Global Connected Solutions For Oil And Gas Market

Market Size in USD Billion

CAGR :

%

USD

8.97 Billion

USD

29.82 Billion

2025

2033

USD

8.97 Billion

USD

29.82 Billion

2025

2033

| 2026 –2033 | |

| USD 8.97 Billion | |

| USD 29.82 Billion | |

|

|

|

|

Connected Solutions for Oil and Gas Market Size

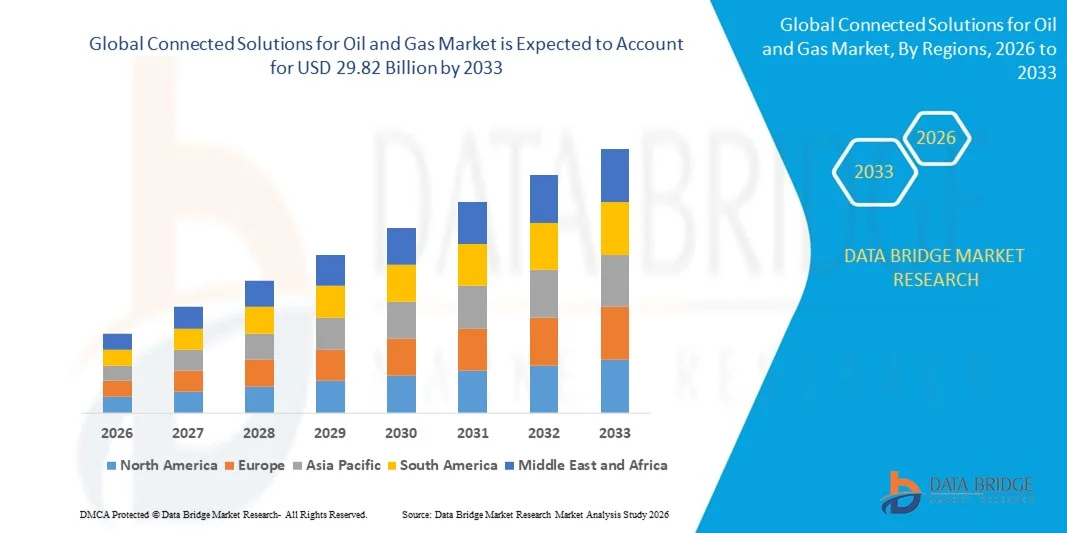

- The global connected solutions for oil and gas market size was valued at USD 8.97 billion in 2025 and is expected to reach USD 29.82 billion by 2033, at a CAGR of 16.20% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital technologies for operational efficiency, predictive maintenance, and real-time monitoring in upstream, midstream, and downstream operations

- Rising demand for automation, advanced analytics, and Internet of Things (IoT)-based solutions to optimize production and reduce operational costs is supporting market expansion

Connected Solutions for Oil and Gas Market Analysis

- The market is witnessing strong growth due to increased investment in smart infrastructure, cloud-based platforms, and edge computing technologies that enable real-time decision-making

- Continuous innovation in connected devices, remote monitoring systems, and AI-driven analytics is enhancing operational efficiency, asset reliability, and overall productivity in the oil and gas sector

- North America dominated the connected solutions for oil and gas market with the largest revenue share of 38.75% in 2025, driven by early adoption of digital technologies, widespread IoT deployment, and advanced infrastructure for upstream, midstream, and downstream operations

- Asia-Pacific region is expected to witness the highest growth rate in the global connected solutions for oil and gas market, driven by government initiatives supporting smart energy infrastructure, rising technological adoption, and expansion of upstream and downstream digital solutions

- The software segment held the largest market revenue share in 2025, driven by the increasing adoption of cloud-based platforms, real-time analytics, and AI-enabled monitoring systems that optimize operations and improve decision-making across oil and gas facilities. Software solutions enable operators to enhance productivity, ensure regulatory compliance, and reduce operational risks

Report Scope and Connected Solutions for Oil and Gas Market Segmentation

|

Attributes |

Connected Solutions for Oil and Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Connected Solutions for Oil and Gas Market Trends

Rising Adoption of Digital and IoT-Based Solutions

- The growing focus on digital transformation and operational efficiency is significantly shaping the connected solutions for oil and gas market, as companies increasingly adopt IoT, cloud, and AI-driven technologies to optimize production, monitor assets in real time, and reduce operational risks. Connected solutions are gaining traction due to their ability to enhance safety, reliability, and cost-effectiveness across upstream, midstream, and downstream operations. This trend strengthens their adoption across oilfield services, refineries, and pipeline management, encouraging vendors to innovate with new platforms and software solutions that cater to evolving industry needs

- Increasing emphasis on predictive maintenance, remote monitoring, and real-time data analytics has accelerated the deployment of connected solutions in exploration, production, and distribution segments. Oil and gas operators are actively integrating digital platforms with existing systems to improve decision-making, reduce downtime, and optimize resource utilization, prompting partnerships between technology providers and energy companies

- Operational efficiency, safety, and environmental compliance trends are influencing technology adoption, with companies emphasizing asset monitoring, leak detection, and energy optimization solutions. These factors are helping operators reduce operational costs, enhance regulatory compliance, and minimize environmental impact, while also driving the adoption of cloud-based and AI-enabled platforms

- For instance, in 2024, Schlumberger in the U.S. and Halliburton in the U.S. expanded their connected solution portfolios by incorporating advanced IoT sensors, AI-based predictive analytics, and remote monitoring systems in upstream and midstream operations. These deployments were introduced in response to rising demand for operational efficiency, safety, and reduced environmental footprint, with integration across offshore, onshore, and pipeline infrastructure

- While demand for connected solutions is growing, sustained market expansion depends on continuous R&D, cost-effective deployment, and interoperability with legacy systems. Vendors are also focusing on improving cybersecurity, scalability, and predictive analytics capabilities to balance operational efficiency, safety, and sustainability for broader adoption

Connected Solutions for Oil and Gas Market Dynamics

Driver

Growing Adoption of IoT, AI, and Cloud-Based Platforms

- Increasing implementation of IoT, AI, and cloud-based platforms is a major driver for the connected solutions market in oil and gas. Operators are deploying smart sensors, predictive maintenance solutions, and digital twins to improve monitoring, reduce downtime, and optimize production efficiency

- Expanding applications across upstream, midstream, and downstream operations are influencing market growth. Connected solutions help enhance safety, operational reliability, and cost-effectiveness while ensuring regulatory compliance and environmental sustainability

- Technology providers and oil and gas companies are actively promoting connected solution adoption through innovation, partnerships, and integration with existing infrastructure. These initiatives are supported by the growing need for real-time data insights, predictive analytics, and remote monitoring capabilities, reinforcing market penetration

- For instance, in 2023, Baker Hughes in the U.S. and Weatherford in Switzerland reported increased adoption of AI-enabled monitoring and IoT-based connected solutions across upstream and midstream operations. This expansion followed rising industry demand for predictive maintenance, real-time operational insights, and reduced environmental impact, driving enhanced efficiency and reliability

- Although rising digitalization trends support growth, wider adoption depends on cost optimization, cybersecurity, and seamless integration with legacy systems. Investment in technology upgrades, cloud infrastructure, and advanced analytics will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Implementation Costs And Integration Challenges

- The relatively high cost of implementing connected solutions, including IoT sensors, cloud platforms, and AI-based analytics, remains a key challenge, limiting adoption among cost-sensitive operators. High initial investments and ongoing maintenance expenses contribute to elevated pricing and slower deployment

- Limited technical expertise and uneven digital maturity across regions restrict adoption in certain markets. Smaller operators may face challenges in integrating connected solutions with legacy systems, resulting in slower technology uptake

- Data security, interoperability, and standardization challenges also impact market growth, as connected solutions require robust cybersecurity measures and compatibility with existing infrastructure. Complex system integration and operational downtime during deployment increase operational risks and costs

- For instance, in 2024, oilfield operators in Southeast Asia and Latin America reported slower adoption of connected solutions due to high implementation costs, lack of trained personnel, and integration challenges with existing equipment. These barriers affected project timelines and ROI expectations, limiting short-term market growth

- Overcoming these challenges will require cost-efficient deployment models, expanded training programs, and enhanced cybersecurity measures. Collaboration between technology providers, operators, and regulatory authorities can help unlock the long-term growth potential of the global connected solutions for oil and gas market. Furthermore, developing scalable, interoperable, and secure platforms will be essential for widespread adoption

Connected Solutions for Oil and Gas Market Scope

The market is segmented on the basis of component, value chain, and application.

- By Component

On the basis of component, the global connected solutions for oil and gas market is segmented into hardware, software, and services. The software segment held the largest market revenue share in 2025, driven by the increasing adoption of cloud-based platforms, real-time analytics, and AI-enabled monitoring systems that optimize operations and improve decision-making across oil and gas facilities. Software solutions enable operators to enhance productivity, ensure regulatory compliance, and reduce operational risks.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for implementation, integration, and managed services that support connected solution deployments. Service offerings, including consulting, maintenance, and training, are increasingly critical for seamless adoption and operational efficiency, particularly in complex upstream and midstream environments.

- By Value Chain

On the basis of value chain, the market is segmented into upstream, midstream, and downstream. The upstream segment accounted for the largest share in 2025 due to extensive deployment of IoT sensors, digital twins, and remote monitoring systems in exploration and production activities, which help optimize resource extraction and enhance operational safety.

The downstream segment is expected to register the fastest growth from 2026 to 2033, driven by increasing digitalization of refineries, distribution networks, and end-to-end supply chain operations. Connected solutions in downstream operations improve efficiency, minimize downtime, and enable predictive maintenance for critical assets.

- By Application

On the basis of application, the market is segmented into asset tracking and monitoring, predictive and preventive maintenance, supply chain management, leak detection, fleet management, and others. The predictive and preventive maintenance segment held the largest market revenue share in 2025, as operators leverage connected solutions to monitor equipment health, prevent unplanned downtime, and reduce maintenance costs.

The leak detection segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing regulatory requirements, environmental concerns, and the adoption of real-time monitoring technologies that detect leaks and minimize operational and ecological risks.

Connected Solutions for Oil and Gas Market Regional Analysis

- North America dominated the connected solutions for oil and gas market with the largest revenue share of 38.75% in 2025, driven by early adoption of digital technologies, widespread IoT deployment, and advanced infrastructure for upstream, midstream, and downstream operations

- Oil and gas operators in the region highly value real-time monitoring, predictive maintenance, and cloud-based analytics to enhance operational efficiency, reduce downtime, and ensure regulatory compliance

- This widespread adoption is further supported by high investments in smart infrastructure, strong technological expertise, and the presence of leading oilfield service providers, establishing connected solutions as a key enabler for operational optimization

U.S. Connected Solutions for Oil and Gas Market Insight

The U.S. connected solutions for oil and gas market captured the largest revenue share in 2025 within North America, fueled by rapid digitalization, strong IoT integration, and adoption of AI-enabled analytics platforms. Operators are increasingly focusing on predictive maintenance, asset monitoring, and supply chain optimization to improve safety, reduce costs, and increase operational reliability. Moreover, collaboration with technology vendors and investments in cloud-based and edge-computing platforms are significantly contributing to market expansion.

Europe Connected Solutions for Oil and Gas Market Insight

The Europe connected solutions for oil and gas market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent safety regulations, rising demand for operational efficiency, and the need for digital transformation in upstream and downstream operations. European operators are investing in predictive analytics, remote monitoring, and AI-powered platforms, enabling energy companies to improve asset management, minimize environmental impact, and optimize production efficiency.

U.K. Connected Solutions for Oil and Gas Market Insight

The U.K. connected solutions for oil and gas market is expected to witness strong growth from 2026 to 2033, driven by increasing adoption of cloud-based solutions, digital twins, and IoT-enabled monitoring systems. Rising emphasis on safety, predictive maintenance, and regulatory compliance is encouraging oil and gas companies to deploy connected platforms for upstream, midstream, and downstream operations. The country’s mature digital infrastructure and robust technology ecosystem are expected to continue stimulating market growth.

Germany Connected Solutions for Oil and Gas Market Insight

The Germany connected solutions for oil and gas market is expected to witness robust growth from 2026 to 2033, fueled by industrial automation, rising demand for energy efficiency, and the integration of smart monitoring solutions. Germany’s strong focus on sustainability, innovation, and digitalization promotes the adoption of connected solutions across refineries, pipelines, and production facilities, enabling enhanced operational reliability and regulatory adherence.

Asia-Pacific Connected Solutions for Oil and Gas Market Insight

The Asia-Pacific connected solutions for oil and gas market is expected to witness the highest growth rate from 2026 to 2033, driven by rapid industrialization, increasing energy demand, and the adoption of digital solutions in countries such as China, India, and Australia. Government initiatives promoting digitalization and smart energy infrastructure are accelerating the deployment of IoT, AI, and cloud-based platforms. Furthermore, APAC’s emergence as a manufacturing and technology hub for connected devices is enhancing accessibility and affordability for operators.

Japan Connected Solutions for Oil and Gas Market Insight

The Japan connected solutions for oil and gas market is expected to witness significant growth from 2026 to 2033, due to the country’s high focus on technological innovation, energy efficiency, and operational safety. Japanese operators are increasingly integrating IoT sensors, predictive maintenance solutions, and AI-driven analytics into upstream and downstream processes. In addition, the need for reducing operational costs and enhancing monitoring capabilities is driving adoption in both offshore and onshore facilities.

China Connected Solutions for Oil and Gas Market Insight

The China connected solutions for oil and gas market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrial growth, high energy demand, and accelerated adoption of digital and IoT technologies. The country’s push towards smart oilfields, digital refineries, and connected pipelines, combined with strong domestic technology providers and government support for industrial automation, is propelling the deployment of connected solutions across upstream, midstream, and downstream operations.

Connected Solutions for Oil and Gas Market Share

The Connected Solutions for Oil and Gas industry is primarily led by well-established companies, including:

Cisco Systems (U.S.)

• Intel Corporation (U.S.)

• General Electric (U.S.)

• Sierra Wireless (Canada)

• Honeywell International Inc. (U.S.)

• Telit (U.K.)

• Schneider Electric (France)

• Robert Bosch GmbH (Germany)

• Siemens (Germany)

• ABB (Switzerland)

• Ericsson (Sweden)

• Huawei Technologies (China)

• IBM (U.S.)

• Hitachi (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Connected Solutions For Oil And Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Connected Solutions For Oil And Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Connected Solutions For Oil And Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.