Global Data Center Cooling Market

Market Size in USD Billion

CAGR :

%

USD

21.58 Billion

USD

76.30 Billion

2024

2032

USD

21.58 Billion

USD

76.30 Billion

2024

2032

| 2025 –2032 | |

| USD 21.58 Billion | |

| USD 76.30 Billion | |

|

|

|

|

Data Center Cooling Market Size

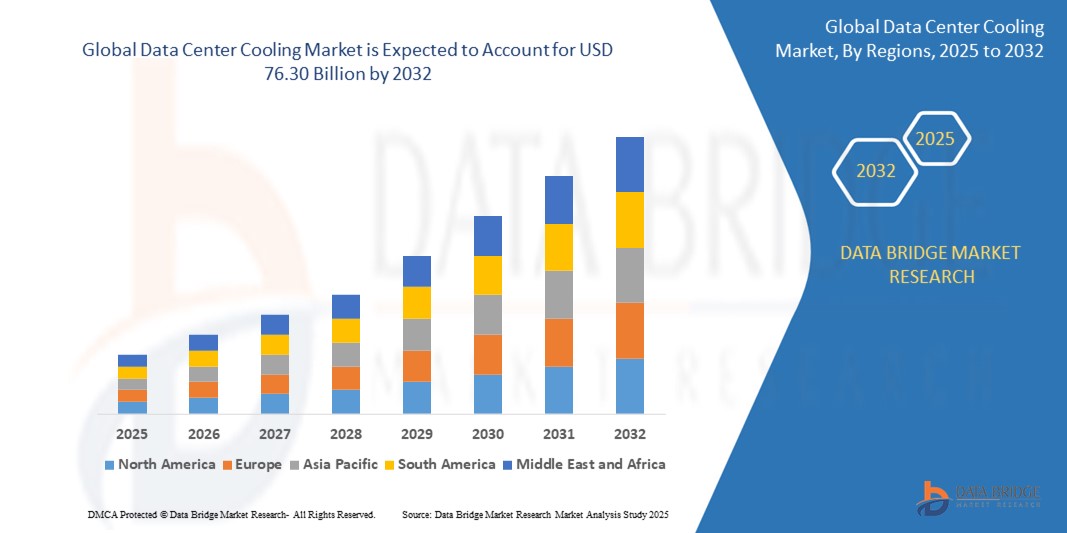

- The global data center cooling market size was valued at USD 21.58 billion in 2024 and is expected to reach USD 76.30 billion by 2032, at a CAGR of 17.10% during the forecast period

- The market growth is largely fuelled by the rising demand for energy-efficient cooling systems to manage heat generation in modern data centers as enterprises shift to high-density computing environments

- Increasing adoption of cloud services, big data, and artificial intelligence technologies is driving the expansion of hyperscale data centers, boosting the need for advanced cooling solutions to ensure uninterrupted performance and equipment longevity

Data Center Cooling Market Analysis

- The data center cooling market is witnessing strong momentum due to increased deployment of liquid cooling systems which offer efficient thermal management for high-performance computing environments

- Vendors are focusing on integrating intelligent monitoring and control technologies within cooling infrastructure to enhance operational efficiency and reduce energy consumption across data centers

- North America dominated the data center cooling market with the largest revenue share of 39.6% in 2024, driven by the rising number of hyperscale and colocation data centers, along with strict government regulations emphasizing energy-efficient infrastructure

- Asia-Pacific is expected to be the fastest growing region in the data center cooling market during the forecast period due to

- The enterprise data center segment accounted for the largest market revenue share in 2024, driven by the growing demand for centralized computing infrastructure among large corporations and cloud service providers. These facilities require sophisticated and high-capacity cooling systems to maintain optimal performance of dense server racks and mission-critical applications

Report Scope and Data Center Cooling Market Segmentation

|

Attributes |

Data Center Cooling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Center Cooling Market Trends

“Rising Adoption of Liquid Cooling Solutions in High-Density Data Centers”

- Liquid cooling systems are increasingly adopted to handle the high heat output of dense computing environments, especially in AI and machine learning workloads, where traditional air cooling proves insufficient

- Google has implemented liquid cooling in its Tensor Processing Unit (TPU) data centers to efficiently manage performance and heat in intensive computing scenarios

- Immersion cooling, a method where servers are submerged in a dielectric fluid, reduces energy consumption and enables sustainable data center operations

- Compact, high-efficiency liquid cooling solutions are enabling the growth of edge computing by meeting the thermal demands of micro data centers with limited space

- Companies such as Submer and Iceotope are investing in scalable liquid cooling innovations, such as modular immersion tanks and integrated direct-to-chip systems, to meet the diverse needs of next-gen data centers

Data Center Cooling Market Dynamics

Driver

“Surging Demand for Energy-Efficient and Sustainable Cooling Technologies”

- Increasing global focus on energy efficiency and carbon footprint reduction is driving the adoption of sustainable cooling technologies in data centers

- Data centers consume substantial energy for cooling, prompting the need for innovative systems to manage temperature while reducing operational costs

- Governments and environmental bodies are encouraging greener practices through regulations and incentives, pushing data center operators toward energy-efficient cooling

- Technologies such as free cooling, liquid cooling, and modular systems are gaining popularity due to their ability to lower Power Usage Effectiveness (PUE)

- For instance, Google has adopted seawater-based cooling for its Finland data center

- Green certifications and climate-conscious strategies are accelerating the shift to eco-friendly cooling, making sustainability a strategic priority for companies such as Microsoft, which is testing underwater data centers for enhanced efficiency

Restraint/Challenge

“High Capital Investment and Infrastructure Compatibility Issues”

- High upfront investment for advanced cooling technologies such as liquid immersion or direct-to-chip cooling limits their adoption, especially among small and mid-sized enterprises

- Integration with existing infrastructure is often complex, requiring structural modifications, retrofitting of electrical systems, and updated airflow management strategies

- Downtime and operational disruptions during installation or upgrades pose a major concern, particularly for mission-critical data centers where uptime is crucial

- Lack of standardized implementation protocols across varied data center designs increases deployment challenges and slows market penetration

- Operational risks, maintenance complexity, and the need for specialized expertise discourage broader adoption

- For instance, smaller firms may avoid liquid cooling systems due to limited technical resources and higher management costs

Data Center Cooling Market Scope

The market is segmented on the basis of type, solutions, service, cooling type, organization size, and industry.

- By Type

On the basis of type, the data center cooling market is segmented into enterprise data center and edge data center. The enterprise data center segment accounted for the largest market revenue share in 2024, driven by the growing demand for centralized computing infrastructure among large corporations and cloud service providers. These facilities require sophisticated and high-capacity cooling systems to maintain optimal performance of dense server racks and mission-critical applications.

The edge data center segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of IoT and 5G technologies that demand localized data processing. Edge data centers are increasingly deployed to reduce latency and improve connectivity in remote or underserved regions, thereby driving demand for compact, energy-efficient cooling solutions.

- By Solutions

On the basis of solutions, the market is segmented into air conditioning, chilling units, cooling towers, economizer system, liquid cooling system, computer room air conditioning (CRAC) and computer room air handler (CRAH), control units, and others. The CRAC and CRAH segment led the market in 2024 due to their proven efficiency and adaptability in various data center environments. These systems are widely used for maintaining precise temperature and humidity levels critical to equipment reliability.

The liquid cooling system segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior thermal efficiency and growing relevance in high-density computing environments. Increasing demand for energy savings and compact cooling designs supports its widespread adoption, especially among hyperscale and AI-driven data centers.

- By Service

On the basis of service, the data center cooling market is segmented into consulting and training, installation and deployment, and maintenance and support. The installation and deployment segment dominated the market in 2024, driven by the increasing number of new data center constructions and modernization of existing facilities.

The maintenance and support segment is expected to witness the fastest growth rate from 2025 to 2032, as businesses emphasize minimizing downtime and enhancing the lifecycle performance of their cooling infrastructure. The rising complexity of cooling technologies further amplifies the need for expert support services.

- By Cooling Type

On the basis of cooling type, the market is segmented into room-based cooling, rack-based cooling, and row based cooling. The room based cooling segment accounted for the largest revenue share in 2024, owing to its widespread deployment in traditional data centers and its capability to handle large-scale cooling requirements.

The rack based cooling segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its targeted approach, high efficiency, and compatibility with high-density computing environments. This method minimizes energy loss and allows for effective heat removal directly from the source.

- By Organization Size

On the basis of organization size, the market is segmented into large organization size and small and medium organization. The large organization segment held the majority share in 2024, fueled by the high data generation needs of multinational companies, hyperscale cloud providers, and global financial institutions. These organizations heavily invest in state-of-the-art cooling systems to ensure continuous operation and regulatory compliance.

The small and medium organization segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rapid digitization of SMEs, adoption of cloud computing, and the proliferation of micro data centers that require efficient and scalable cooling setups.

- By Industry

On the basis of industry, the data center cooling market is segmented into BFSI, IT and telecom, manufacturing, retail, healthcare, energy and utilities, and others. The IT and telecom segment captured the largest revenue share in 2024, attributed to massive data generation from online services, streaming, and social media platforms. These companies require resilient and scalable cooling systems to support 24/7 uptime and network performance.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the surge in electronic health records, telemedicine, and AI-based diagnostics. The critical nature of healthcare data necessitates precise and uninterrupted cooling to ensure secure and compliant data center operations.

Data Center Cooling Market Regional Analysis

- North America dominated the data center cooling market with the largest revenue share of 39.6% in 2024, driven by the rising number of hyperscale and colocation data centers, along with strict government regulations emphasizing energy-efficient infrastructure

- The region benefits from rapid technological advancement, strong digital infrastructure, and the presence of major cloud service providers such as Amazon Web Services, Google Cloud, and Microsoft Azure

- In addition, the high penetration of connected devices and the demand for real-time data processing are accelerating the need for robust, sustainable cooling solutions across North America

U.S. Data Center Cooling Market Insight

The U.S. data center cooling market held a significant 82.3% revenue share in 2024 within North America, driven by the growing deployment of edge data centers and cloud services. Investments from tech giants into AI and high-performance computing (HPC) infrastructure are pushing demand for advanced cooling systems such as liquid cooling and direct-to-chip technologies. Government incentives promoting energy-efficient operations and green data centers are also bolstering market expansion in the country.

Europe Data Center Cooling Market Insight

The Europe data center cooling market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the region's increasing focus on sustainable data infrastructure and carbon neutrality. The European Green Deal and stringent environmental standards are encouraging the adoption of innovative, low-energy cooling systems. In addition, growing digitization across various sectors and the rising number of colocation and enterprise data centers are strengthening market growth.

U.K. Data Center Cooling Market Insight

The U.K. data center cooling market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong demand for energy-efficient technologies and increasing investment in digital infrastructure. The government's focus on net-zero emissions and rising deployment of edge computing are prompting data center operators to upgrade their cooling systems. In addition, the country's flourishing fintech and e-commerce sectors further contribute to market demand.

Germany Data Center Cooling Market Insight

The Germany data center cooling market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's robust industrial base, growing IT infrastructure, and commitment to sustainability. Germany is a leading data center location in Europe, and the emphasis on eco-friendly operations is fostering demand for innovative cooling techniques, such as indirect evaporative and liquid-based solutions.

Asia-Pacific Data Center Cooling Market Insight

The Asia-Pacific data center cooling market is expected to witness the fastest growth rate from 2025 to 2032, fueled by expanding internet penetration, digitization initiatives, and a booming cloud computing ecosystem. Countries such as China, India, Japan, and Singapore are seeing rapid data center construction, driving the need for efficient thermal management solutions. Government support and local manufacturing advantages are further strengthening market expansion.

China Data Center Cooling Market Insight

The China data center cooling market held the largest revenue share in Asia-Pacific in 2024, backed by substantial government investment in digital infrastructure and smart city development. The surge in demand for big data, 5G, and cloud computing services is encouraging the deployment of high-performance data centers, thereby increasing the uptake of advanced cooling systems.

Japan Data Center Cooling Market Insight

The Japan data center cooling market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s high-tech infrastructure, demand for data sovereignty, and growing adoption of AI and IoT. Operators are increasingly shifting towards liquid cooling and energy-saving systems to meet both performance and sustainability goals. Japan’s vulnerability to power outages and natural disasters also necessitates reliable and efficient cooling solutions.

Data Center Cooling Market Share

The Data Center Cooling industry is primarily led by well-established companies, including:

- Schneider Electric (France)

- Vertiv Group Corp. (U.S.)

- STULZ GMBH (Germany)

- Eaton (U.S.)

- FUJITSU (Japan)

- Rittal GmbH & Co. KG (Germany)

- Daikin Applied (U.S.)

- Black Box Corporation (U.S.)

- ALFA LAVAL (Sweden)

- Nortek Air Solutions, LLC (U.S.)

- Airedale Air Conditioning (U.K.)

- 3M (U.S.)

- Coolcentric (U.S.)

- Delta Power Solutions (India)

- EcoCooling (U.K.)

Latest Developments in Global Data Center Cooling Market

- In May 2024, STULZ Modular, a subsidiary of STULZ GmbH specializing in modular data center solutions, partnered with Asperitas to investigate the potential of liquid cooling technology. This collaboration focuses on integrating immersion cooling for high-density data center environments, aiming to deliver innovative solutions tailored to the industry's evolving demands. The partnership emphasizes a modular data center concept that can be deployed in both indoor and outdoor settings, enhancing cooling efficiency

- In April 2024, Schneider Electric made a significant investment of USD 438.4 million to establish India as a manufacturing hub for data center cooling solutions. The inauguration of a state-of-the-art facility in Bengaluru, with an initial investment of USD 130 million, highlights the company’s commitment to addressing the rising demand for innovative cooling technologies. This hub will focus on developing customized solutions specifically designed for India's expanding data center ecosystem

- In April 2024, Mitsubishi Electric launched the MECH-iF range, featuring an air-cooled chiller that utilizes a proprietary single-screw compressor to enhance energy efficiency and reliability. This new product range provides capacities ranging from 345 kW to 921 kW, offering flexibility in refrigerant options with either R1234ze (G04) or R513A (G05). The patented screw variable-speed compressors ensure prolonged operational lifespan, making it suitable for various applications

- In March 2024, Daikin Applied introduced the Navigator WW water-cooled screw chiller, designed with low-global warming potential (GWP) refrigerant R-513A. This eco-friendly cooling solution is aimed at enhancing operational efficiency for customers. In addition, clients can further optimize performance by combining this chiller with the optional Templifier TW water heater, facilitating a cost-effective heat recovery solution. This innovation aligns with growing environmental sustainability efforts in cooling technology

- In November 2023, Schneider Electric partnered with Intel to develop a liquid cooling solution compatible with the cutting-edge Intel Gaudi3 AI accelerator. This innovative cooling system supports both air-cooled and liquid-cooled servers, utilizing Vertiv's pumped two-phase (P2P) cooling infrastructure to maintain optimal performance levels. The collaboration aims to address the increasing cooling demands of AI applications, ensuring efficient thermal management and improved reliability for advanced computing environments

- In October 2023, Schneider Electric announced a USD 1.2 million investment in its Sustainable Tropical Data Center Testbed (STDCT) at the National University of Singapore (NUS), funded by the National Research Foundation of Singapore. This facility is designed to tackle the challenges of maintaining regulated systems in tropical regions, which often incur excessive energy costs. The investment aims to develop sustainable cooling solutions tailored for energy-intensive data centers in tropical climates

- In May 2023, Vertiv Group Corp. launched the Liebert PKDX, a single direct expansion thermal management unit specifically designed for data centers. This advanced unit incorporates rack sensors, intelligent controls, and a centralized optimization system for effective heat management. The Liebert PKDX, which is now available in India, features a plug-and-play design that allows for rapid installation. It operates without water and eliminates the need for additional space in the data hall, enhancing efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.