Global Consignment Software Market

Market Size in USD Billion

CAGR :

%

USD

25.78 Billion

USD

79.43 Billion

2025

2033

USD

25.78 Billion

USD

79.43 Billion

2025

2033

| 2026 –2033 | |

| USD 25.78 Billion | |

| USD 79.43 Billion | |

|

|

|

|

What is the Global Consignment Software Market Size and Growth Rate?

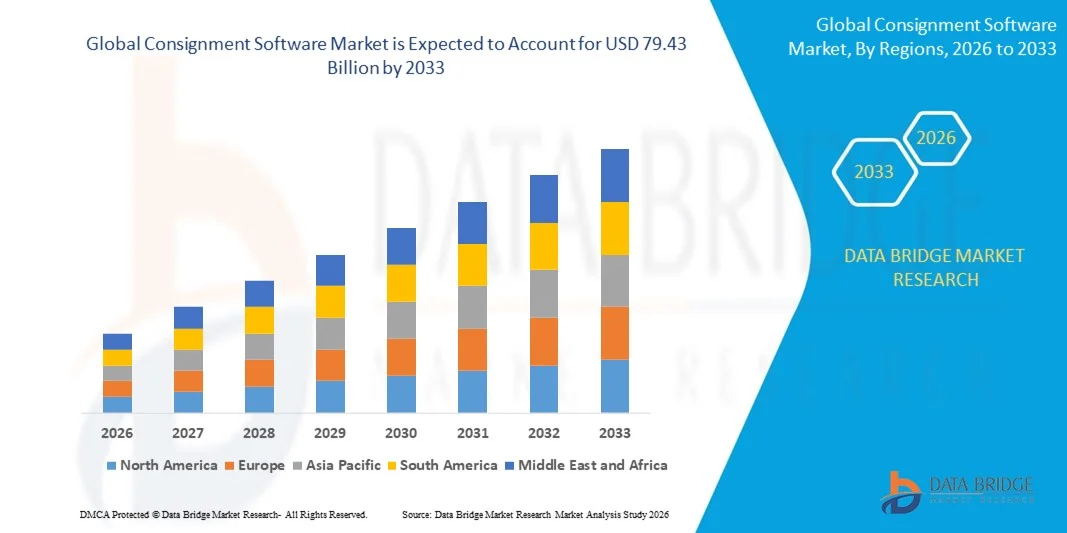

- The global consignment software market size was valued at USD 25.78 billion in 2025 and is expected to reach USD 79.43 billion by 2033, at a CAGR of 15.10% during the forecast period

- Market growth is driven by the rising adoption of digital inventory management, increasing need for real-time tracking and automated reconciliation, growing penetration of cloud-based retail and supply chain platforms, expanding use of data analytics for demand forecasting, and the rapid shift toward omnichannel retail and consignment-based business models, all of which are significantly accelerating adoption of Consignment Software solutions.

What are the Major Takeaways of Consignment Software Market?

- Strong growth in retail, fashion, consumer goods, and resale platforms, along with increasing investments in software-driven supply chain optimization across emerging economies, is creating substantial growth opportunities for the consignment software market

- However, lack of skilled professionals, challenges related to system integration with legacy platforms, data security concerns, and complex implementation requirements may act as key restraints impacting market growth over the forecast period

- North America dominated the consignment software market with a 39.97% revenue share in 2025, driven by high adoption of digital retail technologies, strong presence of resale and recommerce platforms, and rapid digitalization of inventory and point-of-sale systems across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.98% from 2026 to 2033, driven by rapid expansion of organized retail, growing popularity of second-hand marketplaces, and accelerating digital transformation across China, Japan, India, South Korea, and Southeast Asia

- The Cloud segment dominated the market with an estimated 61.3% share in 2025, driven by rising preference for SaaS-based platforms that offer real-time inventory visibility, automatic updates, remote access, and lower upfront infrastructure costs

Report Scope and Consignment Software Market Segmentation

|

Attributes |

Consignment Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Consignment Software Market?

Increasing Shift Toward Cloud-Based, Integrated, and Data-Driven Consignment Software Platforms

- The consignment software market is witnessing strong adoption of cloud-based, subscription-driven platforms that support real-time inventory tracking, automated consignor settlements, multi-store management, and omnichannel sales integration

- Vendors are introducing modular, scalable, and API-enabled solutions with advanced analytics, mobile access, POS integration, and seamless connectivity with eCommerce marketplaces

- Growing demand for cost-efficient, easy-to-deploy, and remotely accessible software is driving adoption across resale stores, thrift chains, franchise consignors, and independent retailers

- For instance, companies such as Liberty4Consignment, Ricochet, ConsignCloud, AccuPOS, and Vend have enhanced their platforms with real-time reporting, automated payouts, barcode/RFID support, and cloud dashboards

- Increasing need for inventory visibility, faster stock turnover, dynamic pricing, and data-driven decision-making is accelerating the shift toward cloud-native consignment software

- As resale and recommerce ecosystems expand globally, Consignment Software remains critical for operational efficiency, scalability, and profitable consignor-retailer collaboration

What are the Key Drivers of Consignment Software Market?

- Rising demand for automated inventory management, consignor tracking, and real-time sales reporting to reduce manual errors and operational overhead

- For instance, in 2025, leading providers such as Liberty4Consignment, Traxia, and Ricochet upgraded their platforms with enhanced analytics, mobile POS support, and multi-location management features

- Growing adoption of second-hand retail, resale marketplaces, thrift stores, and circular economy business models across North America, Europe, and Asia-Pacific is boosting software demand

- Advancements in cloud computing, SaaS architecture, AI-based demand forecasting, and system integrations have strengthened scalability, usability, and deployment speed

- Increasing penetration of eCommerce, omnichannel retailing, and mobile-first store operations is creating demand for centralized, cloud-enabled consignment solutions

- Supported by expanding resale economies, digital transformation initiatives, and SME adoption, the Consignment Software market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Consignment Software Market?

- High costs associated with advanced, enterprise-grade consignment platforms, including customization, integrations, and long-term subscriptions, limit adoption among small retailers

- For instance, during 2024–2025, rising cloud infrastructure costs, software development expenses, and cybersecurity compliance requirements increased operational costs for vendors

- Complexity in data migration, system integration, and staff training creates adoption barriers for traditional or small-scale consignment stores

- Limited digital awareness and low technology readiness among independent and unorganized resale retailers slow market penetration in emerging economies

- Competition from generic POS systems, inventory software, and marketplace-native tools reduces differentiation and intensifies pricing pressure

- To overcome these challenges, vendors are focusing on freemium models, modular pricing, cloud optimization, onboarding support, and AI-driven automation to expand global adoption of consignment software

How is the Consignment Software Market Segmented?

The market is segmented on the basis of deployment mode and enterprise size.

- By Deployment Mode

On the basis of deployment mode, the consignment software market is segmented into Cloud and On-premise solutions. The Cloud segment dominated the market with an estimated 61.3% share in 2025, driven by rising preference for SaaS-based platforms that offer real-time inventory visibility, automatic updates, remote access, and lower upfront infrastructure costs. Cloud-based consignment software enables seamless integration with POS systems, eCommerce platforms, accounting tools, and mobile applications, making it highly attractive for resale stores, thrift chains, and franchise consignors. Easy scalability, faster deployment, and subscription-based pricing further support widespread adoption among SMEs and multi-location retailers.

The On-premise segment is expected to grow at a moderate but steady CAGR from 2026 to 2033, primarily driven by enterprises requiring higher data control, customized workflows, and compliance with strict internal IT policies. However, the continued shift toward digital-first retail models strongly favors cloud-based dominance.

- By Enterprise Size

On the basis of enterprise size, the consignment software market is segmented into Large Enterprises and Small and Medium Enterprises (SMEs). The SME segment dominated the market with a 58.7% share in 2025, as small resale shops, independent consignors, boutique chains, and local thrift stores increasingly adopt affordable, cloud-based consignment platforms to automate inventory management, consignor settlements, and sales tracking. SMEs benefit from low-cost subscription models, minimal IT requirements, and user-friendly interfaces that reduce operational complexity. Growing participation of SMEs in the circular economy and resale commerce further accelerates adoption.

The Large Enterprise segment is projected to register the fastest CAGR from 2026 to 2033, driven by expansion of multi-store resale chains, franchise-based consignment networks, and enterprise-level recommerce platforms. These organizations demand advanced analytics, centralized reporting, multi-location control, and deep system integrations, fueling growth of enterprise-grade consignment software solutions.

Which Region Holds the Largest Share of the Consignment Software Market?

- North America dominated the consignment software market with a 39.97% revenue share in 2025, driven by high adoption of digital retail technologies, strong presence of resale and recommerce platforms, and rapid digitalization of inventory and point-of-sale systems across the U.S. and Canada. Widespread use of cloud-based software, integrated POS solutions, and data-driven retail management tools continues to fuel demand for consignment software among thrift stores, resale chains, and franchise consignors

- Leading vendors in North America are continuously enhancing cloud deployment, mobile accessibility, real-time reporting, and integration with eCommerce and accounting platforms, strengthening regional market leadership

- High technology awareness, strong startup ecosystems, and mature retail infrastructure further reinforce North America’s dominance in the global consignment software landscape

U.S. Consignment Software Market Insight

The U.S. is the largest contributor in North America, supported by a well-established resale economy, rapid growth of recommerce platforms, and widespread adoption of SaaS-based retail management solutions. Increasing focus on circular economy models, second-hand retail, and multi-channel selling drives demand for advanced consignment software offering automation, analytics, and omnichannel integration. Presence of major software providers and a large base of independent consignors further accelerates market growth.

Canada Consignment Software Market Insight

Canada contributes steadily to regional expansion, driven by growing adoption of digital retail solutions among thrift stores, charity shops, and boutique resale chains. Rising cloud penetration, supportive small-business digitization programs, and increasing demand for inventory transparency strengthen consignment software adoption across the country.

Asia-Pacific Consignment Software Market

Asia-Pacific is projected to register the fastest CAGR of 8.98% from 2026 to 2033, driven by rapid expansion of organized retail, growing popularity of second-hand marketplaces, and accelerating digital transformation across China, Japan, India, South Korea, and Southeast Asia. Increasing smartphone penetration, cloud adoption, and eCommerce integration are boosting demand for scalable and mobile-enabled consignment software solutions. Growth of sustainable consumption trends and resale culture further supports regional expansion.

China Consignment Software Market Insight

China leads Asia-Pacific due to strong growth in digital retail platforms, online resale marketplaces, and tech-enabled inventory management solutions. Rising adoption of cloud software among SMEs and increasing focus on circular retail models accelerate market penetration.

Japan Consignment Software Market Insight

Japan shows steady growth supported by organized retail structures, high technology adoption, and increasing demand for efficient inventory and sales management in resale and specialty stores. Emphasis on operational accuracy and data reliability drives adoption of premium consignment software.

India Consignment Software Market Insight

India is emerging as a high-growth market, driven by expanding startup ecosystems, rising thrift and resale platforms, and rapid digitization of small retailers. Affordable SaaS models and mobile-first solutions are accelerating adoption among SMEs.

South Korea Consignment Software Market Insight

South Korea contributes significantly due to strong digital infrastructure, high cloud adoption, and growing interest in sustainable retail practices. Integration of consignment software with online marketplaces and POS systems supports continued market growth.

Which are the Top Companies in Consignment Software Market?

The consignment software industry is primarily led by well-established companies, including:

- Resaleworld.com (U.S.)

- SBS Solutions, Inc. (U.S.)

- GeniusPeddler (U.S.)

- ARMS Business & Technology Solutions (U.S.)

- Cloud Seeders (U.S.)

- Brave New Software, LLC (U.S.)

- My Consignment Manager (U.S.)

- Ricochet Consignment Software (U.S.)

- Tri-Tech (U.S.)

- RJFSOFT (U.S.)

- Liberty4Consignment (U.S.)

- Traxia (U.S.)

- ConsignCloud (U.S.)

- Consignor Connect, LLC (U.S.)

- Innovative Risk Management (U.S.)

- AccuPOS Point of Sale (U.S.)

- Dell (U.S.)

- Honeywell International Inc. (U.S.)

- Infor (U.S.)

- Ingenico (France)

- Intuit Inc. (U.S.)

- Clover Network, Inc. (U.S.)

- LightSpeed (Canada)

- ShopKeep (U.S.)

- Vend Limited (New Zealand)

What are the Recent Developments in Global Consignment Software Market?

- In December 2023, Syrup secured more than USD 17.5 million in Series A funding to scale its AI-driven inventory optimization platform for omnichannel commerce, enabling retailers to improve stock visibility and demand forecasting. This development strengthens the role of AI-based inventory intelligence in modern retail operations

- In October 2023, Shipsy completed the acquisition of Stockone, a cloud-based warehouse and inventory management software provider, with the objective of expanding its end-to-end supply chain and inventory management capabilities. This acquisition enhances Shipsy’s product portfolio and reinforces its position in logistics technology solutions

- In July 2023, ABF (Automation Builds Future) partnered with Primetals Technologies at the METEC trade fair to jointly develop and promote intelligent inventory management solutions for automated storage of finished and semi-finished products. This collaboration highlights growing demand for automation-driven inventory solutions in the manufacturing sector

- In June 2023, Unicommerce launched a new inventory management solution featuring real-time inventory synchronization to help brands maximize order fulfillment and accelerate order processing. This launch supports seamless omnichannel operations and improved inventory accuracy for fast-growing brands

- In May 2023, Avantor, Inc. entered into a strategic partnership with Labguru to integrate Avantor’s Inventory Manager eCommerce platform with Labguru’s LabLIMS and Electronic Lab Notebook solutions for pharmaceutical and research organizations. This integration improves inventory visibility and operational efficiency across laboratory and research environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Consignment Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Consignment Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Consignment Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.