Global Cyclohexane Market

Market Size in USD Billion

CAGR :

%

USD

33.39 Billion

USD

46.40 Billion

2024

2032

USD

33.39 Billion

USD

46.40 Billion

2024

2032

| 2025 –2032 | |

| USD 33.39 Billion | |

| USD 46.40 Billion | |

|

|

|

|

Cyclohexane Market Size

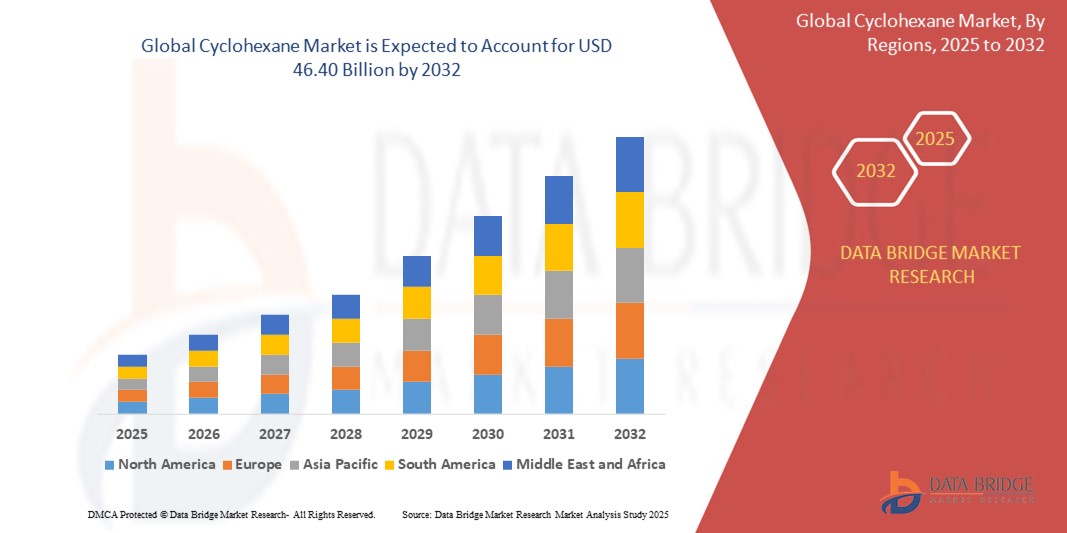

- The global Cyclohexane market size was valued at USD 33.39 billion in 2024 and is expected to reach USD 46.40 billion by 2032, at a CAGR of 4.20% during the forecast period

- Market growth is largely driven by rising demand for cyclohexane in the production of nylon intermediates such as adipic acid and caprolactam, which are extensively used in automotive, textile, and industrial applications

- Furthermore, the expanding automotive and construction sectors, particularly in emerging economies, are contributing to the increased consumption of nylon-based products, thus boosting the demand for cyclohexane as a key feedstock

- In addition, technological advancements in hydrogenation and extraction processes are improving production efficiencies and cost-effectiveness, thereby supporting the market expansion of cyclohexane on a global scale

Cyclohexane Market Analysis

- Cyclohexane, a crucial intermediate in the production of nylon, is increasingly vital in the chemical and polymer industries, particularly for the manufacturing of adipic acid and caprolactam—key precursors in nylon 6 and nylon 66 production

- The escalating demand for nylon-based products in the automotive, textile, and electronics industries is primarily fueling the growth of the Cyclohexane market. Its use in lightweight and high-strength materials supports trends toward improved efficiency and durability

- Asia-Pacific dominates the Cyclohexane market with the largest revenue share of 40.01% in 2025, driven by a strong chemical manufacturing base, rapid industrialization, and significant demand from end-use sectors in China, India, and Southeast Asia

- Europe is expected to be the fastest-growing region in the Cyclohexane market during the forecast period due to the region’s increasing focus on sustainable nylon production, technological innovations, and growing investments in downstream chemical facilities

- The caprolactam production segment is expected to dominate the Cyclohexane market with a market share of 43.2% in 2025, owing to its extensive application in producing nylon 6 for use in fibers, films, and molded plastics

Report Scope and Cyclohexane Market Segmentation

|

Attributes |

Cyclohexane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cyclohexane Market Trends

“Growing Demand Driven by Diversified Industrial Applications and Sustainability Focus”

- A significant and accelerating trend in the global Cyclohexane market is the rising demand across diversified end-user industries such as automotive, aerospace, electrical and electronics, paints and coatings, textile, and construction. This broad industrial adoption is driving volume growth and innovation in Cyclohexane production and applications

- For instance, the growing production of Nylon 6 and Nylon 66 fibers, which heavily rely on Cyclohexane derivatives such as caprolactam and adipic acid, is boosting market demand globally. Leading chemical manufacturers such as BASF and Sinopec have expanded capacities to meet this rising demand in Asia Pacific and North America

- Increasing focus on sustainable manufacturing and environmental regulations is pushing market players to develop greener production technologies. For instance companies such as Honeywell UOP are innovating on catalysts and process technologies that reduce emissions and energy consumption during Cyclohexane synthesis

- The expanding electrical and electronics industry is also a key driver, as Cyclohexane-based polyester polyols are critical raw materials in insulating foams and coatings used for electronic devices. This trend aligns with the rising adoption of electric vehicles and smart devices globally

- Furthermore, regional markets such as Asia Pacific are witnessing rapid growth due to the booming textile and automotive sectors. Manufacturers in China, India, and South Korea are investing in localized Cyclohexane supply chains to support these sectors, further fueling market expansion

- This trend towards diversified applications combined with sustainability considerations is reshaping the global Cyclohexane market landscape. Leading companies are now focusing on capacity expansions, technological advancements, and partnerships to capitalize on these opportunities

- The demand for high-purity Cyclohexane and its derivatives continues to grow steadily, driven by industrial end-users prioritizing quality and regulatory compliance. This is resulting in increased investments in refining and quality control technologies

Cyclohexane Market Dynamics

Driver

“Expanding Industrial Demand and Sustainability Initiatives Fuel Market Growth”

- The growing demand for Cyclohexane as a critical feedstock for multiple industrial applications—including adipic acid, caprolactam, nylon production, and polyester polyols—is a major driver of the global market. These derivatives are essential for manufacturing automotive parts, textiles, coatings, and electronics, driving steady growth across industries worldwide

- For instance, in March 2025, Sinopec announced capacity expansion projects for adipic acid and caprolactam production in China, aiming to meet increasing regional and global demand. Such expansions by major chemical producers underscore the rising need for Cyclohexane

- Increasing environmental regulations and sustainability initiatives are pushing manufacturers to adopt cleaner production technologies and improve energy efficiency in Cyclohexane synthesis, enhancing its market appeal. Companies such as Honeywell UOP and BASF are actively developing catalysts and processes that lower carbon emissions and waste generation

- Moreover, the rise of electric vehicles and smart electronics is expanding the use of Cyclohexane-derived materials, such as polyester polyols for insulation and coatings, further bolstering demand

- The Asia Pacific region, led by China and India, continues to witness robust growth due to booming automotive, textile, and construction sectors, driving localized production and consumption of Cyclohexane

Restraint/Challenge

“Stringent Environmental Regulations and Volatile Raw Material Prices Limit Market Expansion”

- Stringent environmental regulations governing VOC (volatile organic compounds) emissions and hazardous waste disposal present significant challenges to Cyclohexane manufacturers, necessitating costly upgrades in production facilities to ensure compliance

- For instance, the European Union’s Industrial Emissions Directive imposes strict limits on air pollutants, compelling companies to invest heavily in emission control technologies, which can increase operating costs

- In addition, the Cyclohexane market faces price volatility due to fluctuations in crude oil and natural gas feedstock costs, impacting production economics and profit margins

- In February 2025, a sudden spike in crude oil prices disrupted supply chains, leading to increased Cyclohexane prices globally and temporary supply shortages in some regions

- Such price instability can deter downstream manufacturers from committing to long-term supply contracts, limiting market expansion

- Furthermore, the complexity and capital intensity of Cyclohexane production plants restrict new entrants, maintaining competitive pressure among established players

- To mitigate these challenges, market participants are focusing on process optimization, diversification of feedstock sources, and strategic partnerships to stabilize supply and reduce environmental impact

Cyclohexane Market Scope

The market is segmented on the basis of application, end-user industry, and type.

By Application

On the basis of application, the cyclohexane market is segmented into adipic acid, nylon 6, nylon 66, polyester polyol, caprolactam, and other applications. The caprolactam segment dominates the largest market revenue share of 43.2% in 2025, driven by its essential role in the production of nylon 6 used across fibers, engineering plastics, and industrial yarns. the robust growth in textile, automotive, and electronics sectors is fueling the demand for caprolactam, subsequently propelling the cyclohexane market

The adipic acid segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by its wide application in producing nylon 66 and polyurethane products. increasing demand for lightweight and durable materials in automotive and construction industries, along with the shift toward sustainable polyamides, is boosting this segment

• By End-User Industry

On the basis of end-user industry, the cyclohexane market is segmented into automotive, aerospace and defense, electrical and electronics, paints and coatings, textile, construction, and others. The automotive segment held the largest market revenue share in 2025, driven by the growing use of nylon-based components for reducing vehicle weight and improving fuel efficiency. Cyclohexane-derived materials such as nylon are essential in under-the-hood and exterior applications

The electrical and electronics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for heat-resistant and durable polymers in connectors, housings, and circuit board components. The increasing miniaturization and complexity of electronic devices is contributing to the segment’s growth

• By Type

On the basis of type, the cyclohexane market is segmented into small rings, common rings, medium rings, and others. The common rings segment accounted for the largest market revenue share in 2025, attributed to their high stability and extensive use in chemical synthesis processes, particularly in the manufacture of adipic acid and caprolactam. Their well-established production infrastructure and proven compatibility with large-scale industrial reactions continue to drive demand

The medium rings segment is expected to witness the fastest CAGR from 2025 to 2032, driven by ongoing innovations in organic synthesis and growing demand in specialty chemical applications. Their structural flexibility and reactivity make them attractive for high-value chemical intermediates

Cyclohexane Market Regional Analysis

- Asia-Pacific dominates the Cyclohexane market with the largest revenue share of 40.01% in 2025, driven by strong demand from the textile and automotive industries, particularly in China, India, and Southeast Asia. The region’s expanding industrial base and increasing production of nylon-based products are major contributors to this growth

- Countries in the region are witnessing rapid industrialization and infrastructure development, which has led to increased consumption of nylon fibers, plastics, and resins—fueling the demand for cyclohexane as a key raw material

- This dominance is further supported by cost-effective manufacturing capabilities, availability of raw materials, and supportive government initiatives aimed at strengthening chemical and polymer industries in the region

Japan Cyclohexane Market Insight

The Japan cyclohexane market is gaining momentum due to the country’s well-established chemical industry, advanced manufacturing technologies, and significant demand for high-performance materials. Cyclohexane is primarily utilized in the production of caprolactam and adipic acid, which are essential for nylon fiber and resin manufacturing. Japan's strong automotive and electronics sectors are driving consumption, while sustainability efforts are encouraging the development of eco-efficient chemical production processes

China Cyclohexane Market Insight

The China cyclohexane market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s rapid industrial expansion, large-scale nylon production, and high domestic consumption. China remains a major global producer of caprolactam, and its vast textile and automotive sectors continue to drive the demand for cyclohexane. Government incentives supporting chemical manufacturing and export competitiveness further reinforce China’s dominant position in the market

Europe Cyclohexane Market Insight

The European Cyclohexane market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising demand for lightweight and sustainable materials in automotive and construction applications. Stringent environmental regulations are encouraging the use of bio-based and recyclable nylon, leading to growing interest in cleaner cyclohexane production methods. Key countries such as Germany, France, and Belgium are central to the region’s chemical innovation and industrial consumption

U.K. Cyclohexane Market Insight

The U.K. Cyclohexane market is anticipated to grow at a noteworthy CAGR during the forecast period due to ongoing investments in textile innovation and engineering plastics. Increased focus on supply chain resilience post-Brexit, alongside domestic chemical production capabilities and sustainability regulations, is expected to drive the growth of cyclohexane demand for nylon-based applications in consumer goods, automotive parts, and packaging materials

Germany Cyclohexane Market Insight

The German Cyclohexane market is expected to expand at a considerable CAGR, driven by the country's technological leadership in polymer and chemical engineering. Germany is a key player in nylon resin manufacturing, and cyclohexane is integral to this supply chain. As the nation focuses on energy-efficient and green chemistry processes, the integration of sustainable cyclohexane derivatives is gaining momentum across multiple industrial applications

North America Cyclohexane Market Insight

The North America Cyclohexane market is characterized by advanced production infrastructure, particularly in the U.S., which is a major producer and exporter of chemical intermediates. The demand is driven by automotive lightweighting trends, the use of engineering plastics, and increasing caprolactam and adipic acid consumption. Sustainability regulations and the focus on reshoring chemical supply chains are further contributing to steady growth across the region.

U.S. Cyclohexane Market Insight

The U.S. Cyclohexane market captured the largest revenue share of 81% within North America in 2025, supported by high demand for nylon resins and synthetic fibers used in packaging, electronics, and automotive applications. The country’s strong refinery infrastructure and extensive investment in chemical R&D and innovation have positioned it as a key supplier of cyclohexane for both domestic use and export

Cyclohexane Market Share

The Cyclohexane industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Merck KGaA (Germany)

- Cepsa (Spain)

- Exxon Mobil Corporation. (U.S.)

- Chevron Phillips Chemical (U.S.)

- DuPont (U.S.)

- Huntsman International LLC. (U.S.)

- Clariant (Switzerland)

- Dow (U.S.)

- Idemitsu Kosan Co., Ltd. (Japan)

- BP p.l.c. (U.K.)

- Liaoning Yufeng Chemical Co., Ltd. (China)

- PTT Global Chemical Public Company Limited (Thailand)

- REE ATHARVA LIFESCIENCE PVT. LTD. (India)

- Reliance Industries Limited. (India)

- China Petrochemical Corporation (China)

Latest Developments in Global Cyclohexane Market

- In October 2024, Nippon Paint Holdings signed a definitive agreement to acquire LSF11 A5 TopCo LLC and its subsidiaries, collectively known as AOC, for approximately USD 2.3 billion. This acquisition aligns with NPHD’s strategy to expand its global footprint in the specialty chemicals sector, particularly in composite resins and materials used across industries such as automotive, construction, and marine

- In August 2024, INVISTA announced the completion of its nylon 6,6 polymer site expansion at the Shanghai Chemical Industry Park, doubling its annual production capacity to 400,000 metric tons. This investment strengthens local supply capabilities and supports growing demand for nylon products, particularly in industries reliant on cyclohexanone. The expansion integrates advanced polymerization technology and enhances INVISTA’s global nylon 6,6 value chain

- In April 2024, NILIT, a leading Israeli nylon manufacturer, announced a joint venture with Shenma Industry Co., Ltd., a subsidiary of China Pingmei Shenma Group. This partnership aims to expand NILIT’s global presence and strengthen its foothold in the Asian market by producing high-quality industrial-grade nylon. The collaboration will introduce advanced technologies and enhance production capacity to meet growing demand

- In April 2024, Nylon Corporation of America (NYCOA) introduced NY-Clear, an advanced amorphous 6I/6T nylon designed for packaging and precision-molded applications. This transparent nylon offers exceptional clarity and strong permeation resistance, with up to 30% higher resistance to oxygen, carbon dioxide, and water vapor transmission compared to competing materials. NYCOA showcased NY-Clear at NPE 2024, highlighting its superior dimensional stability and heat resistance for flexible food packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cyclohexane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cyclohexane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cyclohexane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.