Global Chromatography Consumables Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

6.48 Billion

2025

2033

USD

4.47 Billion

USD

6.48 Billion

2025

2033

| 2026 –2033 | |

| USD 4.47 Billion | |

| USD 6.48 Billion | |

|

|

|

|

Chromatography Consumables Market Size

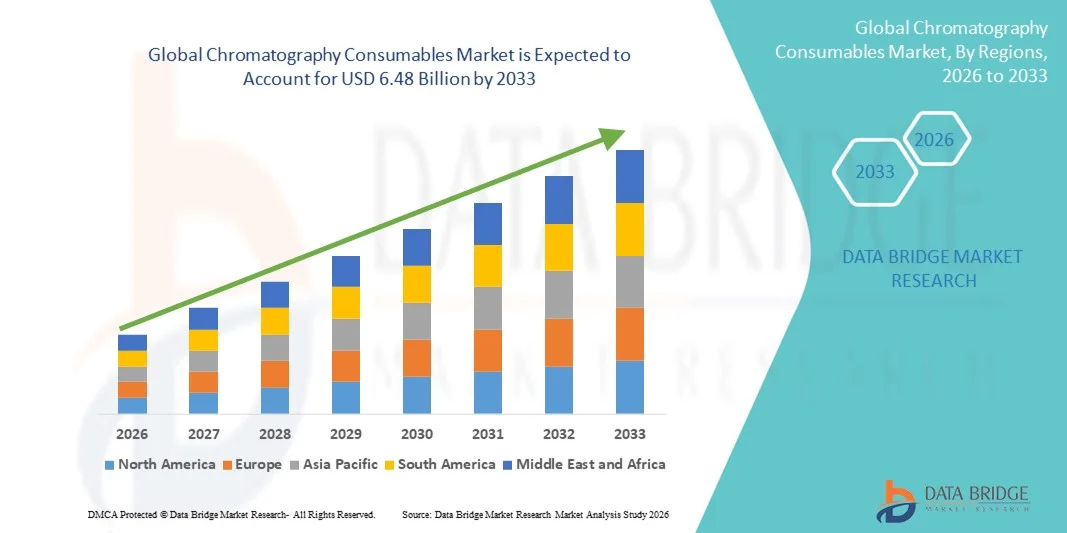

- The global chromatography consumables market size was valued at USD 4.47 billion in 2025 and is expected to reach USD 6.48 billion by 2033, at a CAGR of 4.76% during the forecast period

- The market growth is largely driven by the increasing adoption of chromatography techniques across pharmaceutical, biotechnology, food & beverage, and environmental testing sectors, supported by rising R&D activities and stringent regulatory requirements

- Furthermore, growing demand for high-purity reagents, columns, resins, and other consumables for accurate separation and analysis is positioning chromatography consumables as essential tools in modern analytical workflows, significantly accelerating overall market growth

Chromatography Consumables Market Analysis

- Chromatography consumables, including prepacked columns, vials and well plates, tubing, and syringe filters, are essential components of analytical workflows and play a critical role across pharmaceutical, biotechnology, food & agriculture, environmental, and clinical testing due to their direct influence on analytical accuracy, efficiency, and reproducibility

- The escalating demand for chromatography consumables is primarily driven by increasing pharmaceutical and biotechnology R&D activities, growing quality control requirements, expanding diagnostic testing, and stricter regulatory standards across healthcare, food safety, and environmental monitoring industries

- North America dominated the chromatography consumables market with the largest revenue share of 38.6% in 2025, supported by a well-established pharmaceutical and biotechnology ecosystem, high research funding, advanced laboratory infrastructure, and strong adoption of advanced chromatography techniques, with the U.S. accounting for a major portion of consumable demand across academic, clinical, and industrial laboratories

- Asia-Pacific is expected to be the fastest growing region in the chromatography consumables market during the forecast period due to rapid growth in pharmaceutical manufacturing, increasing investments in life sciences research, expanding hospital and diagnostic laboratory networks, and rising adoption of chromatography techniques across emerging economies

- Liquid chromatography segment dominated the chromatography consumables market with a market share of 47.5% in 2025, driven by its extensive use in pharmaceutical quality control, biologics analysis, food safety testing, and environmental monitoring, along with the high recurring demand for related consumables such as prepacked columns, syringe filters, and vials

Report Scope and Chromatography Consumables Market Segmentation

|

Attributes |

Chromatography Consumables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Chromatography Consumables Market Trends

Rising Adoption of Advanced Liquid Chromatography in Regulated Industries

- A significant and accelerating trend in the global chromatography consumables market is the increasing adoption of advanced liquid chromatography techniques, particularly high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC), across regulated industries such as pharmaceuticals, biotechnology, and food testing, driven by the need for higher sensitivity and faster analysis

- For instance, pharmaceutical manufacturers are increasingly utilizing UHPLC-compatible prepacked columns and syringe filters to achieve higher resolution and reduced run times during drug development and quality control processes, supporting compliance with stringent regulatory standards

- Technological advancements in chromatography consumables, such as improved stationary phase chemistries, low-bleed materials, and enhanced column durability, are enabling more reliable and reproducible separations, especially for complex biologics and impurity profiling applications

- The growing focus on analytical accuracy and trace-level detection is driving demand for high-quality consumables including vials, well plates, and tubing that minimize contamination and sample loss throughout analytical workflows

- The increasing shift toward automation and high-throughput laboratory workflows is further boosting demand for standardized and automation-compatible chromatography consumables to support large sample volumes

- This trend toward high-performance, automation-ready, and application-specific chromatography consumables is reshaping laboratory purchasing behavior, prompting suppliers to expand specialized and validated consumable portfolios

Chromatography Consumables Market Dynamics

Driver

Growing Demand Driven by Expanding Pharmaceutical and Biotech R&D

- The increasing scale of pharmaceutical and biotechnology research and development activities, combined with the rising production of biologics and biosimilars, is a key driver fueling demand for chromatography consumables

- For instance, in recent years, multiple biopharmaceutical companies have expanded biologics manufacturing capacities, increasing routine use of liquid chromatography consumables for protein purification, quality testing, and batch release analysis

- As drug development pipelines grow more complex, chromatography consumables are essential for ensuring accurate separation, identification, and quantification of active pharmaceutical ingredients and impurities throughout development and commercialization stages

- Furthermore, the expansion of hospital and diagnostic laboratories and the rising use of chromatography in clinical and translational research are strengthening recurring demand for consumables across healthcare settings

- Stringent regulatory requirements from authorities such as the FDA and EMA are increasing mandatory testing frequencies, thereby driving consistent and repeat demand for chromatography consumables

- The recurring replacement nature of chromatography consumables, combined with growing testing volumes, biologics expansion, and stricter regulatory oversight, continues to propel sustained market growth globally

Restraint/Challenge

High Consumable Costs and Method Standardization Challenges

- The relatively high cost of premium chromatography consumables, particularly advanced prepacked columns and high-purity syringe filters, poses a challenge for cost-sensitive laboratories, especially in academic and emerging market settings

- For instance, laboratories operating under fixed research budgets may limit frequent column replacement or delay upgrades to advanced consumables, potentially impacting analytical efficiency and throughput

- Variability in consumable performance across suppliers can create method standardization challenges, requiring extensive validation and compatibility testing when switching vendors or adopting new consumable formats

- In addition, improper handling, storage, or reuse of consumables can lead to inconsistent results, increased downtime, and higher overall operational costs for laboratories

- Supply chain disruptions and limited local availability of specialized consumables can delay testing timelines and impact laboratory productivity in certain regions

- Overcoming these challenges through cost optimization strategies, improved standardization, supplier validation, and enhanced user training will be critical for sustaining long-term market adoption

Chromatography Consumables Market Scope

The market is segmented on the basis of product, technology, and application.

- By Product

On the basis of product, the global chromatography consumables market is segmented into prepacked columns, vials and well plates, tubing, and syringe filters. The prepacked columns segment dominated the market with the largest revenue share in 2025, driven by their critical role in both analytical and preparative chromatography workflows across pharmaceuticals, biotechnology, and food testing industries. Prepacked columns offer consistent performance, reduced preparation time, and high reproducibility, making them highly preferred in regulated laboratory environments. Their widespread use in liquid chromatography systems for quality control and method validation further supports their dominance. In addition, increasing biologics production and protein purification activities have significantly boosted demand for high-performance prepacked columns. The availability of application-specific columns tailored for different analytes also enhances their adoption. The recurring replacement cycle of columns due to performance degradation further contributes to sustained revenue generation.

The syringe filters segment is expected to witness the fastest growth during the forecast period, owing to rising sample preparation requirements across pharmaceutical, environmental, and food testing laboratories. Syringe filters play a crucial role in removing particulates and preventing column damage, making them essential for extending instrument life and ensuring data accuracy. The increasing volume of routine analytical testing and high-throughput workflows is driving frequent usage of syringe filters. Growth in diagnostic laboratories and academic research is also contributing to rising demand. Moreover, advancements in membrane materials and compatibility with a wide range of solvents are improving filter efficiency. Their relatively low cost and high replacement frequency further support rapid market expansion.

- By Technology

On the basis of technology, the market is segmented into liquid chromatography, gas chromatography, and others. Liquid chromatography held the largest market revenue share of 47.5% in 2025, driven by its extensive application across pharmaceuticals, biotechnology, food safety, and environmental analysis. Liquid chromatography is widely used for complex sample analysis, impurity profiling, and biomolecule separation, making it indispensable in regulated industries. The growing adoption of HPLC and UHPLC techniques has significantly increased demand for associated consumables such as columns, vials, and syringe filters. Regulatory requirements for precise and reproducible analytical results further reinforce reliance on liquid chromatography. Its compatibility with a wide range of detectors and sample types also supports broad adoption. Continuous technological advancements improving resolution and throughput strengthen its dominant position.

Gas chromatography is anticipated to be the fastest growing technology segment during the forecast period, supported by increasing applications in environmental monitoring, oil and gas analysis, and food testing. Gas chromatography is particularly effective for volatile and semi-volatile compound analysis, driving its adoption in regulatory compliance testing. Rising environmental regulations related to air and water quality are increasing the use of GC-based analytical methods. Improvements in GC column materials and detector sensitivity are enhancing analytical performance. The expansion of petrochemical and energy industries in emerging regions further supports growth. In addition, lower operational costs compared to some advanced LC systems make GC attractive for routine testing laboratories.

- By Application

On the basis of application, the market is segmented into academics and research, hospitals and diagnostic laboratories, pharmaceuticals, food and agriculture, biotech, oil and gas, environmental agencies, and others. The pharmaceuticals segment dominated the chromatography consumables market in 2025, driven by extensive use of chromatography in drug discovery, development, and quality control processes. Pharmaceutical companies rely heavily on chromatography consumables for impurity analysis, stability testing, and batch release activities. Increasing drug development pipelines and stringent regulatory requirements are driving frequent and recurring consumable usage. The rise in generic drugs and contract manufacturing organizations is further boosting demand. Chromatography is also essential for ensuring compliance with global regulatory standards such as FDA and EMA guidelines. The high volume of routine testing across production stages reinforces the segment’s leading market share.

The biotech segment is expected to register the fastest growth during the forecast period, fueled by rapid expansion of biologics, biosimilars, and cell and gene therapy development. Biotechnology applications require highly specialized and high-purity chromatography consumables for protein purification and characterization. Increasing investment in life sciences research and biopharmaceutical innovation is accelerating consumable demand. The complexity of biologic molecules necessitates advanced and frequently replaced consumables. Growth in clinical trials and biologics manufacturing capacity is further driving usage. In addition, rising adoption of chromatography in upstream and downstream bioprocessing supports sustained segment expansion.

Chromatography Consumables Market Regional Analysis

- North America dominated the chromatography consumables market with the largest revenue share of 38.6% in 2025, supported by a well-established pharmaceutical and biotechnology ecosystem, high research funding, advanced laboratory infrastructure, and strong adoption of advanced chromatography techniques

- Laboratories and research institutions in the region place high importance on analytical accuracy, regulatory compliance, and high-throughput testing, driving consistent demand for chromatography consumables such as prepacked columns, syringe filters, and vials across pharmaceutical, biotech, and diagnostic applications

- This strong market position is further supported by a well-established life sciences ecosystem, stringent regulatory standards, early adoption of advanced chromatography technologies, and sustained investments in drug development, clinical research, and environmental testing, reinforcing North America’s leadership in the global market

U.S. Chromatography Consumables Market Insight

The U.S. chromatography consumables market captured the largest revenue share within North America in 2025, driven by the strong presence of pharmaceutical and biotechnology companies and extensive investments in research and development. Laboratories across the country increasingly prioritize high-precision analytical techniques for drug discovery, quality control, and regulatory compliance. The widespread adoption of advanced liquid chromatography systems, coupled with stringent FDA regulations, is sustaining consistent demand for high-quality consumables. In addition, the expansion of diagnostic laboratories and contract research organizations is further strengthening market growth. Continuous innovation in life sciences and analytical testing infrastructure remains a key contributor to market expansion in the U.S.

Europe Chromatography Consumables Market Insight

The Europe chromatography consumables market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by strict regulatory standards related to pharmaceuticals, food safety, and environmental testing. Increasing investments in biotechnology research and growing adoption of chromatography techniques across academic and industrial laboratories are supporting market growth. European laboratories emphasize analytical accuracy, sustainability, and method standardization, which drives demand for high-quality consumables. Growth is observed across pharmaceutical manufacturing, environmental monitoring, and food and agriculture testing applications. The presence of well-established research institutions and life sciences clusters further supports regional expansion.

U.K. Chromatography Consumables Market Insight

The U.K. chromatography consumables market is anticipated to grow at a notable CAGR during the forecast period, supported by strong pharmaceutical research activity and an expanding biotechnology sector. Increasing government and private funding for life sciences research is driving higher utilization of chromatography techniques in academic and industrial laboratories. The country’s focus on regulatory compliance and quality assurance in drug development is fueling recurring demand for consumables. In addition, the growing role of contract research and manufacturing organizations is contributing to sustained market growth. Advancements in analytical testing for clinical and translational research further support market expansion.

Germany Chromatography Consumables Market Insight

The Germany chromatography consumables market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong pharmaceutical, chemical, and biotechnology industries. Germany’s emphasis on precision engineering and high-quality manufacturing aligns well with the adoption of advanced chromatography techniques. Increasing environmental testing and food safety analysis are also contributing to consumable demand. The presence of well-developed laboratory infrastructure and a strong focus on research innovation support market growth. In addition, compliance with stringent European regulatory frameworks is reinforcing the need for reliable and high-performance consumables.

Asia-Pacific Chromatography Consumables Market Insight

The Asia-Pacific chromatography consumables market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid expansion of pharmaceutical manufacturing, rising investments in life sciences research, and increasing adoption of advanced analytical technologies. Countries such as China, Japan, and India are witnessing significant growth in drug development and quality testing activities. Expanding hospital and diagnostic laboratory networks are further boosting consumable demand. Government initiatives supporting biotechnology and pharmaceutical self-sufficiency are accelerating market growth. The region’s cost-effective manufacturing capabilities are also improving accessibility to chromatography consumables.

Japan Chromatography Consumables Market Insight

The Japan chromatography consumables market is gaining momentum due to the country’s advanced research ecosystem, strong pharmaceutical sector, and emphasis on analytical precision. Japanese laboratories place high importance on accuracy, reproducibility, and regulatory compliance, driving steady demand for chromatography consumables. Growth in biologics research and environmental testing is further supporting market expansion. The integration of advanced chromatography techniques in academic and industrial research is becoming increasingly prevalent. In addition, Japan’s aging population is indirectly increasing demand for pharmaceutical and clinical research, supporting consumable usage.

India Chromatography Consumables Market Insight

The India chromatography consumables market accounted for a significant revenue share in Asia Pacific in 2025, driven by rapid growth in pharmaceutical manufacturing, expanding biotechnology research, and increasing adoption of quality testing standards. India’s position as a global hub for generic drug production is fueling extensive use of chromatography consumables in quality control and regulatory compliance. Rising investments in academic research and diagnostic laboratories are further supporting market growth. Government initiatives promoting pharmaceutical innovation and self-reliance are accelerating adoption of advanced analytical techniques. The availability of cost-effective consumables and a growing skilled workforce continue to strengthen India’s market position

Chromatography Consumables Market Share

The Chromatography Consumables industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Waters Corporation (U.S.)

- Shimadzu Corporation (Japan)

- PerkinElmer, Inc. (U.S.)

- Merck KGaA (Germany)

- Bio Rad Laboratories, Inc. (U.S.)

- GE Healthcare (U.S.)

- Restek Corporation (U.S.)

- Phenomenex Inc. (U.S.)

- Danaher (U.S.)

- Sartorius AG (Germany)

- Hamilton Company (U.S.)

- Tosoh Corporation (Japan)

- JASCO, Inc. (Japan)

- GL Sciences Inc. (Japan)

- Avantor, Inc. (U.S.)

- KNAUER Wissenschaftliche Geräte GmbH (Germany)

- Macherey Nagel GmbH & Co. KG (Germany)

- Metrohm AG (Switzerland)

What are the Recent Developments in Global Chromatography Consumables Market?

- In June 2025, Waters Corporation announced the upcoming release of Alliance iS HPLC System Software version 2.0, introducing advanced end-to-end traceability, authenticated user access, and enhanced data integrity for liquid chromatography workflows, setting a new standard for QA/QC compliance and security in laboratories

- In June 2025, a leading laboratory equipment manufacturer (unnamed in press releases) launched an advanced line of chromatography consumables, including precision columns, vials, and filtration systems designed for high-throughput analytical workflows in pharmaceutical and biotech research laboratories

- In April 2025, Waters Corporation expanded its Alliance iS Bio HPLC product line with a new integrated photodiode array (PDA) detector, boosting spectral analysis capabilities and sensitivity for biopharmaceutical development and quality control labs, enabling richer impurity and peak purity characterization

- In September 2024, Agilent Technologies launched the Agilent J&W 5Q GC/MS column series, setting a new benchmark for GC/MS column performance with improved inertness and low-bleed properties tailored for challenging environmental and food testing applications

- In August 2024, Agilent Technologies announced the launch of new Agilent J&W 5Q GC/MS columns, featuring ultra-inert performance and ultra-low-bleed technology that enhances sensitivity, durability, and peak symmetry for trace-level gas chromatography/mass spectrometry applications, improving data quality and reducing the need for frequent column changes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.