Global Data Center Busway Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

4.84 Billion

2024

2032

USD

2.50 Billion

USD

4.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 4.84 Billion | |

|

|

|

|

Data Center Busway Market Size

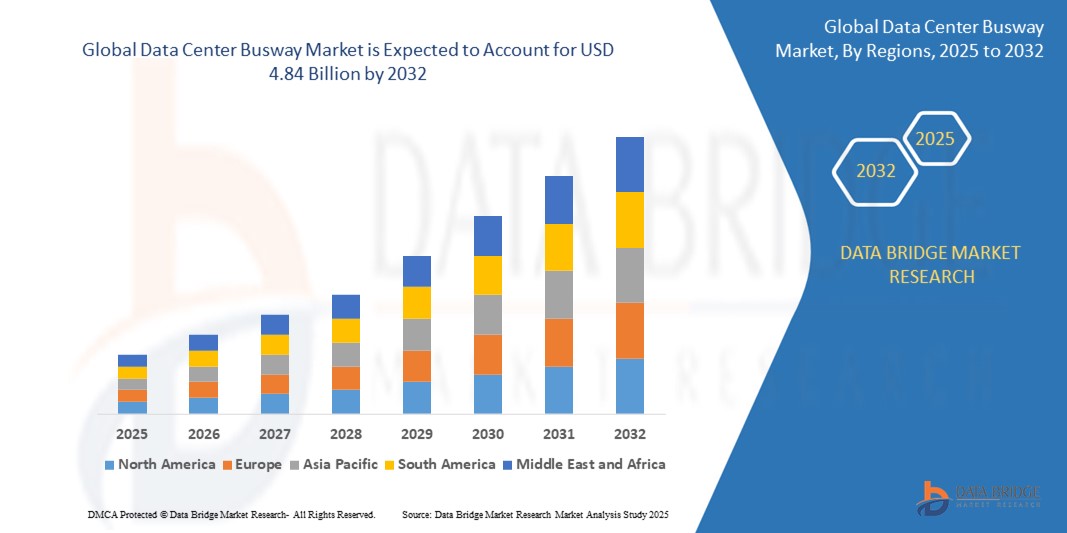

- The global data center busway market was valued at USD 2.50 billion in 2024 and is expected to reach USD 4.84 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.60% primarily driven by the rising demand for energy-efficient and scalable power distribution solutions

- This growth is driven by factors such as the increasing adoption of cloud computing, rapid expansion of data centers, and growing emphasis on modular infrastructure

Data Center Busway Market Analysis

- The data center busway market is steadily growing due to the increasing need for flexible and reliable power distribution in modern IT infrastructures

- For instance, Equinix expanded its SG5 data center in Singapore in 2024 using advanced busway systems, and Digital Realty integrated similar solutions in its new data center campus in Osaka to support high-capacity power loads

- The shift toward modular and scalable data center designs is driving the adoption of busway systems; for instance, Microsoft’s 2023 data center in Cheyenne, Wyoming, implemented modular busways to enable rapid expansion, and Facebook’s Clonee data center in Ireland used busways to minimize downtime during infrastructure upgrades

- Busways are being preferred over traditional cabling because they reduce cable congestion and improve airflow management in high-density environments

- For instance, Amazon Web Services used Starline Track Busway systems in its 2023 Frankfurt facility, and Alibaba Cloud adopted similar technology in its Singapore operations to optimize energy efficiency

- Manufacturers such as Schneider Electric and Siemens are introducing next-generation busway solutions focused on safety, flexibility, and ease of installation

- For instance, Schneider Electric launched the I-Line Busway System in 2024, and Siemens introduced its SIVACON 8PS series to support green data center initiatives and compact layouts

- As the global digital economy continues to expand, businesses are investing in data centers with advanced power infrastructure to ensure performance and efficiency

Report Scope and Data Center Busway Market Segmentation

|

Attributes |

Data Center Busway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Center Busway Market Trends

“Rising Preference for Plug-and-Play Power Distribution Systems”

- Plug-and-play power distribution systems are gaining popularity in data centers for their quick installation and minimal need for complex wiring

- For instance, Digital Realty integrated plug-and-play busway solutions in its Singapore facility to accelerate deployment timelines

- These systems support rapid scalability, allowing data centers to expand or reconfigure power layouts without major downtime

- For instance, Microsoft’s modular data center in Sweden used plug-and-play components to enable seamless upgrades as demand increased

- The modular nature of plug-and-play busways enables hot-swapping, where power units can be added or removed without interrupting ongoing operations, making them ideal for environments that demand high uptime and flexibility

- Data centers benefit from reduced installation time and labor costs when using plug-and-play systems, which is especially valuable during time-sensitive expansions or build-outs

- Many leading manufacturers such as Starline and Schneider Electric are offering advanced plug-and-play busway solutions with integrated safety features and smart monitoring, aligning with the growing demand for user-friendly and efficient power infrastructure in large-scale data centers

Data Center Busway Market Dynamics

Driver

“Growing Demand for Scalable and Energy-Efficient Power Distribution”

- The growing demand for scalable and energy-efficient power distribution is a major driver of the data center busway market, as organizations require flexible infrastructure to meet evolving digital workloads

- Traditional cabling systems often lack the scalability and installation efficiency needed for modern operations, which is why modular busway systems are being adopted for faster, cost-effective power distribution

- For instance, Amazon Web Services in 2023 expanded its data center footprint in Northern Virginia using modular infrastructure, including busway systems, to speed up deployment while optimizing energy efficiency

- Busway systems help reduce cable congestion, enhance airflow, and improve cooling efficiency, which supports sustainability efforts and cuts operational costs

- For instance, Microsoft’s Sweden data center uses streamlined busway systems to maintain sustainable power flow while supporting growing cloud demands

- Major technology providers are now prioritizing power solutions that can scale quickly and reduce downtime, making busway systems a preferred option for hyperscale and enterprise-level data centers

Opportunity

“Integration of Smart Monitoring and IoT in Busway Systems”

- The integration of smart monitoring technologies and Internet of Things-based features is emerging as a key opportunity in the data center busway market, as operators aim for more intelligent and efficient infrastructure

- Smart busway systems enable real-time monitoring of energy usage, fault detection, and predictive maintenance, making data centers more reliable and responsive to issues

- For instance, Starline offers busway solutions with built-in energy monitoring at tap-off points, allowing data center managers to track power loads remotely and detect abnormalities before they cause failures

- These advanced systems support predictive maintenance by analyzing historical and live data, helping to avoid unexpected outages and optimize resource use

- For instance, Vertiv’s smart power monitoring solutions are being used in colocation centers to improve uptime and energy performance

- As digital transformation continues across sectors, the demand for smart, connected infrastructure grows, creating opportunities for vendors to innovate with Internet of Things-enabled busways that support long-term operational and sustainability goals

Restraint/Challenge

“High Initial Cost and Complex Customization Requirements”

- One of the main challenges in adopting data center busway systems is their high initial cost, which includes equipment, specialized installation, and detailed engineering design that can strain the budgets of small to mid-sized enterprises

- The requirement for custom layouts based on power density, architecture, and operational goals makes these systems complex to design and deploy, especially for facilities that require tailored configurations

- For instance, the deployment of a customized busway in a tier-4 data center operated by Equinix in Singapore involved precision engineering and high-end components to ensure zero downtime and full fault tolerance

- Retrofitting existing data centers presents additional complications due to space limitations and the need to maintain uninterrupted services

- For instance, when a financial institution in London upgraded its legacy facility with busway systems, installation had to be done in phases during off-peak hours to avoid service disruptions

- Although busway systems provide long-term efficiency and maintenance benefits, their steep upfront investment and design complexity continue to act as major restraints for budget-conscious or smaller-scale operations

Data Center Busway Market Scope

The market is segmented on the basis of product type, type, implementation, data center type, current ampere, and vertical

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Type |

|

|

By Implementation |

|

|

By Data Center Type |

|

|

By Current Ampere |

|

|

By Vertical |

|

Data Center Busway Market Regional Analysis

“North America is the Dominant Region in the Data Center Busway Market”

- North America dominates the data center busway market due to its advanced technological infrastructure and widespread adoption of cutting-edge digital solutions

- The U.S. significantly contributes to this dominance as tech giants and cloud service providers continue expanding large-scale data centers to manage growing data volumes

- This expansion demands scalable and efficient power distribution systems such as busways, which offer modularity, flexibility, and reduced installation complexity

- The region places strong emphasis on energy efficiency and sustainability, leading to higher adoption of busway systems that optimize airflow and reduce cooling and energy costs

- Continuous investment in innovation, green energy practices, and rapid deployment of digital platforms further strengthens North America's leading position in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is the fastest-growing market for data center busway systems due to rapid digital transformation and rising investments in IT infrastructure

- Countries such as China, India, and Japan are leading this growth, with increasing demand for data storage and processing driving the expansion of data centers

- In China, for instance, government initiatives focused on artificial intelligence and big data have accelerated the adoption of busway systems to support scalable power distribution in expanding facilities

- India’s fast-growing digital economy and surge in cloud computing services are prompting the development of new, modern data centers requiring efficient and flexible power infrastructure

- This widespread construction and modernization across Asia-Pacific highlights the essential role of busway systems in ensuring operational efficiency, energy savings, and future-ready scalability

Data Center Busway Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- EAE Electric (Turkey)

- Vass Electrical Industries (Australia)

- Anord Mardix (Ireland)

- ABB (Switzerland)

- Schneider Electric (France)

- Dingsheng group (China)

- Eaton (Ireland)

- Siemens (Germany)

- Delta Power Solutions (Taiwan)

- Wetown (China)

- Power Plug Busduct Sdn. Bhd (Malaysia)

- Rittal Pvt. Ltd (Germany)

- Tai Sin Electric Limited (Singapore)

- Furukawa Electric Co., Ltd. (Japan)

- Vertiv Group Corp. (U.S.)

- FURUTEC ELECTRICAL SDN. BHD. (Malaysia)

Latest Developments in Global Data Center Busway Market

- In February 2025, Schneider Electric announced the opening of new data center and microgrid testing labs at its Global R&D Center in Massachusetts. This development aims to enhance research and innovation in sustainable energy solutions for data centers and microgrids. The labs will focus on testing advanced power distribution technologies, including energy-efficient systems and renewable integration. The initiative is expected to provide companies with more reliable, sustainable, and scalable energy solutions for their operations. This moves positions Schneider Electric as a leader in advancing energy-efficient infrastructure, impacting the data center market by driving further adoption of green energy technologies and promoting sustainability across industries

- In April 2024, Schneider Electric unveiled the I-Line Track, the next generation of power distribution busway for data centers. This development introduces a more flexible, scalable, and energy-efficient solution for powering data centers, designed to meet the increasing demand for high-performance infrastructure. The I-Line Track allows for quick adjustments to power layouts, making it ideal for rapidly expanding facilities. The system enhances operational efficiency and reduces downtime during installation and upgrades. This innovation is expected to significantly impact the market by driving the adoption of smarter and more adaptable power distribution solutions in data centers globally

- In March 2024, Legrand announced the acquisition of Power Bus Way, a key player in power distribution systems for data centers in North America. This strategic acquisition aims to enhance Legrand's portfolio with advanced busway solutions, positioning the company to better meet the growing demand for energy-efficient and scalable power distribution systems in the data center market. The acquisition will enable Legrand to expand its product offerings and provide more comprehensive solutions to data center operators, driving innovation and supporting the industry's transition to more sustainable energy practices. This move is expected to strengthen Legrand's presence in the North American data center market and contribute to its growth in the global power distribution sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.