size in USD Billion

CAGR :

%

USD

91.07 Billion

USD

337.72 Billion

2024

2032

USD

91.07 Billion

USD

337.72 Billion

2024

2032

| 2025 –2032 | |

| USD 91.07 Billion | |

| USD 337.72 Billion | |

|

|

|

|

Data Centre Rack Server Market Size

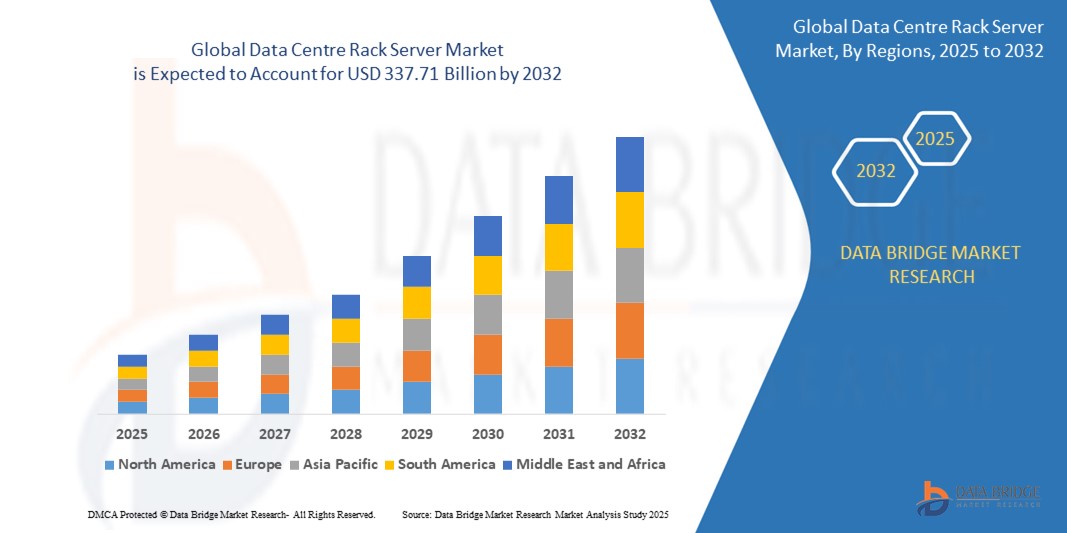

- The global data centre rack server market size was valued at USD 91.07 billion in 2024 and is expected to reach USD 337.71 billion by 2032, at a CAGR of 17.80% during the forecast period

- This growth is driven by factors such as the increasing demand for cloud services, the rise of big data, and the growing need for high-performance computing across various industries

Data Centre Rack Server Market Analysis

- Data centre rack servers are essential components used to manage and store vast amounts of data, providing high-density processing power and efficient space utilization. They are critical in supporting cloud computing, big data analytics, and other enterprise IT infrastructures

- The demand for data centre rack servers is significantly driven by the growing need for high-performance computing, cloud services, and the increasing volume of data generated globally

- North America is expected to dominate the data centre rack server market with largest market share of 42.3%, due to its advanced technological infrastructure, high adoption of cloud services, and significant investments in data centres

- Asia-Pacific is expected to be the fastest growing region in the data centre rack server market during the forecast period due to rapid digital transformation, rising data consumption, and increased demand for cloud and IT services

- Cabinet rack segment is expected to dominate the market with a largest market share of 58.1% due to factors such as these racks are increasingly used in data centers because they provide secure, organized, and modular solutions for housing critical IT equipment. The rising demand for data storage and processing capabilities, spurred by the exponential growth in data generation plays a significant role

Report Scope and Data Centre Rack Server Market Segmentation

|

Attributes |

Data Centre Rack Server Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Centre Rack Server Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- One prominent trend in the evolution of operating microscopes and 3D visualization systems for intraocular surgery is the increasing integration of advanced optics and digital enhancements

- These innovations enhance surgical precision by offering high-definition, real-time visualization of intraocular structures, improving accuracy in delicate procedures.

- For instance, AI-powered systems can automatically adjust server capacities based on workload demands, ensuring higher energy efficiency and minimizing operational costs

- These advancements are transforming the data centre infrastructure, improving resource utilization, and driving the demand for next-generation rack servers designed to support high-performance computing, cloud, and edge computing needs

Data Centre Rack Server Market Dynamics

Driver

“Growing Demand Due to Digital Transformation and Data Explosion”

- The increasing reliance on data-driven decision-making, cloud services, and big data analytics is significantly contributing to the growing demand for data centre rack servers

- As businesses and industries continue to digitize and expand their operations, the need for high-capacity, efficient, and scalable data storage and processing solutions is rising

- With the growing volume of data generated from various sources like IoT devices, social media, and e-commerce, enterprises are investing in advanced data centre rack servers to handle this data load, ensuring optimal performance and scalability

For instance,

- In 2024, global data creation and replication were projected to reach 181 zettabytes by 2025 (according to IDC), fueling the need for efficient data storage solutions.

- As a result, the increasing data consumption, digital transformation, and reliance on cloud computing services are driving the demand for high-performance data centre rack servers

Opportunity

“Artificial Intelligence & Automation Integration for Data Centre Rack Servers”

- AI-powered data centre rack servers can enhance system performance by automating routine management tasks, improving load balancing, and optimizing energy consumption, leading to greater efficiency and reduced operational costs

- AI algorithms can be integrated into rack servers to predict hardware failures, optimize resource allocation, and improve overall uptime, helping data centres reduce downtime and improve service reliability

- AI-based predictive analytics can help identify trends and patterns in data traffic, enabling data centres to better scale their infrastructure in real-time to meet growing demands

For instance,

- In 2024, a report by IDC projected that AI-driven automation in data centres could reduce energy costs by up to 30%, while improving data processing speed and reducing manual errors

- The integration of AI and automation into data centre rack servers presents a significant opportunity to enhance operational efficiencies, reduce costs, and support the growing demands of cloud computing, big data, and IoT applications

Restraint/Challenge

“High Capital and Maintenance Costs Hindering Market Growth”

- The high initial capital investment and ongoing maintenance costs of data centre rack servers pose a significant challenge for market penetration, particularly affecting small and medium-sized enterprises (SMEs) and organizations in developing regions

- These rack servers, which are essential for large-scale data storage, processing, and cloud computing, often require investments ranging from thousands to millions of dollars depending on the scale and complexity

- The substantial financial burden associated with purchasing and maintaining these systems can deter businesses with limited budgets from adopting cutting-edge infrastructure or upgrading existing systems, leading to reliance on outdated technology

- Consequently, these financial constraints can create barriers to broader adoption, particularly in emerging markets, and slow down the overall growth of the data centre rack server market

Data Centre Rack Server Market Scope

The market is segmented on the basis of component, form factor, service, tier type, data centre type, rack, and industry

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Form Factor |

|

|

By Service |

|

|

By Tier Type |

|

|

By Data Centre Type |

|

|

By Rack |

|

|

By Industry |

|

In 2025, the cabinet rack is projected to dominate the market with a largest share in rack segment

The cabinet rack segment is expected to dominate the data centre rack server market with the largest share of 58.1% due to factors such as these racks are increasingly used in data centers because they provide secure, organized, and modular solutions for housing critical IT equipment. The rising demand for data storage and processing capabilities, spurred by the exponential growth in data generation plays a significant role

The IT and telecom is expected to account for the largest share during the forecast period in industry segment

In 2025, the IT and telecom segment is expected to dominate the market with the largest market share of 27.1% due to the exponential growth of data generated by various applications, including cloud computing, big data analytics, and artificial intelligence, necessitates robust and scalable data storage and processing solutions. Data center racks provide the essential infrastructure to house high-density servers and storage devices efficiently, facilitating the seamless management and processing of large volumes of data

Data Centre Rack Server Market Regional Analysis

“North America Holds the Largest Share in the Data Centre Rack Server Market”

- North America dominates the data centre rack server market with largest market share of 42.3%, driven by its advanced technological infrastructure, high demand for cloud services, and a strong presence of key industry players such as IBM, Dell, and Cisco

- The United States holds a significant share of over 36%, due to increasing adoption of cloud computing, big data analytics, and the growing need for high-performance computing to support industries like finance, healthcare, and technology

- The availability of robust data security regulations, well-established digital transformation initiatives, and substantial investments in data centre expansions further strengthen the market in the region

- The increasing number of data centres and high demand for energy-efficient server solutions are fueling market expansion across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Data Centre Rack Server Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the data centre rack server market, driven by rapid digital transformation, increasing data consumption, and growing demand for cloud services

- Countries such as China, India, and Japan are emerging as key markets due to their expanding digital economies, rising demand for data storage, and rapid adoption of technologies like AI, IoT, and big data analytics

- China, with its large population and rapidly expanding technology sector, is investing heavily in infrastructure, creating significant demand for data centre rack servers. India’s growing cloud computing market and the rise of tech startups are contributing to this regional growth as well

- Japan, known for its advanced technology infrastructure, continues to lead in the adoption of high-performance computing solutions and energy-efficient data centre solutions. The country’s emphasis on innovation and sustainability in data centres further supports market growth in the region

Data Centre Rack Server Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco Systems, Inc. (U.S.)

- Broadcom (U.S.)

- Oracle (U.S.)

- Eaton (U.S.)

- Cannon Technologies Ltd (U.K.)

- C & F Tooling (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Preformed Line Products (U.S.)

- Legrand SA (France)

- Tokyo Century Corporation (Japan)

- Infiniti Research Ltd (India)

- Vertiv Group Corp. (U.S.)

- Tripp Lite (U.S.)

- RS Components & Controls (I) Ltd. (India)

- Rittal India Pvt. Ltd. (India)

- Hewlett Packard Enterprise Development LP (U.S.)

- Black Box Corporation (U.S.)

- CtrlS Datacenters Ltd (India)

- Nextra Online Services (India)

- Contabo (Germany)

Latest Developments in Global Data Centre Rack Server Market

- In March 2024, Eaton introduced its innovative SmartRack modular data center solution in North America, designed to meet the escalating demands of edge computing, machine learning, and artificial intelligence (AI). These modular data centers can be deployed within days across a variety of environments, including colocation and enterprise data centers, warehouses, and manufacturing facilities. This development highlights a significant trend in the global Data Centre Rack Server Market, as businesses increasingly seek scalable, efficient, and high-performance solutions to address growing data processing needs

- In April 2022, Rittal GmbH & Co. KG, a leading global manufacturer of system solutions for industrial and IT enclosures, announced a strategic partnership with TD SYNNEX, a prominent global distributor and solutions aggregator within the IT ecosystem. Through this collaboration, Rittal will distribute its IT rack enclosures, solutions, and accessories to IT customers via TD SYNNEX’s extensive distribution network. This partnership reflects a growing trend in the global Data Centre Rack Server Market, as companies increasingly seek streamlined access to high-quality, integrated solutions for their data centre needs

- In August 2022, Vertiv Group Corp. introduced its Vertiv MegaMod Plus and Vertiv MegaMod, turnkey prefabricated modular (PFM) data center solutions across Europe, the Middle East, and Africa (EMEA). These advanced prefabricated modules are available in expandable units of 0.5 or 1 megawatt, with the capability to support IT loads of up to 2 megawatts or more. This launch underscores a key trend in the global Data Centre Rack Server Market, where there is increasing demand for flexible, scalable, and high-performance infrastructure solutions

- In October 2022, NetRack introduced the iRack Block, a cutting-edge solution designed to address the demands of larger installations. This innovative offering marks a significant leap toward intelligent infrastructure, featuring self-cooling, self-powered, and self-contained systems. The iRack Block is tailored to meet the needs of extensive data center requirements, representing a transformative step toward modular data centers. It enhances operational efficiency and adaptability, particularly in large-scale environments. This development aligns with key trends in the global Data Centre Rack Server Market, where the demand for scalable, energy-efficient, and easily deployable solutions is on the rise

- In June 2022, Schneider Electric formed a strategic partnership with Stratus Technologies and Avnet Integrated to enable streamlined, zero-touch edge computing. This collaboration is designed to foster the next phase of industrial innovation by integrating advanced technologies into data center operations. This partnership addresses the increasing demand for flexible, efficient, and secure edge computing solutions. By integrating edge computing capabilities into data center infrastructure, Schneider Electric is aligning with the market's shift towards decentralized, high-performance computing solutions that cater to modern technological advancements such as IoT, AI, and big data analytics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.