Global Data Center Liquid Cooling Market

Market Size in USD Billion

CAGR :

%

USD

2.82 Billion

USD

16.79 Billion

2023

2031

USD

2.82 Billion

USD

16.79 Billion

2023

2031

| 2024 –2031 | |

| USD 2.82 Billion | |

| USD 16.79 Billion | |

|

|

|

|

Data Center Liquid Cooling Market Size

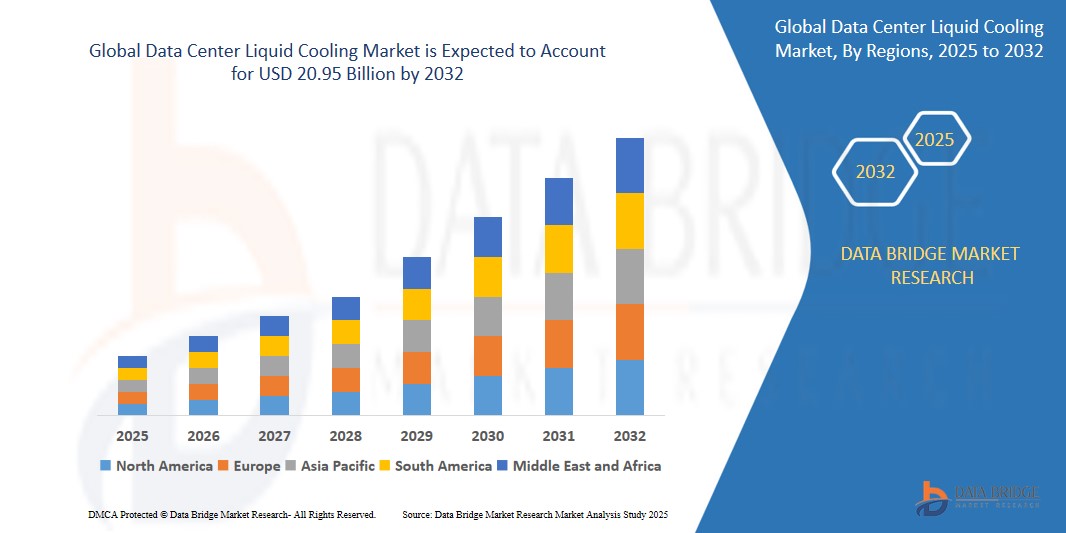

- The global data center liquid cooling market was valued at USD 3.52 billion in 2024 and is expected to reach USD 20.95 billion by 2032, at a CAGR of 24.96% during the forecast period of 2025 to 2032

- This growth is driven by factors such as the growing need for sustainable data center operations, the rise in data generation, advancements in cooling technologies, and the growing adoption of liquid cooling solutions due to their higher efficiency compared to traditional air cooling systems

Data Center Liquid Cooling Market Analysis

-

Data center liquid cooling solutions are critical for maintaining optimal temperatures in high-performance data centers, providing efficient, sustainable, and energy-saving methods of heat dissipation. They are essential for handling the increasing heat loads generated by modern data processing systems, particularly in large-scale operations

- The demand for liquid cooling solutions is significantly driven by the rapid growth in data generation, increasing energy consumption, and the rising need for energy-efficient solutions to reduce the environmental impact of traditional air-cooling methods. Over half of the global demand is driven by the need for improved cooling in high-performance computing (HPC) environments, with the highest demand seen in regions with high-tech industries and large data centers

- The North America region stands out as one of the dominant regions for data center liquid cooling, driven by its robust IT infrastructure, technological advancements, and the growing adoption of sustainable practices within data centers

- For instance, the demand for energy-efficient cooling solutions in the U.S. has steadily increased as more companies are focusing on reducing their carbon footprints and meeting regulatory sustainability standards. The region not only implements but also drives innovations in liquid cooling technologies to meet the growing data storage and processing needs

- Globally, data center liquid cooling solutions are ranked as one of the most critical components for optimizing the operational efficiency and energy consumption of modern data centers, following IT hardware systems like servers and storage devices. Liquid cooling technologies play a pivotal role in enabling higher processing speeds, improving system reliability, and meeting the increasingly stringent environmental regulations around energy use and emissions

Report Scope and Data Center Liquid Cooling Market Segmentation

|

Attributes |

Data Center Liquid Cooling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Center Liquid Cooling Market Trends

"Increasing Adoption of Liquid Cooling for High-Density Servers and AI Workloads"

- One prominent trend in the global data center liquid cooling market is the growing adoption of liquid cooling systems for high-density servers and AI workloads

- These advanced cooling solutions are critical for handling the increased heat generation from high-performance computing systems, such as those used in AI, machine learning, and big data analytics. Liquid cooling systems help maintain optimal temperatures, ensuring the reliability and efficiency of these demanding workloads

- For instance, liquid cooling offers superior heat dissipation compared to traditional air cooling, which is crucial for data centers handling AI-driven tasks that require substantial computational power and energy consumption

- The integration of AI and machine learning algorithms with cooling management systems also enables real-time optimization of cooling performance, further enhancing energy efficiency and reducing operational costs

- This trend is reshaping the way data centers manage heat dissipation, driving the adoption of liquid cooling technologies to meet the evolving needs of high-performance workloads, improving operational efficiency, and enhancing system reliability

Data Center Liquid Cooling Market Dynamics

Driver

"Increasing Demand for Energy-Efficient Cooling Solutions"

- The growing need for energy-efficient cooling solutions in data centers is a significant driver for the global data center liquid cooling market

- As data centers expand and handle ever-growing amounts of data, energy consumption becomes a major concern. Traditional air-cooling systems are often inefficient at managing the heat generated by high-performance servers, leading to higher operational costs and a larger carbon footprint

- The rising pressure on data centers to reduce their environmental impact and meet sustainability goals has led to increased adoption of liquid cooling technologies. Liquid cooling solutions offer better thermal management, reducing the energy required to maintain optimal operating temperatures

- Additionally, the increasing complexity of data workloads, including AI, machine learning, and big data processing, requires more advanced and efficient cooling systems to ensure the reliability and efficiency of critical systems

- As companies and governments prioritize sustainability and energy efficiency, the adoption of liquid cooling solutions is becoming essential to the future of high-performance data centers

For instance,

- In 2023, a study by the International Energy Agency (IEA) highlighted that the growing demand for data processing and storage requires more efficient cooling systems to avoid overloading electrical grids and reduce carbon emissions. This trend has led to a surge in the adoption of liquid cooling technologies, particularly in regions with stringent energy regulations.

Opportunity

"Integration of AI and Machine Learning for Optimized Cooling Management"

- AI-powered management systems are increasingly being integrated into data center liquid cooling solutions, offering opportunities to optimize cooling efficiency, reduce energy consumption, and enhance system performance

- AI algorithms can monitor and analyze real-time temperature data across various servers and equipment, automatically adjusting cooling parameters to ensure optimal performance while minimizing energy usage. This can significantly reduce operational costs and extend the life of data center infrastructure

- Furthermore, machine learning models can predict future cooling needs based on historical data, workload forecasts, and environmental factors, allowing data centers to scale their cooling systems proactively rather than reactively

For instance,

- In 2024, a study by the Global Energy Efficiency Initiative (GEEI) showed that integrating AI with liquid cooling solutions can help reduce cooling energy consumption by up to 40%, especially in large-scale data centers managing AI and big data workloads. This capability is increasingly seen as a major opportunity to help data centers meet sustainability targets and energy efficiency standards

- Additionally, AI can predict potential failures or malfunctions in cooling systems, enabling predictive maintenance and reducing downtime, which further enhances operational efficiency and reduces costs

Restraint/Challenge

"High Initial Investment and Infrastructure Costs"

- The high initial investment and infrastructure costs associated with data center liquid cooling systems pose a significant challenge to the market, particularly for small and medium-sized data centers or those in developing regions

- Liquid cooling systems, especially those designed for large-scale data centers, can require a significant upfront cost, including expenses for specialized equipment, installation, and the necessary modifications to existing data center infrastructure. This can range from hundreds of thousands to millions of dollars, depending on the scale of the operation

- These high costs can deter smaller businesses or organizations with limited budgets from adopting liquid cooling solutions, leading them to continue relying on traditional air-cooling systems that are often less efficient but more affordable

For instance,

- In 2023, according to a report by the International Data Corporation (IDC), while liquid cooling systems offer long-term cost savings in energy consumption, the initial capital expenditure remains a major barrier, particularly for small data centers that are unwilling or unable to commit to such high upfront costs

- Consequently, this financial challenge can slow the overall adoption rate of liquid cooling technologies, especially in emerging markets where cost-conscious decisions are more prevalent

Data Center Liquid Cooling Market Scope

The market is segmented on the basis of component, type of cooling, data center types, enterprise, and end user

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Type of Cooling |

|

|

By Data Center Types |

|

|

By Enterprise |

|

|

By End User |

|

Data Center Liquid Cooling Market Regional Analysis

“North America is the Dominant Region in the Data Center Liquid Cooling Market”

- North America dominates the data center liquid cooling market, driven by advanced technological infrastructure, high adoption of energy-efficient solutions, and a strong presence of leading data center operators and cooling technology providers

- The U.S. holds a significant share due to the rapid expansion of data centers, particularly in the tech hubs like Silicon Valley and Northern Virginia. The rising demand for high-performance computing (HPC) and cloud services, along with the need for sustainable cooling solutions to reduce energy costs, is a major driver in the region

- The availability of well-established regulations promoting energy efficiency, along with increasing investments in green technologies, further strengthens the market

- In addition, the ongoing shift toward edge computing and the growing adoption of liquid cooling solutions by hyperscale data centers are fueling market growth across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the data center liquid cooling market, driven by rapid expansion in data center infrastructure, increasing demand for energy-efficient solutions, and a growing focus on sustainability

- Countries like China, India, and Japan are emerging as key markets due to their rapid urbanization, expanding IT and cloud industries, and increasing data consumption, which demand more efficient cooling systems to manage the high heat loads in data centers

- Japan, with its advanced technology and commitment to energy efficiency, continues to lead in the adoption of liquid cooling solutions for high-density data centers

- China and India, with their rapidly expanding digital economies, are seeing increasing government and private sector investments in modern data center infrastructure, which is fueling the demand for advanced liquid cooling technologies. Additionally, the growing focus on environmental sustainability and energy reduction is contributing to market expansion in these regions

Data Center Liquid Cooling Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Asetek (Denmark)

- Schneider Electric (France)

- Vertiv (U.S.)

- Rittal (Germany)

- CoolIT Systems (Canada)

- Stulz (Germany)

- Green Revolution Cooling (U.S.)

- Midas Green Technologies (U.S.)

- Evapco (U.S.)

- Wikstrøm Cooling Solutions (Finland)

Latest Developments in Global Data Center Liquid Cooling Market

- In June 2024, Perstorp, a leading specialty chemicals company within PETRONAS Chemicals Group Berhad (PCG), entered into a strategic partnership with Intel's Open IP Advanced Liquid Cooling team to develop an innovative synthetic thermal management fluid specifically designed for immersion cooling in data centers. Leveraging Intel’s SuperFluid technology, which uniquely utilizes air as a lubricant, this cutting-edge solution delivers substantial improvements in cooling efficiency, boosting the thermal management capacity from 500 W to an exceptional 800 W per chip

- In May 2024, STULZ Modular, a prominent provider of modular data center solutions and a subsidiary of STULZ GmbH, joined forces with Asperitas to explore the potential of advanced liquid cooling technologies. This strategic collaboration is focused on harnessing immersion cooling to enhance performance in high-density data center environments. Their initiative centers on a modular data center design that integrates cutting-edge immersion cooling solutions, suitable for deployment in both indoor and outdoor installations

- In April 2024, Schneider Electric reinforced its long-term commitment to India by unveiling a substantial investment of USD 438.4 million, positioning the country as a strategic manufacturing hub. The inauguration of a cutting-edge facility in Bengaluru, which received an initial investment of USD 130 million, underscores the company’s objective to meet the growing demand for data center cooling solutions, aligning with the rapid expansion of India’s data center ecosystem

- In March 2024, Daikin Applied launched the Navigator WW water-cooled screw chiller, featuring the low-global warming potential (GWP) R-513A refrigerant, offering an environmentally sustainable cooling solution. This advanced chiller improves energy efficiency and can be paired with the optional Templifier TW water heater, enabling effective heat recovery and ensuring both cost-effectiveness and sustainability across a range of cooling applications in data centers and industrial environments

- In February 2024, SK Enmove unveiled a Memorandum of Understanding (MOU) to establish a collaborative framework for advancing next-generation cooling solutions. The partnership, which includes SK Telecom and Precision Liquid Cooling Iceotope Technologies, is focused on the development of innovative liquid cooling technologies. This initiative aims to improve the efficiency and sustainability of cooling systems across various applications, addressing the increasing need for advanced thermal management in data centers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.