Global Container Washing System Market

Market Size in USD Million

CAGR :

%

USD

958.93 Million

USD

1,307.33 Million

2024

2032

USD

958.93 Million

USD

1,307.33 Million

2024

2032

| 2025 –2032 | |

| USD 958.93 Million | |

| USD 1,307.33 Million | |

|

|

|

|

Container Washing System Market Size

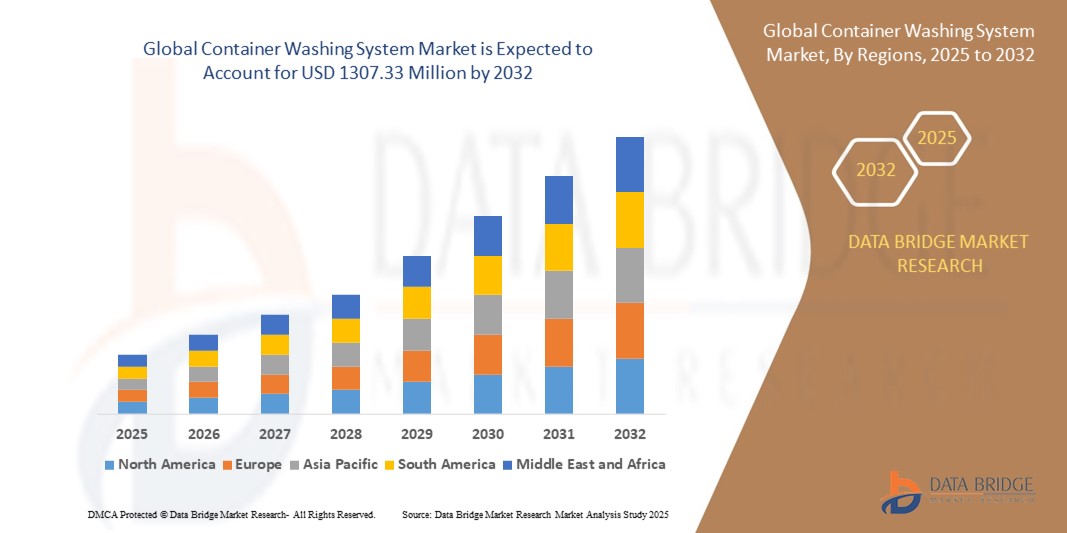

- The global container washing system market size was valued at USD 958.93 million in 2024 and is expected to reach USD 1307.33 million by 2032, at a CAGR of 3.95% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable industrial cleaning practices, increasing adoption of reusable containers in various industries, and growing regulatory pressure to ensure hygiene and safety in packaging processes

- The expanding use of bulk containers in sectors such as chemicals, food processing, and pharmaceuticals is accelerating the demand for efficient, automated container washing solutions that reduce labor costs and turnaround time

Container Washing System Market Analysis

- The market is witnessing steady growth due to the expanding usage of containers across multiple industries such as food and beverage, pharmaceuticals, and chemicals

- Increased focus on water conservation and energy-efficient technologies is driving manufacturers to invest in advanced washing systems with automation and minimal environmental impact

- North America dominated the container washing system market with the largest revenue share in 2024, driven by the widespread adoption of automated industrial cleaning technologies and stringent hygiene standards in the food and chemical sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global container washing system market, driven by expanding manufacturing sectors, supportive government policies promoting industrial automation, and rising demand for efficient cleaning technologies in countries such as China, Japan, and South Korea

- The drum cleaning system segment dominated the market with the largest market revenue share in 2024, driven by its widespread usage in industrial and chemical processing sectors. Drum washers are favored for their high throughput capabilities, ability to handle a range of container sizes, and compatibility with various detergents and solvents. Their adaptability in cleaning both hazardous and non-hazardous materials adds to their demand across manufacturing industries

Report Scope and Container Washing System Market Segmentation

|

Attributes |

Container Washing System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of IoT and Automation in Washing Systems • Rising Demand from Food and Beverage and Pharmaceutical Industries |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Container Washing System Market Trends

“Rising Adoption of Eco-Friendly and Water-Efficient Washing Systems”

- Companies are increasingly shifting toward water-saving container washing systems to align with global sustainability targets

- Advanced washers now incorporate closed-loop systems that recycle and reuse up to 80% of water during operations

- Smart technologies such as automated detergent dosing and high-efficiency nozzles are minimizing both chemical and water usage

- The growing push from environmental regulations is accelerating adoption of energy- and resource-efficient systems across sectors

- For instance, several breweries in Germany adopted eco-smart washers in 2024 to meet the EU’s Green Deal objectives, significantly reducing water consumption

Container Washing System Market Dynamics

Driver

“Increasing Focus on Hygiene and Regulatory Compliance in Food and Beverage Industry”

- Stringent global hygiene regulations are pushing industries to upgrade to advanced container cleaning systems

- Automated washers ensure consistent and validated cleaning cycles, reducing human error and enhancing safety

- Food and beverage manufacturers are investing heavily in sanitation equipment to avoid costly contamination or recalls

- Regulatory bodies such as the FDA and EFSA have imposed tighter controls, increasing the need for audit-ready cleaning documentation

- For instance, a dairy processing company in the U.S. implemented a new container washing system in 2024 to comply with updated FDA hygiene audit standards

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- The upfront capital cost of installing automated container washing systems is often unaffordable for small and medium-sized enterprises

- Operational expenses such as maintenance, skilled labor, energy, and water usage can significantly increase total ownership cost

- Maintenance-related downtimes and the need for specialized technicians may disrupt production continuity

- Cost-sensitive markets in developing countries often lack infrastructure and financing options for such automation investments

- For instance, several mid-sized packaging companies in Brazil postponed container washer upgrades in 2024 due to high investment costs and budget limitations

Container Washing System Market Scope

The market is segmented on the basis of type, technology, application, end user, and distribution channel.

- By Type

On the basis of type, the container washing system market is segmented into drum cleaning system, roller cleaning system, IBC cleaning system, and mixing container cleaning system. The drum cleaning system segment dominated the market with the largest market revenue share in 2024, driven by its widespread usage in industrial and chemical processing sectors. Drum washers are favored for their high throughput capabilities, ability to handle a range of container sizes, and compatibility with various detergents and solvents. Their adaptability in cleaning both hazardous and non-hazardous materials adds to their demand across manufacturing industries.

The IBC cleaning system segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising adoption in the food and beverage, and pharmaceutical sectors. IBC systems offer efficient cleaning of large-volume containers with minimal water usage, ensuring compliance with hygiene standards while minimizing operational downtime and waste generation.

- By Technology

On the basis of technology, the market is segmented into automatic container washing system and semi-automatic container washing system. The automatic segment held the largest revenue share in 2024 due to growing preference for fully automated, closed-loop systems that ensure consistent cleaning performance with reduced labor costs. Industries are increasingly investing in automation to comply with safety standards and to achieve sustainable production goals.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, particularly among small and mid-sized enterprises seeking cost-effective, scalable washing solutions. These systems provide a balance between manual oversight and automated efficiency, making them ideal for moderate-volume operations.

- By Application

On the basis of application, the market is segmented into oil and grease, oil, motor oil, paint, coating, ink, and others. The oil and grease segment led the market in 2024 owing to the widespread need for cleaning heavy-duty containers in the industrial and automotive sectors. High-performance washing units capable of removing viscous residues are essential in maintaining operational safety and regulatory compliance.

The coating and paint segment is expected to witness the fastest growth rate from 2025 to 2032, due to increased demand from chemical manufacturers and packaging firms that require precise decontamination before reuse or disposal.

- By End User

On the basis of end user, the market is segmented into food and beverage, oil and gas, chemical, healthcare, and others. The chemical segment accounted for the largest revenue share in 2024, propelled by the extensive use of hazardous and non-hazardous chemicals requiring specialized cleaning systems.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent sanitation requirements in pharmaceutical production and medical equipment cleaning.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into manufacturers, e-retail, distributors, and retailers. The manufacturers segment dominated the market in 2024 as industries prefer direct procurement for custom-built solutions and bulk orders.

The e-retail segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing digitization of B2B procurement and the ease of comparing product specifications online.

Container Washing System Market Regional Analysis

- North America dominated the container washing system market with the largest revenue share in 2024, driven by the widespread adoption of automated industrial cleaning technologies and stringent hygiene standards in the food and chemical sectors

- Industries across the region increasingly prefer container washing systems to ensure contamination-free operations, reduce manual labor, and comply with government regulations related to safety and sanitation

- The high concentration of manufacturing units, along with growing investments in sustainable industrial infrastructure, further supports market expansion across the U.S. and Canada

U.S. Container Washing System Market Insight

The U.S. container washing system market accounted for the largest revenue share in North America in 2024, fueled by a well-established industrial base and a strong focus on environmental compliance. U.S. industries in food processing, chemicals, and oil and gas are rapidly integrating automated cleaning solutions to reduce water consumption and labor dependency. Furthermore, the demand for systems that support high throughput and precision in container sanitization is contributing to widespread adoption. The presence of key manufacturers and increasing emphasis on worker safety are also key growth drivers.

Europe Container Washing System Market Insight

The Europe container washing system market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict regulations on food safety, chemical handling, and industrial cleanliness. The region's advanced manufacturing sector, combined with its focus on sustainable production, drives demand for water-efficient and energy-saving washing technologies. Countries such as Germany, France, and Italy are seeing rising usage of container cleaning systems in breweries, chemical processing plants, and food industries, supported by automation trends and circular economy initiatives.

U.K. Container Washing System Market Insight

The U.K. container washing system market is expected to witness the fastest growth rate from 2025 to 2032, due to increasing attention on environmental compliance and operational efficiency. The country's strong presence in the food and beverage, pharmaceutical, and coatings industries is prompting a shift towards reliable and automated washing systems. In addition, regulations from authorities such as the Food Standards Agency (FSA) are encouraging businesses to adopt modern container sanitation systems that minimize cross-contamination and reduce waste disposal issues.

Germany Container Washing System Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by its leadership in industrial automation and engineering. German industries emphasize process efficiency and cleanliness, particularly in chemical and paint manufacturing, where clean containers are critical to product quality. Furthermore, strong adherence to eco-friendly industrial operations and the incorporation of Industry 4.0 technologies is encouraging manufacturers to adopt smart and semi-automatic washing systems integrated with control monitoring solutions.

Asia-Pacific Container Washing System Market Insight

The Asia-Pacific container washing system market is expected to grow at the fastest CAGR from 2025 to 2032, supported by rapid industrialization, increasing environmental awareness, and stringent industrial hygiene mandates in emerging economies. Countries such as China, India, and Japan are heavily investing in automation and sustainable cleaning technologies across sectors such as food processing, petrochemicals, and pharmaceuticals. The rising adoption of smart manufacturing practices, coupled with government initiatives focused on industrial modernization, is contributing to strong regional demand.

Japan Container Washing System Market Insight

The Japan container washing system market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's emphasis on automation, quality assurance, and environmental responsibility. Japan's food and healthcare industries require highly reliable and sterile cleaning processes, prompting the adoption of advanced automated systems. In addition, innovations in compact and energy-efficient container washers cater to the needs of limited-space industrial environments, making them highly desirable across urban manufacturing units.

China Container Washing System Market Insight

China accounted for the largest market share in the Asia-Pacific region in 2024, driven by its booming industrial production and focus on eco-friendly manufacturing. Chinese firms in the paint, ink, and oil sectors are increasingly deploying container washing systems to comply with national pollution control regulations. The presence of local manufacturers offering cost-effective, high-capacity systems, along with incentives for industrial modernization, is further stimulating the market. As the country progresses with its smart factory transformation, container cleaning technologies are becoming an essential part of process optimization strategies.

Container Washing System Market Share

The Container Washing System industry is primarily led by well-established companies, including:

- Rotajet Systems Ltd. (U.K.)

- Clayton Equipment (U.K.)

- NUMAFA (Netherlands)

- SRS Engineering Corporation (U.S.)

- Glatt GmbH (Germany)

- CLAYTON EQUIPMENT COMPANY (U.K.)

- PRI PRI Systems (U.S.)

- Dyetech Equipment Group, Inc. (U.S.)

- SF Engineering (U.K.)

- Kärcher India (India)

- HOBART GmbH (Germany)

- Unitech Washers (U.S.)

- Royal Terberg Group (Netherlands)

- Unifortes B.V. (Netherlands)

- Unikon (Netherlands)

- Viscon Logistics (Netherlands)

- Feistmantl Cleaning Systems GmbH (Germany)

Latest Developments in Global Container Washing System Market

- In June 2023, Gröninger designed, built, and commissioned a fully automatic container cleaning system for Cotac. Cotac has been cleaning IBCs and stainless-steel containers at its Mannheim site for years, with many of these containers being used for products that enter the pharmaceutical industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Container Washing System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Container Washing System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Container Washing System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.