Global Clear Brine Fluids Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.57 Billion

2024

2032

USD

1.20 Billion

USD

1.57 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 1.57 Billion | |

|

|

|

|

Clear Brine Fluids Market Size

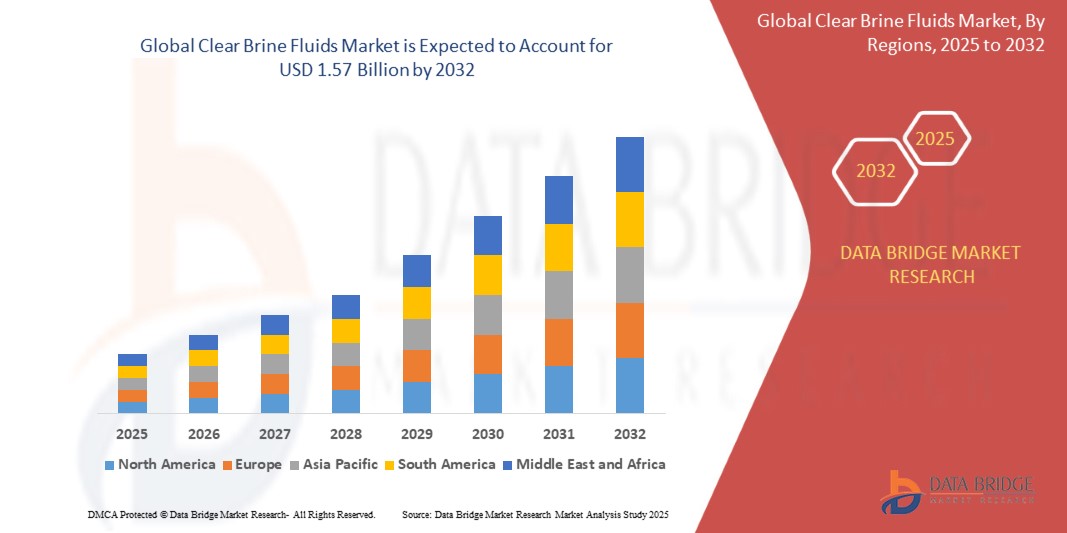

- The global Clear Brine Fluids market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 1.57 billion by 2032, at a CAGR of 3.5% during the forecast period

- The market growth is primarily driven by increasing demand for efficient drilling and completion fluids in oil and gas operations, rising global energy needs, growing offshore and deepwater exploration activities, and advancements in high-performance brine formulations that improve wellbore stability and reduce formation damage.

- Additionally, expanding oilfield operations across North America, the Middle East, and Asia-Pacific, along with growing investments in enhanced oil recovery (EOR) techniques, the adoption of environmentally compatible clear brine fluids, and the push for operational safety and efficiency, are accelerating market expansion across both onshore and offshore sectors..

Clear Brine Fluids Market Analysis

- The Global Clear Brine Fluids Market is driven by increasing oil and gas drilling activities, especially in onshore and offshore exploration. Growing demand for efficient well completion fluids and rising investments in deepwater and ultra-deepwater operations are accelerating market expansion. Technological advancements have led to enhanced brine formulations that improve wellbore stability and minimize reservoir damage.

- Rising focus on environmental safety and stricter regulatory norms are encouraging manufacturers to develop eco-friendly, low-toxicity brine solutions. Additionally, expanding exploration in emerging economies and redevelopment of mature oilfields create growth opportunities. However, high production costs and volatility in raw material prices such as bromine and formate salts pose challenges to sustained market growth.

- North America dominates the Clear Brine Fluids market with a revenue share of around 38% in 2025, driven by strong shale gas activity, mature oilfield infrastructure, and extensive use of completion and workover fluids in unconventional drilling.

- Europe holds a significant share owing to a resurgence in oilfield redevelopment projects, strict safety and environmental regulations, and increased adoption of high-density brine solutions. Asia-Pacific is witnessing rapid growth, supported by urbanization-led energy demand, government support for upstream investment, and increasing offshore E&P activities.

Report Scope and Clear Brine Fluids Market Segmentation

|

Attributes |

Clear Brine Fluids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clear Brine Fluids Market Trends

Increasing Demand for Eco-Friendly, High-Performance Brine Fluids

- Growing environmental awareness is pushing oilfield operators to adopt eco-friendly clear brine fluids, encouraging manufacturers to develop low-toxicity, biodegradable formulations that minimize ecological impact during drilling, completion, and workover operations.

- Stricter global regulations mandating safer drilling practices and reduced chemical discharge are driving demand for brine fluids that support sustainable oilfield operations, aligning with international safety and environmental compliance frameworks.

- Technological advancements in fluid chemistry are enabling the development of high-performance brine systems—such as formate-based or multi-salt blends—that offer excellent thermal stability, wellbore integrity, and reduced formation damage while being environmentally safer than conventional fluids.

- Rising focus on operational efficiency and energy conservation in oilfield projects is promoting the use of clear brine fluids that offer reusability, lower waste generation, and optimized well performance, contributing to cost savings and reduced environmental footprints.

- Collaborations between chemical manufacturers and oilfield service providers are accelerating innovation in sustainable brine formulations, helping address the growing need for cleaner, high-efficiency drilling fluids in both mature and emerging oil & gas regions.

Clear Brine Fluids Market Dynamics

Driver

“Rising Demand for High-Performance and Environmentally Safer Fluids Globally

- Rising environmental concerns and the need for safer oilfield operations are prompting energy companies to adopt high-performance clear brine fluids that minimize formation damage and reduce ecological risks during drilling and completion activities

- Governments and regulatory bodies worldwide are enforcing stricter environmental and safety standards in oil and gas operations, encouraging the use of low-toxicity, eco-friendly brine formulations, particularly in offshore and environmentally sensitive areas.

- Growing awareness around carbon footprint reduction is pushing oilfield operators to choose recyclable, low-emission fluid systems that align with corporate sustainability goals and regulatory compliance in exploration and production projects.

- Rapid industrialization and urbanization, especially in emerging economies, are increasing oil & gas exploration activities, creating strong demand for efficient and environmentally compliant drilling fluids to meet growing energy needs.

- Advancements in fluid chemistry and formulation technologies are enabling manufacturers to develop high-density, temperature-stable brines with reduced environmental impact, enhancing wellbore integrity while appealing to sustainability-conscious operators.

Restraint/Challenge

“High Production Costs and Raw Material Volatility Hinder Market Growth Potential

- Fluctuating prices of key raw materials such as bromine, potassium, and formate salts significantly raise production costs, narrowing profit margins and affecting the competitiveness of clear brine fluids, particularly in cost-sensitive markets.

- The high cost of manufacturing advanced, environmentally safer brine fluids discourages smaller players from entering the market, limiting innovation and slowing market expansion, especially in developing regions.

- Supply chain disruptions and shortages of critical raw materials lead to production delays, affecting project timelines and eroding customer trust, which negatively impacts markerowth and stakeholder confidence.

- Energy-intensive processes required for the production and recycling of high-density brines contribute to elevated operational costs, making it challenging for producers to balance performance, sustainability, and affordability.

- Volatility in raw material availability and pricing creates uncertainty in product cost forecasting, making it difficult for oilfield operators to manage budgets efficiently, thereby restraining the broader adoption of premium clear brine solutions.

Clear Brine Fluids Market Scope

The market is segmented on the basis of typeand end-users.

By Type

On the basis of type, the Clear Brine Fluids market is segmented into potassium chloride, calcium chloride, calcium bromide, sodium bromide, potassium formate, cesium formate, zinc-calcium bromide, and others. The calcium bromide segment holds the largest market share of approximately 40% in 2025, driven by its high thermal stability, compatibility with high-pressure wells, and effectiveness in maintaining wellbore integrity during complex drilling operations.

The potassium formate segment is projected to register the fastest CAGR of around 6.5% from 2025 to 2032, fueled by its low toxicity, reusability, and environmental compatibility, as well as growing demand from offshore deepwater and environmentally sensitive drilling zones where regulatory compliance is a key concern.

By End User

.On the basis of end-users, the Clear Brine Fluids market is segmented into onshore oil & gas, offshore oil & gas, enhanced oil recovery (EOR), and others. The offshore oil & gas segment dominates the market with the largest revenue share in 2025, owing to the rising number of deepwater and ultra-deepwater drilling projects, especially in regions like the Gulf of Mexico, West Africa, and Southeast Asia, where high-performance brine fluids are essential for high-pressure, high-temperature (HPHT) operations.

The enhanced oil recovery (EOR) segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the redevelopment of mature oilfields, increasing global energy demand, and rising adoption of advanced brine formulations that help in improving hydrocarbon recovery while ensuring well integrity and environmental compliance.

Clear Brine Fluids Market Regional Analysis

- North America dominates the Clear Brine Fluids market with an estimated 38% revenue share in 2025, driven by robust oil & gas drilling activity—particularly shale operations in the U.S.—along with strong adoption of high-performance brine formulations for onshore and offshore projects.

- The region’s dominance is supported by strict safety and environmental regulations that require the use of advanced, low-toxicity drilling fluids, as well as consistent demand for clear brine fluids in well completion, workover, and enhanced oil recovery operations

- Rapid oilfield redevelopment, horizontal drilling, and deepwater exploration in the U.S. and Canada are contributing to increased utilization of thermally stable and reservoir-compatible brine fluids, reinforcing North America’s leading market position in the global landscape.

U.S. Clear Brine Fluids Market Insight

The U.S. represents the largest individual market within North America due to its extensive shale gas and tight oil production, particularly in regions like the Permian Basin and Bakken Formation. High investments in horizontal drilling, well completion, and hydraulic fracturing have sustained strong demand for potassium chloride, calcium bromide, and other high-density brines. Furthermore, the increased regulatory focus on environmentally friendly fluids is accelerating the shift toward formate-based and recyclable brine solutions that ensure compliance and minimize formation damage.

Europe Clear Brine Fluids Market Insight

Europe's Clear Brine Fluids market is driven by offshore oil & gas exploration in the North Sea and Eastern Europe, coupled with growing demand for eco-friendly drilling fluids aligned with the region’s stringent environmental standards. Leading oilfield service providers are adopting low-toxicity, multi-salt blends for completion and workover operations. Additionally, the push for energy independence and domestic hydrocarbon production—especially after recent geopolitical tensions—is reinvigorating oilfield activities and supporting demand for advanced brine technologies..

Germany Clear Brine Fluids Market Insight

Germany plays a niche but strategic role within the European market, with a growing emphasis on sustainable drilling practices and the use of low-environmental-impact chemicals in oilfield operations. Though domestic oil production is limited, Germany is a hub for chemical manufacturing and formulation, including brine additives and specialty salts used in high-performance fluids. The country’s strong focus on R&D and environmental compliance is fostering innovation in biodegradable and reusable brine systems..

Clear Brine Fluids Market Share

The Clear Brine Fluids industry is primarily led by well-established companies, including:

- Halliburton Company (U.S.)

- Schlumberger Limited (France / U.S.)

- BASF SE (Germany)

- Cabot Corporation (U.S.)

- TETRA Technologies, Inc. (U.S.)

- Albemarle Corporation (U.S.)

- Israel Chemicals Ltd. (ICL) (Israel)

- Lanxess AG (Germany)

- Zirax Limited (United Kingdom)

- Geo Drilling Fluids, Inc. (U.S.)

- Clear Brine Fluids India Pvt. Ltd. (India)

- Great Lakes Solutions (a Chemtura business) (U.S.)

- Solent Chemicals (India)

- EMEC (Egyptian Mud Engineering & Chemicals Co.) (Egypt)

- Weifang Sinobrom Import and Export Co., Ltd. (China)

Latest Developments in Global Clear Brine Fluids Market

- In June 2024, the U.S. oil & gas industry saw a steady rise in rig activity, particularly in shale regions, boosting demand for high-performance clear brine fluids. These fluids are essential in maintaining wellbore integrity during complex drilling. The increased exploration focus, combined with tightening environmental standards, is encouraging the use of low-toxicity and thermally stable formulations across both onshore and offshore operations.

- In 2024, offshore exploration projects accelerated across North America and West Africa, driven by rising global energy demand. Clear brine fluids—especially calcium bromide and multi-salt blends—gained traction for use in high-pressure, high-temperature (HPHT) wells. Their ability to support formation control, pressure maintenance, and drilling safety made them critical for complex subsea and ultra-deepwater operations, reflecting a growing trend toward advanced well fluid solutions.

- In early 2024, sodium chloride-based clear brine fluids emerged as the leading product type due to their affordability and broad applicability. While potassium and formate-based brines offered superior performance in HPHT wells, sodium chloride maintained dominance in standard operations. Its wide use across onshore drilling, enhanced oil recovery (EOR), and maintenance activities positioned it as a reliable and scalable solution in price-sensitive markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Clear Brine Fluids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Clear Brine Fluids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Clear Brine Fluids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.