Global Chronic Inflammatory Demyelinating Polyneuropathy Cidp Market

Market Size in USD Billion

CAGR :

%

USD

1.87 Billion

USD

3.33 Billion

2024

2032

USD

1.87 Billion

USD

3.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.87 Billion | |

| USD 3.33 Billion | |

|

|

|

|

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Size

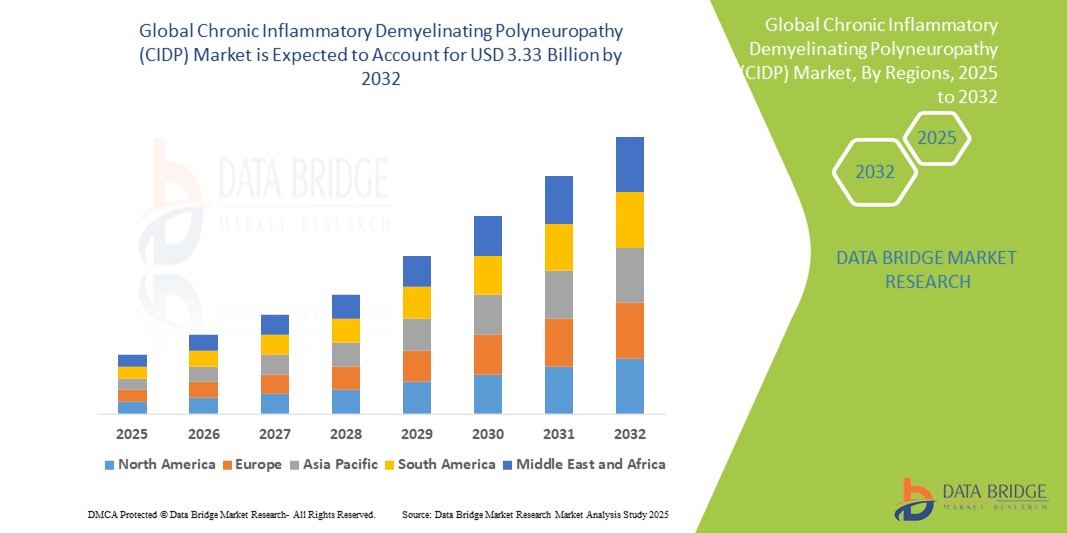

- The global chronic inflammatory demyelinating polyneuropathy (CIDP) market size was valued at USD 1.87 billion in 2024 and is expected to reach USD 3.33 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is primarily driven by increasing awareness and diagnosis of CIDP, along with advancements in treatment options and therapeutic interventions. Growing prevalence of autoimmune disorders and the expanding geriatric population further contribute to market expansion

- Moreover, rising investments in research and development, along with improved healthcare infrastructure globally, are facilitating better patient access to effective treatments. These combined factors are accelerating the adoption of novel therapies and management solutions for CIDP, thereby substantially propelling market growth over the forecast period

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Analysis

- Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) is a rare autoimmune neurological disorder characterized by progressive weakness and sensory dysfunction caused by peripheral nerve damage. It is increasingly recognized due to improved diagnostic tools and growing awareness among healthcare providers and patients

- The escalating demand for effective CIDP treatments is primarily fueled by the rising prevalence of autoimmune and neurological diseases, an aging global population, and expanded access to advanced healthcare services. Innovations in immunotherapy and supportive therapies are further boosting market growth

- North America dominates the chronic inflammatory demyelinating polyneuropathy (CIDP) market with the largest revenue share of 38.9% in 2024, characterized by well-established healthcare infrastructure, increased disease awareness, availability of novel therapies, and a robust presence of leading pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the chronic inflammatory demyelinating polyneuropathy (CIDP) market during the forecast period due to improving healthcare infrastructure, rising patient population, and increasing adoption of advanced treatment modalities in countries such as China, Japan, and India

- Intravenous Immunoglobulin segment dominates the chronic inflammatory demyelinating polyneuropathy (CIDP) market with a market share of 55.5% in 2024, driven by its proven efficacy as the standard first-line therapy, providing symptom relief and improving patient outcomes

Report Scope and Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Segmentation

|

Attributes |

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A significant and emerging trend in the CIDP market is the integration of artificial intelligence (AI) and voice-controlled technologies to enhance patient care and convenience, particularly for individuals with mobility challenges

- For instance, patients with CIDP are increasingly utilizing voice-activated systems to control adjustable beds and other assistive devices. These systems can be integrated with popular voice assistants such as Amazon Alexa and Google Assistant, allowing patients to adjust their environment through simple voice commands, thereby reducing physical strain and improving quality of life

- AI integration in CIDP management is also being explored to predict treatment outcomes. Early changes in nerve conduction study (NCS) variables, analyzed through AI algorithms, can serve as reliable predictors of treatment efficacy, enabling personalized treatment plans and better patient outcomes

- The adoption of AI and voice-controlled technologies in CIDP care reflects a broader trend towards personalized and patient-centric healthcare solutions. These technologies not only enhance patient autonomy but also facilitate remote monitoring and management, which is particularly beneficial for chronic conditions such as CIDP

- As the demand for more convenient and accessible treatment options grows, the integration of AI and voice control in CIDP management is expected to become increasingly prevalent, offering new avenues for improving patient care and quality of life

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Dynamics

Driver

“Growing Demand Due to Rising Prevalence and Advancements in Diagnostic and Therapeutic Solutions”

- The increasing prevalence of CIDP, a chronic autoimmune neurological disorder, is a significant driver for the heightened demand for effective treatment and diagnostic modalities in both clinical and homecare settings

- For instance, in June 2024, argenx received FDA approval for Vyvgart Hytrulo as a treatment for CIDP, marking a major advancement in therapy options and underscoring the market's progression toward targeted immunotherapies. This regulatory milestone is expected to significantly accelerate treatment uptake and broaden therapeutic choices for patients worldwide

- As awareness of CIDP continues to rise among healthcare professionals and patients, earlier and more accurate diagnoses are being made using advanced tools such as EMG, nerve conduction studies, and cerebrospinal fluid analysis—resulting in more timely and effective intervention strategies

- Furthermore, the growing development and use of home-based immunoglobulin therapies and corticosteroids are making CIDP treatment more accessible and patient-friendly, reinforcing the trend toward personalized and flexible care models

- The convenience of self-administered treatments, coupled with technological improvements in monitoring disease progression through connected health platforms, is propelling the adoption of CIDP management strategies across both hospital and homecare sectors. The broader availability of these options and increased R&D investments are contributing to the continued expansion of the global CIDP market.

Restraint/Challenge

“Limited Awareness, High Treatment Costs, and Diagnostic Delays”

- Despite advances in treatment, limited awareness of Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) among patients and general practitioners continues to hinder early diagnosis and timely intervention. The rarity and complex nature of the disease often lead to misdiagnosis or underdiagnosis, which delays the start of appropriate treatment and exacerbates disease progression

- For instance, various clinical studies have noted that many CIDP patients go undiagnosed for months or even years due to the overlapping symptoms with other neurological disorders such as multiple sclerosis or diabetic neuropathy. This delay in recognition and proper referral remains a significant challenge in disease management

- Addressing these diagnostic delays requires enhanced physician education, access to specialized neurologists, and wider availability of advanced diagnostic tools such as nerve conduction studies and spinal fluid analysis. In addition, the high cost of CIDP treatments, particularly intravenous immunoglobulin (IVIg) and corticosteroids, poses a financial burden on both healthcare systems and patients, especially in low- and middle-income countries

- While biosimilar IVIg formulations and insurance coverage are helping to reduce costs in some regions, the affordability and long-term accessibility of CIDP therapies remain a concern, particularly for chronic cases requiring sustained treatment over time

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Scope

The market is segmented on the basis of treatment, diagnosis, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the chronic inflammatory demyelinating polyneuropathy (CIDP) market is segmented into intravenous immunoglobulin (IVIG), corticosteroids, plasmapheresis, physiotherapy, and others. The intravenous immunoglobulin (IVIG) segment dominates the market with the largest revenue share of 55.5% in 2024, attributed to its high efficacy, quick response rates, and wide clinical preference as a first-line therapy. Its non-invasive administration and fewer long-term side effects compared to steroids enhance its adoption in both acute and maintenance therapies.

The physiotherapy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing awareness of supportive therapies to improve patient mobility and quality of life. As a non-pharmacological intervention, physiotherapy complements medical treatment and helps in managing chronic symptoms, especially among aging populations and long-term patients.

- By Diagnosis

On the basis of diagnosis, the chronic inflammatory demyelinating polyneuropathy (CIDP) market is segmented into electrodiagnostic testing, nerve conduction studies, electromyography (EMG), spinal fluid analysis, and others. Electrodiagnostic testing dominated the diagnostic segment in 2024 due to its critical role in confirming CIDP by assessing nerve functionality and damage. It is often the gold standard for differentiating CIDP from other neuropathies and has strong clinical validation, making it a routine diagnostic tool.

The spinal fluid analysis segment is projected to show notable growth through 2032, as advances in lumbar puncture techniques and biomarker analysis improve diagnostic precision. This segment is also gaining attention in research for early detection and disease monitoring.

- By Route Of Administration

On the basis of route of administration, the chronic inflammatory demyelinating polyneuropathy (CIDP) market is segmented into intravenous, oral, and others. The Intravenous segment holds the largest market share in 2024, owing to the widespread use of IVIG and plasmapheresis, which are administered through IV routes. The reliability, controlled dosing, and hospital-based administration contribute to its dominance in both acute and chronic treatment settings.

The Oral segment is expected to witness the fastest CAGR from 2025 to 2032 due to the increasing prescription of oral corticosteroids and the development of oral immunomodulatory drugs, offering convenience and compliance benefits in long-term maintenance therapy.

- By End Users

On the basis of end-users, the chronic inflammatory demyelinating polyneuropathy (CIDP) market is segmented into hospitals, homecare, specialty clinics, and others. Hospitals account for the largest revenue share in 2024 due to the availability of advanced diagnostic and treatment infrastructure, including IVIG infusion facilities and neurological expertise. The demand for hospital-based treatments is driven by the complexity and monitoring required for CIDP therapy initiation.

Homecare is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by the increasing trend of home-based IVIG administration, rising healthcare cost-efficiency needs, and patient preference for at-home management of chronic conditions.

- By Distribution Channel

On the basis of distribution channel, the chronic inflammatory demyelinating polyneuropathy (CIDP) market is segmented into hospital pharmacy, retail pharmacy, online pharmacies, and others. The Hospital Pharmacy segment dominated the market in 2024, benefiting from the direct supply of high-cost treatments such as IVIG and corticosteroids during inpatient and outpatient visits.

The Online Pharmacies segment is projected to witness the fastest growth through 2032, fueled by increasing digitalization, patient convenience, and the expansion of specialty drug delivery services. The growing adoption of telehealth platforms also supports the demand for online procurement of CIDP medications.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Regional Analysis

- North America dominates the chronic inflammatory demyelinating polyneuropathy (CIDP) market with the largest revenue share of 38.9% in 2024, driven by well-established healthcare infrastructure, increased disease awareness, availability of novel therapies, and a robust presence of leading pharmaceutical companies

- Patients in the region benefit from wide access to specialized neurology clinics, reimbursement support for expensive treatments such as IVIG and plasmapheresis, and increasing awareness initiatives around rare neurological disorders such as CIDP

- This strong market performance is further bolstered by ongoing research efforts, favorable regulatory environments, and the growing adoption of home-based therapies, making North America a hub for innovation and access in the CIDP treatment landscape

U.S. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The U.S. chronic inflammatory demyelinating polyneuropathy (CIPD) market captured the largest revenue share in 2024 within North America, driven by early diagnostic capabilities, widespread awareness campaigns, and the availability of advanced immunotherapies such as IVIG and corticosteroids. The country benefits from a robust healthcare infrastructure, favorable insurance coverage for rare diseases, and strong involvement from key market players in research and clinical trials. Furthermore, the shift towards home-based immunoglobulin infusions and rising neurologist engagement in early diagnosis are propelling continued growth across both hospital and outpatient care settings.

Europe Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The Europe chronic inflammatory demyelinating polyneuropathy (CIPD) market is projected to expand at a substantial CAGR throughout the forecast period, primarily fueled by strong neurology expertise, government-backed healthcare reimbursement models, and rising prevalence of autoimmune neuropathies. Several EU countries maintain CIDP treatment guidelines and emphasize accurate electrodiagnostic and spinal fluid assessments, boosting diagnosis rates. In addition, the demand for outpatient and homecare therapies is rising, driven by convenience, reduced hospital stays, and improved patient quality of life.

U.K. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The U.K. chronic inflammatory demyelinating polyneuropathy (CIPD) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased awareness around chronic peripheral neuropathies and access to specialized care through the NHS and private neurology centers. Strong adoption of intravenous immunoglobulin therapies, ongoing research on steroid-sparing treatments, and improved access to electrodiagnostic testing are key contributors. Rising demand for homecare IVIG administration and patient-centric management strategies are further propelling the market forward.

Germany Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The Germany chronic inflammatory demyelinating polyneuropathy (CIPD) market is expected to expand at a considerable CAGR during the forecast period, supported by a highly advanced diagnostic framework, structured care pathways, and widespread clinical use of IVIG, plasmapheresis, and corticosteroids. Germany’s emphasis on precise diagnosis through EMG and nerve conduction studies, as well as comprehensive insurance coverage for CIDP treatment, enhances market penetration. In addition, innovations in immunomodulatory therapies and increased physician education on rare neuroimmune disorders are creating favorable conditions for sustained growth.

Asia-Pacific Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The Asia-Pacific chronic inflammatory demyelinating polyneuropathy (CIPD) market is poised to grow at the fastest CAGR from 2025 to 2032, driven by expanding healthcare access, increased awareness, and rising incidence of immune-mediated neuropathies in countries such as China, Japan, and India. Government efforts to improve rare disease diagnosis, the gradual inclusion of immunoglobulin therapies in public health coverage, and growth in tertiary neurological centers are key factors accelerating adoption. The region is also witnessing a shift toward local manufacturing of IVIG products and growth in clinical trials, expanding treatment availability to broader population

Japan Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The Japan chronic inflammatory demyelinating polyneuropathy (CIPD) market is gaining momentum due to the country’s commitment to neurological research, structured healthcare system, and high patient awareness. The integration of CIDP management into national neurology programs and the widespread availability of diagnostic testing support accurate and timely treatment. Japan’s aging population, high prevalence of neuropathic disorders, and early adoption of home-based IVIG and corticosteroid regimens are significantly contributing to market expansion.

India Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Insight

The India chronic inflammatory demyelinating polyneuropathy (CIPD) market accounted for the largest revenue share in Asia Pacific in 2024, attributed to a rapidly growing patient pool, expanding access to neurology care, and strong local pharmaceutical manufacturing capabilities. India is witnessing increased awareness among neurologists and patients, bolstered by educational initiatives and support from rare disease advocacy groups. Government initiatives toward rare disease coverage and growth in domestic IVIG production are making CIDP treatment more accessible and affordable, especially in urban centers and tertiary care hospitals.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Share

The chronic inflammatory demyelinating polyneuropathy (CIDP) industry is primarily led by well-established companies, including:

- Grifols, S.A. (Spain)

- Octapharma AG (Switzerland)

- CSL (Australia)

- Kedrion S.p.A. (Italy)

- Biotest AG (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- Pfizer Inc. (U.S.)

- Baxter International Inc. (U.S.)

- Hansa Biopharma AB (Sweden)

- Alexion Pharmaceuticals, Inc. (U.S.)

- Biogen Inc. (U.S.)

- Genentech, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- Bio Products Laboratory Limited (U.K.)

- Nihon Pharmaceutical Co., Ltd. (Japan)

- Argenx SE (Netherlands)

- Sanquin Plasma Products B.V. (Netherlands)

- Fresenius Kabi AG (Germany)

- Rhein-Minapharm Biogenetics SAE (Egypt)

Latest Developments in Global Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market

- In March 2025, A comprehensive analysis of the CIDP pipeline highlights a promising future with emerging therapies. Notable developments include Sanofi's Riliprubart, an IgG4 humanized monoclonal antibody in Phase III clinical trials, and Immunovant Sciences GmbH's Batoclimab, an FcRn antagonist in a Phase II study. These indicate a shift towards novel treatment modalities and a strong industry commitment to addressing unmet needs in the CIDP community

- In May 2025, Nuvig Therapeutics announced that the first patient has been dosed in its Phase 2 clinical trial evaluating NVG-2089 for CIDP. NVG-2089 is a recombinant human IgG1-Fc fusion protein designed to mimic the immunomodulatory mechanisms of intravenous immunoglobulin (IVIg), aiming to provide a more consistent, scalable, and convenient alternative to the current standard of care

- In March 2025, Muscular Dystrophy Association Clinical & Scientific Conference underscored the substantial clinical and economic burden of CIDP on healthcare systems, caregivers, and patients. This highlights the ongoing need for improved management strategies and support networks, driving further research and development in the field

- In January 2024, Takeda Pharmaceutical Company Limited received FDA approval for its GAMMAGARD LIQUID as an IVIG therapy for adults diagnosed with CIDP. This approval supports long-term disease management and aims to improve neuromuscular function, reinforcing IVIG as a cornerstone of CIDP treatment

- In June 2024, The U.S. Food and Drug Administration approved Vyvgart Hytrulo (efgartigimod alfa and hyaluronidase-qvfc) for the treatment of CIDP in adults. This subcutaneous injection offers a new therapeutic option for patients, demonstrated to significantly extend the time to clinical deterioration compared to placebo

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.