Global Clinical Chemistry Analyzer Market

Market Size in USD Billion

CAGR :

%

USD

14.82 Billion

USD

21.57 Billion

2024

2032

USD

14.82 Billion

USD

21.57 Billion

2024

2032

| 2025 –2032 | |

| USD 14.82 Billion | |

| USD 21.57 Billion | |

|

|

|

|

Clinical Chemistry Analyzer Market Size

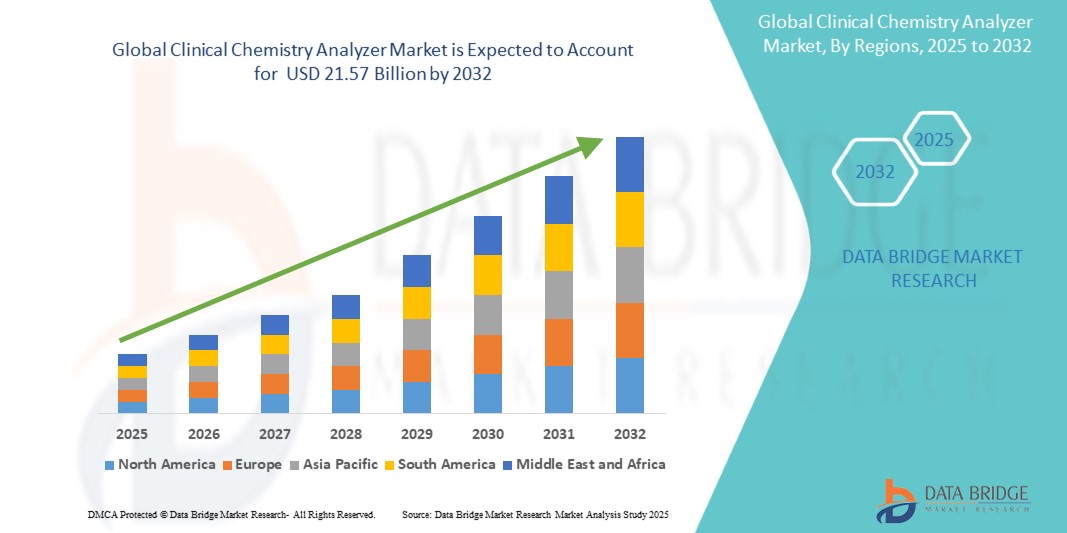

- The global clinical chemistry analyzer market size was valued at USD 14.82 billion in 2024 and is expected to reach USD 21.57 billion by 2032, at a CAGR of 4.8% during the forecast period

- This growth is driven by factors such as the automation & digital integration, next-generation instruments, and aging population & chronic disease prevalence

Clinical Chemistry Analyzer Market Analysis

- Clinical chemistry analyzers are essential diagnostic instruments used in laboratories to measure concentrations of substances in blood and other bodily fluids, including glucose, enzymes, electrolytes, and proteins. These analyzers play a critical role in the diagnosis, monitoring, and treatment of various diseases such as diabetes, cardiovascular disorders, and kidney conditions

- The demand for clinical chemistry analyzers is significantly driven by the rising global burden of chronic diseases, increasing geriatric population, and advancements in automation and laboratory technologies that enhance testing efficiency and accuracy

- North America is expected to dominate the clinical chemistry analyzer market, accounting for approximately 38.5% of the global market share as of 2024. This leadership is driven by the region’s well-established healthcare infrastructure, early adoption of advanced laboratory automation, and the strong presence of major market players such as Abbott, Thermo Fisher Scientific, and Beckman Coulter

- Asia pacific is expected to be the fastest growing region in clinical chemistry analyzer with the percentage of 20.9%. This dominance is attributed to its emerging prominence in the global clinical chemistry analyzers market

- The reagents segment is expected to dominate the clinical chemistry analyzer market with the largest share of 57.4% in 2024 due to its recurring demand in clinical chemistry tests. As a critical component in diagnostic procedures, reagents including enzymes, substrates, proteins, electrolytes, and lipids—are essential for delivering accurate and reliable results. This consistent need across a wide array of tests significantly drives the segment’s dominance. The growing adoption of automated analyzers and the expansion of diagnostic services globally further contribute to the sustained leadership of this segment

Report Scope and Clinical Chemistry Analyzer Market Segmentation

|

Attributes |

Clinical Chemistry Analyzer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clinical Chemistry Analyzer Market Trends

“Automation and Integration Trends in Clinical Chemistry Analyzers”

- One significant trend in the clinical chemistry analyzer market is the growing adoption of automation and integrated systems that streamline laboratory workflows and improve diagnostic efficiency

- Modern analyzers are increasingly equipped with advanced software, robotic sample handling, and data connectivity features that minimize manual intervention and reduce turnaround times

- For instance, integrated systems that combine chemistry and immunoassay testing on a single platform allow for consolidated testing, enhancing throughput and reducing operational costs in high-volume laboratories

- These advancements are transforming clinical diagnostics by enhancing laboratory productivity, reducing errors, and enabling faster clinical decision-making, thereby boosting demand for next-generation automated chemistry analyzers

Clinical Chemistry Analyzer Market Dynamics

Driver

“Rising Demand for Accurate and Rapid Diagnostic Testing”

- The growing global burden of chronic and infectious diseases, such as diabetes, cardiovascular conditions, and kidney disorders, is fueling the demand for clinical chemistry analyzers that can deliver quick, reliable, and high-throughput diagnostic results

- Clinical chemistry tests are essential for the early detection, diagnosis, and monitoring of diseases, driving widespread adoption across hospitals, diagnostic laboratories, and point-of-care settings

- The need for timely and precise diagnostic information is also increasing with the growing aging population, where multiple chronic conditions require regular biochemical monitoring

For instance,

- In February 2024, according to a report by the World Health Organization, non-communicable diseases (NCDs) account for 74% of all global deaths, with cardiovascular diseases and diabetes being major contributors—both of which require consistent biochemical testing

- As a result, clinical chemistry analyzers have become indispensable tools in healthcare, significantly contributing to improved patient management and treatment planning

Opportunity

“Integration of Automation and AI for Enhanced Workflow Efficiency”

- Automation and artificial intelligence are transforming the clinical chemistry analyzer landscape by enabling faster sample processing, minimizing human error, and increasing diagnostic throughput

- AI algorithms integrated into analyzers can offer predictive analytics, flag abnormal results, and help in clinical decision support, leading to improved diagnostic accuracy

- In addition, modern analyzers with auto-sampling, barcoding, and cloud connectivity capabilities offer streamlined operations and remote access to data

For instance,

- In August 2024, a whitepaper by Siemens Healthineers highlighted the efficiency gains achieved through its Atellica Solution analyzer, which combines immunoassay and clinical chemistry on a single platform, supporting over 440 tests per hour with AI-based quality management tools

- This level of automation is crucial for addressing the growing demand for testing, especially in high-volume laboratories and during healthcare crises such as pandemics

Restraint/Challenge

“High Capital Investment and Operational Costs”

- One of the primary challenges facing the clinical chemistry analyzer market is the significant initial investment and ongoing maintenance costs associated with advanced systems

- Many small- and medium-sized laboratories, particularly in low- and middle-income countries, find it financially difficult to procure or upgrade to fully automated, high-throughput analyzers

- Costs are not limited to the equipment alone but also include reagents, consumables, calibration materials, and skilled labor required for operation and maintenance

For instance,

- In November 2024, a publication in the Journal of Laboratory Automation noted that the cost of high-end clinical chemistry analyzers can exceed USD 150,000, and annual maintenance contracts may add 10–15% of that cost, excluding reagent expenses

- These high costs can limit market penetration, particularly in underserved regions, thus posing a restraint on global market growth and accessibility to advanced diagnostic testing

Clinical Chemistry Analyzer Market Scope

The market is segmented on the basis of product, analyzer technology, test analysis, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Analyzer Technology |

|

|

By Test Analysis |

|

|

By End User

|

|

In 2025, the reagents are projected to dominate the market with a largest share in products segment

The reagents segment is expected to dominate the clinical chemistry analyzer market with the largest share of 57.4% in 2024 due to its recurring demand in clinical chemistry tests. As a critical component in diagnostic procedures, reagents including enzymes, substrates, proteins, electrolytes, and lipids are essential for delivering accurate and reliable results. This consistent need across a wide array of tests significantly drives the segment’s dominance. The growing adoption of automated analyzers and the expansion of diagnostic services globally further contribute to the sustained leadership of this segment.

The fully automated clinical chemistry analyzers is expected to account for the largest share during the forecast period in analyzer technology market

In 2025, the fully automated clinical chemistry analyzers segment is expected to dominate the market with the largest market share of 62.5% due to their high throughput, accuracy, and efficiency. These analyzers are essential for handling large volumes of samples in clinical settings, reducing manual errors and increasing productivity. As hospitals and diagnostic laboratories prefer these systems for their streamlined operations, the demand for fully automated analyzers continues to grow. The ongoing shift towards automation in laboratory processes and the need for faster and more accurate testing further contribute to this segment’s market dominance.

Clinical Chemistry Analyzer Market Regional Analysis

“North America Holds the Largest Share in the Clinical Chemistry Analyzer Market”

- North America dominates the clinical chemistry analyzer market, accounting for approximately 38.5% of the global market share as of 2024. This leadership is driven by the region’s well-established healthcare infrastructure, early adoption of advanced laboratory automation, and the strong presence of major market players such as Abbott, Thermo Fisher Scientific, and Beckman Coulter

- U.S., in particular, contributes significantly to this dominance, holding nearly 30.3% of the global market alone. This is attributed to its high testing volumes, growing prevalence of chronic diseases such as diabetes and cardiovascular conditions, and continuous investments in diagnostic innovation and healthcare digitization

- In addition, the region benefits from favourable reimbursement policies, widespread access to healthcare services, and an increasing demand for automated and high-throughput clinical diagnostic solutions. These factors collectively reinforce North America’s leadership in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Clinical Chemistry Analyzer Market”

- Asia-Pacific is expected to register the highest CAGR with market share of 20.9% during the forecast period, fuelled by expanding healthcare infrastructure, increasing investment in public health, and a growing focus on preventive diagnostics

- Countries such as China, India, and Japan are emerging as key contributors, driven by large populations, rising cases of lifestyle-related diseases, and government-led screening programs

- India is projected to witness the highest CAGR of 10.5% within the region due to rapid urbanization, rising healthcare access in rural areas, and growing demand for affordable diagnostic solutions

- In Japan, the presence of cutting-edge medical technology and a high concentration of advanced diagnostic labs make it a leading market for high-end clinical chemistry analyzers

- The region’s increasing healthcare spending and the shift toward automated and integrated lab systems are expected to further accelerate market growth

Clinical Chemistry Analyzer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Siemens (Germany)

- ELITechGroup (France)

- HORIBA, Ltd. (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Randox Laboratories Ltd. (U.K.)

- Ortho Clinical Diagnostics (U.S.)

- Nova Biomedical (U.S.)

- Sysmex Corporation (Japan)

- Bio Systems Diagnostics Pvt. Ltd. (India)

- DiaSys Diagnostic Systems GmbH (Germany)

- Endress+Hauser Group Services AG (Switzerland)

- Diatron (Hungary)

- SFRI (France)

- EKF Diagnostics Holdings plc. (U.K.)

- Medica Corporation (U.S.)

Latest Developments in Global Clinical Chemistry Analyzer Market

- In January 2025, Siemens Healthineers announced the launch of its ADVIA Centaur XPT Immunoassay System in select European markets following CE mark approval. The system is designed to streamline laboratory workflow with enhanced automation, high throughput, and broad assay menu, including infectious diseases and cardiac biomarkers. Its advanced technology minimizes manual intervention and ensures reliable, rapid diagnostics, catering to mid- to high-volume clinical laboratories

- In November 2024, Abbott unveiled enhancements to its Alinity c clinical chemistry system at the Medica Trade Fair in Düsseldorf, Germany. The updated system features improved sample processing time and expanded reagent stability, allowing for faster turnaround and increased operational efficiency in diagnostic labs. These upgrades support laboratories in managing growing testing demands with greater accuracy and reliability

- In October 2024, F. Hoffmann-La Roche Ltd. showcased its next-generation cobas pro integrated solutions at the AACC Annual Scientific Meeting. The system integrates clinical chemistry and immunoassay testing into a single platform, offering high-speed processing and smart automation features to reduce hands-on time. Roche emphasized that this innovation is geared toward maximizing lab efficiency and addressing the global need for rapid, precise diagnostics

- In September 2024, Mindray introduced its latest BS-900M Modular System during the China International Medical Equipment Fair (CMEF). Designed for high-throughput laboratories, the system integrates clinical chemistry and immunoassay modules, offering scalable solutions, intuitive software, and real-time quality control. Mindray’s advancements aim to increase accessibility to robust diagnostics in both developed and emerging healthcare markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.