Global COVID-19 Diagnostics Market Segmentation, By Test Type (Molecular Assays, Serologic Immunoassays and Ancillary Diagnostic Tests), Product (Polymerase Chain Reaction Kits, Point-of-care (POC) Tests Kits, Immunoassay, Instruments, Reagent and Kits), Technology (Polymerase Chain Reaction (PCR), Enzyme Linked Immunosorbent Assay (ELISA), Lateral Flow Immunoassay (LFIA), and Others), Sample Type (Oropharyngeal and Nasopharyngeal Swabs, Nasal Swabs, Blood and Others), Setting (Lab based and Point of Care), End User (Hospitals, Public Health Labs, Private or Commercial Labs, Urgent Care Clinics, Physician Labs) – Industry Trends and Forecast to 2032

COVID-19 Diagnostics Market Analysis

The Centers for Disease Control and Prevention (CDC) has developed two laboratory tests to identify SARS-CoV-2, the virus that causes COVID-19. The CDC 2019-Novel Coronavirus (2019-nCoV) Real-Time RT-PCR Diagnostic Panel, which detects SARS-CoV-2 in respiratory specimens, was the first test distributed for COVID-19 diagnosis, and it was released in February 2020. In July 2020, the CDC released the CDC Influenza SARS-CoV-2 (Flu SC2) Multiplex Assay, which allows public health laboratories to run three tests in a single reaction well. The Flu SC2 Multiplex uses fewer test reagents, has a higher throughput, and provides accurate results for the presence of SARS-CoV-2, influenza A, and influenza B nucleic acid in a patient specimen.

COVID-19 Diagnostics Market Size

Global COVID-19 diagnostics market size was valued at USD 58.90 billion in 2024 and is projected to reach USD 109.03 billion by 2032, with a CAGR of 8.00% during the forecast period of 2025 to 2032.

COVID-19 Diagnostics Market Trends

"Rapid Adoption of At-Home and Rapid Testing Solutions"

One of the key trends in the global COVID-19 diagnostics market is the growing adoption of at-home and rapid testing solutions. With the increasing need for quick and convenient testing, especially in response to rising cases and the urgency to detect new variants, COVID-19 diagnostics that offer rapid results have become increasingly popular. These tests, including rapid antigen and PCR kits for home use, enable consumers to test themselves with minimal discomfort and avoid long waiting times for results. The ease of access and ability to conduct testing at home without needing specialized medical professionals or facilities has significantly driven the demand. Furthermore, as the world continues to battle new COVID-19 waves and variants, the push for faster, more accessible, and cost-effective diagnostic solutions is expected to continue growing, making these technologies integral in the ongoing fight against the pandemic.

Report Scope and Market Segmentation

|

Attributes

|

COVID-19 Diagnostics Key Market Insights

|

|

Segmentation

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Key Market Players

|

QIAGEN (Germany), F.Hoffmann-La Roche Ltd (Switzerland), Seegene Inc. (South Korea), SolGent Co. Ltd (South Korea), Curetis (Germany), KURBO INDUSTRIES LTD. (Japan), Devex (U.S.), Thermo Fisher Scientific Inc (U.S.), Mylab Discovery Solutions Pvt. Ltd (India), Abbott (U.S.), Getein Biotech, Inc (China), Biomaxima SA (Poland), CTK Biotech, Inc (U.S.), CDC (U.S.), BGI (China), Luminex Corporation (U.S.), Avellino.com (U.S.), PerkinElmer Inc (U.S.), Danaher (U.S.), Thermo Fisher Scientific Inc. (U.S.)

|

|

Market Opportunities

|

|

COVID-19 Diagnostics Market Definition

The novel coronavirus is a single-stranded RNA coronavirus that resembles existing SARS-CoV. As this spreads by close contact with an infected individual and is largely spread through respiratory droplets produced by coughing and sneezing. Coronavirus, which is now a global epidemic, was first discovered in the Chinese area of Wuhan. It is also known as coronavirus illness or COVID-19. RT-PCR, isothermal nucleic acid amplification, antibody detection, and other technologies are utilised in testing kits for the COVID-19 test, which is used to identify the SARS-CoV-2 virus. Serological tests are employed for population surveillance, diagnosis, and the identification of antibodies.

COVID-19 Diagnostics Market Dynamics

Drivers

Need for test kits in hospitals is a driver

The need for coronavirus test kits has expanded along with the coronavirus's widespread. With the aid of test kits, coronavirus identification has become more crucial than ever in order to control the infection's spread and boost the market expansion. Only specialised labs that are licenced to conduct the tests included in this kit, which are of the serology and molecular types. As the kits are based on techniques including real-time polymerase chain reactions, IgM ELISA tests, and microneutralization assays, samples are taken from the nose, sputum test, blood sample, throat swab, and nasal aspirate for testing. The demand for the industry is growing as a result of the global coronavirus outbreak. As the number of patients in hospitals is increasing rapidly, the need for test kits in hospitals to diagnose the patients with symptoms is also increasing which is further drive the market growth.

Technological advancements in COVID-19 rapid testing

Vendors created a variety of innovative rapid testing kits, including cups, cards, and smart test kits. Saliva samples were employed in painless quick testing kits. Additionally, test kits with quicker findings were released on the market. Rapid testing is preferred over other COVID-19 testing kits as a result of these developments. For instance, Meril Diagnostics, an international medical firm with operations in India, produces the non-prescription CoviFind COVID-19 Rapid Antigen Self-Test, which is available and has received approval from the Indian Council of Medical Research (ICMR) for routine usage in India. The introduction of novel and innovative diagnostic tests, such as immunoenzymatic serological tests, rapid antigen tests, and RT PCR-based molecular tests, is expected to drive industry demand.

Opportunities

- Rising number of COVID-19 patients

With the rapidly increasing number of COVID-19 patients worldwide, healthcare professionals require a consistent supply of diagnostic kits, which is expected to have a significant impact on the COVID-19 diagnostics market from 2025 to 2032. The growing number of suspected cases and the need to ensure that test results are correct which has resulted in an increase in demand for more kits, as well as increased safety concerns and the need to diagnose and isolate infected persons, which are expected to boost market growth.

Restraints/Challenges

- Lack of knowledge regarding COVID-19

Lack of knowledge regarding COVID-19 and its symptoms, ability to increase in certain developing regions among professionals will obstruct the market's growth rate. Time required for result is more than 24 hours which is bit longer and will act as a restraint, and further challenge the growth of the COVID-19 Diagnostics market in the forecast period mentioned above. The increased number of false-positive and false-negative results is one of the main drawbacks of fast testing. A set of COVID-19 test kits contained instances of findings that were both falsely positive and falsely negative. When verified with alternate COVID-19 testing, individuals with COVID-19 symptoms both tested negative and positive. These incidents caused the use of COVID-19 fast test kits to decline in some countries.

This COVID-19 diagnostics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the COVID-19 diagnostics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Diagnostics Market Scope

The COVID-19 diagnostics market is segmented on the basis of test type, product, technology, sample type, setting and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test Type

- Molecular Assays

- Serologic Immunoassays

- Ancillary Diagnostic Tests

Product

- Polymerase Chain Reaction Kits

- Point-of-care (POC) tests Kits

- Immunoassay

- Instruments

- Reagent and kits

Technology

- Polymerase Chain Reaction (PCR)

- Enzyme Linked Immunosorbent Assay (ELISA)

- Lateral Flow Immunoassay (LFIA)

- Others

Sample Type

- Oropharyngeal and Nasopharyngeal Swabs

- Nasal Swabs

- Blood

- Others

Setting

- Lab based

- Point of Care

End User

- Hospitals

- Public Health Labs

- Private or Commercial Labs

- Urgent care clinics

- Physician Labs

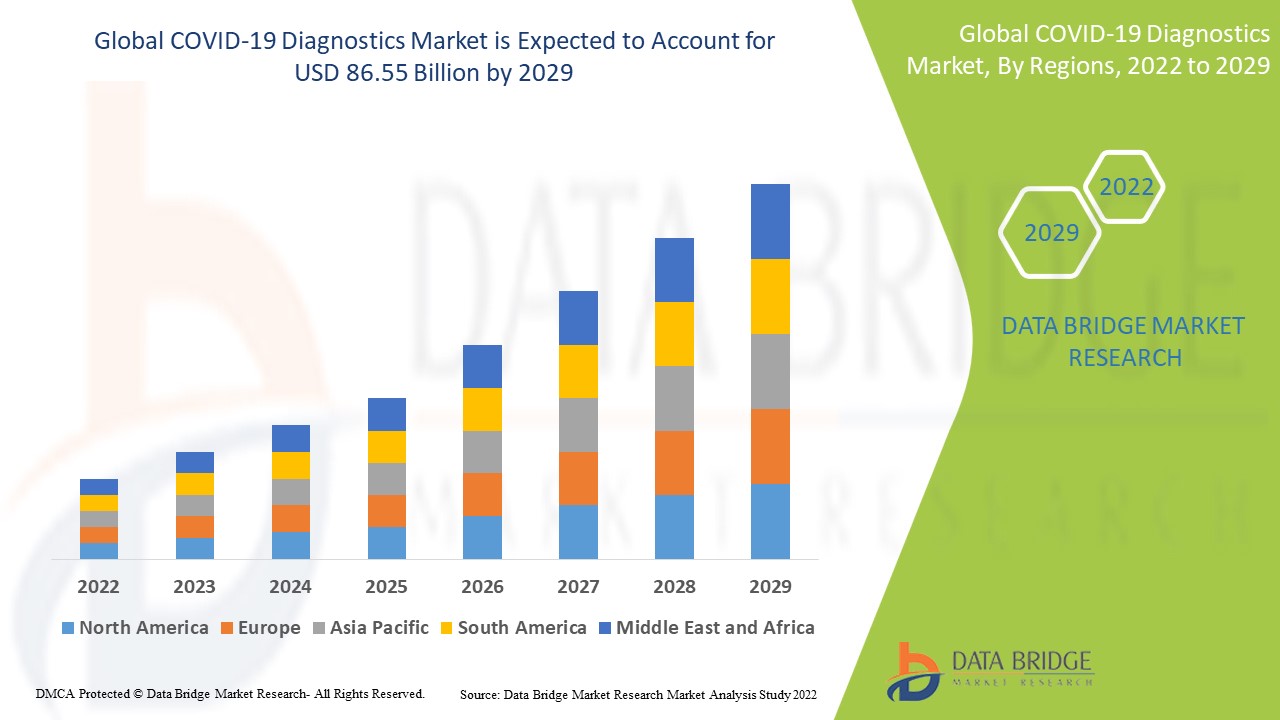

COVID-19 Diagnostics Market Regional Analysis

The COVID-19 diagnostics market is analyzed and market size insights and trends are provided by country, test type, product, technology, sample type, setting and end user as referenced above.

The countries covered in the COVID-19 diagnostics market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the COVID-19 diagnostics market due to the well-established healthcare system and the presence of numerous existing pharma companies in this particular region.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2025 to 2032 owing to the increasing cases of coronavirus along with the presence of several industry players.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

COVID-19 Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

COVID-19 Diagnostics Market Leaders Operating in the Market Are:

- QIAGEN (Germany)

- F.Hoffmann-La Roche Ltd (Switzerland)

- Seegene Inc (South Korea)

- SolGent Co. Ltd (South Korea)

- Curetis (Germany)

- KURBO INDUSTRIES LTD. (Japan)

- Devex (U.S.)

- Thermo Fisher Scientific Inc (U.S.)

- Mylab Discovery Solutions Pvt. Ltd (India)

- Abbott (U.S)

- Getein Biotech, Inc (China)

- Biomaxima SA (Poland)

- CTK Biotech, Inc (U.S.)

- CDC (U.S.)

- BGI (China)

- Luminex Corporation (U.S.)

- Avellino.com (U.S.)

- PerkinElmer Inc (U.S.)

- Danaher (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

Latest Developments in COVID-19 Diagnostics Market

- In July 2021, Abbott launched the PanbioTM COVID-19 antigen self-test in India to expand its quick diagnostics offering to meet screening requirements at home, work, and clinics.

- In March 2021 Roche Diagnostics announced the permission for Emergency Use Authorization (EUA) from the United States Food and Drug Administration (FDA) for the COVID-19 rapid antigen test, which is intended for use by healthcare professionals in point-of-care situations with COVID-19 patients.

SKU-