Global Cladding System Market

Market Size in USD Billion

CAGR :

%

USD

278.81 Billion

USD

444.38 Billion

2024

2032

USD

278.81 Billion

USD

444.38 Billion

2024

2032

| 2025 –2032 | |

| USD 278.81 Billion | |

| USD 444.38 Billion | |

|

|

|

|

Cladding System Market Size

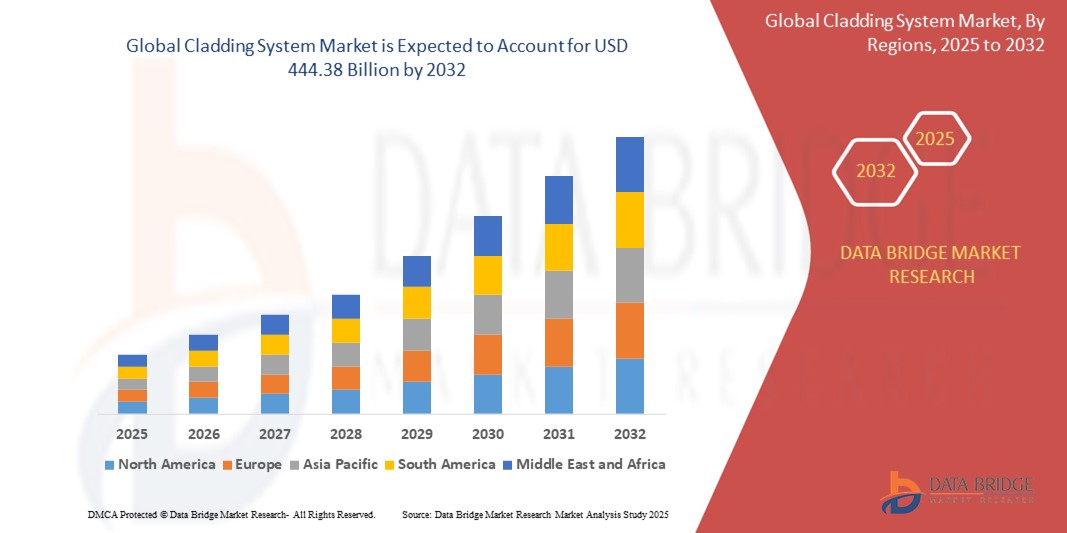

- The global cladding system market size was valued at USD 278.81 billion in 2024 and is expected to reach USD 444.38 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is primarily driven by increasing construction activities, growing demand for energy-efficient building solutions, and advancements in cladding materials that enhance durability and aesthetics

- Rising consumer preference for sustainable and low-maintenance building materials, coupled with stringent regulations promoting green construction, is further accelerating the adoption of cladding systems across residential and non-residential applications

Cladding System Market Analysis

- Cladding systems, used to provide protective and decorative layers to building exteriors, are critical components in modern construction due to their ability to enhance thermal insulation, weather resistance, and aesthetic appeal.

- The surge in demand for cladding systems is fueled by rapid urbanization, increasing focus on sustainable construction practices, and the need for energy-efficient building envelopes

- North America dominated the cladding system market with the largest revenue share of 38.5% in 2024, driven by robust construction activities, high adoption of advanced building materials, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, rising infrastructure investments, and increasing disposable incomes in countries such as China, India, and Japan

- The ceramic segment dominated the largest market revenue share of 32% in 2024, driven by its durability, low maintenance, and aesthetic appeal, making it a preferred choice for both residential and commercial applications

Report Scope and Cladding System Market Segmentation

|

Attributes |

Cladding System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cladding System Market Trends

“Increasing Integration of Smart Technologies and Sustainable Materials”

- The global cladding system market is experiencing a significant trend toward the integration of smart technologies and sustainable materials to enhance building performance and environmental impact

- Smart cladding systems, incorporating technologies such as phase-change materials (PCMs) and sensors, enable adaptive responses to environmental conditions, improving energy efficiency by regulating building temperatures. For instance, PCM-enhanced cladding can reduce cooling energy demand by up to 30%

- The use of recycled and eco-friendly materials, such as recycled aluminum composites, bamboo, and low-carbon fiber cement, is gaining traction as architects and builders prioritize green building certifications and sustainability goals

- Companies such as James Hardie are developing low-carbon cement technologies, with products such as Hardie® Artisan Lap Siding recognized for sustainability and climate resilience

- This trend enhances the appeal of cladding systems for both residential and non-residential applications, aligning with global sustainability initiatives such as the European Green Deal, which aims for climate neutrality by 2050

Cladding System Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Aesthetically Appealing Buildings”

- Increasing consumer and regulatory demand for energy-efficient buildings is a major driver for the global cladding system market, fueled by stringent building codes and sustainability standards worldwide

- Cladding systems enhance energy efficiency by providing thermal insulation, moisture control, and air and vapor barriers, reducing heat transfer and lowering energy consumption for heating and cooling

- The growing construction industry, particularly in emerging economies, drives demand for cladding systems that offer both functional protection and aesthetic appeal to meet modern architectural preferences

- Government initiatives, such as the European Union’s energy efficiency targets and housing programs such as Brazil’s Casa Verde e Amarela, are boosting the adoption of cladding systems

- The rise in urbanization and infrastructure development, especially in Asia-Pacific countries such as China and India, further accelerates demand for advanced cladding solutions in residential and non-residential projects

Restraint/Challenge

“High Installation Costs and Stringent Safety Regulations”

- The high initial costs of cladding system installation, including materials, labor, and integration, pose a significant barrier, particularly in cost-sensitive emerging markets

- Complex installation processes for advanced cladding types, such as curtain walling or rainscreen systems, can lead to delays and increased expenses, deterring adoption in some regions

- Stringent fire safety regulations, driven by high-profile incidents such as cladding-related fires, require manufacturers to comply with rigorous standards, increasing production and compliance costs

- Volatility in raw material prices, such as metals, wood, and polymers, impacts profitability and can limit market growth, especially for smaller manufacturers

- Concerns over maintenance and durability, particularly for materials such as wood that require regular upkeep, and the complexity of repairing systems such as metal cladding, further challenge market expansion

Cladding System market Scope

The market is segmented on the basis of material, component, function, type of cladding, and application

- By Material

On the basis of material, the global cladding system market is segmented into ceramic, wood, stucco and EIFS, brick and stone, metal, vinyl, fiber cement, and others. The ceramic segment dominated the largest market revenue share of 32% in 2024, driven by its durability, low maintenance, and aesthetic appeal, making it a preferred choice for both residential and commercial applications. Ceramic cladding is widely used for tile cladding in various settings, including bathrooms, kitchens, and public buildings, due to its resistance to pollutants and weather conditions.

The fiber cement segment is expected to witness the fastest growth rate from 2025 to 2032, with a projected CAGR of 7.8%. This growth is fueled by its cost-effectiveness, high durability, and ability to withstand high-pressure winds and rainwater, making it ideal for sustainable and low-maintenance cladding solutions in residential and non-residential construction.

- By Component

On the basis of component, the global cladding system market is segmented into roof, walls, windows and doors, and others. The wall segment dominated the market with a revenue share of 42.3% in 2024, attributed to its extensive surface area in buildings and its dual role in providing protection against environmental elements and enhancing aesthetic appeal. Wall cladding is critical for energy efficiency and structural durability, particularly in regions with extreme weather conditions.

The roof segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by the increasing adoption of metal and fiber cement roofing solutions in commercial and industrial buildings. These materials offer superior weather resistance and insulation, contributing to energy savings and building longevity.

- By Function

On the basis of function, the global cladding system market is segmented into insulation, air and vapor control, precipitation control, movement joints and crack control, and others. The insulation segment held the largest market revenue share of 38% in 2024, driven by stringent building codes and green building standards mandating energy-efficient solutions. Insulation-focused cladding systems, such as rainscreen assemblies and insulated metal panels, are increasingly adopted to reduce energy consumption and enhance building performance.

The precipitation control segment is expected to witness significant growth from 2025 to 2032, as cladding systems designed to protect against rain, snow, and moisture gain traction in regions prone to harsh weather. These systems prevent structural deterioration and mold growth, ensuring long-term durability.

- By Type of Cladding

On the basis of type of cladding, the global cladding system market is segmented into curtain walling, sandwich panels, patent glazing, rain screens, metal profile cladding, brick slips, tile hanging, and others. The curtain walling segment held the largest market revenue share of 30% in 2024, owing to its widespread use in commercial buildings for its aesthetic appeal, lightweight nature, and ability to provide thermal and acoustic insulation.

The rain screens segment is projected to grow at the fastest rate from 2025 to 2032, driven by its ability to manage moisture and enhance energy efficiency in modern architectural designs. Rain screens are increasingly adopted in urban areas for their versatility and sustainability.

- By Application

On the basis of application, the global cladding system market is segmented into residential and non-residential. The residential segment dominated the market with a revenue share of 43.7% in 2024, fueled by rising demand for energy-efficient and aesthetically pleasing cladding solutions in homes. The focus on sustainable building practices and government initiatives promoting green buildings further drives this segment.

The non-residential segment is anticipated to witness the fastest growth rate of 8.2% from 2025 to 2032, driven by increased construction of commercial, industrial, and institutional buildings. Cladding systems in non-residential applications enhance weather resistance, fire safety, and visual appeal, particularly in office spaces, shopping malls, and public facilities.

Cladding System Market Regional Analysis

- North America dominated the cladding system market with the largest revenue share of 38.5% in 2024, driven by robust construction activities, high adoption of advanced building materials, and the presence of major industry players

- Consumers prioritize cladding systems for thermal insulation, weather resistance, and enhanced building aesthetics, particularly in regions with varied climatic conditions

- Growth is supported by advancements in cladding materials, such as ceramic, fiber cement, and metal, alongside increasing adoption in both residential and non-residential applications

U.S. Cladding System Market Insight

The U.S. cladding system market captured the largest revenue share of 75.7% in 2024 within North America, fueled by strong demand in both residential and commercial construction sectors. Growing consumer awareness of energy efficiency and sustainable building practices drives the adoption of advanced cladding materials such as vinyl and fiber cement. Stringent building codes and a trend toward modern architectural designs further boost market expansion.

Europe Cladding System Market Insight

The Europe cladding system market is expected to witness significant growth, supported by regulatory focus on energy-efficient buildings and sustainable construction practices. Consumers prefer cladding systems that offer insulation, precipitation control, and aesthetic appeal. Countries such as Germany and France show notable adoption due to increasing urban development and environmental regulations promoting green building solutions.

U.K. Cladding System Market Insight

The U.K. market for cladding systems is projected to experience rapid growth, driven by demand for energy-efficient and visually appealing building exteriors in urban and suburban areas. Rising awareness of insulation benefits and compliance with stringent building safety regulations encourage adoption. The use of materials such as brick slips and metal profile cladding is gaining traction in both new constructions and retrofit projects.

Germany Cladding System Market Insight

Germany is expected to witness robust growth in the cladding system market, attributed to its advanced construction sector and strong emphasis on energy efficiency. German consumers favor high-performance cladding materials such as ceramic and fiber cement that reduce energy consumption and enhance building durability. The integration of cladding systems in premium residential and commercial projects supports sustained market growth.

Asia-Pacific Cladding System Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, expanding construction activities, and rising disposable incomes in countries such as China, India, and Japan. Increasing demand for sustainable and aesthetically pleasing building solutions boosts the adoption of cladding systems. Government initiatives promoting energy efficiency and green construction further accelerate market growth.

Japan Cladding System Market Insight

Japan’s cladding system market is projected to experience rapid growth due to strong consumer preference for high-quality, durable cladding materials that enhance building safety and aesthetics. The presence of major construction firms and the integration of advanced cladding systems in residential and non-residential projects drive market penetration. Rising interest in sustainable construction also contributes to growth.

China Cladding System Market Insight

China holds the largest share of the Asia-Pacific cladding system market, propelled by rapid urbanization, increasing construction projects, and growing demand for energy-efficient building solutions. The country’s expanding middle class and focus on sustainable urban development support the adoption of advanced cladding materials such as metal and vinyl. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Cladding System Market Share

The cladding system industry is primarily led by well-established companies, including:

- Kingspan Group (Ireland)

- Saint-Gobain (France)

- Carea Facade (London)

- M.F. Murray Companies, Inc. (U.S.)

- CGL Facades (U.K.)

- Rockwool A/S (Denmark)

- BASF SE (Germany)

- Sto SE & Co KGaA (Germany)

- Dryvit (U.S.)

- ParexGroup LTD (France)

- Terraco Holdings Ltd (U.K.)

- Etex Group (Belgium)

- FunderMax (Austria)

- Euramax Cladding (Netherlands)

- Cupa Pizarras (U.S.)

- Danpal (France)

What are the Recent Developments in Global Cladding System Market?

- In May 2025, Kingspan Group and Etex Group continued to drive growth in the cladding and building materials market through a combination of strategic acquisitions and innovative product launches. Both companies emphasized sustainability, energy efficiency, and high-performance solutions in their offerings. Kingspan advanced its “Completing the Envelope” strategy, focusing on low-carbon building envelopes, while Etex expanded its lightweight construction portfolio, reinforcing its position in global markets. These ongoing efforts reflect a broader industry trend toward green building solutions and resilient infrastructure, with both firms playing key roles in shaping the future of sustainable construction

- In July 2024, the cladding industry saw a significant innovation with the introduction of self-cleaning façade technologies powered by nanotechnology. These advanced coatings, often based on titanium dioxide (TiO₂) and zinc oxide (ZnO), utilize photocatalytic and hydrophilic properties to break down organic pollutants and allow rainwater to wash away dirt, reducing the need for manual cleaning. Applied via spray or dip coating, these solutions enhance the durability, aesthetics, and sustainability of building exteriors. This development addresses growing demand for low-maintenance, long-lasting materials in both modern and heritage architecture

- In June 2024, Sotech Optima introduced a groundbreaking variation of its Optima FC+ rainscreen cladding system—the Optima Meadow, a fully integrated “living wall” solution developed in collaboration with Vertical Meadow. This innovative system incorporates a hinged perforated front panel that allows for the insertion of a seed membrane, enabling plants to grow directly on the façade. Delivered dry to site and activated with integrated irrigation, Wi-Fi, and power systems, the solution supports urban biodiversity, reduces carbon footprint, and simplifies maintenance. This launch reflects the growing trend toward sustainable, biophilic design in the cladding and construction sectors

- In January 2023, Aquarian Cladding, a UK-based specialist in brick façade systems, launched Gebrik Modular, a factory-produced, panelized cladding solution tailored for the modular housing market. Designed for buildings under 11 meters, Gebrik Modular consists of lightweight, non-load-bearing insulated panels that are quick to install and compatible with most common substrates. With over 700 clay brick finishes available, the system offers both aesthetic flexibility and thermal efficiency, enabling faster construction timelines and reduced reliance on traditional bricklaying labor. This launch addresses key industry challenges such as labour shortages, weather dependency, and the need for offsite construction efficiency

- In March 2022, Mitrex, a Canadian solar technology innovator, launched Solar Brick, a groundbreaking building-integrated photovoltaic (BIPV) solution that transforms traditional brick facades into renewable energy-generating surfaces. Designed to mimic the appearance of classic masonry, Solar Brick panels integrate monocrystalline solar cells capable of generating up to 330W per panel, all while maintaining architectural aesthetics. The product is ideal for both new construction and retrofits, offering a seamless blend of design, durability, and sustainability. This launch underscores Mitrex’s mission to revolutionize the cladding sector by embedding solar functionality into everyday building materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cladding System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cladding System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cladding System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.