Global Data Center Power Market

Market Size in USD Billion

CAGR :

%

USD

18.50 Billion

USD

32.70 Billion

2024

2032

USD

18.50 Billion

USD

32.70 Billion

2024

2032

| 2025 –2032 | |

| USD 18.50 Billion | |

| USD 32.70 Billion | |

|

|

|

|

Data Centre Power Market Size

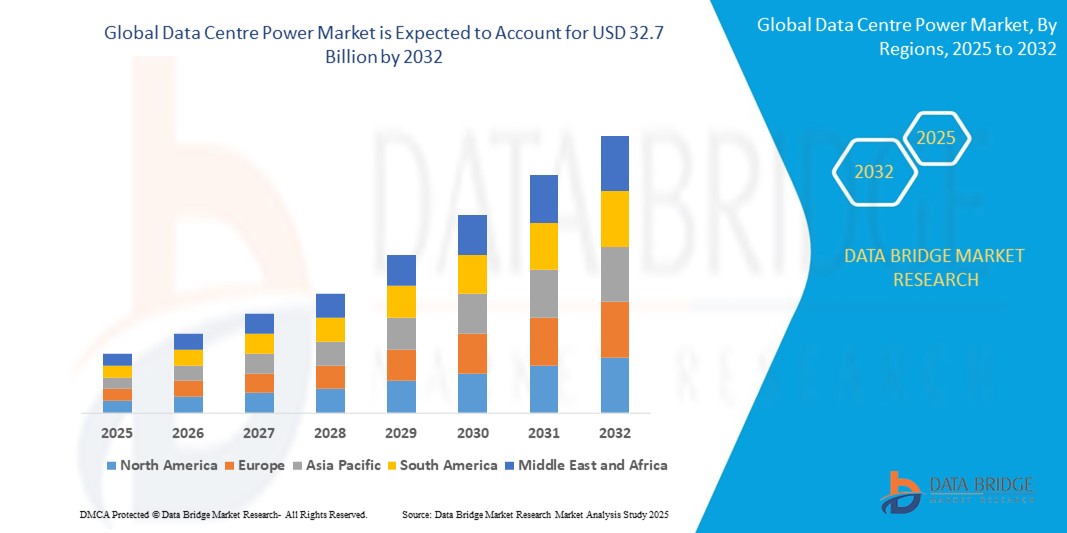

- The Global Data Centre Power Market Size was valued at USD 18.5 Billion in 2024 and is expected to reach USD 32.7 Billion by 2032, at a CAGR of 8.5% during the forecast period

- The growth of the Global Data Centre Power Market is fueled by the exponential increase in data consumption driven by cloud computing, big data analytics, and the Internet of Things (IoT) necessitates the expansion of data center infrastructure globally, thereby boosting demand for reliable and efficient power solutions

Data Centre Power Market Analysis

The Global Data Centre Power Market is witnessing robust growth, driven primarily by the rapid expansion of data centers worldwide due to surging demand for cloud services, big data processing, and the proliferation of IoT devices. As enterprises increasingly shift toward digital transformation, the need for reliable, scalable, and energy-efficient power solutions becomes critical to ensure uninterrupted operations and optimal performance. The market encompasses a diverse range of products, including uninterruptible power supplies (UPS), power distribution units (PDUs), batteries, and power management software, each playing a pivotal role in managing and optimizing power consumption within data centers.

Hyperscale data centers, operated by major cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud, are significant consumers of advanced power infrastructure, propelling innovation and investment in high-capacity and efficient power solutions. At the same time, the rise of edge data centers, which bring computing closer to the end-user, is creating new opportunities for distributed power systems tailored for smaller, localized facilities.

Sustainability is increasingly shaping market dynamics, with data center operators under pressure to reduce energy consumption and carbon emissions. This has led to the adoption of green power technologies, integration of renewable energy sources, and the deployment of AI-driven power management tools that enable real-time monitoring, predictive maintenance, and optimized energy use.

Report Scope and Data Centre Power Market Segmentation

|

Attributes |

Global Data Centre Power Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Data Centre Power Market Trends

“Innovation and Integration: Advancing Precision Through Smart Technologies”

- One of the most impactful trends shaping the Global Data Centre Power Market is the integration of cutting-edge smart technologies into power management systems. Modern data centres increasingly incorporate wireless connectivity options such as Bluetooth and Wi-Fi, enabling seamless real-time monitoring and control. This connectivity, combined with IoT compatibility, allows operators to access critical power usage data remotely, facilitating proactive decision-making and rapid response to anomalies.

- Cloud-based monitoring platforms further enhance this ecosystem by providing centralized dashboards that aggregate data from multiple facilities and devices, supporting automated logging and remote calibration processes. These technological enhancements significantly improve operational efficiency, reduce downtime, and optimize power consumption across diverse environments, including industrial sites, laboratories, and healthcare facilities.

- Moreover, manufacturers are investing heavily in developing digital power instruments with low drift characteristics and self-diagnostic features. These instruments leverage AI-driven predictive maintenance to anticipate potential failures before they occur, minimizing manual intervention and maintenance costs. The adoption of infrared and contactless power measurement technologies is expanding, especially in sectors such as pharmaceutical cold chain logistics, clinical diagnostics, and food safety, where non-invasive and hygienic monitoring is critical.

- The convergence of Industry 4.0 principles, edge computing, and precision metrology is revolutionizing calibration and power management processes. This integration accelerates calibration cycles, enhances data accuracy, and promotes smarter, more automated workflows, empowering data centers to meet evolving demands for reliability and efficiency.

Data Centre Power Market Dynamics

Driver

“Rising Demand for Precision, Regulatory Compliance, and Digital Transformation”

- The global emphasis on quality assurance, process validation, and regulatory adherence is a powerful catalyst for growth in the data centre power market. Regulations from agencies like the FDA, GMP, and standards such as ISO 17025 mandate stringent calibration and monitoring protocols across pharmaceuticals, healthcare, and food & beverage industries, driving demand for high-precision power instruments.

- Post-pandemic, the pharmaceutical sector has seen unprecedented growth in research & development, vaccine production, and clinical trials, further intensifying the need for precise temperature-sensitive calibration and power monitoring solutions. This surge is complemented by expanding investments in calibration and metrology laboratories across emerging markets, broadening the geographic footprint and accessibility of advanced data centre power technologies.

- Technological innovations in sensor miniaturization, digital integration, and automated calibration tools are making sophisticated power management systems more affordable and versatile, thereby enhancing market penetration. Additionally, the rapid growth of smart factories and bioprocess monitoring, coupled with the critical requirements of cold chain logistics, underscores the importance of reliable and accurate power monitoring systems to maintain product integrity and operational continuity.

Restraint/Challenge

“High Cost, Technical Complexity, and Limited Awareness in Developing Regions”

- Despite the promising growth prospects, several challenges impede the widespread adoption of advanced data centre power solutions. The high capital expenditure required for state-of-the-art precision power instruments and calibration equipment can deter small and medium enterprises, particularly in price-sensitive markets.

- Calibration and power management processes often involve technical complexities such as sensor drift, environmental interference, and the need for highly skilled personnel to operate and maintain these systems. These factors contribute to operational challenges, especially in developing regions where technical expertise and training infrastructure may be limited.

- Furthermore, the lack of awareness about advanced calibration standards and the benefits of modern power management solutions restricts adoption in some emerging markets. Regulatory fragmentation and inconsistent calibration protocols across countries add another layer of complexity, delaying global standardization and interoperability.

- In industrial environments, harsh conditions like vibration, electromagnetic interference, and extreme temperatures can degrade the performance and accuracy of power systems. This necessitates the deployment of specialized equipment or protective measures, which can increase costs and complicate implementation.

Data Centre Power Market Scope

The market is segmented on the basis of Power Type, Component, Application and End-User Industry.

|

Segmentation |

Sub-Segmentation |

|

By Power Type |

|

|

By Component |

|

|

By Application |

|

|

By End-User Industry |

|

- By Power Type

By Power type, the market is segmented into Uninterruptible Power Supply (UPS), Power Distribution Units (PDUs), and Power Management Software. UPS systems are the backbone of critical data center infrastructure, providing backup power during outages to ensure high availability and avoid data loss. With increasing dependence on 24/7 digital services, demand for scalable, energy-efficient UPS solutions—especially modular and lithium-ion based systems—is rapidly rising. PDUs enable the safe and efficient distribution of electricity within server racks, and their advanced forms—such as intelligent and switched PDUs—offer remote monitoring and energy usage tracking, essential for power optimization in high-density environments. Meanwhile, Power Management Software is gaining prominence due to growing needs for visibility, analytics, and automation. These platforms help data center operators reduce energy waste, monitor consumption trends, perform predictive maintenance, and comply with sustainability goals and regulatory requirements.

- By Component

By component, the market is divided into Hardware and Software. Hardware includes core equipment such as UPS systems, PDUs, generators, batteries, cooling units, switchgear, and circuit protection devices. These components ensure uninterrupted power supply, redundancy, and fault tolerance. Technological innovations in modularity, miniaturization, and efficiency have led to smarter hardware deployments in modern data centers. On the other hand, Software components are integral for managing the dynamic power needs of data centers. They include energy management platforms, real-time monitoring tools, AI-based automation systems, and digital twins that simulate performance under varying loads. The integration of software with AI and IoT technologies is transforming traditional power systems into intelligent ecosystems capable of self-optimization.

- By Application

In terms of application, the market finds application across Hyperscale, Colocation, and Enterprise Data Centres. Hyperscale data centers, operated by tech giants like Google, Microsoft, and Amazon, require extremely robust, redundant, and scalable power systems to support massive computing loads, distributed workloads, and multi-site failover capabilities. Colocation data centers, which lease space and resources to multiple clients, demand flexible and modular power systems with high levels of monitoring and tenant-specific metering. Power usage effectiveness (PUE) and remote control capabilities are crucial in this segment. Enterprise data centers, typically owned by private or public organizations for internal use, prioritize energy efficiency, uptime, and cost control. Many are transitioning to hybrid models where power infrastructure must accommodate both on-premise and cloud operations.

- By End-User Industry

By End-User Industry, the data centre power market serves a wide array of end-user industries. The IT and Telecom sector dominates due to exponential growth in cloud computing, mobile data, content streaming, and edge computing. These sectors require low-latency, high-efficiency power systems for data transmission and storage. The Banking, Financial Services, and Insurance (BFSI) industry is highly reliant on secure, always-on infrastructure for transaction processing, digital banking, and cybersecurity, making reliable power systems a top priority. The Government and Public Sector is investing heavily in digital transformation, smart city infrastructure, and secure citizen services, all of which require robust data centers with resilient power capabilities. Manufacturing is increasingly adopting Industry 4.0 technologies, which drive the need for edge computing and real-time data analysis—thus requiring decentralized but reliable data center power solutions that can withstand industrial environments.

Data Centre Power Market Regional Analysis

- North America holds a dominant position in the global data centre power market, driven by the early adoption of cloud technologies, the presence of hyperscale data centre operators (such as Amazon Web Services, Microsoft Azure, and Google Cloud), and high internet penetration. The U.S. is the key contributor, benefiting from robust digital infrastructure, government initiatives supporting clean energy in data centres, and rising investments in AI and big data analytics. The growing demand for edge computing and 5G services is further boosting the need for scalable and energy-efficient power systems in regional and edge data centres. Additionally, data centre operators in this region are increasingly integrating renewable energy sources and advanced power management software to achieve carbon neutrality.

- Europe represents a significant share of the market, particularly led by countries like Germany, the UK, the Netherlands, and France. The region is witnessing steady growth due to stringent energy efficiency regulations, sustainability goals, and the growing demand for colocation services. The European Green Deal and data privacy regulations (like GDPR) are encouraging investments in highly secure and energy-compliant data centres. The emergence of smart cities, digital sovereignty efforts, and expansion of digital services in healthcare and finance are fueling demand for intelligent power systems. Moreover, the adoption of liquid cooling and AI-driven power monitoring is gaining momentum across European data centres.

- The Asia-Pacific region is expected to register the fastest growth in the data centre power market, fueled by rapid digitalization, the expansion of e-commerce, increasing mobile data usage, and government-led smart city initiatives. Countries such as China, India, Japan, Singapore, and Australia are leading the regional market. Massive investments from global hyperscalers (like Google and AWS) and local giants (like Alibaba and Tencent) are resulting in the construction of large-scale data centres. The demand for scalable, energy-efficient UPS systems and intelligent PDUs is rising due to power stability issues and infrastructure gaps in developing economies. APAC is also witnessing growth in modular and edge data centres, which require compact, integrated power solutions.

- The MEA region is gradually emerging as a promising market, particularly in countries like the UAE, Saudi Arabia, and South Africa. With increasing focus on digital transformation, smart governance, and ICT infrastructure development under initiatives like Saudi Vision 2030 and the UAE’s Smart Dubai, there is a growing need for reliable data centre infrastructure and power systems. Although power infrastructure challenges remain, investments in renewable energy and data centre expansion by telecom operators and cloud providers are supporting market growth. The demand for compact, reliable UPS systems and hybrid power solutions is rising to overcome intermittent power supply issues.

- Latin America is witnessing steady growth in the data centre power market, primarily driven by increasing internet access, rising cloud adoption, and digital transformation efforts across Brazil, Mexico, Chile, and Colombia. While the region faces challenges such as high energy costs and regulatory fragmentation, investments by global data centre operators and cloud service providers are growing. The adoption of power-efficient hardware and software is increasing to cope with unreliable grid infrastructure in some areas. Brazil leads the regional market due to a strong data ecosystem and rising demand from banking, telecom, and retail sectors.

North America Data Centre Power Market Insight

The North America Data Centre Power Market is one of the most mature and technologically advanced globally, with the United States accounting for the majority of regional revenue. The region’s growth is primarily driven by the rapid proliferation of hyperscale data centres, widespread adoption of cloud computing, AI-driven applications, and the rise of 5G and edge computing.

Major tech giants such as Amazon Web Services (AWS), Microsoft, Google, Meta, and Oracle continue to invest heavily in expanding their data centre footprint, which in turn fuels demand for robust, scalable, and energy-efficient power infrastructure. The region is also witnessing a surge in colocation facilities as enterprises seek flexible data storage solutions and managed services, thereby driving the adoption of advanced UPS systems, intelligent PDUs, and power management software.

Europe Data Centre Power Market Insight

The Europe Data Centre Power Market is experiencing steady and strategic growth, driven by data localization laws, digital sovereignty initiatives, and the European Union’s push for sustainable and energy-efficient infrastructure. Countries like Germany, the United Kingdom, the Netherlands, France, and Ireland are key hubs, hosting a significant concentration of hyperscale and colocation data centres due to strong connectivity, tech talent, and regulatory maturity.

A defining characteristic of the European market is its strict energy efficiency regulations and sustainability mandates. Initiatives such as the European Green Deal, the Climate-Neutral Data Centre Pact, and country-level net-zero targets are compelling data centre operators to adopt eco-friendly power systems, including high-efficiency UPS units, intelligent PDUs, and renewable energy integration (e.g., solar and wind power). Operators are increasingly implementing AI-enabled power management systems to reduce energy waste and achieve lower Power Usage Effectiveness (PUE) ratios.

Asia Pacific Data Centre Power Market Insight

The Asia Pacific (APAC) Data Centre Power Market is experiencing rapid and dynamic growth, driven by surging internet usage, digital transformation, and the expansion of hyperscale cloud and content providers across emerging and developed economies. Countries such as China, India, Japan, Singapore, Australia, and South Korea are at the forefront of this growth, supported by rising data consumption, 5G rollouts, and government-backed digital initiatives.

Major global cloud players like Amazon Web Services (AWS), Google Cloud, Microsoft Azure, and Alibaba Cloud are aggressively expanding their infrastructure across the region to meet escalating demand from enterprises, fintech, OTT platforms, and e-commerce. This has led to a sharp increase in the construction of new data centres, which in turn is fueling demand for robust, scalable, and energy-efficient power solutions, such as Uninterruptible Power Supply (UPS) systems, intelligent Power Distribution Units (PDUs), and advanced power management software.

In developing economies like India and Indonesia, the demand is being driven by increased mobile penetration, the rise of edge computing, and government policies supporting data localization. However, inconsistent grid reliability in some regions is prompting a shift toward redundant and modular power systems, including hybrid and battery-based backup solutions.

Middle East and Africa Data Centre Power Market Insight

The Middle East and Africa (MEA) Data Centre Power Market is witnessing gradual but promising growth, fueled by increased digitization efforts, government-backed smart city initiatives, and the expansion of cloud and colocation infrastructure. Countries like the United Arab Emirates (UAE), Saudi Arabia, South Africa, Kenya, and Nigeria are emerging as strategic data centre hubs due to growing demand for digital services, rising internet penetration, and improving power and telecom infrastructure.

In the Middle East, government initiatives such as Saudi Vision 2030 and the UAE’s National Digital Transformation Program are playing a key role in attracting global cloud service providers and infrastructure investments. Leading operators like Amazon Web Services (AWS), Microsoft Azure, and Oracle Cloud have announced or launched regional data centre facilities, which is significantly boosting the demand for energy-efficient power backup systems, intelligent PDUs, and scalable UPS solutions.

The emphasis on sustainable and green power systems is also increasing, particularly in the Gulf countries, where high energy consumption and cooling needs challenge operators to adopt AI-powered energy management, liquid cooling, and solar-powered backup solutions.

Data Centre Power Market Share

The Data Centre Power Industry is primarily led by well-established companies, including:

- Schneider Electric

- Eaton Corporation

- ABB Ltd.

- Vertiv Group Corp.

- Siemens AG

- General Electric (GE)

- Huawei Technologies Co., Ltd.

- Delta Electronics, Inc.

- CyberPower Systems, Inc.

- Socomec group

Latest Developments in Data Centre Power Market

- In 2021, companies like Vertiv launched new power management systems tailored for edge data centres, while Eaton introduced its 93PM G2 UPS system, offering higher power density for hyperscale deployments. The momentum continued into 2022, with Schneider Electric unveiling its EcoStruxure Micro Data Centre solutions integrated with lithium-ion UPS and remote monitoring capabilities. That same year, ABB ramped up its investments in digital twin technologies and renewable power integration for data centres.

- In 2023, Huawei Digital Power introduced its Smart Data Centre Facility solution, leveraging AI, modular UPS, and lithium battery systems to improve energy efficiency by over 15%. Delta Electronics expanded its modular UPS offerings with the Modulon DPH series, targeting fast-growing markets in Asia-Pacific and the EMEA region.

- The year 2024 saw significant innovation as Legrand launched intelligent PDUs with cybersecurity and real-time analytics, and Microsoft completed the first phase of its AI-optimized, renewable-powered data centre in Sweden. Meanwhile, AWS enhanced its infrastructure in India and South Africa by deploying advanced UPS and energy storage systems to reduce its carbon footprint.

- By 2025, the industry continues to evolve. Rittal and HPE collaborated on launching edge-ready enclosures that combine smart power distribution and cooling. Equinix announced a major sustainability initiative to retrofit over 100 global data centres with high-efficiency UPS systems powered by renewables. Google, pushing its sustainability agenda further, introduced AI-driven energy tracking tools across its global data centre network to lower Power Usage Effectiveness (PUE) and improve transparency in energy consumption. These advancements underscore a growing emphasis on resilience, intelligence, and green transformation across the data centre power ecosystem.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Data Center Power Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Center Power Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Center Power Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.