Global Compostable Packaging Market

Market Size in USD Billion

CAGR :

%

USD

55.53 Billion

USD

89.85 Billion

2024

2032

USD

55.53 Billion

USD

89.85 Billion

2024

2032

| 2025 –2032 | |

| USD 55.53 Billion | |

| USD 89.85 Billion | |

|

|

|

|

Compostable Packaging Market Size

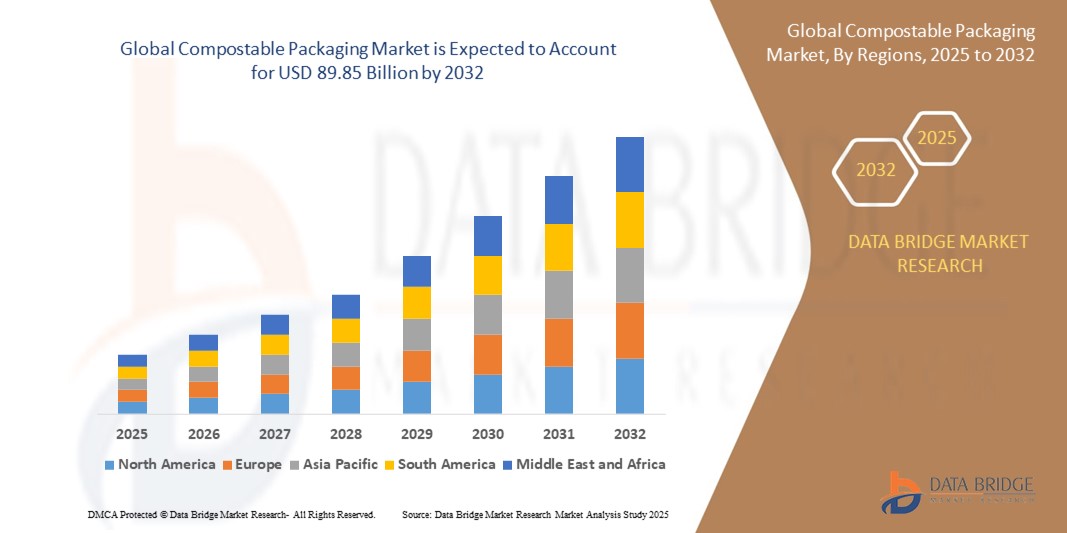

- The global compostable packaging market was valued at USD 55.53 billion in 2024 and is expected to reach USD 89.85 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.20%, primarily driven by increasing consumer demand for sustainable and eco-friendly packaging solutions

- This growth is driven by advancements in biodegradable material technologies, such as plant-based polymers and water-soluble films

Compostable Packaging Market Analysis

- The compostable packaging market has experienced substantial growth, driven by increasing consumer awareness of environmental sustainability and plastic pollution. The rising demand for biodegradable, plant-based, and recyclable packaging materials has led to the widespread adoption of compostable packaging across various industries, including food and beverage, personal care, and e-commerce. Advancements in bio-based polymers, water-soluble materials, and sustainable manufacturing techniques are enhancing the market’s potential, ensuring a balance between environmental responsibility and product functionality

- The market is primarily fueled by government regulations restricting single-use plastics, rising investments in eco-friendly packaging solutions, and a shift towards corporate sustainability initiatives. Businesses are increasingly adopting compostable packaging for food delivery, retail, and FMCG sectors to meet consumer expectations and reduce environmental impact. In addition, technological advancements in packaging durability, shelf life extension, and composting efficiency are driving greater adoption

- For instance, in Europe, leading supermarket chains and food brands are replacing conventional plastic packaging with certified compostable alternatives, ensuring compliance with regulatory mandates while catering to eco-conscious consumers

- Globally, the compostable packaging market is witnessing rapid innovation and expansion, with developments in seaweed-based films, mushroom-based packaging, and home-compostable flexible pouches revolutionizing the industry. As brands and manufacturers continue to adopt sustainable solutions, the market is set to grow significantly, reinforcing the circular economy and waste reduction initiatives worldwide

Report Scope and Compostable Packaging Market Segmentation

|

Attributes |

Compostable Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Compostable Packaging Market Trends

“Advancements in Biodegradable and Bio-Based Packaging Materials”

- The demand for biodegradable and bio-based packaging materials is growing as companies seek eco-friendly alternatives to traditional plastic packaging while maintaining durability and product protection. Innovations in plant-based polymers, mycelium packaging, and algae-based films are revolutionizing the industry by offering fully compostable, non-toxic, and sustainable solutions

- Leading manufacturers are investing in research and development of bio-based plastics, focusing on renewable raw materials such as cornstarch, sugarcane, and cellulose to create packaging that degrades naturally without harming the environment

- Governments and regulatory bodies worldwide are implementing stricter regulations on single-use plastics, encouraging businesses to transition towards compostable materials that comply with circular economy goals

For instance,

- In January 2024, BASF introduced a new line of compostable bioplastics designed for food packaging applications, offering enhanced flexibility and strength while maintaining full biodegradability

- In October 2023, Notpla, a U.K.-based sustainable packaging startup, launched algae-based packaging solutions for the food service industry, replacing traditional plastic coatings in takeaway containers

- In August 2023, TIPA expanded its range of compostable flexible packaging to include high-barrier films suitable for fresh produce, bakery items, and dry foods

- As innovation in biodegradable and bio-based packaging continues, brands across industries are expected to adopt compostable solutions, driving long-term growth and environmental benefits in the compostable packaging market

Compostable Packaging Market Dynamics

Driver

“Stringent Government Regulations and Bans on Single-Use Plastics”

- Governments worldwide are implementing strict regulations and bans on single-use plastics, pushing businesses to adopt compostable and biodegradable packaging solutions that align with sustainability goals and circular economy principles

- Regulatory bodies are introducing extended producer responsibility (EPR) programs, mandating that manufacturers reduce plastic waste, invest in eco-friendly materials, and improve waste management infrastructure to promote compostable packaging adoption

- The rising implementation of plastic taxes, eco-labeling requirements, and sustainability certifications is compelling companies to transition toward biodegradable and compostable packaging options to remain compliant and appeal to environmentally conscious consumers

For instance,

- In January 2024, the European Union introduced stricter regulations on plastic packaging waste, requiring companies to use a minimum percentage of compostable materials in their products

- In July 2023, California enforced its Plastic Pollution Prevention Act, mandating a phased reduction in single-use plastic packaging and encouraging businesses to use compostable alternatives

- In March 2023, India expanded its ban on single-use plastics, leading to a surge in demand for compostable food packaging and biodegradable bags

- As governments continue to tighten restrictions on plastic waste, the Compostable Packaging market will witness significant growth, driving innovation, investment, and adoption of sustainable alternatives across various industries

Opportunity

“Expansion of Compostable Packaging in the Foodservice and Takeout Industry”

- The growing demand for sustainable food packaging in restaurants, cafés, and takeaway services is creating new opportunities for compostable packaging solutions, as businesses seek to minimize plastic waste and meet consumer expectations for eco-friendly dining experiences.

- Fast-food chains, meal delivery services, and catering companies are increasingly investing in compostable containers, cutlery, and wraps to enhance sustainability efforts, comply with regulations, and attract environmentally conscious customers.

- The rise of urbanization, busy lifestyles, and online food delivery platforms has fueled the demand for biodegradable and compostable food packaging, leading to increased adoption of plant-based materials and water-soluble alternatives in the foodservice industry.

For instance,

- In October 2024, McDonald’s expanded its compostable packaging initiative by replacing plastic cutlery and straws with biodegradable fiber-based alternatives across multiple markets

- In July 2023, Just Salad introduced a 100% compostable takeout packaging line, reducing its reliance on single-use plastics and reinforcing its sustainability commitment

- In May 2023, Deliveroo partnered with sustainable packaging companies to provide restaurants with affordable compostable containers and utensils, promoting eco-friendly takeout solutions

- As sustainability becomes a key differentiator in the foodservice industry, the adoption of compostable packaging will continue to grow, driving market expansion, regulatory compliance, and innovation in biodegradable food packaging solutions

Restraint/Challenge

“High Production Costs Limiting Mass Adoption of Compostable Packaging”

- The higher cost of compostable packaging materials compared to conventional plastic and synthetic alternatives poses a significant challenge for widespread adoption, especially among small and mid-sized businesses

- Raw material sourcing, specialized manufacturing processes, and compliance with compostability standards contribute to elevated production expenses, making it difficult for companies to offer cost-competitive compostable packaging solutions

- Limited economies of scale, high RandD investments, and the need for improved durability and shelf-life stability further increase the financial burden on manufacturers, restricting the mass adoption of compostable alternatives in mainstream packaging markets

For instance,

- In June 2023, a study by the Ellen MacArthur Foundation emphasized the need for government subsidies and incentives to make compostable materials more affordable and scalable for the packaging industry

- To drive mass adoption and cost competitiveness, companies in the Compostable Packaging market must invest in material innovations, scale production capabilities, and seek regulatory support to reduce costs and enhance affordability across various industries

Compostable Packaging Market Scope

The market is segmented on the basis of product, material, packaging layer, distribution channel, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Material |

|

|

By Packaging Layer |

|

|

By Distribution Channel |

|

|

By End-User |

|

Compostable Packaging Market Regional Analysis

“North America is the Dominant Region in the Compostable Packaging Market”

- North America leads the compostable packaging market in both revenue and market share, driven by a strong demand for sustainable packaging solutions

- Growing environmental awareness and a preference for eco-friendly alternatives are key factors propelling the region’s dominance in the sector

- Corporate sustainability initiatives and shifting consumer preferences towards environmentally conscious choices further support market growth

- As sustainability continues to gain momentum, North America is expected to maintain its leadership in the compostable packaging market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is set for rapid growth in the compostable packaging market, driven by strong demand from various industries

- Government initiatives supporting sustainable packaging management are accelerating the region’s market expansion

- The rising need for efficient and eco-friendly packaging solutions is positioning Asia-Pacific as a key player in the global market

- With continuous advancements and policy support, Asia-Pacific is expected to remain the fastest-growing region in the compostable packaging sector

Compostable Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- TIPA LTD (Israel)

- SmartSolve - Water Soluble Materials (U.S.)

- Özsoy Plastik (Turkey)

- ultragreen (U.S.)

- Hosgör Plastik (Turkey)

- Eurocell Plc (U.K.)

- Tetra Pak International S.A. (Switzerland)

- Kruger Inc. (Canada)

- Amcor plc (Switzerland)

- Mondi (U.K.)

- International Paper (U.S.)

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- Klabin S.A. (Brazil)

- Rengo Co., Ltd. (Japan)

- WestRock Company (U.S.)

- Stora Enso (Sweden)

- Bemis Manufacturing Company (U.S.)

- BASF (Germany)

- Clearwater Paper Corporation (U.S.)

Latest Developments in Global Compostable Packaging Market

- In January 2024, Sealed Air launched its new CRYOVAC brand compostable overwrap tray at the International Product and Processing Expo (IPPE) 2024, marking a major step forward in sustainable packaging for protein products. This biobased alternative to expanded polystyrene (EPS) trays aligns with the industry's shift towards eco-friendly packaging solutions

- In September 2023, Pakka Ltd. introduced a new range of compostable flexible packaging solutions targeting the Fast-Moving Consumer Goods (FMCG) sector. This launch underscores the company’s commitment to reducing packaging waste, particularly in India, and enhancing sustainability in the industry

- In August 2022, TIPA unveiled a new compostable packaging solution developed using a unique blend of polymers. Designed for applications such as compostable films and laminates, this innovation caters to markets including fashion, fresh produce, and dry food packaging, reinforcing the demand for biodegradable alternatives

- In June 2022, Green Dot Bioplastics expanded its Terratek BD line by introducing nine new compostable grades tailored for single-use packaging applications. This development strengthens the company's efforts in improving biodegradability rates across film extrusion, thermoforming, and injection molding processes

- In August 2021, Crawford Packaging launched an eco-friendly poly-mailer made from 100% recycled materials. Despite its sustainable composition, the poly-mailer maintains the same high quality as traditional versions, offering a cost-effective and lightweight alternative for environmentally conscious businesses

- In January 2021, Novamont acquired BioBag Group to drive innovation in organic waste collection and composting systems. This strategic acquisition has not only reinforced Novamont’s presence in the compostable packaging sector but also created new growth opportunities for sustainable packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COMPOSTABLE PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COMPOSTABLE PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT/EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL COMPOSTABLE PACKAGING MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES

5.2 VENDOR SELECTION CRITERIA

5.3 PESTEL ANALYSIS

5.4 FACTORS AFFECTING BUYING DECISION

5.5 BRAND SHARE ANALYSIS

5.6 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 GLOBAL COMPOSTABLE PACKAGING MARKET, BY MATERIAL,2022-2031,(USD MILLION)

7.1 OVERVIEW

7.2 PLASTIC

7.2.1 BIO-SOURCED PLASTIC

7.2.1.1. PLA

7.2.1.2. PHA

7.2.1.3. STARCH-BASED

7.2.1.4. BIO-PBS

7.2.2 NON-BIO SOURCES PLASTIC

7.2.2.1. PBAT

7.2.2.2. PBS COPOLYESTERS

7.2.2.3. PBL

7.2.2.4. OTHERS

7.3 PAPER & PAPERBOARD

7.3.1 COATED UNBLEACHED

7.3.2 MOLDED FIBER

7.3.3 FLEXIBLE PAPER

7.3.4 OTHERS

7.4 OTHERS

8 GLOBAL COMPOSTABLE PACKAGING MARKET, BY PRODUCT,2022-2031,(USD MILLION)

8.1 OVERVIEW

8.2 BAGS

8.2.1 BAGS, BY TYPE

8.2.1.1. OPEN BAG

8.2.1.2. QUATTRO SEAL BAG

8.2.1.3. BAR WRAPPER

8.2.1.4. STAND-UP POUCH

8.2.1.5. REASABLE FLAP BAG

8.2.1.6. GUESTED BAG

8.2.1.7. PILLOW BAG

8.2.1.8. ZIPPER BAG

8.2.1.9. OTHERS

8.3 CUPS

8.4 POUCHES & SACHETS

8.5 BOWLS

8.6 TRAYS

8.6.1 TRAYS, BY TYPE

8.6.1.1. FOOD TRAYS

8.6.1.2. UTILITY TRAYS

8.6.1.3. OTHERS

8.7 PLATES

8.8 CLAMSHELLS

8.9 CUTLERY

8.1 STRAWS

8.11 LIDS

8.12 FILMS

8.13 OTHERS

9 GLOBAL COMPOSTABLE PACKAGING MARKET, BY PACKAGING LAYER,2022-2031,(USD MILLION)

9.1 OVERVIEW

9.2 PRIMARY PACKAGING

9.3 SECONDARY PACKAGING

9.4 TERTIARY PACKAGING

10 GLOBAL COMPOSTABLE PACKAGING MARKET, BY DISTRIBUTION CHANNEL,2022-2031,(USD MILLION)

10.1 OVERVIEW

10.2 B2B

10.3 B2C

10.3.1 ONLINE

10.3.1.1. E-COMMERCE WEBSITE

10.3.1.2. COMPANY-OWNED WEBSITE

10.3.2 OFFLINE

10.3.2.1. SUPERMARKET/HYPERMARKET

10.3.2.2. SPECIALTY STORES

10.3.2.3. OTHERS

11 GLOBAL COMPOSTABLE PACKAGING MARKET, BY END-USE,2022-2031,(USD MILLION)

11.1 OVERVIEW

11.2 FOOD & BEVERAGE

11.2.1 FOOD, BY END-USE

11.2.1.1. FRUITS & VEGETABLES

11.2.1.2. DAIRY PRODUCTS

11.2.1.3. BAKERY & CONFECTIONERY

11.2.1.4. MEAT, FISH & POULTRY

11.2.1.5. CONVENIENCE FOOD

11.2.1.6. SAUCES, DRESSINGS & SPREADS

11.2.1.7. OTHERS

11.2.2 BEVERAGE, BY BY END-USE

11.2.2.1. NON-ALCOHOLIC

11.2.2.2. ALCOHOLIC

11.2.3 FOOD & BEVERAGE, BY MATERIAL

11.2.3.1. PLASTIC

11.2.3.2. PAPER & PAPERBOARD

11.2.3.3. OTHERS

11.3 AGRICULTURE

11.3.1 AGRICULTURE, BY MATERIAL

11.3.1.1. PLASTIC

11.3.1.2. PAPER & PAPERBOARD

11.3.1.3. OTHERS

11.4 ELECTRICAL & ELECTRONICS

11.4.1 ELECTRICAL & ELECTRONICS, BY END-USER

11.4.1.1. CD/DVD

11.4.1.2. HOME APPLIANCES

11.4.1.3. CELL PHONES

11.4.1.4. ELECTRONICS

11.4.1.5. OTHERS

11.4.2 ELECTRICAL & ELECTRONICS, BY MATERIAL

11.4.2.1. PLASTIC

11.4.2.2. PAPER & PAPERBOARD

11.4.2.3. OTHERS

11.5 PERSONAL & HOME CARE

11.5.1 PERSONAL & HOME CARE, BY MATERIAL

11.5.1.1. PLASTIC

11.5.1.2. PAPER & PAPERBOARD

11.5.1.3. OTHERS

11.6 TEXTILE GOODS

11.6.1 TEXTILE GOODS, BY MATERIAL

11.6.1.1. PLASTIC

11.6.1.2. PAPER & PAPERBOARD

11.6.1.3. OTHERS

11.7 AUTOMOTIVE

11.7.1 AUTOMOTIVE, BY MATERIAL

11.7.2 PLASTIC

11.7.3 PAPER & PAPERBOARD

11.7.4 OTHERS

11.8 MEDICAL

11.8.1 MEDICAL, BY END-USE

11.8.1.1. MEDICINES

11.8.1.2. WIPES

11.8.1.3. BOTTLES

11.8.1.4. OTHERS

11.8.2 MEDICAL, BY MATERIAL

11.8.2.1. PLASTIC

11.8.2.2. PAPER & PAPERBOARD

11.8.2.3. OTHERS

11.9 CHEMICALS

11.9.1 CHEMICALS, BY MATERIAL

11.9.1.1. PLASTIC

11.9.1.2. PAPER & PAPERBOARD

11.9.1.3. OTHERS

11.1 OTHERS

11.10.1 OTHERS, BY MATERIAL

11.10.1.1. PLASTIC

11.10.1.2. PAPER & PAPERBOARD

11.10.1.3. OTHERS

12 GLOBAL COMPOSTABLE PACKAGING MARKET, BY GEOGRAPHY ,2022-2031,(USD MILLION)

GLOBAL COMPOSTABLE PACKAGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 SINGAPORE

12.3.6 THAILAND

12.3.7 INDONESIA

12.3.8 MALAYSIA

12.3.9 PHILIPPINES

12.3.10 AUSTRALIA & NEW ZEALAND

12.3.11 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AMERICA

13 GLOBAL COMPOSTABLE PACKAGING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL COMPOSTABLE PACKAGING MARKET- COMPANY PROFILE

15.1 MONDI

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 AMCOR PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 INTERNATIONAL PAPER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 WESTROCK COMPANY.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 TIPA LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 BIOME BIOPLASTICS + FUTAMURA

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 NATUREWORKS LLC +FLO GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 BIOPAK

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 AMS COMPOSTABLE (AMS GLOBAL SUPPLIERS GROUP)

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 BIOTEC PVT. LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 EASY FLUX

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 GEORGIA-PACIFIC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 NTIC (NORTHERN TECHNOLOGIES INTERNATIONAL CORPORATION)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 PAPER WATER BOTTLE

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ULTRAGREEN (ULTRA GREEN SUSTAINABLE PACKAGING)

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 WUXI TOPTEAM CO. LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 PACTIV EVERGREEN INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 GENPAK LLC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 DART CONTAINER CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 HUHTAMAKI

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

Global Compostable Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Compostable Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Compostable Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.