Global Data Center Construction Market

Market Size in USD Billion

CAGR :

%

USD

48.39 Billion

USD

95.72 Billion

2024

2032

USD

48.39 Billion

USD

95.72 Billion

2024

2032

| 2025 –2032 | |

| USD 48.39 Billion | |

| USD 95.72 Billion | |

|

|

|

|

Data Center Construction Market Size

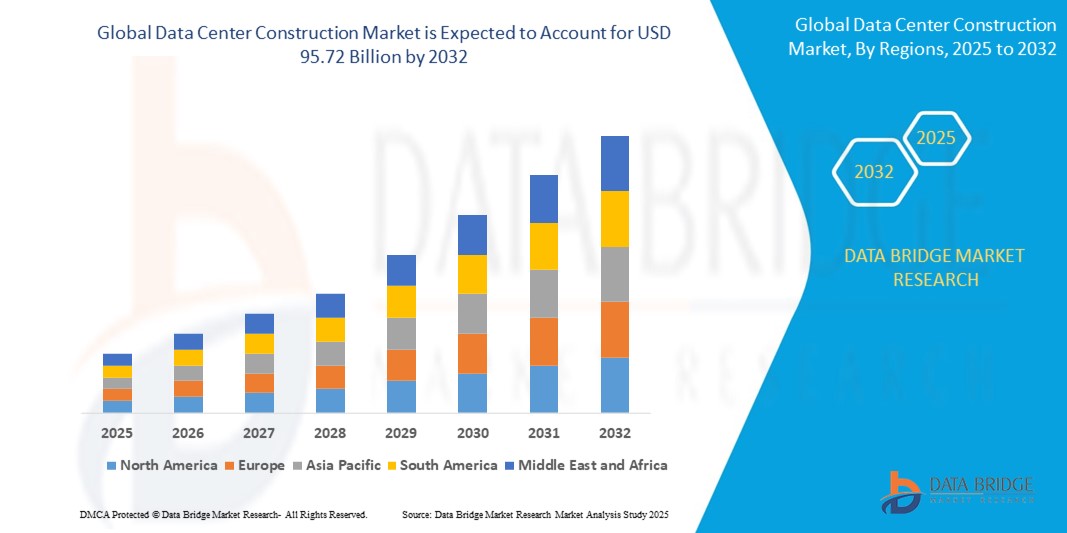

- The global data center construction market was valued at USD 48.39 million in 2024 and is expected to reach USD 95.72 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.90 % primarily driven by the increasing demand for cloud services, AI technologies, and digital transformation initiative

- This growth is driven by factors such as the rapid expansion of internet usage, surge in data traffic, and rising investments in hyperscale and edge data centres

Data Center Construction Market Analysis

- The data center construction market is witnessing significant expansion due to rising digitalization across sectors such as banking, healthcare, and e-commerce

- For instance, in 2024, Microsoft announced a USD 3.3 billion investment to build a new data center campus in Wisconsin, and Oracle launched a new cloud region in Chicago to enhance service availability

- Companies are increasingly adopting modular and prefabricated designs to reduce construction time and increase scalability

- For instance, Google’s USD 1.2 billion data center project in Kansas uses modular components, and Equinix has implemented prefabricated infrastructure in multiple facilities across Europe

- Sustainable construction practices are becoming a top priority, including the use of renewable energy and energy-efficient technologies

- For instance, Meta's data center in Altoona, Iowa, runs entirely on wind energy, and Amazon’s data center in Virginia integrates solar and battery storage systems for continuous green power

- Advanced systems such as AI-powered temperature controls, real-time energy monitoring, and biometric security are being integrated into new facilities

- Leading construction firms such as DPR Construction and Turner Construction are collaborating with major tech companies for high-tech data center projects

Report Scope and Data Center Construction Market Segmentation

|

Attributes |

Data Center Construction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Data Center Construction Market Trends

“Adoption of Modular Construction Methods”

- Modular construction in data centers involves building standardized, prefabricated units off-site and assembling them on-site, allowing faster deployment and reduced construction timelines

- For instance, Google used modular designs for its data center expansion in Kansas in 2023

- This method enables scalability and flexibility, allowing companies to build in phases and expand based on demand

- For instance, Microsoft’s modular data center model allows the company to scale operations globally in weeks instead of months

- Modular construction improves quality control as components are built in controlled factory environments, reducing weather-related delays and on-site errors

- These modular units are pre-integrated with advanced systems such as cooling, electrical infrastructure, and security features, streamlining the installation and operational readiness of data centers

- With growing demand for quick and efficient infrastructure, major players such as Amazon, IBM, and Meta are adopting modular approaches to meet the increasing need for digital services and high-performance computing systems

Data Center Construction Market Dynamics

Driver

“Rising Demand for Cloud Services and Data Consumption”

- The rising demand for cloud-based services is one of the primary drivers of data center construction, with major tech firms such as Amazon Web Services, Microsoft Azure, and Google Cloud expanding their infrastructure to meet customer needs

- For instance, Amazon announced 15 new data center projects globally in 2024 to support cloud capacity

- Rapid growth in data consumption through applications such as video streaming, artificial intelligence, financial services, and online gaming is increasing the need for high-performance, low-latency data centers

- Post-2020, digital transformation across small and medium enterprises has accelerated, with cloud adoption rising to support remote work, virtual collaboration, and scalable business operations

- Sectors such as education, healthcare, and government are increasingly shifting to digital platforms, requiring robust and secure data storage

- For instance, Google is supporting educational initiatives with cloud-based solutions that rely on local and regional data centers

- This demand has led to a surge in hyperscale and edge data center development, allowing data to be processed closer to users for enhanced speed and reliability, and ensuring sustained construction momentum in the coming years

Opportunity

“Integration of Sustainable and Green Construction Practices”

- The growing global focus on climate change and environmental sustainability is creating strong demand for green data centers that prioritize energy efficiency, low emissions, and eco-friendly construction materials

- Companies adopting renewable energy sources such as wind and solar for powering data centers are gaining industry leadership

- For instance, Meta’s Altoona, Iowa data center operates entirely on wind energy and Apple’s Viborg facility in Denmark is powered by 100 percent renewable energy

- There is a growing market for retrofitting existing data centers with sustainable solutions such as liquid cooling, free cooling, and artificial intelligence-based energy monitoring to enhance operational efficiency and reduce environmental impact

- Construction firms that incorporate sustainable building techniques and water-saving cooling systems are securing a competitive advantage and attracting environmentally conscious clients

- Green building certifications such as Leadership in Energy and Environmental Design are influencing investor confidence and customer preferences, encouraging companies to align their data center projects with certified sustainability benchmarks

Restraint/Challenge

“High Initial Capital Investment and Complex Regulatory Compliance”

- High initial capital investment remains a major hurdle in the data center construction market, as building state-of-the-art facilities involves heavy expenditures on land, energy-efficient infrastructure, advanced cooling systems, and skilled labour

- These upfront costs can reach hundreds of millions, making it difficult for smaller firms and new entrants to compete, especially when compared to large tech corporations with massive budgets

- Regulatory compliance is another significant restraint, with governments and environmental agencies imposing strict norms on energy consumption, water usage, and emissions

- For instance, in parts of Europe, data center projects must undergo comprehensive environmental impact assessments before receiving construction approval

- Navigating diverse and evolving regulations across global markets can cause project delays and increased costs, particularly in regions where obtaining permits and licenses is time-consuming

- The integration of complex technologies such as biometric access, real-time monitoring, and fire suppression systems, along with challenges such as equipment delays and labour shortages, further adds to the cost and complexity of construction efforts

Data Center Construction Market Scope

The market is segmented on the basis of infrastructure type, data center type, organization size, and vertical

|

Segmentation |

Sub-Segmentation |

|

By Infrastructure Type |

|

|

By Data Center Type |

|

|

By Organization Size |

|

|

By Vertical |

|

Data Center Construction Market Regional Analysis

“North America is the Dominant Region in the Data Center Construction Market”

- North America leads the global data center construction market due to the strong presence of major tech giants such as Amazon Web Services, Microsoft Azure, and Google Cloud

- The U.S. plays a critical role with its advanced digital economy and technological infrastructure, supporting the growth of data center development

- There has been consistent development of hyperscale and colocation data centers to meet the rising demand for cloud computing, big data processing, and artificial intelligence applications

- The region benefits from a mature regulatory framework that supports data center construction and a stable business environment

- Access to skilled labor continues to be a significant factor in maintaining North America's leadership in the global data center construction sector

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia Pacific is the fastest-growing region in the data center construction market, driven by widespread adoption of digital services, increased internet penetration, and the rise of e-commerce and social media

- Countries such as China, India, Japan, and Singapore are experiencing a significant surge in demand for high-capacity data centers due to increasing data consumption and technological advancements

- China’s expansion of its digital infrastructure and India’s rapidly growing startup ecosystem are fostering large-scale investments in data center projects

- Global cloud service providers and local tech firms are quickly expanding in the region to accommodate the growing needs of businesses and consumers

- This dynamic market environment is establishing Asia Pacific as a key hotspot for future growth in data center construction, attracting investments from both local and international players

Data Center Construction Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- Acer Inc. (Taiwan)

- Ascenty (Brazil)

- Cisco Systems, Inc. (U.S.)

- Dell Inc. (U.S.)

- Equinix, Inc. (U.S.)

- Fujitsu (Japan)

- Gensler (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Hitachi, Ltd. (Japan)

- HostDime Global Corp. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- IBM (U.S.)

- INSPUR Co., Ltd. (China)

- IPXON Networks (U.S.)

- KIO (Mexico)

- Lenovo (China)

- Oracle (U.S.)

- Schneider Electric (France)

- Vertiv Group Corp. (U.S.)

Latest Developments in Global Data Center Construction Market

- In December 2024, ABB Electrification inaugurated a Smart Buildings & Smart Power Technology Hub in London, UK. This development serves as an interactive facility showcasing ABB's advanced power distribution and building automation solutions. The hub features fully operational circuit breakers, interconnected switchgear, sensors, and KNX controllers, providing customers with hands-on technical training opportunities. It is designed to facilitate customer engagement, technical sessions, and corporate events, reflecting ABB's commitment to driving innovation. The hub will benefit businesses by offering an immersive experience to better understand and utilize these cutting-edge technologies, impacting the market by fostering the adoption of smart power solutions in data centers, commercial buildings, and residential infrastructure

- October 2024, Dell Technologies introduced its AI Factory initiative, which transforms data centers by offering integrated rack-scalable systems, servers, storage, and data management solutions. The development includes the new Dell Integrated Rack 7000 (IR7000), which is optimized for high-density AI workloads and features liquid cooling capabilities. This technology is designed to manage up to 480KW of power while capturing nearly 100% of generated heat, making it highly energy-efficient. The solution benefits businesses by simplifying AI infrastructure deployment through a plug-and-play system. This development will significantly impact the market by providing scalable and cost-effective AI infrastructure solutions, enabling businesses to streamline their data center operations and support advanced machine learning and AI workloads

- In February 2024, Cisco Systems Inc. expanded its partnership with NVIDIA to accelerate AI adoption in enterprises. This collaboration focuses on providing AI infrastructure solutions specifically designed for seamless deployment and management in data centers. Leveraging Ethernet-based networking, these solutions aim to enhance data center efficiency and streamline the management of AI and machine learning workloads. This development benefits enterprises by offering scalable, high-performance infrastructure that supports growing AI needs. The market impact is significant, as this partnership will drive the widespread adoption of AI technologies across industries, helping businesses optimize their operations and support advanced AI and machine learning applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DATA CENTER CONSTRUCTION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DATA CENTER CONSTRUCTION MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 MULTIVARIATE MODELLING

2.2.5 TOP TO BOTTOM ANALYSIS

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 VENDOR SHARE ANALYSIS

2.2.8 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.9 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DATA CENTER CONSTRUCTION MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 REGULATORY STANDARDS

5.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.4 PENETRATION AND GROWTH POSPECT MAPPING

5.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

5.6 TECHNOLOGY ANALYSIS

5.6.1 KEY TECHNOLOGIES

5.6.2 COMPLEMENTARY TECHNOLOGIES

5.6.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.7 COMPANY COMPETITIVE ANALYSIS

5.7.1 STRATEGIC DEVELOPMENT

5.7.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.7.2.1. CHALLENGES

5.7.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.7.3 CUSTOMER BASE

5.7.4 SERVICE POSITIONING

5.7.5 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.7.6 APPLICATION REACH

5.7.7 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Application Reach

6 COMPANY SERVICE PLATFORM MATRIX

6.1 USED CASES & ITS ANALYSIS

7 FIG 4. USED CASE ANALYSIS

Company Product/Service offered

8 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY OFFERING

8.1 OVERVIEW

8.2 SOLUTIONS

8.2.1 HVAC

8.2.2 COOLING SOLUTIONS

8.2.3 BUILDING AUTOMATION AND CONTROL SYSTEM (BACS)

8.2.4 OTHERS

8.3 SERVICES

8.3.1 MANAGED SERVICES

8.3.2 PROFESSIONAL SERVICES

8.3.2.1. DESIGN AND CONSULTING

8.3.2.2. TRAINING AND EDUCATION

8.3.2.3. INSTALLATION AND INTEGRATION

8.3.2.4. SUPPORT AND MAINTENANCE

9 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY INFRASTRUCTURE TYPE

9.1 OVERVIEW

9.2 ELECTRICAL INFRASTRUCTURE

9.2.1 UPS

9.2.2 REMOTE POWER PANELS

9.2.3 POWER DISTRIBUTION UNITS

9.2.4 GENERATORS

9.2.5 TRANSFER SWITCHESELECTRICAL POWER MANAGEMENT SYSTEMS

9.2.6 OTHERS

9.3 MECHANICAL INFRASTRUCTURE

9.3.1 HAVC

9.3.2 PLUMBING

9.3.3 CHILLERS

9.3.4 OTHERS

9.4 GENERAL CONSTRUCTION

10 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY TIER STANDARDS

10.1 OVERVIEW

10.2 TIER 1

10.3 TIER 2

10.4 TIER 3

10.5 TIER 4

11 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY DATA CENTER TYPE

11.1 OVERVIEW

11.2 ENTERPRISE DATA CENTERS

11.3 COLOCATION DATA CENTERS

11.4 HYPERSCALE DATA CENTERS

11.5 EDGE DATA CENTERS

11.6 MODULAR DATA CENTERS

11.7 OTHERS

12 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY ORGANIZATION SIZE

12.1 OVERVIEW

12.2 SMALL SIZE ORGANIZATION

12.3 MEDIUM SIZE ORGANIZATION

12.4 LARGE SIZE ORGANIZATION

13 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY END USE INDUSTRY

13.1 OVERVIEW

13.2 BANKING

13.2.1 BY INFRASTRUCTURE TYPE

13.2.1.1. ELECTRICAL INFRASTRUCTURE

13.2.1.2. MECHANICAL INFRASTRUCTURE

13.2.1.3. GENERAL CONSTRUCTION

13.3 FINANCIAL SERVICES AND INSURANCE

13.3.1 BY INFRASTRUCTURE TYPE

13.3.1.1. ELECTRICAL INFRASTRUCTURE

13.3.1.2. MECHANICAL INFRASTRUCTURE

13.3.1.3. GENERAL CONSTRUCTION

13.4 IT AND TELECOMMUNICATIONS

13.4.1 BY INFRASTRUCTURE TYPE

13.4.1.1. ELECTRICAL INFRASTRUCTURE

13.4.1.2. MECHANICAL INFRASTRUCTURE

13.4.1.3. GENERAL CONSTRUCTION

13.5 GOVERNMENT AND DEFENSE

13.5.1 BY INFRASTRUCTURE TYPE

13.5.1.1. ELECTRICAL INFRASTRUCTURE

13.5.1.2. MECHANICAL INFRASTRUCTURE

13.5.1.3. GENERAL CONSTRUCTION

13.6 HEALTHCARE

13.6.1 BY INFRASTRUCTURE TYPE

13.6.1.1. ELECTRICAL INFRASTRUCTURE

13.6.1.2. MECHANICAL INFRASTRUCTURE

13.6.1.3. GENERAL CONSTRUCTION

13.7 RETAIL COLOCATION

13.7.1 BY INFRASTRUCTURE TYPE

13.7.1.1. ELECTRICAL INFRASTRUCTURE

13.7.1.2. MECHANICAL INFRASTRUCTURE

13.7.1.3. GENERAL CONSTRUCTION

13.8 POWER AND ENERGY

13.8.1 BY INFRASTRUCTURE TYPE

13.8.1.1. ELECTRICAL INFRASTRUCTURE

13.8.1.2. MECHANICAL INFRASTRUCTURE

13.8.1.3. GENERAL CONSTRUCTION

13.9 MANUFACTURING

13.9.1 BY INFRASTRUCTURE TYPE

13.9.1.1. ELECTRICAL INFRASTRUCTURE

13.9.1.2. MECHANICAL INFRASTRUCTURE

13.9.1.3. GENERAL CONSTRUCTION

13.1 OTHERS

14 GLOBAL DATA CENTER CONSTRUCTION MARKET, BY REGION

14.1 GLOBAL DATA CENTER CONSTRUCTION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 NORTH AMERICA

14.1.1.1. U.S.

14.1.1.2. CANADA

14.1.1.3. MEXICO

14.1.2 EUROPE

14.1.2.1. GERMANY

14.1.2.2. FRANCE

14.1.2.3. U.K.

14.1.2.4. ITALY

14.1.2.5. SPAIN

14.1.2.6. RUSSIA

14.1.2.7. TURKEY

14.1.2.8. BELGIUM

14.1.2.9. NETHERLANDS

14.1.2.10. SWITZERLAND

14.1.2.11. SWEDEN

14.1.2.12. DENMARK

14.1.2.13. POLAND

14.1.2.14. REST OF EUROPE

14.1.3 ASIA PACIFIC

14.1.3.1. JAPAN

14.1.3.2. CHINA

14.1.3.3. SOUTH KOREA

14.1.3.4. INDIA

14.1.3.5. AUSTRALIA AND NEW ZEALAND

14.1.3.6. SINGAPORE

14.1.3.7. THAILAND

14.1.3.8. MALAYSIA

14.1.3.9. INDONESIA

14.1.3.10. PHILIPPINES

14.1.3.11. TAIWAN

14.1.3.12. VIETNAM

14.1.3.13. REST OF ASIA PACIFIC

14.1.4 SOUTH AMERICA

14.1.4.1. BRAZIL

14.1.4.2. ARGENTINA

14.1.4.3. REST OF SOUTH AMERICA

14.1.5 MIDDLE EAST AND AFRICA

14.1.5.1. SOUTH AFRICA

14.1.5.2. EGYPT

14.1.5.3. SAUDI ARABIA

14.1.5.4. U.A.E

14.1.5.5. ISRAEL

14.1.5.6. KUWAIT

14.1.5.7. QATAR

14.1.5.8. REST OF MIDDLE EAST AND AFRICA

14.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL DATA CENTER CONSTRUCTION MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL DATA CENTER CONSTRUCTION MARKET, SWOT ANALYSIS

17 GLOBAL DATA CENTER CONSTRUCTION MARKET, COMPANY PROFILE

17.1 TURNER CONSTRUCTION COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 DPR CONSTRUCTION(GE JOHNSON)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 AECOM

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 SCHNEIDER ELECTRIC

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 M. A. MORTENSON COMPANY

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 ARUP

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 BRASFIELD & GORRIE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CORGAN.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 CURRIE & BROWN HOLDINGS LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 FORTIS CONSTRUCTION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GENSLER

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 HOLDER CONSTRUCTION GROUP, LLC

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 JACOBS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 ROGERS-O’BRIEN CONSTRUCTION COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 SKANSKA

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 STO BUILDING GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 CHINDATA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 EQUINIX, INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 DELTA ELECTRONICS, INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 CACHE VALLEY ELECTRIC COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 HONEYWELL INTERNATIONAL INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 SECURE IT ENVIRONMENTS LIMITED

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MACE GROUP

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 U.S. ENGINEERING COMPANY HOLDINGS

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Data Center Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Center Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Center Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.