Global Composites Market, By Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Others), Product (Carbon, Glass), Resin Type (Thermoset Composites, Thermoplastic Composites), Manufacturing Process (Lay-Up Process, Filament Winding Process, Injection Molding Process, Pultrusion Process, Compression Molding Process, Resin Transfer Molding (RTM) Process, Others), End-Use Industry (Transportation, Aerospace and Defense, Wind Energy, Construction and Infrastructure, Pipe and Tank, Marine, Electrical and Electronics, Others) - Industry Trends and Forecast to 2031.

Composites Market Analysis and Size

In the aerospace industry, global composites play a pivotal role in revolutionizing aircraft manufacturing alongside traditional materials such as aluminum alloys. Composites, including carbon fiber-reinforced polymers (CFRP) and fiberglass-reinforced polymers (FRP), are extensively used in aircraft structures, including fuselages, wings, and tail sections, due to their exceptional strength-to-weight ratio and resistance to corrosion and fatigue. This enables the development of lightweight yet robust aircraft, enhancing fuel efficiency and overall performance.

For instance, NASA's award of a USD 800,000 Phase II STTR contract to AnalySwift LLC in July 2023 underscores the aerospace industry's reliance on advanced composites. The development of the Design Tool for Advanced Tailorable Composites (DATC) aims to enhance design capabilities, reflecting the industry's ongoing pursuit of innovative materials to improve aircraft performance, efficiency, and sustainability.

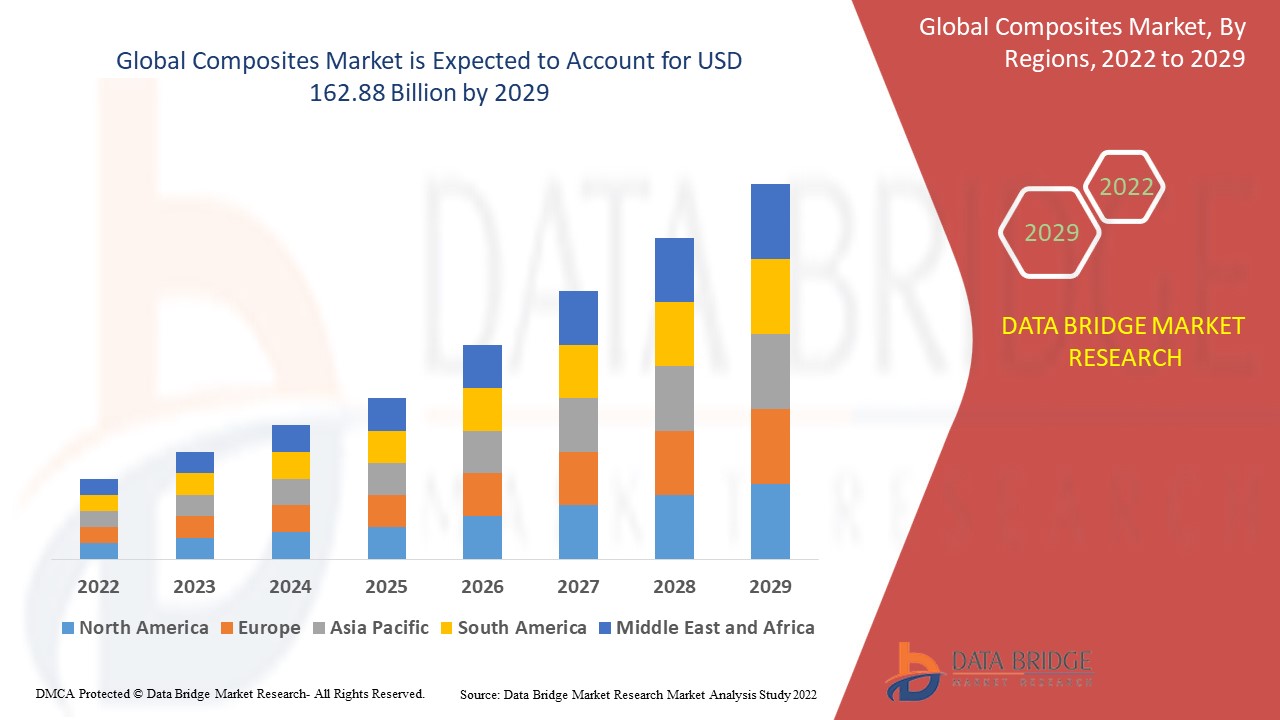

Global composites market size was valued at USD 102.64 billion in 2023 and is projected to reach USD 189.99 billion by 2031, with a CAGR of 8.00% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Others), Product (Carbon, Glass), Resin Type (Thermoset Composites, Thermoplastic Composites), Manufacturing Process (Lay-Up Process, Filament Winding Process, Injection Molding Process, Pultrusion Process, Compression Molding Process, Resin Transfer Molding (RTM) Process, Others), End-Use Industry (Transportation, Aerospace and Defense, Wind Energy, Construction and Infrastructure, Pipe and Tank, Marine, Electrical and Electronics, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

DOW (U.S.), Halocarbon, LLC (U.S.) Freudenberg SE (Germany), The Chemours Company (U.S.), Metalubgroup (Israel), Huntsman International LLC (U.S.), Bostik (France), H.B. Fuller Company (U.S.), Sika AG (Switzerland), Cardolite Corporation (U.S.), DAIKIN (Japan), Kukdo Chemical Co., Ltd., (South Korea), BASF SE(Germany), Covestro AG (Germany), LANXESS (Germany), Dupont (U.S.), SOLVAY (Belgium), Wanhua (China), Arkema (France), Hexion (U.S.) and Woodbridge (Canada)

|

|

Market Opportunities

|

|

Market Definition

Composites are materials made from two or more constituent materials with significantly different physical or chemical properties. These materials are combined to create a new material with enhanced mechanical, thermal, or electrical properties compared to its components. Composites find wide applications across various industries, including aerospace, automotive, construction, and renewable energy, due to their lightweight, durable, and versatile nature.

Composites Market Dynamics

Drivers

- Increasing Infrastructure Development Expands the Demand for Composites Globally

Composites offer advantages such as durability, corrosion resistance, and design flexibility, making them ideal for various infrastructure components such as bridges, buildings, pipelines, and roadways. Composites enable faster construction processes and lower maintenance costs, contributing to overall project efficiency and longevity. As governments worldwide prioritize infrastructure upgrades and expansions, the demand for composites in these projects is expected to continue rising, fueling growth in the global composites market.

- Growing Cost-Effectiveness Due to Enhanced Composite Production

Advances in manufacturing technologies, such as automated production processes and improved material formulations, have contributed to reducing production costs and enhancing efficiency in composite manufacturing. The durability and corrosion resistance of composites often lead to lower maintenance and replacement costs over the product lifecycle compared to traditional materials, making them a cost-effective choice for many applications. As industries increasingly prioritize cost-efficient solutions, composites continue to gain traction as a viable alternative, driving their widespread adoption and market growth.

Opportunities

- High Advancements in Material Science Increase the Applications for Composites

Through continual research and development efforts, new composite formulations are engineered with enhanced properties such as increased strength, durability, and thermal resistance. Innovations in nanotechnology and additive manufacturing techniques further contribute to the development of next-generation composites with tailored functionalities and improved processing capabilities. These advancements widen the scope of applications for composites and enable manufacturers to meet evolving customer demands for lightweight, high-performance materials in sectors such as aerospace, automotive, and renewable energy.

For instance, the collaboration between Arris Composites and Hyundai Motor Group exemplifies how advancements in material science, particularly in advanced polymer composites, are increasing applications for composites in industries such as automotive. Arris Composites' next-gen Additive Molding platform, supported by USD 34 million in funding, highlights the potential for scaled applications in aerospace and consumer markets.

- Rising Demand for Renewable Energy Promotes the Adoption of Composites

Composites play a crucial role in the sector, primarily in the manufacturing of wind turbine blades. These blades require materials with high strength, durability, and fatigue resistance to withstand harsh environmental conditions and ensure efficient energy production. Composites, such as fiberglass and carbon fiber-reinforced polymers, offer the ideal combination of properties needed for turbine blades, making them essential components in the renewable energy landscape. As the push for sustainable energy sources intensifies globally, the demand for composites in renewable energy applications is expected to continue rising, further driving growth in the composites market.

Restraints/Challenges

- Growing Complexity of Manufacturing Processes limits the Growth of Composites

Producing composites involves intricate procedures such as curing, molding, and post-processing, requiring specialized equipment, expertise, and meticulous quality control measures. These complexities often result in longer production lead times and higher production costs compared to conventional materials. These challenges hinder the widespread adoption of composites, particularly for small and medium-sized enterprises, limiting market growth and penetration across various industries.

- Limited Material Knowledge Hampers the Growth of Composites

The lack of comprehensive understanding may hinder confidence in using composites for safety-critical applications in industries such as aerospace and automotive. Additionally, the variability in material properties and behavior among different composite formulations makes it challenging to predict and ensure consistent performance, leading to concerns about reliability and quality control.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In February 2024, Owens Corning acquired Masonite for USD 3.9 billion, bolstering its presence in building materials and the glass reinforcement sector of its Composites segment

- In June 2023, Solvay and Spirit AeroSystems announced a collaboration aimed at advancing composite development for sustainable aircraft technologies. This partnership facilitates joint research with Spirit's extensive network of industrial, academic, and supply-chain partners

Composites Market Scope

The market is segmented on the basis of fiber type, product, resin type, manufacturing process and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Fiber Type

- Glass Fiber Composites

- Carbon Fiber Composites

- Natural Fiber Composites

- Others

Product

- Carbon

- Glass

Resin Type

- Thermoset Composites

- Thermoplastic Composites

Manufacturing Process

- Lay-Up Process

- Filament Winding Process

- Injection Molding Process

- Pultrusion Process

- Compression Molding Process

- Resin Transfer Molding (RTM) Process

- Others

End-Use Industry

- Transportation

- Aerospace and Defense

- Wind Energy

- Construction and Infrastructure

- Pipe and Tank

- Marine

- Electrical and Electronics

- Others

Composites Market Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, fiber type, product, resin type, manufacturing process and end-use industry as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market due to rising aircraft deliveries and significant capacity expansion in aerospace composites production. This dominance is fueled by efforts from various market players within the region, who are strategically expanding their capabilities to meet the growing demand for advanced composite materials in aerospace applications. This trend underscores North America's pivotal role in shaping the future of the composites industry, particularly in the context of aerospace technology and production.

The Asia-Pacific region is expected to experience significant growth due to several factors. This includes the region's thriving manufacturing sector, particularly in transportation, construction, infrastructure, and wind energy industries. The presence of numerous manufacturers coupled with the region's expanding infrastructure and energy projects further contributes to this lucrative growth outlook.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Composites Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are

- DOW (U.S.)

- Halocarbon, LLC (U.S.)

- Freudenberg SE (Germany)

- The Chemours Company (U.S.)

- Metalubgroup (Israel)

- Huntsman International LLC (U.S.)

- Bostik (France)

- H.B. Fuller Company (U.S.)

- Sika AG (Switzerland)

- Cardolite Corporation (U.S.)

- DAIKIN (Japan)

- Kukdo Chemical Co., Ltd., (South Korea)

- BASF SE (Germany)

- Covestro AG (Germany)

- LANXESS (Germany)

- Dupont (U.S.)

- SOLVAY (Belgium)

- Wanhua (China)

- Arkema (France)

- Hexion (U.S.)

- Woodbridge (Canada)

SKU-