Global Chip Scale Package Csp Leds Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

8.13 Billion

2024

2032

USD

2.10 Billion

USD

8.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 8.13 Billion | |

|

|

|

|

Chip-Scale Package (CSP) LEDs Market Size

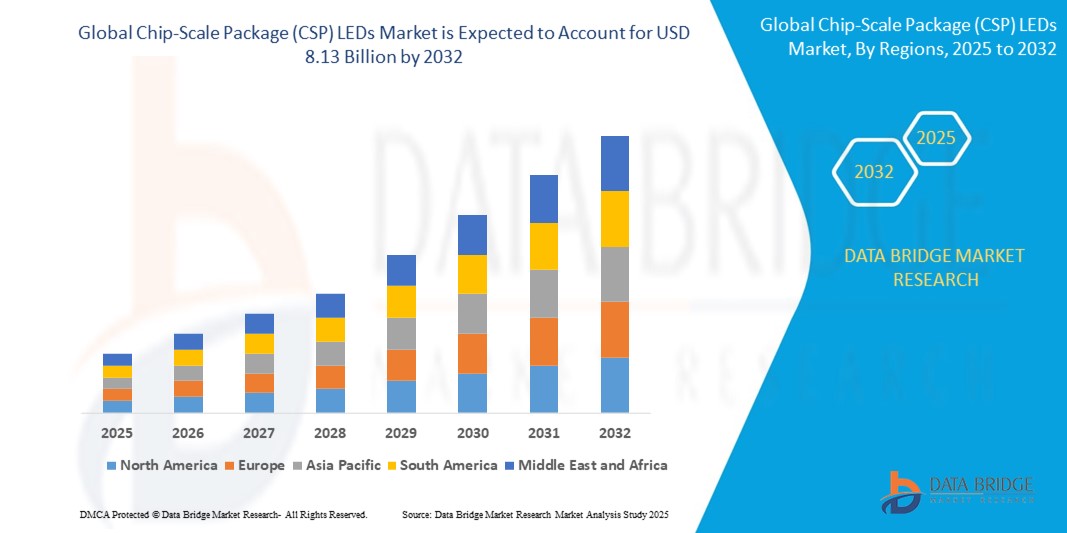

- The global Chip-Scale Package (CSP) LEDs Market size was valued at USD 2.10 billion in 2024 and is expected to reach USD 8.13 billion by 2032, at a CAGR of 16.2% during the forecast period

- This growth is driven by factors such as the Energy Efficiency and Sustainability, Technological Advancements in LED Manufacturing, and Growing Adoption in Automotive Lighting Applications

Chip-Scale Package (CSP) LEDs Market Analysis

- Traditional LEDs generally undergo from the chip/die manufacturing to packaging processes where the die would be attached to an interposer such as a yielding a packaged LED, ceramic substrate or LED package.

- Chip-scale package (CSP) LEDs have some separate steps of having manufactured chips going through a packaging line which are eliminated because at the die-level itself the chips are cingulated and coated with phosphor.

- Asia-pacific dominates the chip-scale package (CSP) LEDs market due to rising presence of key market players, rising demand for CSP LED by the automotive industry for replacement of headlights and increasing adoption in general lighting applications in this region.

- North America is expected to be the fastest growing region in the Chip-Scale Package (CSP) LEDs Market during the forecast period due to increasing demand for energy-efficient lighting solutions and advancements in LED technology across industries like automotive, consumer electronics, and general lighting.

- High-Power segment is expected to dominate the market with a market share of 52.89% due to its superior brightness and thermal performance. These LEDs are ideal for demanding applications like automotive lighting and outdoor displays where high intensity is required.

Report Scope and Chip-Scale Package (CSP) LEDs Market Segmentation

|

Attributes |

Chip-Scale Package (CSP) LEDs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chip-Scale Package (CSP) LEDs Market Trends

“Miniaturization of Electronic Devices”

- As technology evolves, gadgets like smartphones, wearables, and even medical devices are getting smaller and more compact. However, performance can’t be compromised — they still need bright, efficient lighting solutions that don’t take up much space. CSP LEDs are perfect for this because they’re tiny yet powerful. Unlike traditional LEDs, CSPs don’t require a substrate package, which means they can be embedded directly into circuits.

- This helps manufacturers reduce device size while improving brightness and energy efficiency. As consumers demand sleeker, lighter electronics with longer battery life, CSP LEDs are becoming a go-to solution. The push toward miniaturization is especially strong in industries like healthcare, consumer tech, and automotive. With more products needing smarter, smaller lighting, the use of CSP LEDs is growing rapidly across sectors.

- For instance, In July 2024 , a medical tech firm introduced a next-gen endoscope equipped with CSP LEDs, helping doctors see inside the body more clearly through thinner and more flexible tools.

Chip-Scale Package (CSP) LEDs Market Dynamics

Driver

“Growing Demand for Compact and High-Performance Lighting”

- As devices like smartphones, smartwatches, and electric cars get thinner and more advanced, there’s a strong need for lighting components that are small but powerful. CSP LEDs fit this need perfectly because they don’t need a separate package — they’re tiny and can be placed directly on circuits.

- This helps manufacturers save space while still getting bright, efficient light output. Industries like automotive, consumer electronics, and healthcare are all moving toward smaller, smarter products, which is driving up demand for CSP LED technology. As innovation continues and gadgets become even more compact, CSP LEDs will play an even bigger role in modern design

For instance,

- In January 2025 , a wireless earbud brand added a tiny CSP LED to show charging status without making the earbuds heavier or bulkier.

Opportunity

“Growth in Automotive Lighting”

- The automotive industry is rapidly adopting CSP LEDs due to their compact size, high brightness, and energy efficiency. As vehicles become more advanced, especially with electric and autonomous cars on the rise, lighting systems like headlights, taillights, and interior lighting need better performance without taking up much space. CSP LEDs offer a solution by providing brighter light output while using less power.

- This makes them ideal for modern car designs that focus on style, safety, and sustainability. With trends like adaptive driving beams and smart lighting systems, the demand for CSP LEDs in automotive applications is growing fast. Governments are also pushing for greener technologies, which supports this shift. As more car manufacturers look to upgrade their lighting solutions, the CSP LED market has a big chance to grow alongside them.

For instance,

- In January 2024 , a Japanese auto supplier launched brake lights using CSP LED technology that turned on faster and lasted longer than older bulbs, helping reduce rear-end collision risks in their latest sedan lineup.

Restraint/Challenge

“High Manufacturing and Development Costs”

- Even though CSP LEDs offer great benefits, making them at scale can be expensive. The production process needs high-precision equipment and special materials, which drives up manufacturing costs. Unlike regular LEDs, CSPs don’t have a standard package, so assembling them requires extra care and investment.

- Smaller companies may not have the budget to adopt this technology, slowing down its spread in some markets. Also, as demand grows, suppliers face pressure to maintain quality while lowering prices — which isn't easy. Until production becomes more cost-effective, many businesses might stick with cheaper alternatives, limiting the growth of CSP LEDs in certain areas.

For instance,

- By March 2025, a local lighting firm was still testing CSP LEDs due to the high initial investment needed for full-scale production.

Chip-Scale Package (CSP) LEDs Market Scope

The market is segmented on the basis power ranges, application, end-user and packaging material.

|

Segmentation |

Sub-Segmentation |

|

Power ranges |

|

|

Application |

|

|

End User |

|

|

Packaging material |

|

In 2025, the cataract surgery is projected to dominate the market with a largest share in segment

In 2025, cataract surgery is projected to dominate the ophthalmic surgery market with a share of 52.89% in the surgical procedures segment . This growth is driven by an aging global population and rising prevalence of cataracts. Technological advancements, such as femtosecond laser-assisted surgeries, are enhancing outcomes and boosting adoption. Increasing healthcare spending and improved access to eye care services also contribute to this trend. The demand for refractive cataract surgery is further fueling market expansion.

The Mid-Power is expected to account for the largest share during the forecast period in market

In 2025, The Mid-Power segment is expected to account for the largest market share of 48.65% during the forecast period in the wireless charging market . This growth is driven by rising adoption in consumer electronics such as smartphones and wearables. Increasing demand for convenient and efficient charging solutions supports mid-power applications. Technological advancements and standardization across industries are further boosting market penetration. Additionally, growing investments in IoT and smart devices are fueling the demand for mid-power wireless charging systems.

Chip-Scale Package (CSP) LEDs Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Chip-Scale Package (CSP) LEDs Market”

- The Asia-Pacific region is expected to hold the largest share in the Chip-Scale Package (CSP) LEDs market in the coming years. This growth is driven by the rising demand for energy-efficient lighting solutions across various industries. Countries like China, Japan, and South Korea are leading the market due to their strong manufacturing base and technological advancements. The increasing adoption of CSP LEDs in consumer electronics, automotive lighting, and general lighting applications is boosting the market in the region. Government initiatives promoting energy conservation are also encouraging the use of LED lighting.

- Additionally, rapid urbanization and infrastructure development are contributing to higher demand. The presence of major LED manufacturers and suppliers in Asia-Pacific further supports market growth. With growing investments in R&D and smart lighting technologies, the region is well-positioned for continued expansion. The rise in disposable income and awareness about energy-saving products is also fueling consumer demand. All these factors combined are making Asia-Pacific the leading market for CSP LEDs globally.

“North America is Projected to Register the Highest CAGR in the Chip-Scale Package (CSP) LEDs Market”

- North America is expected to see the fastest growth in the Chip-Scale Package (CSP) LEDs market over the coming years. This growth is fueled by increasing demand for compact, energy-efficient lighting in sectors like automotive, consumer electronics, and healthcare. The region’s focus on advanced technologies and smart lighting systems supports this trend.

- Strong R&D capabilities and investments from leading tech firms are accelerating CSP LED adoption. The push for sustainable and low-power lighting in homes and businesses also contributes to this rise. North America’s growing EV and smart vehicle market further boosts the need for compact LEDs.

- The presence of key players and start-ups in the U.S. enhances innovation. Government support for energy-efficient solutions adds another layer of momentum. Demand for premium displays and wearables is also helping drive CSP LED integration. Overall, North America is on a fast track in this evolving market.

Chip-Scale Package (CSP) LEDs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Lumileds Holding B.V.,

- SAMSUNG,

- Seoul Semiconductor Co., Ltd.,

- LG INNOTEK,

- OSRAM GmbH,

- NICHIA CORPORATION,

- EPISTAR Corporation,

- Cree Inc.,

- Genesis Photonics Inc.,

- Modern Lighting,

- Lextar Electronics Corporation,

- Shenzhen MTC,

- Unistars,

- Dpower Opto-electronic Co.Ltd, Plessey,

- Cambridge Nanotherm Limited,

- Hongli Zhihui Group Co.LTD.,

- Bridgelux Inc.,

- EVERLIGHT,

- Flory Optoelectronic Materials Co. Ltd.,

- Dow,

- TDK Corporation,

- Jiangsu Bree Optronics Co. Ltd.

Latest Developments in Global Chip-Scale Package (CSP) LEDs Market

- In March 2025, Seoul Semiconductor showcased its SunLike LED technology at the JAPAN SHOP 2025 exhibition in Tokyo. This innovation aims to replicate the full spectrum of natural sunlight, promoting eye health and enhancing learning efficiency. Clinical trials have validated benefits such as myopia prevention and improved memory retention. Seoul Semiconductor continues to lead in LED innovation with over 18,000 patents and significant annual R&D investments.

- At CES 2025 in Las Vegas, LG Innotek unveiled its Nexlide A+ vehicle lighting module, which won the CES 2025 Innovation Award. Additionally, the company introduced the RGB-IR In-Cabin Camera Module, designed for advanced driver-assistance systems (ADAS). These innovations underscore LG Innotek's commitment to future mobility solutions, attracting significant interest from industry professionals and customers.

- In January 2025, Samsung showcased its 2025 TV lineup featuring anti-glare screens and AI-powered features under the Vision AI brand. The S95F QD-OLED model boasts a brightness of 4,000 nits and improved glare-free coatings. Vision AI includes tools like AI Upscaling and Auto HDR Remastering, enhancing the viewing experience. These advancements reflect Samsung's focus on integrating cutting-edge technology into its display products.

- In early 2025, Cree announced the launch of its latest CSP LED products, designed to offer higher efficiency and compactness for various applications. These products aim to meet the growing demand for energy-efficient lighting solutions in both consumer and industrial sectors. Cree's continued innovation in CSP LED technology positions it as a key player in the market.

- In February 2025, Bridgelux introduced a new line of CSP LED solutions tailored for automotive and architectural lighting applications. These LEDs offer enhanced thermal management and color consistency, addressing the specific needs of high-performance lighting systems. Bridgelux's commitment to quality and innovation continues to drive advancements in the CSP LED market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chip Scale Package Csp Leds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chip Scale Package Csp Leds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chip Scale Package Csp Leds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.