Global Crude Sulfate Turpentine Market

Market Size in USD Million

CAGR :

%

USD

609.93 Million

USD

964.82 Million

2024

2032

USD

609.93 Million

USD

964.82 Million

2024

2032

| 2025 –2032 | |

| USD 609.93 Million | |

| USD 964.82 Million | |

|

|

|

|

Crude Sulfate Turpentine Market Size

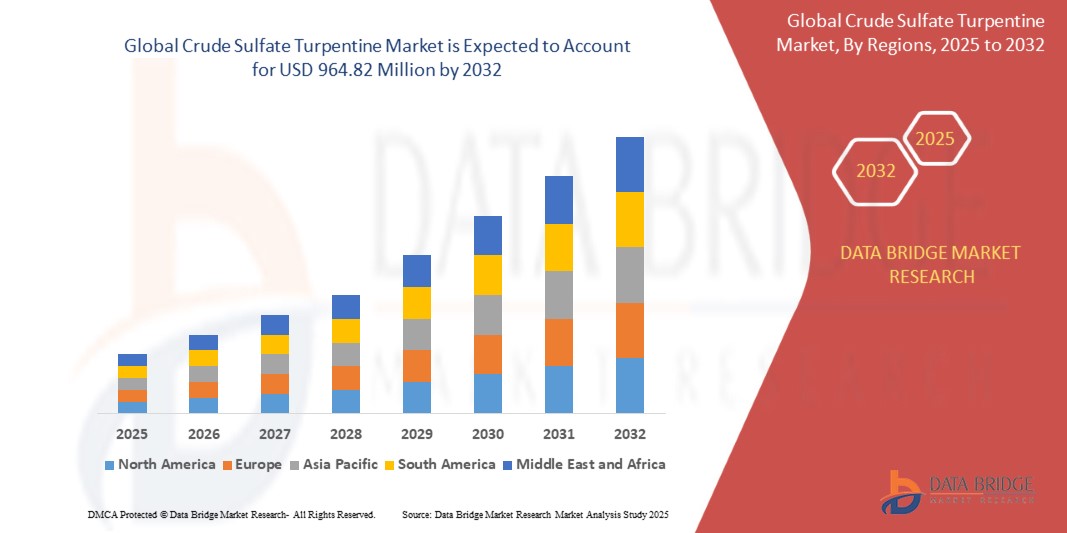

- The global crude sulfate turpentine market size was valued at USD 609.93 million in 2024 and is expected to reach USD 964.82 million by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for natural and bio-based raw materials in fragrance, adhesives, and solvents industries

- The volatility in crude oil prices and the rising regulatory pressure on synthetic chemicals are encouraging industries to substitute petrochemical-based ingredients with natural derivatives such as crude sulfate turpentine, enhancing its market relevance across multiple end-use sectors

Crude Sulfate Turpentine Market Analysis

- The growing shift towards sustainable and environmentally friendly chemical sources is encouraging manufacturers to adopt crude sulfate turpentine as a renewable alternative to petroleum-derived solvents

- Its wide-ranging applications in perfumes, flavoring agents, resins, and as a chemical intermediate in the production of aroma chemicals are further boosting market traction

- North America held a prominent share in the crude sulfate turpentine market in 2024, driven by the rising demand for bio-based solvents and increasing production of kraft pulp across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global crude sulfate turpentine market, driven by increasing demand for aromatic chemicals, cost-effective production capabilities, and rapid growth of the paper industry in countries such as China, India, and Indonesia

- The alpha pinene segment accounted for the largest market revenue share in 2024, primarily due to its extensive usage in the synthesis of fragrance and flavor compounds. Its strong aromatic characteristics and high availability from turpentine distillation make it a preferred ingredient in perfumes, disinfectants, and household products. The demand for alpha pinene continues to grow with the rising consumer preference for bio-based products in both industrial and personal care applications

Report Scope and Crude Sulfate Turpentine Market Segmentation

|

Attributes |

Crude Sulfate Turpentine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Bio-Based Solvents and Fragrances • Increasing Applications in Pharmaceutical and Adhesive Industries |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Crude Sulfate Turpentine Market Trends

“Growing Preference for Natural and Renewable Ingredients in Industrial Formulations”

- Rising consumer awareness regarding the environmental impact of synthetic chemicals is encouraging industries to adopt bio-based ingredients such as crude sulfate turpentine

- Regulatory pressures in regions such as Europe are compelling manufacturers to substitute petroleum-derived chemicals with renewable alternatives

- Fragrance and flavor industries are increasingly utilizing turpentine-derived compounds such as pinene and limonene in place of synthetic aroma chemicals

- Crude sulfate turpentine, being derived from renewable pine resources, is emerging as a sustainable solution for paints, adhesives, and cleaning agents

- For instance, A fragrance manufacturer in Germany reported switching 60% of its synthetic inputs to turpentine-based derivatives to meet natural product demand and certification requirements

Crude Sulfate Turpentine Market Dynamics

Driver

“Rising Demand for Bio-Based Chemicals Across Multiple Industries”

- Bio-based compounds derived from crude sulfate turpentine are replacing petrochemical-based inputs in adhesives, coatings, and personal care applications

- Growing sustainability goals among global manufacturers are increasing the demand for pine-derived materials such as alpha-pinene and beta-pinene

- The cosmetics and fragrance sectors are leading in adopting turpentine-derived aroma ingredients for clean-label and green-certified products

- International policies supporting reduced carbon emissions and eco-friendly sourcing are accelerating market adoption of turpentine-based solvents

- For instance, European perfumery brands have integrated turpentine-based limonene as a core ingredient in their new natural fragrance lines to align with consumer expectations

Restraint/Challenge

“Volatility in Supply and Pricing of Raw Material Inputs”

- Crude sulfate turpentine supply is dependent on the pulp and paper industry, making it vulnerable to shifts in paper production trends

- Mill closures or reduced output in the kraft pulp industry can significantly constrain the availability of turpentine as a byproduct

- Seasonal and regional restrictions on logging impact the consistency of pinewood feedstock used in the pulping process

- Transportation issues in remote forest regions further disrupt supply chains, affecting delivery timelines and increasing costs

- For instance, A temporary closure of a major pulp mill in the U.S. Northwest region led to a 15% drop in crude sulfate turpentine supply, impacting downstream chemical manufacturers

Crude Sulfate Turpentine Market Scope

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the crude sulfate turpentine market is segmented into alpha pinene, beta pinene, delta 3 carene, camphene, limonene, and others. The alpha pinene segment accounted for the largest market revenue share in 2024, primarily due to its extensive usage in the synthesis of fragrance and flavor compounds. Its strong aromatic characteristics and high availability from turpentine distillation make it a preferred ingredient in perfumes, disinfectants, and household products. The demand for alpha pinene continues to grow with the rising consumer preference for bio-based products in both industrial and personal care applications.

The delta 3 carene segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing application in pharmaceutical formulations and as a potential biofuel component. Delta 3 carene’s unique aroma profile and low toxicity contribute to its rising appeal among manufacturers of natural aroma chemicals and green solvents. Its role in producing fine chemicals also supports its growing prominence across global markets.

• By Application

On the basis of application, the crude sulfate turpentine market is segmented into aromatic chemicals, adhesives, paints and printing inks, camphor, and others. The aromatic chemicals segment held the largest market revenue share in 2024, driven by high demand from the flavor and fragrance industry. The ability to extract valuable derivatives such as pinene and limonene makes crude sulfate turpentine a cost-effective raw material for this sector.

The adhesives segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the shift towards renewable feedstocks and increasing adoption in industrial and consumer adhesive formulations. Crude sulfate turpentine’s compatibility with polymer resins and its role in enhancing adhesion and solubility are contributing factors to its rapid growth in this application area.

Crude Sulfate Turpentine Market Regional Analysis

- North America held a prominent share in the crude sulfate turpentine market in 2024, driven by the rising demand for bio-based solvents and increasing production of kraft pulp across the region

- The region benefits from the presence of major paper and pulp manufacturers, particularly in the U.S., which ensures a consistent supply of crude sulfate turpentine as a byproduct

- Moreover, growing awareness regarding sustainable and eco-friendly alternatives in the chemical and fragrance industries is further accelerating market demand

U.S. Crude Sulfate Turpentine Market Insight

The U.S. crude sulfate turpentine market dominated the North American region in 2024, supported by a well-established kraft pulping industry and rising investment in bio-based chemical processing. The growing use of crude sulfate turpentine in adhesives, paints, and aroma chemicals is further driving demand. In addition, the country’s advanced refining capabilities and focus on renewable feedstocks enhance production efficiency. This, along with regulatory support for low-emission products, continues to stimulate market growth.

Europe Crude Sulfate Turpentine Market Insight

The Europe crude sulfate turpentine market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the region’s push for green chemicals and adherence to strict environmental regulations. European manufacturers are increasingly leveraging crude sulfate turpentine for the production of fragrances and flavoring agents. Countries such as Germany, Finland, and Sweden—major players in pulp production—are contributing significantly to the regional supply. The demand is also supported by increased utilization in paints, inks, and coatings.

Germany Crude Sulfate Turpentine Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032. The country’s focus on sustainable chemical solutions, along with its dominant pulp and paper processing capacity, is a primary growth driver. In addition, the expanding fragrance and cosmetics sectors are increasingly sourcing natural aromatic bases derived from crude sulfate turpentine, further promoting domestic consumption and innovation in value-added derivatives.

U.K. Crude Sulfate Turpentine Market Insight

The U.K. crude sulfate turpentine market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for sustainable and bio-based raw materials in the chemicals and personal care industries. With a strong focus on environmental compliance and circular economy practices, U.K.-based manufacturers are gradually adopting crude sulfate turpentine as a renewable ingredient in fragrances, paints, and adhesives. In addition, rising awareness among consumers regarding natural product formulations is fostering the use of terpene-derived compounds across multiple applications.

Asia-Pacific Crude Sulfate Turpentine Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization and expanding pulp and paper manufacturing in countries such as China, India, and Indonesia. Rising demand for aroma chemicals, bio-solvents, and industrial resins in the region is accelerating market expansion. In addition, the cost-effective production and abundant availability of raw materials position Asia-Pacific as a key exporter of crude sulfate turpentine and its derivatives.

China Crude Sulfate Turpentine Market Insight

China held the largest revenue share in the Asia-Pacific crude sulfate turpentine market in 2024, owing to its substantial kraft pulp production capacity and strong domestic demand for terpene-based chemicals. Crude sulfate turpentine is widely used in the country’s rapidly growing adhesives, ink, and fragrance sectors. The government’s focus on green chemistry and the development of eco-friendly manufacturing practices are also contributing to the continued expansion of this market segment.

Japan Crude Sulfate Turpentine Market Insight

Japan is expected to witness the fastest growth rate from 2025 to 2032, driven by its advanced manufacturing infrastructure and growing interest in natural and low-emission alternatives. The country’s well-developed fragrance and cosmetics sectors are increasingly incorporating terpene-based ingredients sourced from crude sulfate turpentine. Moreover, the push for green chemistry and innovation in industrial solvents is encouraging Japanese companies to invest in sustainable raw material sourcing, contributing to market expansion.

Crude Sulfate Turpentine Market Share

The Crude Sulfate Turpentine industry is primarily led by well-established companies, including:

- Renessenz LLC (U.S.)

- International Flavors & Fragrances Inc. (U.S.)

- Privi Speciality Chemicals Limited (India)

- Derives Resiniques et Terpeniqes (France)

- Lawter Inc. (U.S.)

- Pine Chemical Group (Finland)

- ACURO ORGANICS LIMITED (U.S.)

- Millennium Specialty Chemicals Inc. (U.S.)

- Qingshuiyuan Technology CO., Ltd., (China)

- Aurora Fine Chemicals (U.S.)

- Zouping Dongfang Chemical Co., Ltd. (China)

- Salicylates and Chemicals Pvt. Ltd (India)

- KRATON CORPORATION (Japan)

- OOO Torgoviy Dom Lesokhimik (Russia)

- PInova, Inc. (U.S.)

- Weyerhaeuser Company (U.S.)

Latest Developments in Global Crude Sulfate Turpentine Market

- In May 2023, Sika Group successfully finalized the acquisition of MBCC Group, a strategic move aimed at enhancing the company's sustainable transformation in the construction sector. This acquisition is expected to bolster Sika's position in the concrete bonding agents market

- In May 2022, Euclid Chemical Company acquired Chryso's North American cement grinding aids and additives business. The acquisition aims to improve cement performance and reduce CO2 emissions during production, aligning with sustainability goals

- In April 2022, Euclid Chemical Company further strengthened its presence in the North American construction industry by acquiring Chryso's cement grinding aids and additives business. This acquisition enhances Euclid's capabilities in providing advanced solutions for concrete and masonry construction

- In August 2021, Sika AG launched an innovative concrete repair solution designed to offer long-term protection for buildings while significantly reducing CO2 emissions. This new product sets a benchmark for low environmental impact in concrete repair solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Crude Sulfate Turpentine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Crude Sulfate Turpentine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Crude Sulfate Turpentine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.