Global Clogs Market

Market Size in USD Billion

CAGR :

%

USD

20.94 Billion

USD

52.21 Billion

2024

2032

USD

20.94 Billion

USD

52.21 Billion

2024

2032

| 2025 –2032 | |

| USD 20.94 Billion | |

| USD 52.21 Billion | |

|

|

|

|

Clogs Market Size

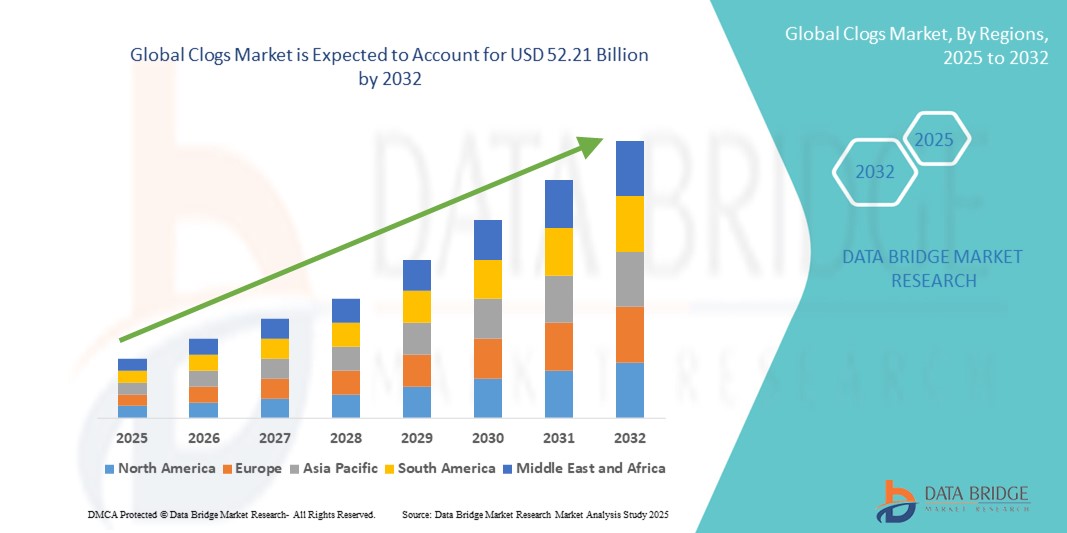

- The global clogs market size was valued at USD 20.94 billion in 2024 and is expected to reach USD 52.21 billion by 2032, at a CAGR of 12.10% during the forecast period

- The market growth is largely fueled by the increasing popularity of casual and comfortable footwear among consumers across all age groups, driven by changing fashion trends and the rise of health-conscious lifestyles

- Furthermore, rising demand for supportive, ergonomic, and durable footwear in both professional and everyday use especially among healthcare workers, hospitality staff, and aging populations is establishing clogs as a preferred footwear choice. These converging factors are accelerating the adoption of clogs, thereby significantly boosting the industry’s growth

Clogs Market Analysis

- Clogs, featuring a slip-on design and ergonomic build, are increasingly recognized as essential footwear across fashion and professional domains due to their superior comfort, support, and growing appeal in both casual and occupational settings

- The escalating demand for clogs is primarily fueled by the rising popularity of comfort-focused fashion, increasing awareness around foot health, and expanding usage in healthcare, hospitality, and everyday wear

- North America dominated the clogs market with the largest revenue share of 39.5% in 2024, supported by a strong consumer inclination toward casual and orthopedic footwear, the influence of athleisure trends, and a well-established retail presence of leading clog brands

- Asia-Pacific is expected to be the fastest growing region in the clogs market during the forecast period due to a growing middle class, rapid urbanization, and heightened demand for stylish yet functional footwear

- Casual clogs segment dominated the clogs market with a market share of 46.8% in 2024, driven by their versatility, affordability, and rising adoption as everyday footwear across all age groups and lifestyles

Report Scope and Clogs Market Segmentation

|

Attributes |

Clogs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clogs Market Trends

Rising Demand for Comfort-Driven and Sustainable Footwear

- A significant and accelerating trend in the global clogs market is the increasing consumer preference for footwear that combines ergonomic comfort with sustainable design and materials. This shift is largely driven by lifestyle changes, heightened awareness of foot health, and growing environmental consciousness

- For instance, leading brands such as Crocs and Birkenstock have expanded their product lines to include clogs made from eco-friendly materials such as bio-based Croslite and recycled components. These innovations cater to a rising consumer base seeking both comfort and responsible fashion choices

- Health professionals, hospitality staff, and frontline workers continue to drive demand for functional clogs with orthopedic support, slip resistance, and lightweight construction. EVA-based clogs, known for their cushioning and durability, remain particularly popular in these segments

- Simultaneously, clogs are being reimagined as fashion-forward footwear. Designer collaborations and bold new colorways are elevating the perception of clogs from utility wear to trendy casual footwear, particularly among Gen Z and millennial consumers seeking unique, retro-inspired styles

- The rise of hybrid clogs blending traditional clog elements with sneaker-such as aesthetics and technology is also shaping the market. These styles are designed for all-day wear and appeal to both casual consumers and professionals, boosting market diversification

- This trend toward comfort-driven, sustainable, and style-conscious clog designs is redefining the segment and broadening its appeal across diverse consumer demographics and use cases globally

Clogs Market Dynamics

Driver

Health Awareness and Occupational Demand Fueling Market Expansion

- The growing awareness of foot health and the increasing need for practical, supportive footwear in various professions are key drivers of the global clogs market. Consumers are prioritizing comfort and support in their footwear, particularly as prolonged standing and walking become more common in modern work environments

- For instance, clogs are widely used in healthcare, food service, and educational sectors due to their slip-resistant soles, cushioned insoles, and easy-to-clean materials. Brands such as Dansko and Sanita have capitalized on this trend by offering ergonomically designed occupational clogs with added arch support and anti-fatigue technology

- The pandemic-era focus on comfort and wellness has also influenced everyday fashion, accelerating consumer interest in footwear that supports all-day wearability. As a result, casual clogs have gained traction among homebound consumers, fitness enthusiasts, and travelers

- The rise in e-commerce and direct-to-consumer footwear brands has also enabled easier access to a wider range of clog styles and price points, further expanding the customer base. The growing trend of personalization, such as customizable colors and charms, is enhancing consumer engagement and boosting repeat purchases

- These factors, combined with the multifunctional appeal of clogs across work, leisure, and fashion, are driving robust growth in both developed and emerging markets

Restraint/Challenge

Perception Barriers and Seasonal Demand Fluctuations

- Despite growing popularity, the clogs market faces challenges in overcoming longstanding perceptions of clogs as bulky, unattractive, or utilitarian. While recent fashion endorsements and modern redesigns have improved brand image, some consumer segments remain reluctant to adopt clogs for style-oriented or formal use

- In addition, clogs often experience seasonal fluctuations in demand, with sales peaking in spring and summer due to their open design and breathability. This seasonality limits consistent year-round revenue generation, particularly in colder regions where closed-toe footwear dominates during winter months

- Another challenge lies in balancing cost with sustainability. While many brands are introducing eco-friendly materials, these often come at a higher production cost, which can translate into elevated retail prices. Price sensitivity among consumers in emerging markets may limit the adoption of premium, sustainable clog options

- Addressing these challenges through continued product innovation, targeted marketing, and expanding year-round product lines including insulated or closed-back clogs for winter will be essential for maintaining long-term growth and broadening market appeal

Clogs Market Scope

The market is segmented on the basis of product, material, end-user, and distribution channel.

- By Product

On the basis of product, the clogs market is segmented into casual clogs and occupational clogs. The casual clogs segment dominated the market with the largest market revenue share of 46.8% in 2024, driven by increasing consumer preference for comfort-driven and versatile footwear suitable for daily wear, travel, and at-home use. Their lightweight nature, fashionable designs, and appeal to a wide demographic have significantly contributed to their popularity across global markets.

The occupational clogs segment is anticipated to witness strong growth from 2025 to 2032, fueled by rising demand in professional environments such as healthcare, hospitality, and food service sectors. These clogs are designed for extended wear, offering slip resistance, arch support, and durable materials, making them ideal for workers who spend long hours on their feet.

- By Material

On the basis of material, the clogs market is segmented into leather, rubber, synthetic, and others. The synthetic segment dominated the market with the largest market revenue share in 2024, primarily due to the widespread use of EVA and other flexible, lightweight materials that provide cushioning, affordability, and ease of manufacturing. These materials are especially favored in both casual and professional clog categories for their water resistance and versatility in design.

The leather segment is expected to witness steady growth during forecast period, particularly in the premium and fashion-conscious consumer segments, as leather clogs offer superior durability, aesthetics, and long-term wearability. Meanwhile, rubber clogs remain in demand for their ruggedness and suitability for wet or industrial environments, making them a preferred choice in outdoor and heavy-duty applications.

- By End-User

On the basis of end-user, the clogs market is segmented into men, women, and kids. The women segment held the largest market revenue share in 2024, driven by a broader range of product offerings, increased fashion trends incorporating clogs, and growing consumer focus on ergonomic footwear. Women-specific collections often include stylish designs, vibrant colors, and enhanced comfort features, boosting their appeal in both casual and occupational categories.

The kids segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by the demand for safe, easy-to-wear, and colorful footwear options among young consumers. Features such as slip resistance, washable materials, and character-themed designs make clogs increasingly popular for children’s footwear.

- By Distribution Channel

On the basis of distribution channel, the clogs market is segmented into offline and online. The offline segment dominated the market with the largest market revenue share in 2024, driven by consumer preference for trying footwear in physical stores to assess fit, comfort, and quality before purchase. Retail chains, brand outlets, and specialty footwear stores continue to play a crucial role in shaping purchasing decisions, particularly in regions where digital penetration is lower.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing influence of e-commerce, mobile shopping apps, and direct-to-consumer brand platforms. Convenient delivery options, easy returns, and access to a wider variety of styles and sizes are encouraging consumers to shop for clogs online, particularly in urban and digitally savvy markets.

Clogs Market Regional Analysis

- North America dominated the clogs market with the largest revenue share of 39.5% in 2024, supported by a strong consumer inclination toward casual and orthopedic footwear, the influence of athleisure trends, and a well-established retail presence of leading clog brands

- Consumers in the region increasingly prioritize ergonomics, long-wear comfort, and versatile designs in their footwear, making clogs a preferred choice for both everyday use and occupational needs in sectors such as healthcare and hospitality

- This strong adoption is further supported by higher disposable incomes, a health-conscious population, and the growing popularity of branded and fashionable clog offerings, positioning clogs as both a functional and stylish footwear option across diverse age groups and lifestyles

U.S. Clogs Market Insight

The U.S. clogs market captured the largest revenue share of 80.2% in 2024 within North America, driven by rising demand for comfort-centric footwear in both casual and professional settings. Consumers are increasingly favoring clogs for their ergonomic benefits, ease of use, and stylish adaptability. The growing trend of athleisure and work-from-home culture has further accelerated adoption. In addition, widespread brand recognition, strong retail networks, and growing acceptance in fashion and occupational wear continue to fuel market growth.

Europe Clogs Market Insight

The Europe clogs market is projected to grow at a substantial CAGR throughout the forecast period, supported by heightened health awareness, fashion-forward styling, and a preference for sustainable footwear options. European consumers value comfort and quality, driving demand for orthopedic and eco-friendly clogs. The region sees strong adoption across both casual and professional use cases, with clogs increasingly integrated into hospital uniforms, hospitality wear, and seasonal fashion collections.

U.K. Clogs Market Insight

The U.K. clogs market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the growing appeal of functional fashion and comfort footwear. Rising consumer awareness around foot health and the popularity of hybrid work models are boosting the demand for versatile clogs. Fashion retailers and direct-to-consumer brands are expanding their clog offerings, while occupational use in healthcare and education sectors further supports market expansion.

Germany Clogs Market Insight

The Germany clogs market is expected to expand at a considerable CAGR during the forecast period, driven by high demand for durable, orthopedic-friendly footwear and a strong preference for quality craftsmanship. German consumers prioritize functionality and sustainability, leading to a rise in demand for leather and eco-conscious clog designs. The widespread use of clogs in healthcare, food service, and wellness sectors continues to reinforce their appeal.

Asia-Pacific Clogs Market Insight

The Asia-Pacific clogs market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, fueled by urbanization, increasing health consciousness, and rising disposable incomes across key countries including China, India, and Japan. The influence of Western fashion trends and the growing popularity of online retail platforms are expanding access to a wide variety of clog styles, making them a rising choice for both comfort and utility in the region.

Japan Clogs Market Insight

The Japan clogs market is gaining traction due to a cultural emphasis on minimalism, comfort, and hygiene. Japanese consumers appreciate clogs for their slip-on design, ease of cleaning, and suitability for indoor use. Demand is rising in both healthcare and domestic segments, with clogs increasingly integrated into hospital footwear and home lifestyles. The market is also seeing innovation in material design and aesthetic appeal, aligning with local consumer preferences.

India Clogs Market Insight

The India clogs market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by a growing middle class, increasing focus on foot comfort, and rising acceptance of clogs in everyday and professional environments. Affordable pricing, domestic manufacturing, and the proliferation of online retail have made clogs widely accessible. The segment is experiencing especially strong growth in healthcare and hospitality sectors, where comfort and utility are critical.

Clogs Market Share

The Clogs industry is primarily led by well-established companies, including:

- Birkenstock (Germany)

- Dansko, LLC. (U.S.)

- Native Shoes (Canada)

- Sanita (Denmark)

- Calzuro (Italy)

- OOFOS (U.S.)

- Alegria (U.S.)

- Bogs (U.S.)

- FitFlop (U.K.)

- Haflinger (Germany)

- Cape Clogs (Sweden)

- Orthofeet (U.S.)

- Troentorp (Sweden)

- Dr. Scholl’s Shoes (U.S.)

- Hoka (U.S.)

- Stegmann (Austria)

- WoolFit (Germany)

- MedShoes (Portugal)

- Birki’s (Germany)

What are the Recent Developments in Global Clogs Market?

- In May 2024, Crocs, Inc. announced the expansion of its sustainable product line through the introduction of clogs made with bio-based Croslite materials, reaffirming the company’s commitment to achieving net-zero carbon emissions by 2030. This move aligns with growing consumer demand for environmentally responsible footwear, highlighting Crocs’ leadership in combining comfort with sustainability in the global clogs market

- In April 2024, Birkenstock Group B.V. & Co. KG launched its Spring/Summer collection featuring upgraded clog models with enhanced footbed technology and breathable materials. The new line emphasizes both ergonomic comfort and fashion-forward design, reinforcing Birkenstock’s positioning as a premium comfort footwear brand catering to both lifestyle and professional segments worldwide

- In March 2024, Dansko, LLC introduced a new professional clogs series designed specifically for healthcare and hospitality workers, incorporating antimicrobial linings, slip-resistant soles, and lightweight construction. This innovation reflects the company’s ongoing focus on supporting frontline professionals with footwear that delivers long-lasting comfort, safety, and functionality

- In February 2024, Calzuro, an Italian medical footwear brand, expanded its presence in North America through new distribution agreements with healthcare suppliers. Known for its sterilizable clogs, the brand’s growth reflects increasing demand for hygienic and supportive footwear in clinical settings, contributing to the global adoption of occupational clogs

- In January 2024, Native Shoes, a Canadian footwear company, launched a line of 100% recyclable EVA clogs under its “Remix Project,” an initiative focused on circular fashion. These clogs can be returned and recycled into new products at the end of their lifecycle, showcasing innovation in sustainable design and appealing to eco-conscious consumers around the world

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.