Global Core Banking Solutions Market

Market Size in USD Billion

CAGR :

%

USD

16.71 Billion

USD

37.42 Billion

2024

2032

USD

16.71 Billion

USD

37.42 Billion

2024

2032

| 2025 –2032 | |

| USD 16.71 Billion | |

| USD 37.42 Billion | |

|

|

|

|

Core Banking Solutions Market Size

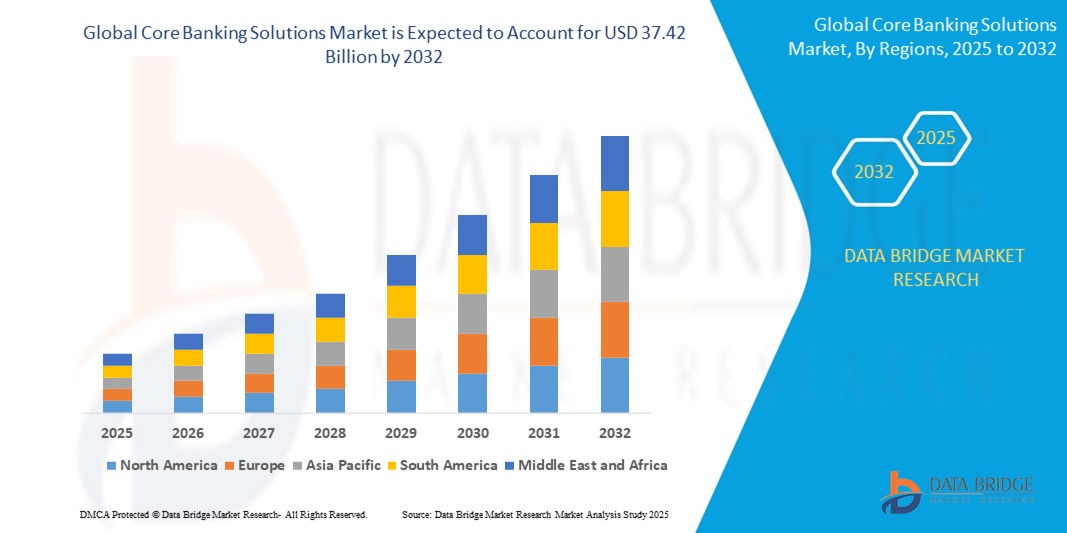

- The global core banking solutions market size was valued at USD 16.71 billion in 2024 and is expected to reach USD 37.42 billion by 2032, at a CAGR of 10.6% during the forecast period

- The market growth is driven by the increasing adoption of digital banking, advancements in cloud-based technologies, and the need for modernized banking infrastructure to enhance operational efficiency and customer experience

- Rising demand for seamless, secure, and integrated banking solutions, coupled with regulatory requirements for compliance and risk management, is positioning core banking solutions as critical components of financial institutions’ digital transformation strategies

Core Banking Solutions Market Analysis

- Core banking solutions, encompassing software and services that manage critical banking operations such as deposits, loans, and payments, are pivotal in modernizing financial institutions by enabling real-time transaction processing, enhanced customer service, and integration with digital banking channels

- The surge in demand is fueled by the growing adoption of mobile and internet banking, increasing regulatory pressures, and the need for scalable, flexible systems to meet evolving customer expectations

- North America dominated the core banking solutions market with the largest revenue share of 42.5% in 2024, driven by early adoption of digital banking technologies, high investment in IT infrastructure, and the presence of major market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid digitization, increasing financial inclusion, and rising adoption of mobile banking in countries such as India and China

- The enterprise customer solutions segment dominated the largest market revenue share of 38% in 2024, driven by the increasing demand for integrated platforms that streamline customer management, account services, and personalized banking experiences for large financial institutions

Report Scope and Core Banking Solutions Market Segmentation

|

Attributes |

Core Banking Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Core Banking Solutions Market Trends

“Increasing Integration of AI and Advanced Analytics”

- The global core banking solutions market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and advanced analytics

- These technologies enable sophisticated data processing, offering deeper insights into customer behavior, transaction patterns, and operational efficiency

- AI-powered core banking solutions facilitate proactive decision-making, such as identifying potential fraud, optimizing loan approvals, and predicting customer needs

- For instances, several providers are developing AI-driven platforms that personalize financial products, streamline compliance processes, and enhance risk management based on real-time data analysis

- This trend is increasing the appeal of core banking solutions for financial institutions, improving customer satisfaction and operational agility

- AI algorithms analyze vast datasets, including transaction histories, customer interactions, and market trends, to deliver tailored services and predictive insights

Core Banking Solutions Market Dynamics

Driver

“Rising Demand for Digital Banking and Enhanced Customer Experience”

- Growing consumer demand for seamless digital banking services, such as mobile banking, real-time payments, and personalized financial products, is a key driver for the global core banking solutions market

- Core banking systems enhance customer experience by offering features such as instant transaction processing, 24/7 account access, and integrated financial management tools

- Regulatory mandates in regions such as North America, which dominates the market, are pushing banks to adopt advanced core banking solutions to comply with standards for transparency and security

- The proliferation of cloud computing and 5G technology is enabling faster data processing and lower latency, supporting innovative banking services such as real-time currency exchange and mobile-first banking

- Financial institutions are increasingly adopting modern core banking platforms as standard offerings to meet customer expectations and remain competitive

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant initial investment required for core banking system deployment, including hardware, software, and integration, poses a barrier to adoption, particularly for small and medium enterprises (SMEs) and institutions in emerging markets

- Integrating modern core banking solutions with legacy systems can be complex and costly, requiring extensive customization and testing

- Data security and privacy concerns are major challenges, as core banking systems handle sensitive customer and transactional data, raising risks of breaches, misuse, or non-compliance with regulations such as GDPR and CCPA

- The fragmented regulatory landscape across countries, particularly in the fast-growing Asia-Pacific region, complicates compliance for global providers, adding operational challenges

- These factors can deter adoption, especially in regions with high cost sensitivity or stringent data privacy awareness

Core Banking Solutions market Scope

The market is segmented on the basis of type, offering, deployment mode, enterprise size, channel, function, and end user.

- By Type

On the basis of type, the global core banking solutions market is segmented into enterprise customer solutions, deposits, loans, mortgages, transfer, payments and withdrawal, currency exchange, and others. The enterprise customer solutions segment dominated the largest market revenue share of 38% in 2024, driven by the increasing demand for integrated platforms that streamline customer management, account services, and personalized banking experiences for large financial institutions.

The payments and withdrawal segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of digital payment systems, real-time transaction processing, and consumer demand for seamless, secure, and instant payment solutions. Advancements in fintech and mobile banking technologies further accelerate this growth.

- By Offering

On the basis of offering, the global core banking solutions market is segmented into software and services. The software segment is expected to hold the largest market revenue share of 62% in 2024, driven by the critical role of core banking software in enabling efficient transaction processing, account management, and compliance with regulatory requirements. Financial institutions increasingly rely on scalable software solutions to modernize legacy systems.

The services segment is anticipated to experience the fastest growth rate of 18.5% from 2025 to 2032, driven by the growing need for implementation, consulting, and maintenance services to support complex core banking software deployments. Demand for customized solutions and ongoing support is enhancing adoption.

- By Deployment Mode

On the basis of deployment mode, the global core banking solutions market is segmented into cloud and on-premises. The cloud segment is expected to hold the largest market revenue share of 58% in 2024, owing to its flexibility, scalability, and cost-effectiveness, which enable financial institutions to adapt to changing market demands and reduce infrastructure costs.

The cloud segment is also anticipated to witness the fastest growth from 2025 to 2032, driven by the increasing adoption of cloud-based solutions in Asia-Pacific and other regions, where banks seek to leverage advanced technologies such as AI and machine learning for enhanced operational efficiency and customer experience.

- By Enterprise Size

On the basis of enterprise size, the global core banking solutions market is segmented into large enterprises and small and medium enterprises (SMEs). The large enterprises segment dominated the market revenue share of 70% in 2024, driven by the need for robust, scalable, and secure core banking systems to manage high transaction volumes and complex operations in major financial institutions.

The SMEs segment is expected to witness rapid growth of 20.2% from 2025 to 2032, fueled by increasing digitalization and the adoption of cost-effective cloud-based core banking solutions tailored to the needs of smaller institutions, particularly in emerging markets such as Asia-Pacific.

- By Channel

On the basis of channel, the global core banking solutions market is segmented into ATMs, internet banking, mobile banking, bank branches, and others. The mobile banking segment is expected to hold the largest market revenue share of 45% in 2024, driven by the widespread adoption of smartphones and consumer preference for convenient, on-the-go banking services.

The internet banking segment is anticipated to experience significant growth from 2025 to 2032, as financial institutions invest in user-friendly online platforms to enhance customer engagement and provide seamless access to banking services, particularly in tech-savvy regions such as North America and Asia-Pacific.

- By Function

On the basis of function, the global core banking solutions market is segmented into account management, transaction processing, risk management, customer relationship management, reporting and analytics, product management, loan management, compliance management, and others. The transaction processing segment is expected to hold the largest market revenue share of 40% in 2024, driven by its critical role in enabling real-time, secure, and efficient handling of financial transactions across multiple channels.

The reporting and analytics segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for data-driven insights to enhance decision-making, optimize operations, and meet regulatory reporting requirements. The integration of AI and advanced analytics further drives adoption.

- By End User

On the basis of end user, the global core banking solutions market is segmented into banks, credit unions and community banks, and other financial institutions. The banks segment dominated the market revenue share of 73% in 2024, owing to the high volume of transactions, extensive branch networks, and the need for advanced core banking systems to support diverse services.

The credit unions and community banks segment is anticipated to witness rapid growth of 19.8% from 2025 to 2032, driven by the increasing adoption of modern core banking solutions to enhance operational efficiency, improve customer experience, and compete with larger financial institutions, particularly in regions such as Asia-Pacific.

Core Banking Solutions Market Regional Analysis

- North America dominated the core banking solutions market with the largest revenue share of 42.5% in 2024, driven by early adoption of digital banking technologies, high investment in IT infrastructure, and the presence of major market players

- Financial institutions prioritize core banking solutions to enhance operational efficiency, improve customer experience, and ensure compliance with regulatory requirements, particularly in regions with diverse economic conditions

- Growth is supported by advancements in banking software, including cloud-based platforms and AI-driven analytics, alongside rising adoption in both large enterprises and small and medium enterprises (SMEs)

U.S. Core Banking Solutions Market Insight

The U.S. core banking solutions market captured the largest revenue share of 84.8% in 2024 within North America, fueled by strong demand for digital transformation in banking and growing awareness of the benefits of integrated banking platforms. The trend towards personalized banking services and stringent regulatory standards further boosts market expansion. Financial institutions’ increasing adoption of cloud-based solutions complements traditional on-premises deployments, creating a diverse product ecosystem.

Europe Core Banking Solutions Market Insight

The Europe core banking solutions market is expected to witness significant growth, supported by regulatory emphasis on financial transparency and customer-centric banking services. Banks and financial institutions seek solutions that enhance transaction processing, risk management, and customer relationship management. Growth is prominent in both new system implementations and legacy system upgrades, with countries such as Germany and France showing significant adoption due to rising digital banking trends and economic stability.

U.K. Core Banking Solutions Market Insight

The U.K. market for core banking solutions is expected to witness rapid growth, driven by demand for enhanced customer experiences and seamless digital banking services in urban and suburban settings. Increased interest in mobile and internet banking, coupled with growing awareness of data security and compliance benefits, encourages adoption. Evolving financial regulations influence banking choices, balancing innovation with regulatory compliance.

Germany Core Banking Solutions Market Insight

Germany is expected to witness rapid growth in the core banking solutions market, attributed to its advanced financial services sector and high focus on operational efficiency and customer satisfaction. German banks prefer technologically advanced solutions that streamline account management, transaction processing, and compliance management. The integration of these solutions in large enterprises and SMEs supports sustained market growth.

Asia-Pacific Core Banking Solutions Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding financial services sectors and rising digital adoption in countries such as China, India, and Japan. Increasing awareness of customer relationship management, risk management, and transaction processing solutions is boosting demand. Government initiatives promoting financial inclusion and digital banking further encourage the adoption of advanced core banking solutions.

Japan Core Banking Solutions Market Insight

Japan’s core banking solutions market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced banking platforms that enhance operational efficiency and customer satisfaction. The presence of major financial institutions and the integration of core banking solutions in enterprise systems accelerate market penetration. Rising interest in mobile and internet banking also contributes to growth.

China Core Banking Solutions Market Insight

China holds the largest share of the Asia-Pacific core banking solutions market, propelled by rapid urbanization, rising financial institution presence, and increasing demand for digital banking solutions. The country’s growing middle class and focus on smart financial services support the adoption of advanced core banking platforms. Strong domestic software development capabilities and competitive pricing enhance market accessibility.

Core Banking Solutions Market Share

The core banking solutions industry is primarily led by well-established companies, including:

- FIS (Fidelity National Information Services, Inc.) (USA)

- Bricknode (Sweden)

- Jayam solutions (India)

- Forbis (Lithuania)

- NCR VOYIX Corporation (USA)

- HCL Technologies Limited (India)

- Unisys (USA)

- Infosys Limited (India)

- TATA Consultancy Services Limited (India)

- Jack Henry & Associates, Inc. (USA)

- SAP (Germany)

- Oracle (USA)

- Capgemini (France)

- nCino (USA)

- Finastra (UK)

What are the Recent Developments in Global Core Banking Solutions Market?

- In July 2025, 10x Banking unveiled Meta Core, a groundbreaking cloud-native banking platform designed to fast-track digital transformation for financial institutions. Meta Core simplifies banking application development by abstracting common product elements and the core ledger, allowing banks to build customized products with as few as 2,000 lines of code. This dramatically reduces complexity and risk compared to legacy systems. The platform offers enterprise-grade security, AI-ready data architecture, and unlimited scalability, empowering banks to innovate faster and serve customers more effectively. Meta Core marks a major leap toward cloud-native modernization in the banking sector

- In May 2025, Temenos launched a cutting-edge Generative AI solution designed to revolutionize how banks engage with their data and drive operational efficiency. Integrated with Temenos Core and Financial Crime Mitigation (FCM) platforms, the solution enables users to interact with complex banking data through natural language queries, delivering instant insights and streamlining decision-making. It supports secure, explainable, and auditable AI practices, helping banks enhance productivity, compliance, and profitability. This innovation reflects Temenos’ commitment to responsible AI and empowers financial institutions to create hyper-personalized services and optimize performance across operations

- In April 2025, Zand Bank, the UAE’s first digital-only bank, announced its adoption of the Infosys Finacle Solutions suite to enhance its corporate banking services. Hosted on Microsoft Azure, the cloud-native platform empowers Zand to deliver a customer-centric, future-ready banking experience with advanced capabilities in AI, predictive analytics, and blockchain integration. The modular architecture and open APIs of Finacle accelerate innovation, improve scalability, and streamline operations. This strategic move positions Zand at the forefront of digital finance, enabling it to offer secure, personalized, and efficient services to corporate clients

- In January 2025, 10x Banking and DLT Apps formed a strategic partnership to revolutionize data migration for financial institutions. By combining 10x’s cloud-native meta core banking platform with DLT Apps’ AI-powered TerraAi and MigratIO tools, the collaboration offers a fast, secure, and auditable migration path from legacy and non-legacy systems. The joint solution enables banks to load data in any sequence, validate it in a controlled environment, and maintain full audit trails—ensuring data integrity, quality, and minimal downtime. This partnership empowers institutions to modernize confidently and accelerate their digital transformation journeys

- In January 2025, Temenos and Deloitte announced a strategic partnership to help U.S. financial institutions modernize their core banking and payments systems through cloud-based solutions. By combining Deloitte’s deep consulting expertise with Temenos’ composable SaaS banking platform, the collaboration aims to accelerate the delivery of modern digital experiences while reducing costs and deployment risks. The partnership also supports emerging business models such as Banking-as-a-Service (BaaS) and Instant Payments, enabling banks to enhance operational resilience and customer engagement. This joint go-to-market strategy strengthens Temenos’ presence in the U.S. and empowers banks to embrace digital transformation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Core Banking Solutions Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Core Banking Solutions Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Core Banking Solutions Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.