Global Cognitive Collaboration Market

Market Size in USD Billion

CAGR :

%

USD

15.95 Billion

USD

60.79 Billion

2024

2032

USD

15.95 Billion

USD

60.79 Billion

2024

2032

| 2025 –2032 | |

| USD 15.95 Billion | |

| USD 60.79 Billion | |

|

|

|

|

Cognitive Collaboration Market Size

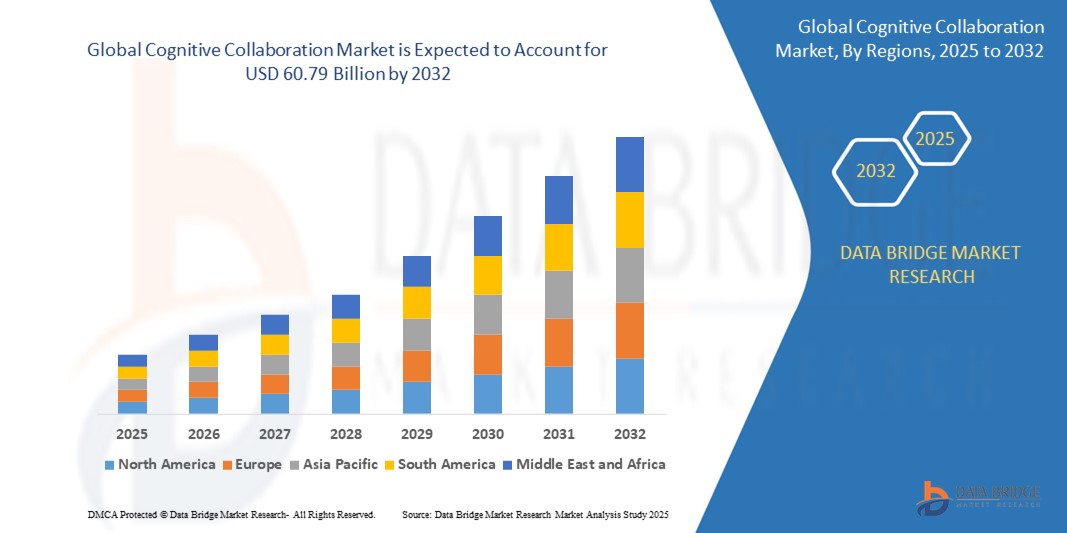

- The global cognitive collaboration market size was valued at USD 15.95 billion in 2024 and is expected to reach USD 60.79 billion by 2032, at a CAGR of 18.20% during the forecast period

- The market growth is largely fuelled by the increasing integration of artificial intelligence (AI) and machine learning (ML) into communication platforms, rising demand for real-time analytics, and the need for enhanced productivity in remote and hybrid work environments

- The surge in demand for smart meeting solutions, contextual collaboration, and unified communication tools across industries such as IT, healthcare, BFSI, and education is expected to further accelerate market expansion

Cognitive Collaboration Market Analysis

- The growing adoption of intelligent virtual assistants, facial recognition, and smart meeting solutions is transforming enterprise collaboration by enabling smarter decision-making and streamlined workflows

- Enterprises are increasingly leveraging cognitive collaboration tools to enhance customer experience, automate repetitive tasks, and support data-driven communication strategies across departments

- North America dominated the cognitive collaboration market with the largest revenue share of 42.6% in 2024, driven by early adoption of AI technologies, widespread cloud infrastructure, and strong presence of major technology providers

- Asia-Pacific region is expected to witness the highest growth rate in the global cognitive collaboration market, driven by increasing adoption of AI-powered tools, rapid digital transformation across enterprises, and supportive government initiatives promoting smart infrastructure and cloud computing technologies

- The solutions segment dominated the market with the largest market revenue share in 2024, driven by the increasing integration of AI-based tools in collaboration platforms to enhance user productivity, automate repetitive tasks, and improve real-time communication. Enterprises are leveraging advanced cognitive features such as sentiment analysis, automated meeting summaries, and context-based recommendations to streamline workflows and boost engagement

Report Scope and Cognitive Collaboration Market Segmentation

|

Attributes |

Cognitive Collaboration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Of AI Integration in Collaboration Platforms • Rising Demand for Cognitive Tools in Remote Work Environments |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cognitive Collaboration Market Trends

“Rise of AI-Powered Virtual Assistants in Enterprise Communication”

- AI-powered virtual assistants are increasingly integrated into enterprise communication platforms to automate tasks such as meeting scheduling and note-taking

- These tools reduce manual workloads and improve productivity by offering contextual reminders and real-time recommendations

- Growing popularity of hybrid and remote work models is driving adoption of intelligent assistants that support asynchronous and synchronous collaboration

- Virtual assistants enhance the user experience through voice commands, smart transcription, and predictive responses

- Integration of AI in platforms such as Microsoft Teams, which uses Cortana to facilitate quick actions and responses, exemplifies this growing trend

Cognitive Collaboration Market Dynamics

Driver

“Growing Need for Real-Time Insights and Intelligent Collaboration Tools”

- Businesses are adopting cognitive collaboration tools to gain real-time insights from emails, chats, and meetings for faster decision-making

- AI and machine learning enable intelligent data filtering and context-aware information sharing

- These tools improve team responsiveness by automating repetitive communications and surfacing actionable insights

- Enterprises are leveraging AI to enhance employee productivity and customer engagement simultaneously

- For instance, Salesforce Einstein, integrates with collaboration platforms to deliver predictive analytics and real-time recommendations, enabling smarter collaboration

Restraint/Challenge

“Data Privacy and Security Concerns”

- Processing sensitive internal communications raises concerns over data misuse, especially in highly regulated industries

- Cloud-based deployments often involve cross-border data transfer, increasing compliance complexities

- Organizations are cautious about integrating third-party AI due to limited transparency in how data is accessed and processed

- Security lapses or breaches could lead to legal consequences and damage brand credibility

- For instance, compliance with GDPR in the European Union requires robust encryption and access control mechanisms, influencing adoption decisions among enterprises

Cognitive Collaboration Market Scope

The market is segmented on the basis of component, organization size, deployment mode, application area, and vertical.

• By Component

On the basis of component, the cognitive collaboration market is segmented into solutions and services. The solutions segment dominated the market with the largest market revenue share in 2024, driven by the increasing integration of AI-based tools in collaboration platforms to enhance user productivity, automate repetitive tasks, and improve real-time communication. Enterprises are leveraging advanced cognitive features such as sentiment analysis, automated meeting summaries, and context-based recommendations to streamline workflows and boost engagement.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising demand for consulting, implementation, and support services. As organizations transition to intelligent communication environments, they require expert guidance to deploy, manage, and optimize cognitive collaboration tools. Tailored service offerings are helping businesses reduce adoption complexity while ensuring better ROI on cognitive investments.

• By Organization Size

On the basis of organization size, the market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The large enterprises segment held the largest revenue share in 2024 due to their greater budgetary capacity to adopt cutting-edge collaboration solutions, coupled with a higher volume of data that benefits from intelligent analysis. These organizations often seek scalable platforms that improve team productivity and customer engagement across geographies.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing cloud adoption and the need for efficient, low-cost collaboration tools. With increasing competition and limited internal resources, SMEs are turning to AI-enabled communication platforms to enhance operations, automate workflows, and support remote teams.

• By Deployment Mode

On the basis of deployment mode, the market is segmented into cloud and on-premises. The cloud segment dominated the market in 2024, primarily due to its scalability, cost-effectiveness, and ease of integration with third-party services and collaboration platforms. Organizations are rapidly shifting to cloud-based solutions to enable remote collaboration, ensure real-time access, and reduce infrastructure overhead.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, particularly among industries such as banking and healthcare, where data privacy and compliance are critical. These organizations prefer in-house infrastructure to maintain control over sensitive data while deploying cognitive collaboration solutions with internal IT teams.

• By Application Area

On the basis of application area, the market is segmented into data analytics, facial recognition, and social media assistance. The data analytics segment accounted for the largest share in 2024, supported by growing demand for real-time insights, performance tracking, and decision-making capabilities. AI-powered tools that analyze conversations, documents, and user behavior are enabling more effective collaboration.

Facial recognition is expected to witness the fastest growth rate from 2025 to 2032, driven by rising use in meeting authentication, user verification, and emotion detection. Social media assistance is also gaining traction as businesses seek cognitive tools to automate customer interactions and manage brand presence across platforms.

• By Vertical

On the basis of vertical, the market is segmented into IT and telecom, energy and utilities, banking, financial services, and insurance (BFSI), education, healthcare, retail, and others. The IT and telecom segment held the largest market revenue share in 2024, driven by high digital adoption rates and the need for seamless internal collaboration across geographically dispersed teams.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the increasing use of cognitive tools to streamline patient communication, support virtual consultations, and manage large volumes of health data efficiently.

Cognitive Collaboration Market Regional Analysis

- North America dominated the cognitive collaboration market with the largest revenue share of 42.6% in 2024, driven by early adoption of AI technologies, widespread cloud infrastructure, and strong presence of major technology providers

- Enterprises in the region increasingly rely on intelligent communication tools for improving productivity, streamlining workflows, and enhancing virtual collaboration in remote and hybrid work environments

- The market is further supported by high investments in digital transformation, rapid deployment of AI-powered assistants, and the demand for real-time analytics and automation across business operations

U.S. Cognitive Collaboration Market Insight

The U.S. cognitive collaboration market held a significant revenue share of 78.9% in 2024 within North America, propelled by rapid digital innovation, robust enterprise IT spending, and widespread use of unified communication platforms. Organizations across sectors such as healthcare, finance, and education are leveraging AI-driven collaboration solutions to improve decision-making and employee engagement. The adoption of platforms integrated with technologies such as IBM Watson and Microsoft Azure Cognitive Services is accelerating due to their advanced capabilities in natural language processing, data analytics, and automation.

Europe Cognitive Collaboration Market Insight

The Europe cognitive collaboration market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing digitalization across enterprises and stringent data privacy regulations that encourage secure AI deployments. The rise in demand for smart communication tools, driven by hybrid work policies and employee productivity goals, is fostering the uptake of cognitive platforms. Adoption is particularly strong in countries such as Germany, the U.K., and France, where organizations are prioritizing compliance, collaboration efficiency, and cloud integration in their digital strategies.

U.K. Cognitive Collaboration Market Insight

The U.K. cognitive collaboration market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid growth of the AI sector and government initiatives promoting digital adoption. Businesses across the country are integrating cognitive tools to streamline communication, automate routine tasks, and support decision-making. The country’s mature enterprise landscape and demand for secure, AI-powered platforms—especially in finance and healthcare—are bolstering the market. In addition, increasing focus on hybrid work environments is boosting demand for smart collaboration software.

Germany Cognitive Collaboration Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, due to its emphasis on technological innovation and data privacy. The country's advanced industrial infrastructure and growing reliance on AI for business optimization are key drivers of adoption. German enterprises are actively implementing cognitive solutions to enhance customer experience, support real-time collaboration, and improve internal workflows. Sectors such as automotive, manufacturing, and telecom are leading in deploying AI-integrated communication tools tailored to their operational requirements.

Asia-Pacific Cognitive Collaboration Market Insight

The Asia-Pacific cognitive collaboration market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid digital transformation, increasing investments in AI technologies, and a growing remote workforce across countries such as China, Japan, and India. The rise in mobile-first collaboration tools, cloud adoption, and integration of cognitive services in enterprise communication platforms is fueling the market. Supportive government initiatives in digital innovation and tech-focused economic reforms are further accelerating adoption in sectors such as IT, education, and retail.

Japan Cognitive Collaboration Market Insight

The Japan’s cognitive collaboration market i is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s advanced technology infrastructure and demand for efficiency in business communication. The aging workforce and focus on digital accessibility are promoting the use of AI-driven virtual assistants and automation tools. Japanese enterprises are integrating cognitive features into collaboration platforms to enhance productivity, streamline customer service, and support knowledge management. The emphasis on innovation and strong government backing for AI initiatives continue to create new opportunities for cognitive platform providers.

China Cognitive Collaboration Market Insight

The China dominated the Asia-Pacific cognitive collaboration market in 2024, attributed to its large enterprise base, rapid digital transformation, and favorable government policies supporting AI development. The country’s robust ecosystem of technology startups and cloud service providers has made cognitive tools widely accessible across industries. Businesses are increasingly deploying AI-powered communication platforms to manage high volumes of data, automate workflows, and improve operational agility. Strong demand in sectors such as e-commerce, finance, and education continues to drive growth in the Chinese market.

Cognitive Collaboration Market Share

The cognitive collaboration industry is primarily led by well-established companies, including:

- Ribbon Communications Operating Company, Inc. (U.S.)

- AudioCodes Ltd. (Israel)

- ADTRAN (U.S.)

- Avaya Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- GENBAND, Inc. (U.S.)

- Ingate Systems AB (Sweden)

- Oracle (U.S.)

- Patton Electronics Co. (U.S.)

- Huawei Technologies Co., Ltd (China)

- Nokia (Finland)

- Advantech Co., Ltd (Taiwan)

- Sangoma Technologies (Canada)

Latest Developments in Global Cognitive Collaboration Market

- In May 2024, Wipro announced a collaboration with Microsoft to introduce a new suite of cognitive assistants for the financial services sector, powered by generative artificial intelligence (GenAI). The suite includes Wipro GenAI Investor Intelligence, Wipro GenAI Investor Onboarding, and Wipro GenAI Loan Origination

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.