Global Commodity Plastics Market

Market Size in USD Billion

CAGR :

%

USD

560.12 Billion

USD

902.91 Billion

2023

2031

USD

560.12 Billion

USD

902.91 Billion

2023

2031

| 2024 –2031 | |

| USD 560.12 Billion | |

| USD 902.91 Billion | |

|

|

|

|

Commodity Plastics Market Analysis and Size

In the construction industry, commodity plastics market find extensive applications in various aspects of building and infrastructure development. These plastics are utilized for manufacturing pipes, fittings, insulation materials, roofing, flooring, and other structural components. Their versatility, durability, and cost-effectiveness make them popular choices for construction projects. Commodity plastics such as PVC, polyethylene, and polystyrene are particularly favored for their ability to withstand harsh environmental conditions, resist corrosion, and provide excellent thermal and acoustic insulation.

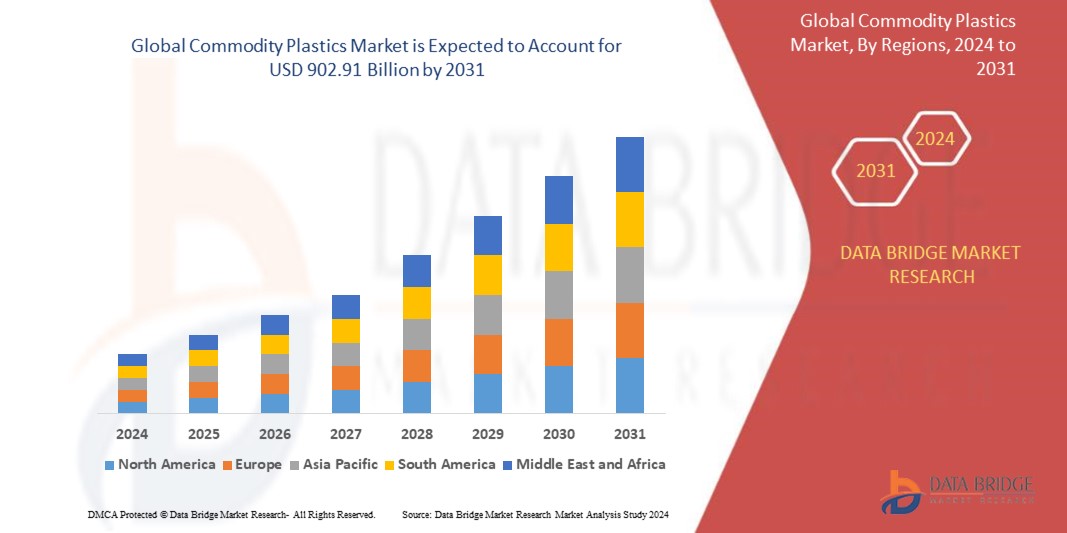

Global commodity plastics market size was valued at USD 560.12 billion in 2023 and is projected to reach USD 902.91 billion by 2031, with a CAGR of 6.15% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Commodity Plastics Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Polyethylene (PE), Polyvinyl Chloride (PVC), Polystyrene (PS), Polypropylene (PP), Polymethyl Methacrylate (PMMA), Acrylonitrile Butadiene Styrene (ABS), and Others), Type of Plastic (Reusable and Recyclable), Application (Packaging, Automotive, Electronics, Consumer Goods, Construction, Textile, Medical and Pharmaceutical and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, Rest of the Middle East and Africa |

|

Market Players Covered |

Exxon Mobil Corporation (U.S.), Chevron Phillips Chemical Company, LLC (U.S.), BASF SE (Germany), Dow (U.S.), DuPont (U.S.), LyondellBasell Industries Holdings B.V. (Netherlands), Borealis AG (Austria), Braskem (Brazil), Eni S.p.A (Italy), Formosa Plastics Corporation (Taiwan), Sumitomo Chemical Co., Ltd. (Japan), Hanwha Group (South Korea), INEOS (Switzerland), LG Chem (South Korea), Lotte Chemical (South Korea), Mitsubishi Chemical Corporation (Japan), Nova Chemicals Corporate (Canada), PTT Global Chemical Public Company Limited (Thailand), Reliance Industries Limited (India), SABIC (Saudi Arabia), Sumitomo Chemical Co. Ltd. (Japan), Westlake Chemical Corporation (U.S.) |

|

Market Opportunities |

|

Market Definition

Commodity plastics is a group of widely used synthetic polymers produced in large volumes for various everyday applications. They are typically derived from petrochemicals and include materials such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polystyrene (PS), among others. Commodity plastics are known for their versatility, affordability, and ease of production, making them ubiquitous in industries such as packaging, consumer goods, automotive, construction, and agriculture.

Commodity Plastics Market Dynamics

Drivers

- Growing Versatility of Commodity Plastics Leads to its Widespread Adoption

Commodity plastics offer a broad spectrum of properties, including flexibility, durability, chemical resistance, and foldability, making them suitable for a wide range of applications across various industries. Their ability to be easily formed into different shapes, sizes, and configurations enables manufacturers to tailor them to specific needs, enhancing product performance and functionality. This adaptability allows commodity plastics to be utilized in diverse sectors such as packaging, automotive, construction, electronics, and consumer goods.

- Increasing Infrastructure Development Leads to the Growing Demand of the Commodity Plastics

Commodity plastics such as PVC, polyethylene, and polypropylene are integral in infrastructure projects for manufacturing pipes, cables, insulation, and structural components. These materials offer advantages such as durability, corrosion resistance, and cost-effectiveness, making them preferred choices for infrastructure development. As governments and private entities invest in upgrading transportation, energy, and water systems globally, the demand for commodity plastics continues to rise. This trend is expected to persist as urbanization accelerates and emerging economies prioritize infrastructure investments, further propelling the growth of the commodity plastics market.

Opportunities

- Increasing Development in Healthcare Infrastructure Promotes the Adoption of Commodity Plastics

As countries invest in expanding and upgrading their healthcare facilities, there is a growing demand for medical equipment, devices, and packaging materials made from commodity plastics. These plastics offer properties such as sterility, durability, and flexibility, making them ideal for applications in hospitals, clinics, laboratories, and pharmaceutical industries. Commodity plastics contribute to the production of single-use medical supplies, protective gear, and diagnostic tools, addressing the increasing need for hygiene and safety standards in healthcare settings.

- Rising Consumer Preferences for Convenience Products Increases Demand for Flexible Packaging

Flexible packaging offers numerous advantages, including lightweight, cost-effectiveness, and versatility in design. Commodity plastics such as polyethylene (PE) and polypropylene (PP) are commonly used in flexible packaging applications due to their flexibility, durability, and barrier properties. With rising consumer preferences for convenience and on-the-go products, there is a growing need for flexible packaging solutions across various industries including food and beverage, pharmaceuticals, and personal care.

Restraints/Challenges

- Volatility in Raw Material Prices Disrupts Supply Chains

Fluctuations in crude oil prices directly impact the cost of petrochemical feedstocks used in the production of commodity plastics such as polyethylene and polypropylene. This volatility can lead to uncertainty in production costs, affecting profit margins and overall competitiveness for manufacturers. Rapid and unpredictable price changes make it challenging for companies to plan budgets, invest in long-term projects, and maintain stable pricing for their customers. Such instability can disrupt supply chains, erode investor confidence, and hinder strategic decision-making within the commodity plastics industry, thus impeding its growth potential.

- Increasing Regulatory Pressures Impact Development Commodity Plastics Industry

Increasingly stringent regulations aimed at reducing plastic waste, promoting recycling, and addressing environmental concerns pose challenges for manufacturers. Compliance with these regulations often requires investments in new technologies, processes, and materials, adding to production costs. Varying regulatory frameworks across different regions and countries can create complexities for companies operating in global markets. Regulatory uncertainty and evolving standards may hinder innovation and product development efforts within the commodity plastics industry.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

• In November 2023, Fresh Del Monte Produce Inc. collaborated with Arena Packaging to introduce Reusable Plastic Containers (RPCs) tailored for banana packaging. This collaboration addresses the growing demand for sustainable packaging solutions in the commodity plastics market, offering an alternative to single-use plastic packaging for fresh produce. The use of RPCs not only extends the shelf life of bananas but also reduces operational costs and carbon emissions, reflecting a shift towards eco-friendly practices in packaging

• In October 2023, CocaCola India launched CocaCola in 100% recycled PET (rPET) bottles, produced by SLMG Beverages Ltd. and Moon Beverages Ltd. This initiative contributes to the evolving landscape of the commodity plastics market by promoting the use of recycled materials in beverage packaging. CocaCola demonstrates its commitment to sustainability by utilizing rPET, aligning with global efforts to reduce plastic waste and minimize environmental impact in the packaging industry

• In February 2023, Ecolab and TotalEnergies collaborated to introduce a new plastic packaging solution derived from recycled materials. This joint venture responds to the growing demand for sustainable packaging options within the commodity plastics market. Incorporating recycled materials into their packaging production, Ecolab and TotalEnergies support the circular economy objectives of the European Union (EU) while addressing environmental concerns associated with heavy-use plastic packaging

Commodity Plastics Market Scope

The market is segmented on the basis of type, type of plastic and application. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target markets.

Type

- Polyethylene (PE)

- High Density Polythene (HDPE)

- Low Density Polythene (LDPE)

- Linear Low Density Polythene (LLDPE)

- Ultra-High Molecular Weight Polyethylene (UHMW)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polystyrene (PS)

- Polypropylene (PP)

- Polypropylene Homo-Polymers (PPH)

- Polypropylene Co-Polymers (PPC)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

Type of Plastic

- Reusable

- Recyclable

Application

- Packaging

- Film Wraps

- Plastic Bags

- Industrial and Household Chemical Containers

- Milk Jugs

- Cereal Box Liners

- Others

- Automotive

- Electronics

- Consumer Goods

- Construction

- Textile

- Medical and Pharmaceutical

- Others

Commodity Plastics Market Regional Analysis/Insights

The market is analysed, and market size, volume information is provided by country, type, type of plastic and application as referenced above.

The countries covered in market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America.

The Asia-Pacific dominates the commodity plastics market primarily due to increased demand in packaging and medical sectors across various countries. Economic and healthcare advancements, coupled with significant investments in construction, are driving further growth in the region. This trend is expected to continue during the forecast period, solidifying Asia-Pacific's dominance in the commodity plastics market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Commodity Plastics Market Share Analysis

The market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to the market.

Some of the major players operating in the market are:

- Exxon Mobil Corporation (U.S.)

- Chevron Phillips Chemical Company, LLC (U.S.)

- BASF SE (Germany)

- Dow (U.S.)

- DuPont (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Borealis AG (Austria)

- Braskem (Brazil)

- Eni S.p.A (Italy)

- Formosa Plastics Corporation (Taiwan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Hanwha Group (South Korea)

- INEOS (Switzerland)

- LG Chem (South Korea)

- Lotte Chemical (South Korea)

- Mitsubishi Chemical Corporation (Japan)

- Nova Chemicals Corporate (Canada)

- PTT Global Chemical Public Company Limited (Thailand)

- Reliance Industries Limited (India)

- SABIC (Saudi Arabia)

- Sumitomo Chemical Co. Ltd. (Japan)

- Westlake Chemical Corporation (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Commodity Plastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Commodity Plastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Commodity Plastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.