Global Cider Perry Market

Market Size in USD Billion

CAGR :

%

USD

102.32 Billion

USD

178.83 Billion

2024

2032

USD

102.32 Billion

USD

178.83 Billion

2024

2032

| 2025 –2032 | |

| USD 102.32 Billion | |

| USD 178.83 Billion | |

|

|

|

|

Cider/Perry Market Size

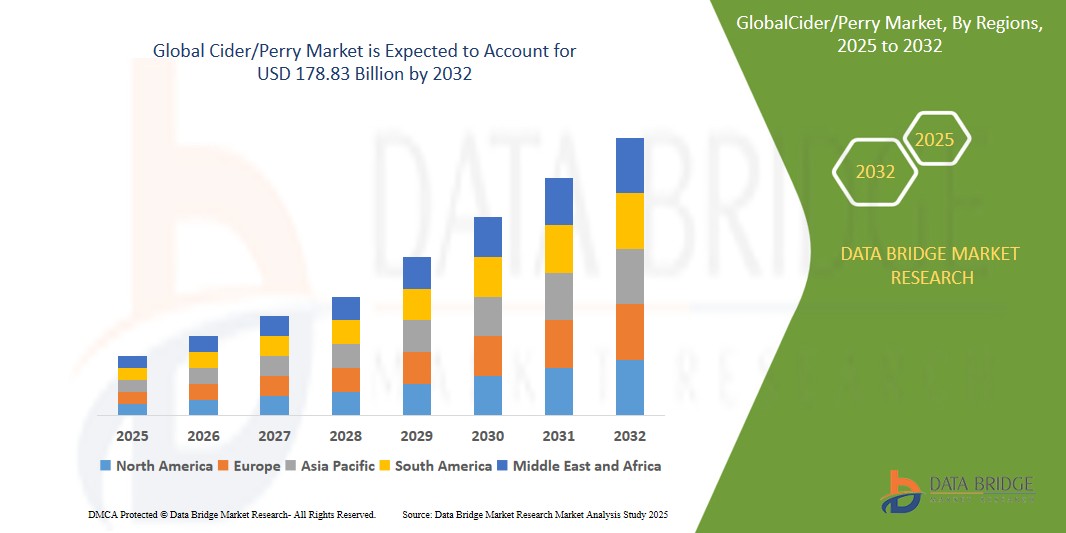

- The Global Cider/Perry Market size was valued at USD 102.32 billion in 2024 and is expected to reach USD 178.83 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by increasing demand for premium spirits on account of rising per capita income

- Furthermore, the growing health-conscious consumers, increasing consumption on account of nutritional benefits, growing health-conscious consumers, rising awareness regarding the benefits of Cider which includes detoxification, acid reflux, lower blood pressure, improve diabetes, and support weight loss are further anticipated to propel the growth of the Cider/Perry Market

Cider/Perry Market Analysis

- Perry is produced similarly to cider, but involves the usage of fermented juice from pears instead of apples. It is often confused with wine. Perry pears are described as wild pears and are small, round

- Increasing demand for premium spirits on account of rising per capita income as well as consumption of alcohol as a status symbol is a vital factor escalating the market growth

- North America dominates the Cider/Perry Market with the largest revenue share of 40.01% in 2025, characterized by increasing demand for low-alcohol beverages and craft innovations. U.S. and Canadian consumers are shifting toward natural, gluten-free alternatives like cider and perry.

- Asia-Pacific is expected to be the fastest growing region in the Cider/Perry Market during the forecast period due to changing lifestyles, growing alcohol consumption among millennials, and rising disposable incomes

- Glass bottles segment is expected to dominate the Cider/Perry Market with a market share of 41.5% in 2025, driven by consumer perception of premium quality and sustainability. Glass bottles are favored for their ability to preserve flavor and carbonation

Report Scope and Cider/Perry Market Segmentation

|

Attributes |

Cider/Perry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cider/Perry Market Trends

“Premiumization and Flavor Innovation Driving Market Growth”

- A significant trend in the global cider and perry market is the shift towards premiumization and the expansion of flavor varieties.

- Consumers are increasingly seeking high-quality, artisanal products with unique flavor profiles, leading manufacturers to introduce a wide array of options, including exotic fruit infusions, botanical extracts, and spice combinations.

- This diversification caters to evolving consumer tastes and preferences, offering more personalized drinking experiences.

- The emergence of craft cider and perry producers has further fueled this trend, with small-scale producers experimenting with unique ingredients and production techniques to create artisanal and limited-edition offerings.

- This trend is expected to continue shaping the global cider and perry market, driving growth and innovation in the years to come.

Cider/Perry Market Dynamics

Driver

“Rising Demand for Gluten-Free and Low-Alcohol Beverages”

- The increasing prevalence of health-conscious consumers and those with gluten intolerances or sensitivities is a significant driver for the heightened demand for cider and perry products.

- Cider is naturally gluten-free and often perceived as a healthier choice compared to other alcoholic beverages, attracting health-conscious consumers seeking alternatives to traditional beers and spirits.

- The rise of craft and artisanal producers who focus on quality and innovation has contributed to the growth of the cider industry.

- These players create unique blends and flavors that cater to niche markets, enhancing consumer interest in cider as a premium beverage choice.

Restraint/Challenge

“Competition from Established Alcoholic Beverages and Seasonality of Consumption”

- The cider and perry market face significant challenges from established alcoholic beverages such as beer and wine, which often have broader brand recognition and consumer loyalty.

- Cider consumption also exhibits distinct seasonality, with higher demand during warmer months, leading to fluctuations in sales and production planning.

- Additionally, cultural differences and traditions in some countries may restrain the growth of the global cider market, as cider may not be as deeply ingrained in the drinking culture compared to other beverages.

Cider/Perry Market Scope

The market is segmented on the basis of packaging, product, and distribution channel.

- By Packaging

On the basis of packaging, the cider/perry market is segmented into draught, glass bottles, cans, plastic bottles, and others. The glass bottles segment dominates the largest market revenue share of 41.5% in 2025, driven by consumer perception of premium quality and sustainability. Glass bottles are favored for their ability to preserve flavor and carbonation, and are commonly used in on-premise and off-premise retail channels. The growing trend toward craft cider consumption further supports this segment’s dominance due to the aesthetic and traditional appeal of glass packaging.

The cans segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, fueled by increasing demand for portable and single-serve options. Cans offer lightweight convenience, faster chilling times, and greater recyclability, making them ideal for outdoor and casual consumption settings. Rising popularity of canned alcoholic beverages and innovations in can design support strong market expansion.

- By Product

On the basis of product, the cider/perry market is segmented into cider and perry. The cider segment held the largest market revenue share in 2025, driven by its broader consumer base and extensive flavor offerings. Cider appeals to both beer and wine drinkers, and its low alcohol content and gluten-free nature make it an attractive alternative. The presence of established global brands and growing craft cider movements continue to boost consumption across key markets.

The perry segment is expected to witness the fastest CAGR from 2025 to 2032, due to its niche appeal and rising interest in heritage drinks. While less common than cider, perry is gaining attention among premium beverage consumers and in regions with traditional production, such as the UK and parts of Europe. Its unique taste profile and artisanal production methods support increased interest and trial among enthusiasts.

- By Distribution Channel

On the basis of distribution channel, the cider/perry market is segmented into online trade and offline trade. The offline trade segment accounted for the largest market revenue share in 2025, driven by strong consumer preference for purchasing alcoholic beverages through retail outlets, pubs, and bars. Brick-and-mortar retail provides access to a wide selection, immediate availability, and brand visibility. In-store promotions and on-premise consumption play a crucial role in shaping consumer behavior.

The online trade segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the convenience of home delivery, wider product availability, and changing consumer purchasing habits. Digital platforms are increasingly used by producers and retailers to reach tech-savvy consumers. The growing popularity of e-commerce in the alcohol sector, especially post-COVID-19, further accelerates this trend.

Cider/Perry Market Regional Analysis

- North America dominates the cider/perry market with the largest revenue share of 40.01% in 2024, driven by increasing demand for low-alcohol beverages and craft innovations. U.S. and Canadian consumers are shifting toward natural, gluten-free alternatives like cider and perry.

- This preference is supported by growing health awareness and the premiumization of alcoholic beverages.

- Strong distribution networks and frequent product launches further solidify the region’s leadership, with demand peaking during seasonal festivals and sporting events. Cider/perry's crisp taste and artisanal image appeal across both millennial and older demographics.

U.S. Cider/Perry Market Insight

The U.S. cider/perry market captured the largest revenue share of 81.04% within North America in 2025, fueled by the rise in craft cider breweries and expanding retail availability. The market thrives on consumer preference for flavored, organic, and locally produced ciders. Cider festivals and experiential marketing campaigns also enhance product visibility. Innovation in packaging and flavor profiles, including botanical infusions and barrel-aged variants, fuels consumer interest. Additionally, a growing trend of food pairing with ciders in gastropubs and restaurants significantly supports market growth and consumer trial.

Europe Cider/Perry Market Insight

The European cider/perry market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s deep-rooted cider culture and strong domestic production. The UK, France, and Spain lead in consumption and exports, while increasing interest in organic and artisanal variants bolsters category growth. Rising health consciousness is driving demand for low-sugar and low-ABV versions. Cider is increasingly consumed beyond traditional settings—appearing in formal dining and cocktail mixology. Sustainability efforts in sourcing and production also appeal to Europe’s environmentally-conscious consumers, strengthening market expansion.

U.K. Cider/Perry Market Insight

The U.K. cider/perry market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its legacy of cider consumption and innovation from craft producers. British consumers continue to favor traditional apple-based ciders but are also exploring flavored and hybrid options. Growing investment in branding, sustainable sourcing, and experiential marketing is improving consumer engagement. The shift to premium and canned formats, as well as increasing on-trade sales post-pandemic, further boosts the category. Government support for local cider production also enhances domestic competitiveness.

Germany Cider/Perry Market Insight

The German cider/perry market is expected to expand at a considerable CAGR during the forecast period, fueled by shifting consumer preferences toward light and natural alcoholic beverages. While beer remains dominant, ciders and perry are gaining popularity, especially among young urban consumers. Growing availability in retail and hospitality venues, along with product diversification by local and international brands, is increasing adoption. The German market benefits from an openness to innovation in flavor and packaging, aligning with broader European sustainability and health trends in alcoholic beverages.

Asia-Pacific Cider/Perry Market Insight

The Asia-Pacific Cider/Perry Market is poised to grow at the fastest CAGR of over 22.46% in 2025, driven by changing lifestyles, growing alcohol consumption among millennials, and rising disposable incomes. Countries like China, Japan, South Korea, and Australia are leading the surge, supported by e-commerce expansion and Western influence on drinking habits. Ciders are being positioned as trendy, sessionable alternatives to beer and wine. Rising interest in low-alcohol, fruity, and health-forward beverages is driving consumer adoption, with strong marketing and influencer campaigns helping educate new drinkers in the region.

Japan Cider/Perry Market Insight

The Japan Cider/Perry Market is gaining momentum due to a cultural shift toward more casual and personalized alcohol consumption. Ciders and perry are increasingly viewed as refreshing and sophisticated alternatives, especially among women and young professionals. Growth is supported by the emergence of domestic producers and imported craft brands. Integration into bars, restaurants, and retail convenience stores, along with Japan’s appreciation for seasonal and regional flavors, is boosting visibility. Strong alignment with the country’s health-conscious and refined palate preferences is also supporting market development.

China Cider/Perry Market Insight

The China Cider/Perry Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by rising middle-class income, a young urban population, and aggressive marketing by international and local cider brands. The shift from high-ABV traditional spirits to lighter, fruit-based alcoholic drinks fuels market demand. Distribution through online platforms, modern retail, and restaurants is making ciders widely accessible. As Chinese consumers explore more diverse and health-conscious drinking options, cider/perry’s image as a trendy, approachable beverage continues to gain ground. Government alcohol moderation campaigns also favor this category’s rise.

Cider/Perry Market Share

The Cider/Perry industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Berry Global Inc. (U.S.)

- Crown (U.S.)

- Closure Systems International (U.S.)

- Maynard & Harris Plastics (U.K.)

- Berlin Packaging (U.S.)

- O.Berk Company, LLC (U.S.)

- Mold-Rite Plastics (U.S.)

- TAPLAST S.r.l. (Italy)

- Reynolds Packaging (U.S.)

- BALL CORPORATION (U.S.)

- AptarGroup, Inc. (U.S.)

- BERICAP (Germany)

- Silgan Holdings Inc. (U.S.)

- Guala Closures S.p.A (Italy)

- Dhiren Plastic Industries (India)

- RAEPAK Ltd (U.K.)

- Weener Empire Plastics Pvt. Ltd. (India)

- Anant (Brand of A. T. Manufacturing Co.) (India)

- Aroma Industries (India)

Latest Developments in Global Cider/Perry Market

- In May 2024, Budweiser Brewing Group introduced Brutal Fruit Cider in the UK, a premium offering crafted to rejuvenate the cider market. This fruit cider features a mix of citrus, ruby apple, and delicate spice notes, showcased in a light pink hue reminiscent of cocktails. To boost its appeal among younger consumers, the brand collaborated with British singer Pixie Lott, supporting the launch through events and digital marketing efforts.

- In March 2024, Heineken unveiled Strongbow Zest cider, targeting younger drinkers and reinforcing its position in the cider segment. This new variant offers a lively flavor profile combining citrus and apple notes, delivering a crisp and invigorating experience. Heineken’s approach emphasizes catering to health-conscious individuals by providing a lower-calorie option that maintains great taste.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cider Perry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cider Perry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cider Perry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.