Global Corporate Learning Management System Market

Market Size in USD Billion

CAGR :

%

USD

12.92 Billion

USD

83.65 Billion

2024

2032

USD

12.92 Billion

USD

83.65 Billion

2024

2032

| 2025 –2032 | |

| USD 12.92 Billion | |

| USD 83.65 Billion | |

|

|

|

|

Corporate Learning Management System Market Size

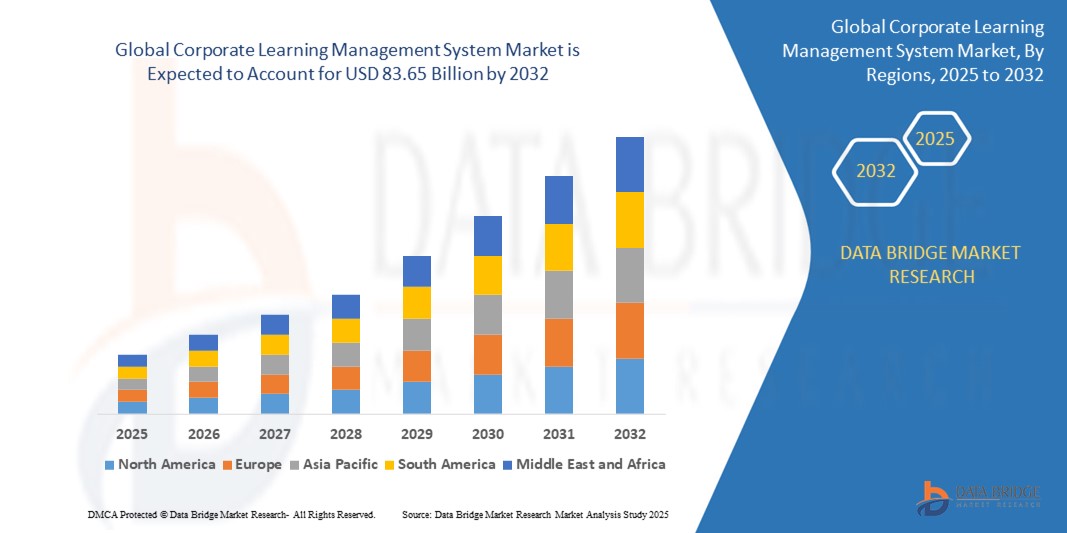

- The global corporate learning management system market size was valued at USD 12.92 billion in 2024 and is expected to reach USD 83.65 billion by 2032, at a CAGR of 26.30% during the forecast period

- The market growth is largely fueled by growing need for employee upskilling and reskilling, demand for scalable and flexible training, the necessity for compliance management, the focus on improving employee engagement and retention, and the increasing reliance on data-driven learning insights

- Technological advancements such as AI, microlearning, mobile learning, and immersive tech enhance LMS effectiveness. The rise of remote work necessitates centralized digital learning. Cloud-based solutions offer scalability and integration with other systems. Growing awareness of strategic learning benefits also fuels adoption

Corporate Learning Management System Market Analysis

- Corporate learning management systems are increasingly vital platforms for modern organizational development and talent management in both corporate and educational settings. This is due to their enhanced efficiency in delivering training, robust tracking and reporting capabilities, and seamless integration with other enterprise systems

- The escalating demand for Corporate LMS is primarily fueled by the growing emphasis on continuous employee learning and development, the increasing need for scalable and flexible training solutions for diverse workforces, and a rising organizational preference for data-driven insights into learning outcomes

- North America is expected to dominate the corporate learning management system market with a share of 36.5% due to significant presence of leading global corporations and a strong organizational focus on continuous employee development and upskilling initiatives

- Asia-Pacific is expected to be the fastest growing region in the corporate learning management system market with a share of during the forecast period due to increasing digitalization, a growing emphasis on skill development, and technological advancements across countries such as China, Japan, and India

- Services segment is expected to dominate the market with a market share of 67.5% due to persistent demand for bespoke implementation services tailored to organizational needs and the critical requirement for ongoing technical support and system maintenance.

Report Scope and Corporate Learning Management System Market Segmentation

|

Attributes |

Corporate Learning Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Corporate Learning Management System Market Trends

“Increasing Adoption of AI-Powered Personalized Learning”

- A significant and accelerating trend in the global Corporate Learning Management System (LMS) market is the deepening integration with artificial intelligence (AI) to deliver personalized learning experiences. This fusion of technologies is significantly enhancing learner engagement and skill development within organizations

- For instance, platforms such as Cornerstone OnDemand and TalentLMS are increasingly incorporating AI-driven features to analyze individual learning styles and recommend tailored content pathways. Similarly, Degreed leverages AI to curate learning resources from various sources based on an employee's skills gaps and career goals

- AI integration in Corporate LMS enables features such as recommending relevant learning content based on an individual's role, past performance, and identified skill gaps, leading to more effective upskilling and reskilling initiatives. Furthermore, AI-powered chatbots, such as those found in platforms such as Lattice, offer learners instant support and guidance, improving the overall learning experience

- The seamless integration of personalized learning with broader talent management ecosystems facilitates a more strategic approach to employee development. Through a single interface, HR and learning professionals can manage learning programs alongside performance management, career development, and succession planning, creating a unified and data-driven approach to talent growth

- This trend towards more intelligent, adaptive, and learner-centric learning platforms is fundamentally reshaping user expectations for corporate training. Consequently, companies such as EdCast are developing AI-enabled learning experience platforms (LXPs) with features such as AI-powered content curation and personalized learning paths based on individual needs and organizational objectives

- The demand for corporate LMS that offers seamless AI-powered personalized learning is growing rapidly across various industries, as organizations increasingly prioritize employee upskilling, reskilling, and continuous development to remain competitive in the evolving business landscape

Corporate Learning Management System Market Dynamics

Driver

“Increased Demand for Remote Learning”

- The increasing prevalence of remote work arrangements and the growing need for flexible learning solutions among organizations are significant drivers for the heightened demand for Corporate Learning Management Systems (LMS)

- For instance, during and after the COVID-19 pandemic, companies such as Zoom and Microsoft Teams, while primarily communication platforms, saw increased usage for virtual training sessions, highlighting the need for robust digital learning infrastructure. Such shifts in work and learning paradigms by organizations are expected to drive the Corporate LMS market growth in the forecast period

- As organizations embrace remote and hybrid work models, and as employees seek continuous professional development regardless of location, Corporate LMS offers advanced features such as on-demand access to learning materials, virtual classrooms, and collaborative learning tools, providing a compelling solution over traditional in-person training methods

- Furthermore, the growing recognition of the importance of continuous learning and upskilling in a rapidly evolving business landscape is making Corporate LMS an integral component of organizational development strategies, offering seamless integration with other HR and talent management systems

- The convenience of accessing training anytime, anywhere, the ability to track employee progress remotely, and the scalability of online learning platforms are key factors propelling the adoption of Corporate LMS in both large enterprises and small to medium-sized businesses. The trend towards cloud-based LMS solutions and the increasing availability of user-friendly and feature-rich platforms further contribute to market growth

Restraint/Challenge

“High Implementation Costs”

- Concerns surrounding the potentially high costs associated with implementing and maintaining a Corporate Learning Management System (LMS) pose a significant challenge to broader market penetration. As Corporate LMS often involves software licensing fees, infrastructure upgrades, data migration, and ongoing support, it can represent a substantial investment for organizations

- For instance, smaller businesses or those with limited budgets might find the initial outlay for comprehensive platforms such as Workday Learning or Oracle Talent Management Cloud prohibitive

- Addressing these cost concerns through flexible pricing models, scalable solutions, and demonstrating a clear return on investment is crucial for wider adoption. Companies such as Gomo Learning and Articulate 360 offer more accessible pricing structures and focus on ease of use to appeal to a broader range of organizations

- While the long-term benefits of an effective LMS, such as improved employee performance and reduced training costs, can outweigh the initial investment, the perceived premium for sophisticated learning technology can still hinder widespread adoption, especially for organizations that are unsure of the immediate impact or have budget constraints

- Overcoming these challenges through transparent pricing, demonstrating clear ROI, offering flexible and scalable solutions, and providing robust support and training will be vital for sustained market growth in the Corporate LMS sector

Corporate Learning Management System Market Scope

The market is segmented on the basis of component, deployment type, delivery mode, organization size, and vertical.

- By Component

On the basis of component, the market is segmented into solutions and services. The services segment dominates the largest market revenue share of 67.5% in 2025, driven by persistent demand for bespoke implementation services tailored to organizational needs and the critical requirement for ongoing technical support and system maintenance. This also includes the essential provision of comprehensive training programs for administrators and end-users, ensuring effective platform adoption and utilization.

The solutions segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rapid incorporation of cutting-edge AI, enhanced personalization capabilities, improved mobile learning experiences, and the growing requirement for innovative and adaptable corporate learning technologies.

- By Deployment Type

On the basis of deployment type, the market is segmented into on-premises and cloud. The cloud segment dominates the largest market revenue share in 2025, driven by the inherent scalability and flexibility it offers to organizations of all sizes, alongside reduced upfront infrastructure costs and simplified IT management. Its accessibility from anywhere with an internet connection and ease of updates further contribute to its widespread adoption.

The on-premises segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand from organizations with stringent data security and compliance requirements, offering them greater control over their data and infrastructure. Advancements in on-premises solutions that provide enhanced security features and integration capabilities are also fueling this growth.

- By Delivery Mode

On the basis of delivery mode, the market is segmented into distance learning, instructor-led training, and blended learning. The distance learning segment dominates the largest market revenue share in 2025, driven by the growing adoption of online learning platforms for their scalability, accessibility, and cost-effectiveness in delivering training to a dispersed workforce. The flexibility and convenience offered by asynchronous learning options also contribute significantly to its dominance.

The instructor-led training segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing recognition of the value of interactive and personalized learning experiences facilitated by live instructors in virtual or blended formats. The need for immediate feedback, collaborative learning, and addressing complex topics effectively is fueling this rapid growth.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small and medium-sized enterprises. The large enterprises segment dominates the largest market revenue share in 2025, driven by extensive need for robust and scalable learning management systems to cater to their vast and diverse employee base, along with complex training and compliance requirements. Their greater budgets often allow for investment in comprehensive and feature-rich platforms.

The small and medium-sized enterprises segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing recognition of the importance of employee training for their growth and competitiveness, coupled with the rising availability of affordable and user-friendly cloud-based LMS solutions tailored to their needs and budget constraints.

- By Vertical

On the basis of vertical, the market is segmented into software and technology, healthcare, retail, banking, financial services, and insurance, manufacturing, government, defense, and telecom. The software and technology segment dominates the largest market revenue share in 2025, driven by the continuous need for rapid upskilling and reskilling in this dynamic sector, along with the early adoption of sophisticated learning technologies to maintain a competitive edge. The complex and evolving nature of their work necessitates robust training platforms

The retail segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need to train a large, often geographically dispersed workforce on product knowledge, customer service, and compliance, leveraging scalable and cost-effective e-learning solutions.

Corporate Learning Management System Market Regional Analysis

- North America dominates the corporate learning management system market with the largest revenue share of 36.5% in 2025, driven by the significant presence of leading global corporations and a strong organizational focus on continuous employee development and upskilling initiatives

- Businesses in the region highly prioritize investing in advanced learning technologies to enhance workforce capabilities and maintain a competitive edge

- This widespread adoption is further supported by a robust technological infrastructure, a digitally proficient workforce, and the increasing emphasis on data-driven talent management strategies

U.S. Corporate Learning Management System Market Insight

U.S. corporate learning management system market captured the largest revenue share within North America in 2025, fueled by the rapid adoption of digital learning platforms and the increasing emphasis on continuous employee development. Organizations are increasingly prioritizing the enhancement of workforce skills through intelligent and accessible learning solutions. The growing preference for flexible online training, combined with robust demand for personalized learning paths and mobile learning integration, further propels the Corporate LMS industry. Moreover, the increasing integration of learning platforms with other enterprise systems, such as HR and talent management suites, is significantly contributing to the market's expansion.

Europe Corporate Learning Management System Market Insight

The European corporate learning management system market is projected to expand at a substantial CAGR throughout the forecast period. This regional market growth is largely due to the European Union's greater emphasis on boosting digital skills and incorporating technology into education, as outlined in the Digital Education Action Plan. Consequently, educational institutions across Europe are increasingly adopting LMS. Furthermore, the rising attention from governments and educational bodies on improving workforce skills and learning is fueling the need for adaptable and readily available training solutions, establishing LMS platforms as critical resources for upskilling and reskilling the workforce.

U.K. Corporate Learning Management System Market Insight

U.K. corporate learning management system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of digital learning adoption and a desire for enhanced employee skills and development. In addition, the increasing need for effective onboarding and continuous training is encouraging both large enterprises and SMEs to choose comprehensive learning management solutions. The U.K.'s embrace of digital technologies, alongside its robust business and education infrastructure, is expected to continue to stimulate market growth.

Germany Corporate Learning Management System Market Insight

German corporate learning management system market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of the importance of digital learning and the demand for technologically advanced, future-oriented solutions. Germany’s well-established industrial and educational infrastructure, combined with its emphasis on innovation and workforce development, promotes the adoption of sophisticated LMS platforms across various sectors. The integration of learning management systems with other enterprise software is also becoming increasingly prevalent, with a strong preference for secure, data-privacy focused solutions aligning with local business standards.

Asia-Pacific Corporate Learning Management System Market Insight

The Asia-Pacific Corporate Learning Management System market is poised to grow at the fastest CAGR in 2025, driven by increasing digitalization, a growing emphasis on skill development, and technological advancements across countries such as China, Japan, and India. The region's growing focus on continuous learning and workforce upskilling, supported by government initiatives promoting digital education and training, is driving the adoption of robust LMS platforms. Furthermore, as APAC emerges as a hub for technological innovation and digital transformation, the accessibility and implementation of advanced learning management systems are expanding to a wider range of organizations.

Japan Corporate Learning Management System Market Insight

Japan corporate learning management system market is gaining momentum due to the country’s advanced technological landscape, increasing adoption of digital learning, and demand for efficient training solutions. The Japanese market places a significant emphasis on quality and continuous improvement, and the adoption of sophisticated LMS platforms is driven by the increasing need for effective employee development and compliance training. The integration of learning management systems with other HR technologies and performance management tools is fueling growth. Moreover, Japan's focus on lifelong learning and addressing skill gaps in its workforce is likely to spur demand for user-friendly, secure, and comprehensive learning solutions in both corporate and educational sectors.

China Corporate Learning Management System Market Insight

China Corporate Learning Management System Market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding corporate sector, rapid digitalization of businesses, and high rates of technology integration in training processes. China stands as one of the largest markets for digital learning solutions, and corporate LMS platforms are becoming increasingly popular in enterprises of all sizes and across various industries. The strong government support for digital transformation and the availability of diverse and competitive LMS offerings from domestic providers are key factors propelling the market in China.

Corporate Learning Management System Market Share

The corporate learning management system industry is primarily led by well-established companies, including:

- Absorb Software Inc. (Canada)

- Adobe Inc. (U.S.)

- Anthology Inc. (U.S.)

- Cornerstone OnDemand (U.S.)

- CrossKnowledge (France)

- D2L Corporation (Canada)

- Docebo (Italy)

- Epignosis (Greece)

- G-Cube Webwide Software Pvt Ltd (India)

- Growth Engineering (U.K.)

- IBM Corporation (U.S.)

- Instructure Inc. (U.S.)

- LearnUpon (Ireland)

- Mindflash (U.S.)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- PowerSchool (U.S.)

Latest Developments in Global Corporate Learning Management System Market

- In January 2024, Google Cloud unveiled a new conversational commerce solution that integrates AI-driven virtual agents into retailers' websites and mobile applications. These agents engage customers through natural language interactions, offering personalized product recommendations tailored to individual preferences. This innovation aims to enhance the shopping experience, making it more interactive and responsive, thereby increasing customer satisfaction and potentially driving higher conversion rates for retailers

- In August 2023, Inbenta acquired Horizn, a Toronto-based software company specializing in interactive product demonstrations. This acquisition will integrate Horizn’s innovative technology into Inbenta’s AI-driven customer experience platform. By enhancing its offerings with Horizn’s capabilities, Inbenta aims to provide clients with engaging, immersive experiences that facilitate product understanding and customer satisfaction, thus reinforcing its commitment to transforming digital interactions in the marketplace

- In August 2023, Kore.ai introduced an integration of its Experience Optimization Platform with Zoom Contact Center, providing users with an intelligent virtual assistant powered by the Kore.ai XO platform. This integration enables Zoom's customers to leverage advanced conversational AI, enhancing customer service efficiency and responsiveness. By automating interactions, it allows businesses to streamline operations and improve user engagement, ultimately driving better customer experiences and satisfaction

- In September 2021, The Astro robot was announced as a unique device designed to assist users with various tasks, including home monitoring and facilitating communication with loved ones. This innovative technology represents a new frontier in personal robotics, aiming to enhance daily life through automation and support. By combining practicality with advanced AI, Astro seeks to become a helpful companion in everyday settings

- In April 2021, Microsoft announced its acquisition of Nuance Communications for USD 19.7 billion in an all-cash deal, aiming to strengthen its voice recognition and transcription technology capabilities. Nuance, a leader in AI-based solutions, brings extensive expertise that will enhance Microsoft's offerings in healthcare and other sectors. This acquisition reflects Microsoft's commitment to advancing AI technologies and integrating them into its product ecosystem to better serve its customers

- In March 2021, Google Cloud announced the general availability of Vertex AI, a managed machine learning platform designed to streamline the development and maintenance of AI models. Vertex AI provides businesses with robust tools and infrastructure, enabling faster deployment of machine learning applications. By facilitating easier access to advanced AI capabilities, Google Cloud aims to empower organizations to leverage AI technologies more effectively and efficiently

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.