Global Clinical Trial Imaging Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

2.29 Billion

2024

2032

USD

1.23 Billion

USD

2.29 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 2.29 Billion | |

|

|

|

|

Clinical Trial Imaging Market Size

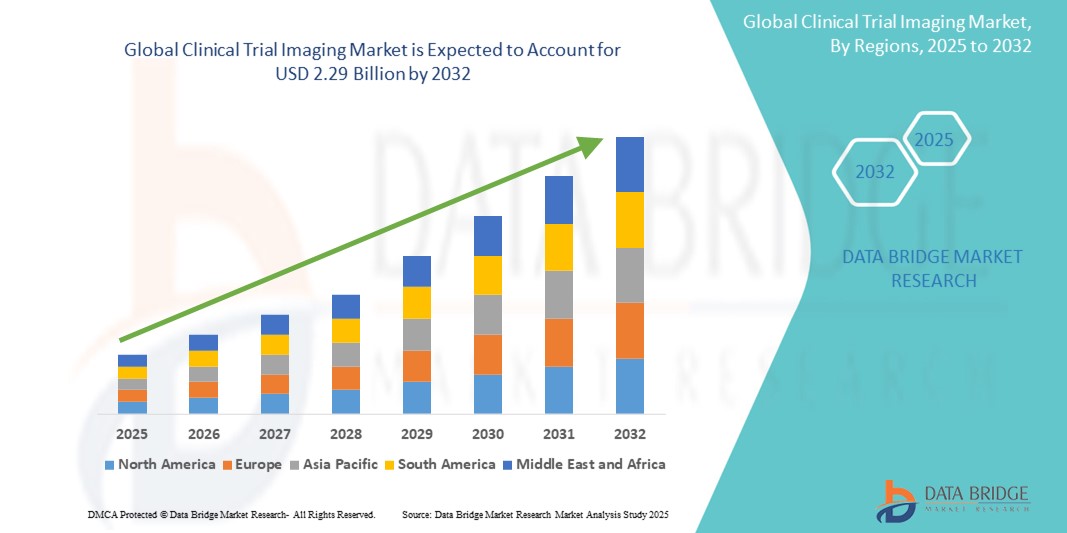

- The global clinical trial Imaging market was valued at USD 1.23 billion in 2024 and is expected to reach USD 2.29 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.1% primarily driven by the increasing demand for advanced imaging technologies and the rising number of clinical trials worldwide

- This growth is driven by factors such as the growing need for accurate and non-invasive imaging solutions to monitor patient responses, technological advancements in imaging modalities, and the expansion of the healthcare sector, particularly in emerging markets

Clinical Trial Imaging Market Analysis

- The clinical trial imaging market has been growing rapidly, driven by the increasing use of advanced imaging technologies such as magnetic resonance imaging and positron emission tomography in drug development and clinical trials

- For instance, the use of MRI in neurology trials has helped researchers better understand the effects of treatments on brain conditions

- Imaging technologies are now essential for tracking disease progression and treatment responses, helping researchers monitor the effects of new therapies with higher precision

- For instance, in cardiovascular trials, CT scans are often used to assess heart function and arterial health in response to new drugs

- Real-time imaging solutions have become crucial in oncology trials, where accurate tumor assessment is needed to evaluate treatment efficacy, such as in the case of PET scans used in cancer research

- For instance, PET scans, are frequently used in studies such as the development of targeted therapies for lung cancer

- Collaboration between imaging companies and contract research organizations has improved service integration, enhancing workflow efficiency and reducing timelines in clinical trials. Companies such as Covance and Parexel have partnered with imaging firms to provide seamless trial management services that include imaging data collection and analysis

- The integration of artificial intelligence in imaging systems has elevated the accuracy of data analysis, with AI helping to automatically detect changes in scans, speeding up the assessment process and reducing human error. AI is particularly beneficial in clinical trials such as Alzheimer’s disease, where it helps identify early signs of neurodegeneration from MRI scans

Report Scope and Clinical Trial Imaging Market Segmentation

|

Attributes |

Clinical Trial Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Clinical Trial Imaging Market Trends

“Increasing Adoption of Advanced Imaging Technologies”

- The increasing adoption of advanced imaging technologies is revolutionizing clinical trials by offering high-resolution, detailed images that improve the accuracy of data collected

- For instance, in oncology trials, PET scans are now routinely used to assess tumor response to treatment, providing more precise monitoring of cancer therapies

- Magnetic resonance imaging is widely used in neurological trials, allowing researchers to track changes in the brain's structure and function

- For instance, MRI is crucial in Alzheimer’s disease trials to monitor the progression of neurodegeneration and evaluate the effects of potential treatments

- In cardiovascular research, advanced imaging techniques such as computed tomography are used to assess heart function and vascular health, enabling researchers to better understand the impact of new drugs on the cardiovascular system

- The use of advanced imaging in early-phase clinical trials is growing, providing researchers with the ability to detect and measure drug effects in the earliest stages of treatment. This trend is particularly valuable in the development of novel treatments for diseases such as diabetes and chronic pain

- Integration of imaging technologies with real-time data analysis is becoming increasingly common, allowing for immediate feedback on treatment effects and helping clinicians make quicker, more informed decisions during clinical trials

Clinical Trial Imaging Market Dynamics

Driver

“Increasing Demand for Precision Medicine in Clinical Trials”

- The growing demand for precision medicine is one of the key drivers of the clinical trial imaging market, as treatments are increasingly tailored to individual patients based on their genetic makeup, lifestyle, and other factors

- In oncology clinical trials, advanced imaging technologies such as magnetic resonance imaging and positron emission tomography are used to monitor tumor size, detect metastasis, and evaluate how patients respond to specific treatments such as targeted therapies or immunotherapy

- Real-time monitoring through imaging allows researchers to adjust treatment plans based on the patient's unique response, improving the overall efficacy of personalized treatments

- For instance, PET scans are used to track how well a cancer patient's tumor is shrinking, helping doctors decide whether to continue or alter the treatment plan

- Precision medicine is also becoming increasingly important in neurology trials, where imaging technologies such as MRI are used to monitor disease progression in conditions such as Alzheimer's disease, allowing for adjustments in drug protocols based on individual responses

- As pharmaceutical companies continue to invest in personalized therapies, the need for advanced imaging solutions to assess these therapies' efficacy will keep growing, further fueling innovation in the clinical trial imaging market

Opportunity

“Integration of Artificial Intelligence in Imaging”

- The integration of artificial intelligence in clinical trial imaging presents a major growth opportunity by transforming how clinical data is collected, analyzed, and interpreted

- For instances, AI-powered imaging platforms such as those developed by Zebra Medical Vision are being used to analyze large sets of medical images, significantly reducing the time needed for diagnosis and treatment planning

- AI-powered imaging solutions are particularly beneficial in oncology, neurology, and cardiology trials, where early detection and precise monitoring of disease progression are essential. In cancer trials, AI algorithms are used to automatically detect tumor growth or shrinkage, as seen in studies involving AI-driven systems that analyze PET scans for more accurate monitoring of lung cancer treatments

- AI algorithms can also identify subtle changes in imaging data, such as early signs of disease progression or adverse effects, which may not be immediately visible to human observers, improving patient safety in clinical trials. In Alzheimer's disease trials, AI is used to detect early brain changes in MRI scans, helping identify the effectiveness of drug treatments before symptoms appear

- The continuous learning capability of AI algorithms allows them to improve accuracy over time, enabling more precise predictions and insights as they are exposed to larger datasets

- For instances, IBM's Watson Health has been used to enhance the analysis of radiology images, improving diagnostic accuracy over time in clinical trials for cardiovascular diseases

- By incorporating AI into clinical trial imaging, pharmaceutical companies and research organizations can streamline workflows, reduce human error, and speed up the clinical trial process, providing a significant opportunity for the market to expand in the coming years. AI systems such as Aidoc’s radiology software have already been adopted by clinical trial organizations to improve efficiency and data processing speed during trials

Restraint/Challenge

“High Cost of Advanced Imaging Technologies”

- One of the primary challenges faced by the clinical trial imaging market is the high cost associated with advanced imaging technologies

- For instance, techniques such as magnetic resonance imaging, positron emission tomography, and computed tomography require significant investments in both the equipment and its ongoing maintenance, which can be a financial burden for smaller research organizations

- The installation and upkeep of advanced imaging systems can be prohibitively expensive, particularly in emerging markets where budgets for clinical trials are more limited. This can restrict the ability of smaller research facilities or hospitals to participate in high-end clinical trials, reducing access to essential imaging technologies

- In addition to the upfront costs, the complexity of operating these technologies also demands highly trained personnel

- For instance, in oncology trials, specialized radiologists are needed to interpret PET scan images. The need for expert analysis increases both the time and financial costs of the trial, contributing to overall expenses

- The financial strain caused by expensive imaging technologies can result in budget constraints for clinical trial sponsors, particularly in large-scale trials with multiple imaging requirements. This can limit the number of trials conducted or delay the adoption of newer imaging techniques. An instance of this is the use of AI-powered PET scans, which while improving efficiency, still require substantial investment

- In resource-limited settings, the high costs of advanced imaging technologies are a significant barrier

- For instance, clinical trials in developing countries often struggle to incorporate high-resolution imaging technologies due to the financial constraints of both equipment and trained professionals, making it a challenge for these regions to access cutting-edge imaging solutions

Clinical Trial Imaging Market Scope

The market is segmented on the basis of product and services, modality, application, end user and distributor

|

Segmentation |

Sub-Segmentation |

|

By Product and Services |

|

|

By Modality |

|

|

By Application |

|

|

By End User |

|

|

By Distributor |

|

Clinical Trial Imaging Market Regional Analysis

“North America is the Dominant Region in the Clinical Trial Imaging Market”

- North America dominates the clinical trial imaging market, primarily due to the U.S. favorable reimbursement policies, which encourage significant investment in research and development, particularly in imaging technologies

- These reimbursement policies have led to continuous advancements in imaging modalities such as magnetic resonance imaging, positron emission tomography, and computed tomography, ensuring North America remains at the forefront of clinical trial innovations

- The rise of contract research organizations (CROs) in both the U.S. and Canada has contributed to the region's dominance by providing specialized services such as the management of imaging data and the application of advanced technologies for better monitoring of patients and disease progression

- CROs play a crucial role in enhancing the efficiency and quality of clinical trials, which further strengthens North America's leadership in clinical trial imaging

- With strong healthcare infrastructure, a high number of clinical trials, and an increasing focus on precision medicine and AI-driven imaging solutions, North America continues to grow and maintain its dominant position in the clinical trial imaging market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is the fastest-growing market in clinical trial imaging, driven by countries such as China, India, and Japan, where advancements in healthcare infrastructure, regulatory reforms, and increased investments in clinical research are happening rapidly

- China has emerged as a hub for clinical trials, offering a large patient population and streamlined regulatory processes, which make it an attractive destination for pharmaceutical companies conducting early-stage drug development

- India contributes significantly to the growth with its cost-effective clinical trial solutions and diverse patient pool, offering global pharmaceutical companies an opportunity to minimize costs while accelerating drug development in various therapeutic areas

- Japan is heavily investing in precision medicine and advanced imaging technologies, particularly for oncology and neurology trials. The country's focus on cutting-edge technologies is enhancing the overall quality of clinical trials in the region

- The rise in the number of contract research organizations (CROs) and increased collaborations between tech companies and research institutions in the Asia-Pacific region further accelerates the market's growth, positioning it as a leader in clinical trial imaging in the years to come

Clinical Trial Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Navitas Life Sciences (U.S.)

- Resonance Health Ltd. (Australia)

- BioTelemetry, a Philips Company (U.S.)

- IXICO plc (U.K.)

- ICON plc (Ireland)

- Image Core Lab (India)

- anagram 4 clinical trials (Spain)

- Quotient Sciences (U.K.)

- Radiant Sage LLC (U.S.)

- WORLDCARE CLINICAL (U.S.)

- Clario (U.S.)

- Parexel International Corporation (U.S.)

- Median Technologies (France)

- Perspectum (U.K.)

- Calyx (Nottingham)

- Invicro LLC (U.S.)

Latest Developments in Global Clinical Trial Imaging Market

- In May 2022, Bruker launched novel 7-Tesla and 9.4-Tesla preclinical MRI magnets, designed to enhance the precision of imaging in clinical research. These advanced MRI systems offer higher resolution imaging, enabling researchers to gain more detailed insights into disease mechanisms at the molecular level. The new technology is expected to improve the efficiency and accuracy of preclinical trials, particularly in oncology, neurology, and cardiovascular research. This development will impact the market by advancing imaging capabilities, accelerating drug development, and enabling more precise assessments of therapeutic efficacy

- In March 2022, Fujifilm India introduced a new range of products at the 74th IRIA (Indian Radiological and Imaging Association) Conference. The company unveiled advanced imaging solutions, including diagnostic imaging technologies designed to enhance healthcare delivery in India. These products aim to improve the quality of medical imaging and assist healthcare professionals in providing more accurate diagnoses. The introduction of these technologies will have a significant impact on the market by expanding access to high-quality imaging solutions, ultimately enhancing the capabilities of medical institutions and accelerating advancements in clinical trials

- In January 2022, ERT and BioClinica merged to form Clario, a leading technology solutions company for clinical trial innovation. This merger combines ERT's clinical trial data collection expertise and BioClinica’s imaging solutions, creating a unified platform to enhance trial efficiency. Clario aims to streamline clinical trial processes, offering integrated services in data collection and imaging, improving accuracy, speed, and patient outcomes. This development is expected to have a significant impact on the market by advancing clinical trial technology and driving innovation

- In November 2021, Clario and XingImaging expanded their partnership to deliver PET imaging solutions for clinical trials in China. This development aims to enhance the accuracy and efficiency of clinical trials by integrating advanced PET imaging technology with Clario's data collection and analytics capabilities. The partnership will enable pharmaceutical companies and CROs to conduct more precise trials, improving the monitoring of disease progression and treatment efficacy. This expansion will significantly benefit the market by providing access to high-quality imaging services in China, helping accelerate drug development in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.