Global Dairy Packaging Market

Market Size in USD Million

CAGR :

%

USD

32.47 Million

USD

47.11 Million

2024

2032

USD

32.47 Million

USD

47.11 Million

2024

2032

| 2025 –2032 | |

| USD 32.47 Million | |

| USD 47.11 Million | |

|

|

|

|

Dairy Packaging Market Size

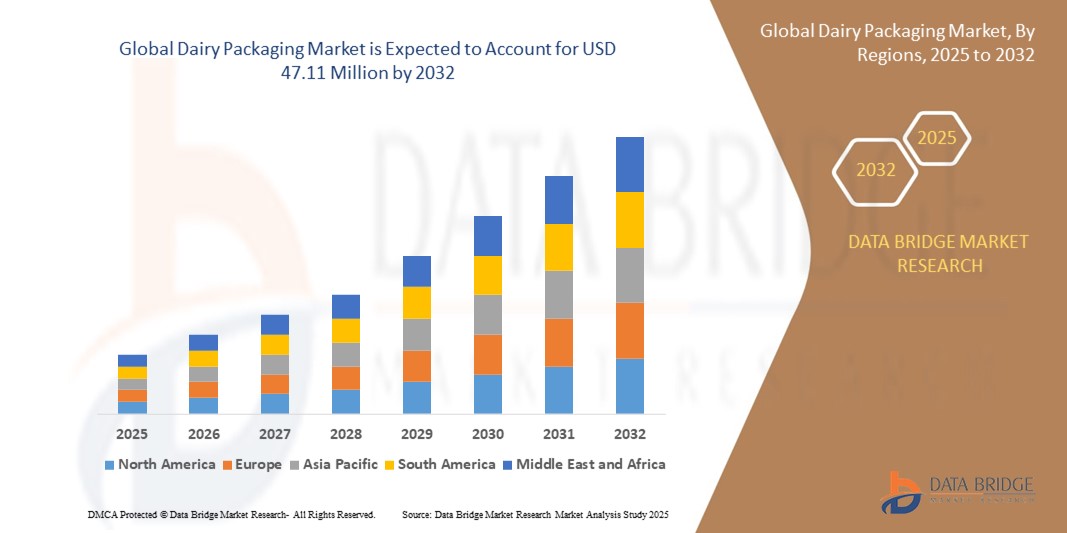

- The global dairy packaging market size was valued at USD 32.47 million in 2024 and is expected to reach USD 47.11 million by 2032, at a CAGR of 4.76% during the forecast period

- This growth is driven by factors such as the increasing demand for dairy products, the rise in consumer preference for convenience packaging, and advancements in sustainable packaging solutions

Dairy Packaging Market Analysis

- The dairy packaging market is witnessing a shift towards sustainable and eco-friendly packaging solutions, with an increasing number of companies opting for recyclable materials. This trend reflects the growing consumer demand for environmentally responsible packaging in the food and beverage industry

- The market is also experiencing significant innovations in packaging technology, such as the introduction of smart packaging that extends shelf life and improves product safety. These advancements are expected to enhance the overall consumer experience and increase market appeal

- North America is expected to dominate the dairy packaging’s market due to the high demand for packaged dairy products, strong consumer base, and the presence of major packaging companies

- Asia-Pacific is expected to be the fastest growing region in the dairy packaging market during the forecast period due to rapid urbanization, increasing disposable incomes, and rising awareness of packaged dairy products

- Plastic segment is expected to dominate the market with a market share of 45.6% % due to its durability, cost-effectiveness, and widespread use in packaging milk and other dairy products

Report Scope and Dairy Packaging Market Segmentation

|

Attributes |

Dairy Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dairy Packaging Market Trends

“Shift Towards Sustainable Materials”

- Sustainable packaging is becoming a key trend in the dairy packaging market as consumers increasingly seek environmentally friendly options and companies respond to stricter regulations

- For instance, Danone has committed to making all its packaging recyclable, reusable, or compostable and has introduced plant-based bottles for several of its dairy brands

- Convenience packaging is gaining popularity, especially among urban consumers who prefer single-serve and resealable formats for on-the-go lifestyles

- For instance, Amul and Nestlé have launched portable, easy-to-carry dairy drink packs targeting school-goers and working professionals

- The integration of smart packaging is improving consumer engagement and product traceability in the dairy sector, enhancing both safety and transparency

- For instance, Arla Foods uses QR codes on its milk cartons to provide sourcing and nutritional details, helping consumers make informed choices

- Shelf-stable packaging is expanding as it enables longer product life without refrigeration, making dairy accessible in areas with limited cold chain infrastructure

- For instance, Tetra Pak’s aseptic packaging is widely used for milk and yogurt products in regions such as South Asia and Africa where cold storage is less reliable

Dairy Packaging Market Dynamics

Driver

“Rising Demand for Convenient and Ready-to-Consume Dairy Products”

- The increasing demand for on-the-go dairy products is driving innovations in packaging. Consumers are looking for convenient and portable dairy options, leading manufacturers to create packaging that offers ease of use

- For instance, Danone has developed resealable pouches for its yogurt products, allowing consumers to enjoy a fresh snack at their convenience, promoting portability and ease of consumption

- Sustainability is becoming a key factor in dairy packaging innovation. With rising environmental awareness, consumers and companies are prioritizing eco-friendly packaging solutions

- For instance, Major companies such as Nestlé have started using recyclable materials in their dairy packaging, aligning with growing consumer demand for sustainable practices in the food industry

- Single-serve and portion-controlled dairy products are on the rise. As more people adopt busy lifestyles, small and single-serve packaging options are becoming increasingly popular

- Technological advancements in packaging are helping extend the shelf life of dairy products. Innovations in packaging materials are allowing for longer product freshness and improved safety.

- For instance, Brands such as Chobani are using advanced barrier films in their packaging to keep their yogurt products fresh longer without the need for preservatives, enhancing the product's quality

- Consumer preference for healthier and more nutritious snacks is influencing dairy packaging trends. As dairy-based snacks gain popularity, packaging is evolving to meet the needs of health-conscious consumers

- For instance, brands such as The Laughing Cow are designing smaller, portable cheese portions that cater to consumers looking for healthy, convenient snack options on the go

Opportunity

“Expansion of Smart Packaging Technologies”

- Smart packaging enhances the consumer experience by offering real-time product information

- For instance, companies such as Nestlé have started using QR codes on dairy products to provide consumers with detailed information about the product's origin, nutritional facts, and expiry dates

- RFID tags and temperature indicators help dairy manufacturers track products from production to delivery, ensuring quality control. Lactalis is implementing such smart packaging solutions to improve product freshness and manage inventory more effectively across their supply chain

- Smart packaging allows for better waste management by providing clear expiration dates and inventory management. This helps reduce the amount of food waste generated, with companies such as Danone adopting these technologies to increase sustainability across their packaging lines

- By integrating smart packaging, dairy manufacturers can streamline operations and reduce waste, cutting unnecessary costs

- For instance, Friesland Campina is using smart packaging to reduce spoilage and improve distribution efficiency, contributing to cost savings

- Offering real-time freshness monitoring and personalized notifications fosters trust and brand loyalty among consumers. Smart packaging solutions, such as those being tested by Arla, allow customers to check the freshness of their dairy products through mobile apps, enhancing their overall experience and satisfaction

Restraint/Challenge

“Volatility in Raw Material Prices”

- Fluctuations in raw material prices, particularly plastics and paperboard, present a significant challenge in the dairy packaging market. Price volatility directly affects packaging costs, which in turn impacts dairy product pricing.

- For instance, during the global supply chain crisis from 2021 to 2022, dairy companies such as Dairy Farmers of America reported delays and increased costs in sourcing packaging materials, which led to higher production expenses and longer delivery times

- Rising prices of petroleum-based plastics and paperboard are a major concern for dairy packaging manufacturers. Global supply chain disruptions, inflation, and geopolitical issues are contributing to the price hikes of these materials.

- For instance, in 2021, companies such as Tetra Pak announced price increases for their packaging products, citing higher raw material costs as a primary reason, which strained manufacturers' budgets and affected their profit margins

- As environmental regulations push for eco-friendly packaging, the cost of sustainable materials such as bioplastics or recycled paper increases. These alternatives often come at a premium compared to traditional materials.

- For instance, in 2022, Arla Foods highlighted that using more sustainable packaging options, such as bioplastics, raised production costs, putting pressure on their overall pricing strategy

- Smaller dairy producers are particularly vulnerable to fluctuations in raw material costs. Without the scale to absorb rising prices, these companies may struggle to stay competitive in the market.

- For instance, smaller dairy producers in the U.K. experienced financial difficulties during the 2021 supply chain disruptions due to their reliance on more expensive packaging and limited purchasing power

- Volatility in raw material prices requires dairy packaging companies to adopt strategic planning and diversify their supply chains. Investing in sustainable and cost-effective solutions is essential for long-term market stability.

- For instance, Companies such as Nestlé have started focusing on building more resilient and diverse supply chains, ensuring they can maintain production even amid material shortages and price fluctuations

Dairy Packaging Market Scope

The market is segmented on the basis of type, raw material, packaging product, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Raw Material |

|

|

By Packaging Product |

|

|

By Application |

|

In 2025, the flexible is projected to dominate the market with a largest share in packaging product segment

The flexible segment is expected to dominate the dairy packaging market with the largest share of 42.8% in 2025 due to its being lightweight, durable, and cost-effective, making them a popular choice for packaging dairy products.

The plastic packaging is expected to account for the largest share during the forecast period in raw material market

In 2025, the plastic packaging segment is expected to dominate the market with the largest market share of 45.6% due to its versatile and widely used for dairy products such as milk, yogurt, and cheese due to their excellent barrier properties and durability.

Dairy Packaging Market Regional Analysis

“North America Holds the Largest Share in the Dairy Packaging Market”

- North America is the dominating region in the dairy packaging market, holding the largest market share of around 35-40%

- The demand for packaged dairy products, including single-serve and ready-to-consume options, is a major factor contributing to this dominance

- The presence of leading dairy packaging companies in the U.S. and Canada strengthens the region's market leadership

- The strong retail and e-commerce infrastructure in North America supports the widespread availability and adoption of packaged dairy products

“Asia-Pacific is Projected to Register the Highest CAGR in the Dairy Packaging Market”

- Asia-Pacific is the fastest growing region in the dairy packaging market

- Rapid urbanization and increasing disposable incomes in countries such as China and India are driving the demand for packaged dairy products

- The rise in consumer awareness regarding product quality and safety is contributing to the market's growth in the region

- The expanding middle-class population in Asia-Pacific is fuelling the demand for dairy products, driving packaging innovations to cater to this growing consumer base

Dairy Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amcor Limited (Australia)

- Ball Corporation (U.S.)

- Bemis Company, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Tetra Pak International S.A. (Switzerland)

- International Paper (U.S.)

- Sealed Air (U.S.)

- MeadWestvaco Corporation (U.S.)

- Mondi (U.K.)

- Nampak Ltd. (South Africa)

- Rexam plc (U.K.)

- Ardagh Group (Luxembourg)

- RPC Group Plc (U.K.)

- Evergreen Packaging LLC (U.S.)

- Industrial Development Company sal (Lebanon)

- ELOPAK (Norway)

- Blue Ridge Paper Products (U.S.)

- CLONDALKIN GROUP (Ireland)

- CKG Packaging, INC. (U.S.)

- Crown (U.S.)

- Essel Propack Limited (India)

- Fabri-Kal (U.S.)

- Coveries (U.S.)

- Exopack Holdings (U.S.)

- Grahman Packaging Company (U.S.)

Latest Developments in Global Dairy Packaging Market

- In October 2023, IVE Group Limited (Australia) acquired JacPak Pty Ltd for AUD 35 million, marking its entry into the fibre-based packaging sector. This strategic acquisition allows IVE to expand its portfolio into the short-to-medium-run folding cartons market, valued at approximately AUD 800 million. By leveraging JacPak's existing capacity and customer base, IVE aims to diversify its offerings and strengthen its position in the Australian packaging industry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dairy Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dairy Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dairy Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.