Global Control Valves Market

Market Size in USD Billion

CAGR :

%

USD

9.85 Billion

USD

17.65 Billion

2024

2032

USD

9.85 Billion

USD

17.65 Billion

2024

2032

| 2025 –2032 | |

| USD 9.85 Billion | |

| USD 17.65 Billion | |

|

|

|

|

Control Valves Market Size

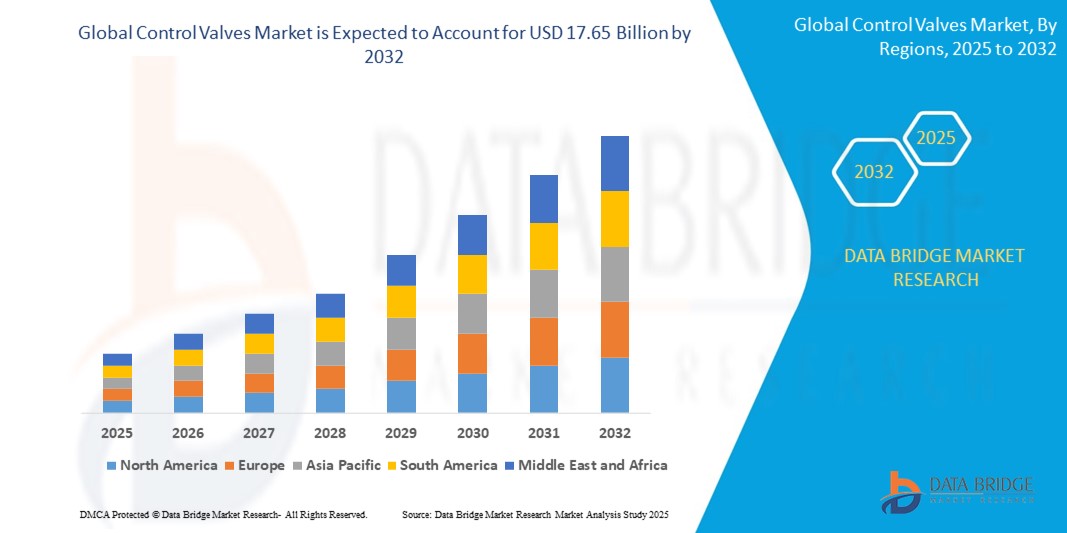

- The global Control Valves market was valued at USD 9.85 billion in 2024 and is expected to reach USD 17.65 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.57% primarily driven by the increasing demand for automation and process control systems in industries such as oil & gas, chemicals, power, and water treatment

- This growth is driven by factors such as technological advancements in valve design, the expansion of industrial infrastructure, stringent safety and regulatory standards, and the rising need for energy efficiency in manufacturing processes

Control Valves Market Analysis

- Control valves are devices used to regulate the flow, pressure, temperature, or liquid level in industrial processes by adjusting the size of the flow passage as per control signals, ensuring optimal performance and efficiency in systems such as pipelines, reactors, and power plants

- The control valves market is expanding due to increasing demand in industries such as oil and gas, chemicals, power generation, and water treatment, where these valves regulate essential processes such as flow, pressure, and temperature in real-time

- For instance, in the oil and gas sector, control valves manage pressure during the extraction process, ensuring the safety and efficiency of drilling operations

- Industries are adopting advanced control valves that provide higher precision, reliability, and efficiency, as seen in power plants. In coal-fired power plants, control valves help maintain precise temperature and pressure, which is crucial for ensuring consistent energy production and minimizing fuel consumption

- The market is shifting toward smart control valves integrated with digital systems, enabling real-time monitoring and remote control

- For instance, in the water treatment industry, smart control valves are being used to optimize water flow and ensure compliance with environmental regulations by allowing operators to make real-time adjustments from a distance

- Products such as globe, ball, and butterfly valves are the most popular in the market, with each type offering specific benefits depending on application needs

- For instance, ball valves are widely used in the oil and gas sector for their ability to quickly shut off flow in pipelines, preventing leaks and potential accidents

- Technological innovations in valve materials and designs are helping reduce maintenance costs, such as corrosion-resistant materials used in chemical plants

- For instance, in the chemical industry, valves made from high-performance alloys are reducing wear and tear caused by exposure to aggressive chemicals, thus extending their service life and lowering operational costs

Report Scope and Control Valves Market Segmentation

|

Attributes |

Control Valves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Control Valves Market Trends

“Growing Adoption of Smart Control Valves”

- The adoption of smart control valves is growing rapidly as industries embrace automation and digital technologies, enabling real-time data monitoring and remote control

- For insance, in oil refineries such as ExxonMobil's operations, smart control valves allow operators to remotely adjust settings, ensuring optimal production efficiency without the need for physical presence at the valve location

- Equipped with sensors and advanced communication systems, smart control valves allow for continuous monitoring of performance, reducing the risk of system failures by providing alerts on potential issues. In chemical plants such as Dow Chemical, smart control valves monitor the condition of valves and provide early alerts for any sign of wear or malfunction, preventing major breakdowns and costly repairs

- These valves are being used to optimize flow and pressure control, ensuring maximum efficiency in industrial processes. In power plants such as those of General Electric, smart control valves manage steam flow with high precision, reducing energy consumption and improving power generation efficiency by ensuring that only the required amount of steam is used

- The integration of predictive maintenance capabilities is one of the main benefits, helping companies avoid unexpected downtimes

- For instance, in water treatment plants such as those operated by Veolia, smart control valves help monitor pressure and flow, alerting operators to potential issues, thus ensuring continuous water supply and reducing operational disruptions

- The trend is also seen in industries that require precise control over fluids, such as in food processing companies such as Nestlé, where smart valves ensure the consistent flow of ingredients during mixing and packaging, improving both productivity and product quality

Control Valves Market Dynamics

Driver

“Increasing Demand for Automation Control Systems”

- The increasing demand for automation control systems is transforming industries such as oil and gas, power generation, and water treatment, where control valves regulate key processes such as flow, pressure, and temperature, ensuring optimal performance and reducing human intervention, such as in power plants where control valves optimize steam flow in turbines to enhance energy efficiency

- As industries seek higher productivity and operational efficiency, automated control systems are being integrated with control valves to monitor and adjust system parameters in real-time, as seen in the chemical industry, where control valves help regulate the flow of chemicals in reactors for consistent product quality

- Automation not only reduces human error but also improves safety by providing accurate control over hazardous processes

- For instance, in oil refineries, control valves regulate crude oil flow, minimizing the risk of leaks and ensuring safe refining operations

- Smart control valves, integrated with sensors and communication technology, are becoming increasingly popular in automated systems, offering features such as remote control and predictive maintenance, which is particularly useful in water treatment plants, where operators can monitor valve performance from a distance and avoid unexpected breakdowns

- The push towards automation in industries is accelerating the demand for control valves, as more companies aim to enhance system reliability and efficiency, such as in the food processing sector, where automated control systems ensure the precise flow of ingredients for consistent production quality

Opportunity

“Technological Advancements in Smart Control Valves”

- Integration of smart technologies in control valves is a major opportunity, driven by Industry 4.0, focusing on automation, data exchange, and real-time monitoring, enabling predictive maintenance and optimized flow control across industries such as oil and gas, water treatment, and power generation

- For instance, Shell has integrated smart control valves in its refineries to enhance pipeline efficiency and reduce unplanned shutdowns

- Smart control valves equipped with sensors, actuators, and communication devices can collect and transmit performance data, allowing real-time monitoring and proactive decision-making in critical applications, such as managing pressure and flow rates in oil pipelines to prevent leaks and corrosion

- For instance, BP has deployed IoT-enabled smart valves in its offshore rigs to detect anomalies and prevent environmental hazards

- Remote monitoring and control of valves in industries such as power generation and water treatment help reduce operational risks, enhance safety, and ensure compliance with stringent regulations, such as monitoring water distribution networks to detect pressure anomalies before system failures occur

- For instance, Siemens has implemented intelligent valve solutions in municipal water plants to prevent water wastage and ensure optimal pressure management

- Predictive maintenance powered by smart control valves minimizes costly downtime by identifying potential faults before failures, ensuring continuous operations in industries such as chemical processing, where precise flow control is crucial for maintaining product quality and process efficiency

- Rising demand for energy-efficient and low-maintenance control valves is driving continuous innovation, with manufacturers developing advanced models that integrate seamlessly with digital systems, offering enhanced durability and functionality to meet the evolving needs of modern industries

Restraint/Challenge

“High Initial Cost of Smart Control Valves”

- One of the major challenges in adopting smart control valves is the high initial cost, as they require advanced technology, including sensors, actuators, and communication systems, which significantly increase their upfront price compared to traditional control valves

- For instance, small manufacturing firms often struggle to justify the cost of upgrading to smart valve systems due to budget constraints

- Installation and integration of smart control valves into existing infrastructure can be complex and costly, especially in industries with older systems, for instance, many oil refineries operating with legacy equipment face substantial investment requirements for retrofitting smart valves and ensuring compatibility with digital monitoring platforms

- Companies in industries with tight margins or cost-saving priorities may hesitate to invest in smart control valves due to the financial burden of upgrading

- For instance, water treatment facilities in developing regions often prioritize lower-cost conventional valves over smart solutions due to budget limitations

- Managing and maintaining smart control valves requires skilled personnel, adding to operational costs and limiting widespread adoption

- Despite the benefits of remote monitoring and predictive maintenance, the combination of high initial costs and the need for specialized expertise presents a significant barrier to adoption

Control Valves Market Scope

The market is segmented on the basis of component, material, type, operation, size, and end user

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Material |

|

|

By Type |

|

|

By Operation |

|

|

By Size |

|

|

By End User |

|

Control Valves Market Regional Analysis

“North America is the Dominant Region in the Control Valves Market”

- North America is the dominating region in the global control valves market, driven by its advanced technological infrastructure and the strong presence of key industry players

- The U.S. and Canada lead in smart control valve adoption, fuelled by increasing automation and Industry 4.0 initiatives across various sectors

- Well-established industries such as oil and gas, water treatment, and power generation have significantly contributed to the high demand for control valves in the region

- Stringent regulatory frameworks for industrial safety and efficiency encourage industries to adopt advanced valve technologies, ensuring compliance and operational reliability

- Continuous innovation and investment in smart manufacturing and industrial automation further strengthen North America's dominance in the control valves market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest-growing region in the control valves market, driven by rapid industrialization, urbanization, and increasing investments in key industries

- Countries such as China, India, and Japan are witnessing a surge in demand for energy-efficient and automated solutions, especially in oil and gas, energy and power, and water treatment sectors

- Massive infrastructure expansion projects and government initiatives promoting smart manufacturing are accelerating the adoption of control valves in the region

- A growing focus on sustainability and efficient resource management is pushing industries to adopt advanced control valve technologies for optimized operations

- Rising foreign direct investments (FDIs) and the presence of global industry leaders expanding their operations in APAC are further driving the market growth

Control Valves Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens (Germany)

- Baker Hughes Company (U.S.)

- Honeywell International Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- ABB (Switzerland)

- PARKER HANNIFIN CORP (U.S.)

- Eaton (Ireland)

- NAFFCO (U.A.E.)

- Flowserve Corporation (U.S.)

- Watts (U.S.)

- Curtiss-Wright Corporation (U.S.)

- Valvitalia SpA (Italy)

- PetrolValves (Italy)

- TRILLIUM FLOW TECHNOLOGIES (U.K.)

- Crane Company (U.S.)

- KITZ Corporation (Japan)

- Spirax Sarco Limited (U.K.)

- SLB (U.S.)

Latest Developments in Global Control Valves Market

- In November 2023, Emerson launched its new Fisher Whisper Trim technology for rotary and globe valves. This innovation focuses on reducing noise and vibration in industrial applications, particularly in high-pressure and high-velocity environments. The technology enhances valve performance by providing more precise flow control and extending valve lifespan. The development is expected to benefit industries such as oil and gas, power generation, and chemicals by improving safety, reducing maintenance costs, and offering more reliable systems. This advancement strengthens Emerson's position in the control valves market by meeting the growing demand for quieter and more efficient valve solutions

- In June 2023, Flowserve Corporation announced that its Valtek Valdisk high-performance butterfly valve has received licensor approval. This development marks a significant milestone as the valve is now approved for use in critical applications across industries such as oil and gas, power, and chemicals. The Valtek Valdisk valve offers enhanced flow control, durability, and reliability, particularly in challenging and high-pressure environments. With this approval, Flowserve aims to provide improved performance, safety, and operational efficiency to customers. The move is expected to strengthen Flowserve’s position in the control valve market by offering a high-performance solution that meets stringent industry standards, driving demand for more reliable and efficient valve systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Control Valves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Control Valves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Control Valves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.