Global Compressor Rental Market

Market Size in USD Million

CAGR :

%

USD

4,564.41 Million

USD

7,813.23 Million

2022

2030

USD

4,564.41 Million

USD

7,813.23 Million

2022

2030

| 2023 –2030 | |

| USD 4,564.41 Million | |

| USD 7,813.23 Million | |

|

|

|

|

Compressor Rental Market Analysis and Size

The large-scale demand for new rental air services is expected to drive the growth of the compressor rental industry over the forecast period. Furthermore, compressors are extremely useful in domestic activities, it aids in the transfer of air in a variety of industries such as oil extraction, chemical plants, transportation, automotive, and beverages and renting personalised compressors is expected to provide cost savings to the buyer as well as a reduction in higher repair costs due to system breakdown.

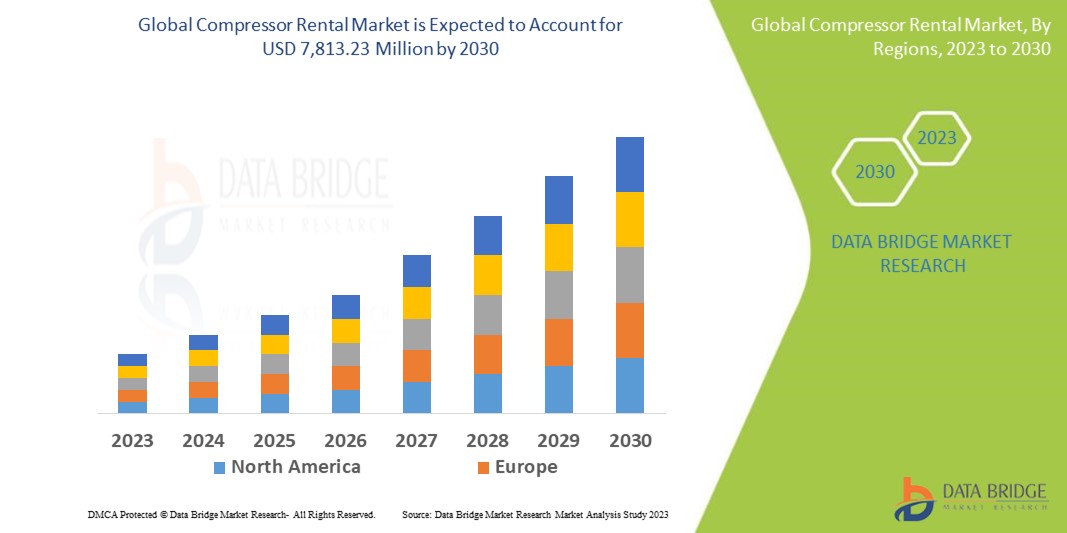

Data Bridge Market Research analyses that the global compressor rental market which was USD 4,564.41 million in 2022, is expected to reach USD 7,813.23 million by 2030, and is expected to undergo a CAGR of 6.95% during the forecast period 2023 to 2030. This indicates that the market value. “rotary screw” dominates the type segment of the compressor rental market owing increasing technological advancement. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Compressor Rental Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Compressor Type (Rotary Screw and Reciprocating), Drive Type (Electric Driven Compressor, Gas Driven Compressor, Engine Driven Compressor and Hydraulic Driven Compressor), Lubrication System (Oil Lubricated and Oil Free), End Use (Construction, Mining, Power, Oil and Gas, Chemical and Manufacturing), |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

ELGi (U.S.), Atlas Copco AB (Sweden), Ingersoll Rand (Ireland), The Hertz Corporation (U.S.), United Rental, Inc (U.S.), Ashtead Group (U.K.), AKTIO Corporation (Japan), Loxam (France), Aggreko (U.K.), Ar Brasil Compressores (Brazil ), Caterpillar (U.S.), Cisco Air Systems (U.S.), J Pen Medical (U.K.), Sullivan-Palatek Inc (U.S.), KWIPPED, Inc (U.S.), Aditya Air Products (India) |

|

Market Opportunities |

|

Market Definition

Compressor rental refers to the practice of leasing or renting compressors, which are mechanical devices used to increase the pressure of a gas or air. Compressors are commonly used in industries such as manufacturing, construction, oil and gas, mining, and many others. Rather than purchasing compressors outright, businesses and individuals can opt to rent them from specialized rental companies.

Global Compressor Rental Market Dynamics

Drivers

- Growing demand for compressed air

Compressed air is widely used in various industries, including manufacturing, construction, oil and gas, and mining. The increasing demand for compressed air in these sectors drives the need for compressor rentals, as it provides a cost-effective solution for meeting temporary or fluctuating air demand.

- Infrastructure development and construction projects

The construction industry is a major consumer of compressors for various applications such as pneumatic tools, concrete spraying, and sandblasting. Rapid urbanization, infrastructure development projects, and construction activities in emerging economies fuel the demand for compressor rentals.

- Expansion of the oil and gas industry

The oil and gas industry heavily relies on compressors for drilling, well testing, pipeline maintenance, and other operations. As the oil and gas sector continues to grow and explore new reserves, the demand for compressor rentals increases to support these activities.

- Need for temporary backup or replacement

Compressors are critical equipment in many industrial processes, and any downtime can result in significant losses. Renting compressors serves as a backup solution during equipment failure or maintenance, allowing businesses to continue their operations smoothly without interruption.

Opportunities

- Emerging economies and infrastructure development

The rapid industrialization and infrastructure development taking place in emerging economies provide significant opportunities for the compressor rental market. Countries such as China, India, Brazil, and Southeast Asian nations are witnessing increased construction activities, which require compressors for various applications.

- Technological advancements

The global compressor rental market can benefit from technological advancements in compressor design and features. Innovations such as energy-efficient compressors, digital control systems, and remote monitoring capabilities enhance the performance, reliability, and sustainability of compressors. Rental companies can invest in and offer the latest compressor technologies to attract customers seeking advanced equipment.

Restraints/Challenges

- Competition from equipment manufacturers

Some compressor manufacturers also offer rental services as part of their business model. These manufacturers often have established brand recognition and customer loyalty. Competing with such companies can be challenging for independent rental companies, particularly when customers prefer to rent directly from equipment manufacturers.

-

Fluctuating demand and economic conditions

The global compressor rental market is closely tied to the overall economic conditions and the industries it serves. During periods of economic downturn or industry slowdowns, the demand for compressor rentals may decline. This can impact the revenue and profitability of rental companies, making it essential for them to diversify their customer base and explore other market segments.

This global compressor rental market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global compressor rental market Contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In May 2023, ELGi announced the showcase of the EN Series Duplex rotary screw air compressor at the Car Wash Show, highlighting its performance and reliability

- In December 2021, Aerzen announced that it had added its new TVS2500 air compressor to its 10-bar range of air compressors

Global Compressor Rental Market Scope

The global compressor rental market is segmented on the basis of compressor type, drive type, lubrication system and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Compressor Type

- Rotary Screw

- Reciprocating

Drive Type

- Electric Driven Compressor

- Gas Driven Compressor

- Engine Driven Compressor

- Hydraulic Driven Compressor

Lubrication System

- Oil Lubricated

- Oil Free

End Use

- Construction

- Mining

- Power

- Oil and Gas

- Chemical and Manufacturing

Compressor rental market Regional Analysis/Insights

The global compressor rental market is analysed and market size insights and trends are provided by country, compressor type, drive type, lubrication system and end-use as referenced above.

The countries covered in the global compressor rental market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the global compressor rental market because of the, strong presence of major players in the market, growing demand for compressed air and infrastructure development and construction projects.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increase in government initiatives to promote awareness, growing research activities in the region, availability of massive untapped markets, large population pool, and emerging economies and infrastructure development

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The global compressor rental market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for global compressor rental market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the global compressor rental market. The data is available for historic period 2015-2020.

Competitive Landscape and Global Compressor Rental Market Share Analysis

The global compressor rental market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Compressor rental market.

Some of the major players operating in the compressor rental market are:

- ELGi (U.S.)

- Atlas Copco AB (Sweden)

- Ingersoll Rand (Ireland)

- The Hertz Corporation (U.S.)

- United Rental, Inc (U.S.)

- Ashtead Group (U.K.)

- AKTIO Corporation (Japan)

- Loxam (France)

- Aggreko (U.K.)

- Ar Brasil Compressores (Brazil )

- Caterpillar (U.S.)

- Cisco Air Systems (U.S.)

- J Pen Medical (U.K.)

- Sullivan-Palatek Inc (U.S.)

- KWIPPED, Inc (U.S.)

- Aditya Air Products (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.