Global Dairy Testing Market, By Type (Safety Testing and Quality Analysis), Technology (Traditional and Rapid), Product (Milk and Milk Powder, Cheese, Butter and Spreads, Infant Food, Ice Cream and Desserts, Yogurt, and Others) – Industry Trends and Forecast to 2031.

Dairy Testing Market Analysis and Size

The dairy testing market is advancing with sophisticated technologies such as PCR and ELISA for rapid pathogen detection and quality assessment. Automation is enhancing throughput, ensuring faster and more accurate results. Stringent regulations and rising consumer demand for safe dairy products globally fuel growth. Continuous innovation in testing methods and equipment is key to meeting evolving industry standards and ensuring dairy product safety.

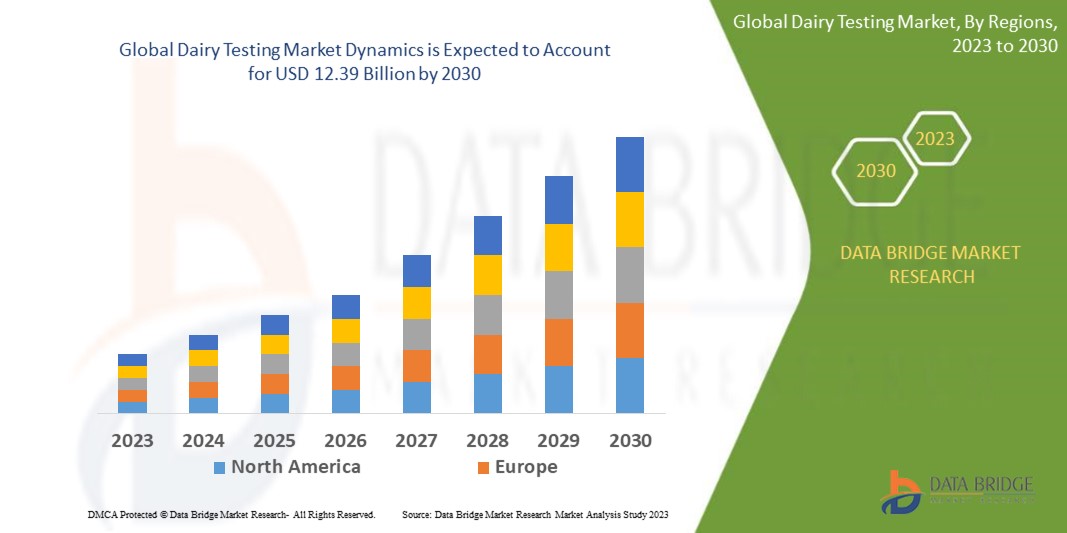

The global dairy testing market size was valued at USD 6.87 billion in 2023 and is projected to reach USD 13.48 billion by 2031, with a CAGR of 8.80% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Safety Testing and Quality Analysis), Technology (Traditional and Rapid), Product (Milk and Milk Powder, Cheese, Butter and Spreads, Infant Food, Ice Cream and Desserts, Yogurt, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

Market Players Covered

|

SGS Société Générale de Surveillance SA (Switzerland), Bureau Veritas (France), Eurofins Scientific (Luxembourg), Intertek Group plc (U.K.), Mérieux NutriSciences Corporation (U.S.), ALS (Australia), AsureQuality (New Zealand), Charm Sciences (U.S.), Premier Analytics Servies (U.K.), Dairyland Laboratories, Inc. (U.S.), AES Laboratories Pvt. Ltd. (India), EnviroLogix (U.S.), and Krishgen Biosystems (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Dairy testing involves rigorous analysis of milk and dairy products to ensure quality, safety, and compliance with standards. It includes microbiological, chemical, and physical tests to detect contaminants, assess nutritional content, and verify processing integrity. Dairy testing plays a crucial role in safeguarding consumer health, maintaining product consistency, and meeting regulatory requirements in the dairy industry.

Dairy Testing Market Dynamics

Drivers

- Rising Consumption of Dairy Products

The increasing global consumption of dairy products, such as milk, cheese, yogurt, and butter, drives the demand for rigorous testing across the supply chain. For instance, in 2023, the European Union implemented stricter testing protocols for dairy imports to ensure compliance with food safety standards. This trend emphasizes the critical need for frequent testing to maintain product quality, mitigate contamination risks, and uphold consumer confidence in dairy products worldwide.

- Outbreaks of Foodborne Diseases

High-profile outbreaks of foodborne illnesses linked to dairy products underscore the urgent need for robust testing measures. Industry stakeholders are increasingly investing in advanced technologies such as PCR and rapid spectroscopy for accurate pathogen detection and compositional analysis. For example, the 2018 outbreak of Salmonella in dairy products in the US led to heightened demand for improved testing solutions, driving market growth as manufacturers prioritize safety and regulatory compliance.

Opportunities

- Technological Advancements in Testing Methods

Technological advancements such as PCR and spectroscopy revolutionize dairy testing by offering rapid pathogen detection and precise compositional analysis. For instance, PCR enables quick identification of pathogens such as Listeria and Salmonella in dairy products, ensuring swift action to prevent outbreaks. Spectroscopy methods provide detailed analysis of milk composition, detecting adulteration or nutritional content accurately. These innovations not only enhance testing efficiency but also create new market opportunities for advanced dairy testing solutions.

- Rising Consumer Demand for Transparency

The rising consumer demand for transparency in food products presents a significant opportunity in the dairy testing market. Consumers increasingly seek detailed information about the safety and quality of dairy products they purchase. For instance, dairy brands that conduct thorough testing for contaminants such as antibiotics and pesticides can capitalize on this trend by emphasizing their rigorous testing protocols. This enhances consumer trust, strengthens brand reputation, and fosters loyalty, driving market growth.

Restraints/Challenges

- Skill Shortages and Training Needs

Skill shortages in dairy testing hinder market growth by limiting the adoption of advanced techniques and maintaining high standards. The industry's reliance on skilled labor exacerbates challenges in training and education, requiring sustained investment. This deficit impacts operational efficiency and compliance, posing obstacles to meeting stringent regulatory requirements.

- High Cost of Testing Equipment and Maintenance

The high cost of acquiring and maintaining advanced dairy testing equipment poses a significant financial barrier for smaller producers and testing facilities. This limitation restricts their access to the latest technologies, impacting the accuracy and efficiency of testing processes. Consequently, it hinders overall market participation and innovation in dairy testing, exacerbating disparities in capabilities across the industry.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2021, Bureau Veritas acquired AET, a company specializing in laboratory and sustainability testing, along with product development. AET's robust R&D activities were a key attraction aimed at enhancing BV's client base and global presence

- In 2021, SGS developed a rapid PCR method for detecting salmonella in various foods, providing results in under 5 days, contrasting with the traditional method's longer timeframe. This ISO-accredited test was implemented at SGS-Laagrima laboratory in Morocco

- In 2021, SGS completed the acquisition of SYNLAB Analytics and Services for EUR 550 million. This acquisition bolsters SGS's global footprint in critical sectors such as life sciences, environment, food, and oil condition monitoring. SYNLAB Analytics & Services, based in Germany, specializes in food, environmental, dairy testing, and tribology services

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Dairy Testing Market Scope

The market is segmented on the basis of type, technology and product. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Safety Testing

- Pathogens

- Cronobacter sakazakii

- E. Coli

- Salmonella

- Campylobacter

- Listeria

- Others

- Vibrio

- Clostridium

- Staphylococcus

- Bacillus

- Pesticides

- Mycotoxins

- Adulterants

- Genetically Modified Organisms (GMOS)

- Quality Analysis

Technology

- Traditional

- Agar Culturing

- Rapid

- Convenience-Based

- Immunoassay

- Chromatography and Spectrometry

- Polymerase Chain Reaction (PCR)

Product

Dairy Testing Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, type, technology and product as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

North America is expected to dominate the dairy testing market due to its numerous processing companies. Stringent regulations ensuring food safety and health will further propel market growth in the region, driving demand for advanced testing technologies and practices.

Asia-Pacific is expected to be the fastest-developing region in the dairy testing market during the forecast period. This growth is driven by rising consumer demand for healthy dairy products in the region. Factors such as increasing awareness about food safety and quality are also contributing to market expansion in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Dairy Testing Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- SGS Société Générale de Surveillance SA (Switzerland)

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (U.K.)

- Mérieux NutriSciences Corporation (U.S.)

- ALS (Australia)

- AsureQuality (New Zealand)

- Charm Sciences (U.S.)

- Premier Analytics Servies (U.K.)

- Dairyland Laboratories, Inc. (U.S.)

- AES Laboratories Pvt. Ltd. (India)

- EnviroLogix (U.S.)

- Krishgen Biosystems (U.S.)

SKU-