Global Chinese Hamster Ovary Cells Cho Market

Market Size in USD Million

CAGR :

%

USD

394.42 Million

USD

750.54 Million

2024

2032

USD

394.42 Million

USD

750.54 Million

2024

2032

| 2025 –2032 | |

| USD 394.42 Million | |

| USD 750.54 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) Cells Market Size

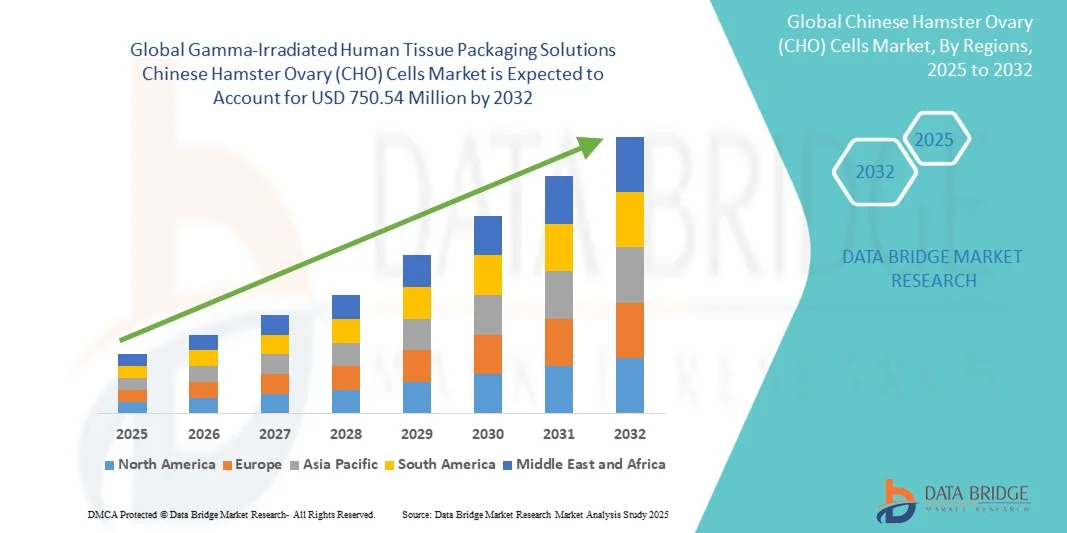

- The Global Chinese Hamster Ovary (CHO) Cells Market was valued at USD 394.42 Million in 2024 and is expected to reach USD 750.54 Million by 2032 at a CAGR of 8.5% during the forecast period

- This growth is driven by factors such as increasing demand for biologics, advancements in cell line engineering, rising investments in biotechnology research, and expanding applications in gene therapy

- Furthermore, continuous technological advancements in cell line engineering, process optimization, and bioproduction automation are enhancing productivity and product quality. These converging factors are accelerating CHO cell utilization in biologics development, thereby significantly boosting the market’s growth

Chinese Hamster Ovary (CHO) Cells Market Analysis

- Chinese Hamster Ovary (CHO) cells are a type of mammalian cell line which is commonly used in biotechnology and biomedical research, particularly in the field of cell culture and bioprocessing. These cells have become essential tools in biotechnology and biomedical research. CHO cells are known for their adherence to culture surfaces, robust growth characteristics, and ability to express recombinant proteins.

- One of the primary uses of CHO cells is in the production of recombinant proteins, including therapeutic antibodies and enzymes. They can be genetically engineered to express specific genes of interest, and their capacity for performing post-translational modifications similar to human cells ensures the quality of biopharmaceutical products. CHO cells are also renowned for their genetic stability, which means they introduced genetic modifications consistently over multiple generations, ensuring the reliability and consistency of bioprocessing.

- In 2025, the North America is expected to dominate the Global Chinese Hamster Ovary (CHO) Cells Market with a 40.21% market share, while Asia-Pacific is projected to be the fastest-growing region with a CAGR of 10.1% due to increasing biopharmaceutical research, expanding biologics manufacturing capabilities, rising investments in biotechnology, and supportive government initiatives promoting biosimilar production

- In 2025, the services segment is expected to dominate the Global Chinese Hamster Ovary (CHO) Cells Market with a 66.56% market share owing to the increasing demand for specialized services related to CHO cell line development, bioprocessing, and contract manufacturing.

Report Scope and Ophthalmic Operational Microscope Market Segmentation

|

Attributes |

Ophthalmic Operational Microscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) Cells Market Trends

“Growing Integration of Artificial Intelligence (AI) in Cell Line Development”

- One prominent trend in the Global Chinese Hamster Ovary (CHO) Cells Market is the increasing integration of artificial intelligence (AI) in cell line development and bioprocess optimization

- AI algorithms are being used to analyze large datasets, predict optimal culture conditions, and identify high-yielding clones more efficiently than traditional methods

- For instance, machine learning models can process experimental data to predict cell performance, reducing the time and cost associated with trial-and-error approaches in CHO cell-based production

- This technology enables faster development timelines, improved product quality, and better scalability for biologic manufacturing

- The use of AI is transforming CHO cell research and biomanufacturing, leading to increased efficiency, reduced development costs, and a competitive edge for companies adopting advanced digital solutions

Chinese Hamster Ovary (CHO) Cells Market Dynamics

Driver

“Rising Use of CHO Cells in the Genetic Study”

- Rising application of Chinese Hamster Ovary (CHO) cells in genetic research is a clear and accelerating driver for the global CHO market. As genetic tools (CRISPR, RMCE, RNA-seq, single-cell multi-omics) mature, CHO cells are no longer merely production hosts; they are experimental platforms for dissecting genotype–phenotype relationships, testing gene-editing strategies, and rationally engineering host traits (growth, productivity, glycosylation, stress tolerance)

- That shift expands demand across three linked market vectors: (1) upstream—licensed/engineered CHO cell lines and gene-editing services; (2) process development—analytics, omics, digital-twin and AI tools needed to translate genetic insights into stable high-yield clones; and (3) manufacturing—CDMO capacity and single-use/continuous platforms optimized for genetically enhanced hosts

- In short, genetic-study activity feeds an expanding ecosystem (software, analytics, cell-banking, reagents, CDMO runs), increasing both the breadth and depth of commercial CHO offerings and therefore raising market size, billings, and strategic importance of CHO-derived manufacturing capabilities

- For Instance- In January 2025, an article in NIH stated that a genome-scale, non-viral CRISPR knockout screening dataset for CHO-K1 and derived recombinant cells was published (Sci Data), providing a comprehensive resource to identify genes that affect cell fitness and protein production—evidence that functional genomic screening in CHO is now mature, publicly documented, and directly informing cell-engineering programs

- In April 2025, article published in NIH stated that a meta-analysis of CHO transcriptomes (“Fantastic genes…”) was accepted/published on PMC (open-access) after revision in early 2025; the paper integrates RNA-seq and epigenetic data across hundreds of CHO samples and calls out the need for targeted genetic engineering to control expression programs—this is direct evidence that genomic/epigenomic studies of CHO are defining engineering targets for industrial cell-line improvement

- The rising use of CHO cells in genetic studies is not only reinforcing their dominance as the gold-standard expression system for biologics but also expanding their role as experimental platforms for functional genomics, regulatory testing, and cell engineering

Restraint/Challenge

“High Cost of CHO Cell–Based Production as a Market Restraint”

- The high capital and operating costs associated with CHO cell–based biologics production represent a major restraint on the global CHO cells market

- Large upfront investments in bioreactor capacity, cleanrooms, single-use systems or stainless-steel infrastructure, and specialized downstream purification equipment—combined with expensive raw materials (media, chromatography resins), skilled labour, complex regulatory compliance and long validation timelines—raise the total cost of ownership for manufacturers and CDMOs

- These cost pressures increase time-to-market, compress margins, discourage smaller developers from in-house manufacturing, and can slow adoption in lower-income regions; collectively they constrain demand for new cell lines, consumables and service contracts tied to CHO platforms

- For instance, In July 2025, the U.S. Department of Health & Human Services’ Office of the Assistant Secretary for Planning and Evaluation (HHS-ASPE) released an issue brief noting that spending on biologics has been increasing substantially and that biologics’ complexity and cost profile (development and manufacturing) are material drivers of rising drug expenditures—underscoring the economic restraint posed by biologics/CHO manufacturing costs

- In March 2024, the European Commission published policy and research material (Joint Research Centre / DG R&I analyses) noting that biotech and biomanufacturing require highly specialised equipment and skilled multidisciplinary workforces—factors that increase manufacturing unit costs and present barriers for scaling production across the EU

- Despite being the gold standard for therapeutic protein and monoclonal antibody production, CHO cell–based manufacturing remains significantly constrained by its high cost structure. Capital-intensive infrastructure requirements, costly raw materials, specialized workforce needs, and stringent compliance processes elevate overall production expenses, limiting participation by smaller firms and hindering access in emerging markets

Global Chinese Hamster Ovary (CHO) Cells Market Scope

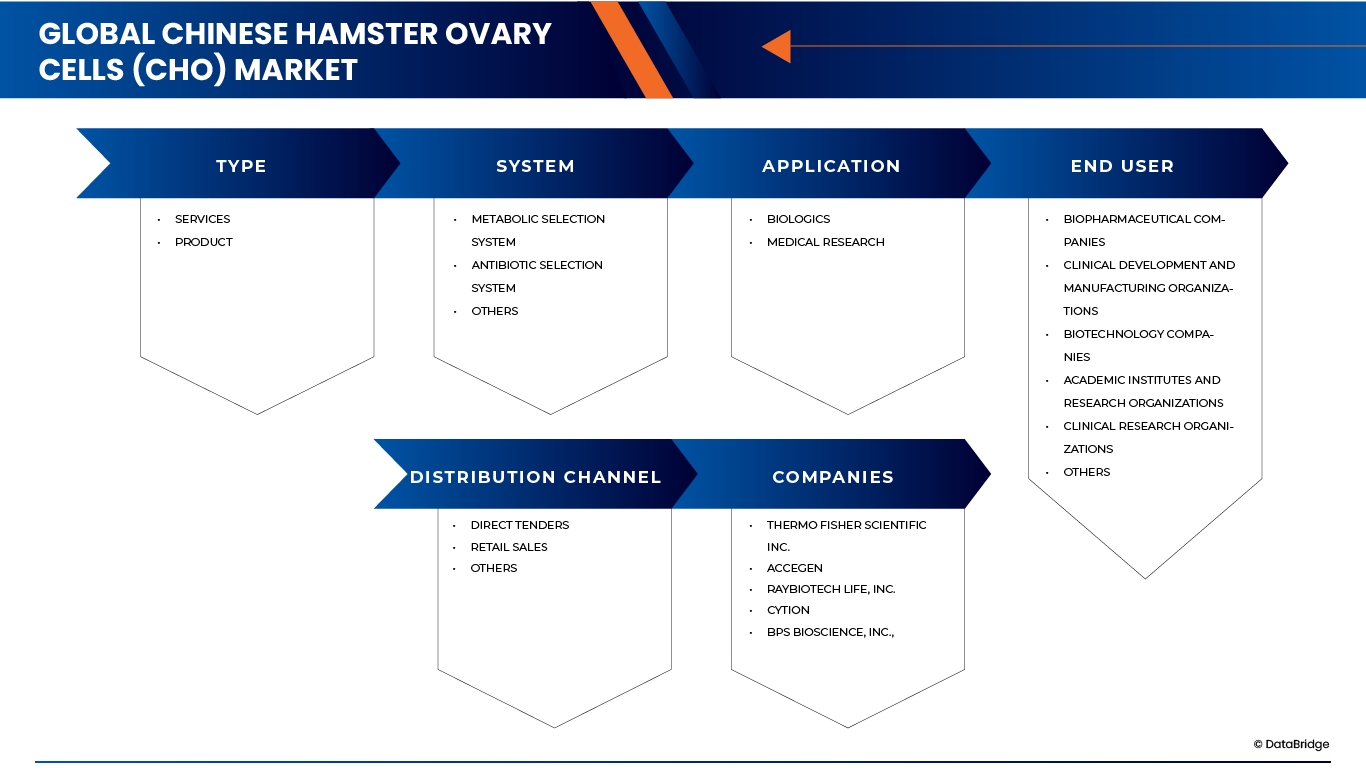

The market is segmented on the basis type, system, application, end-user, and distribution channel.

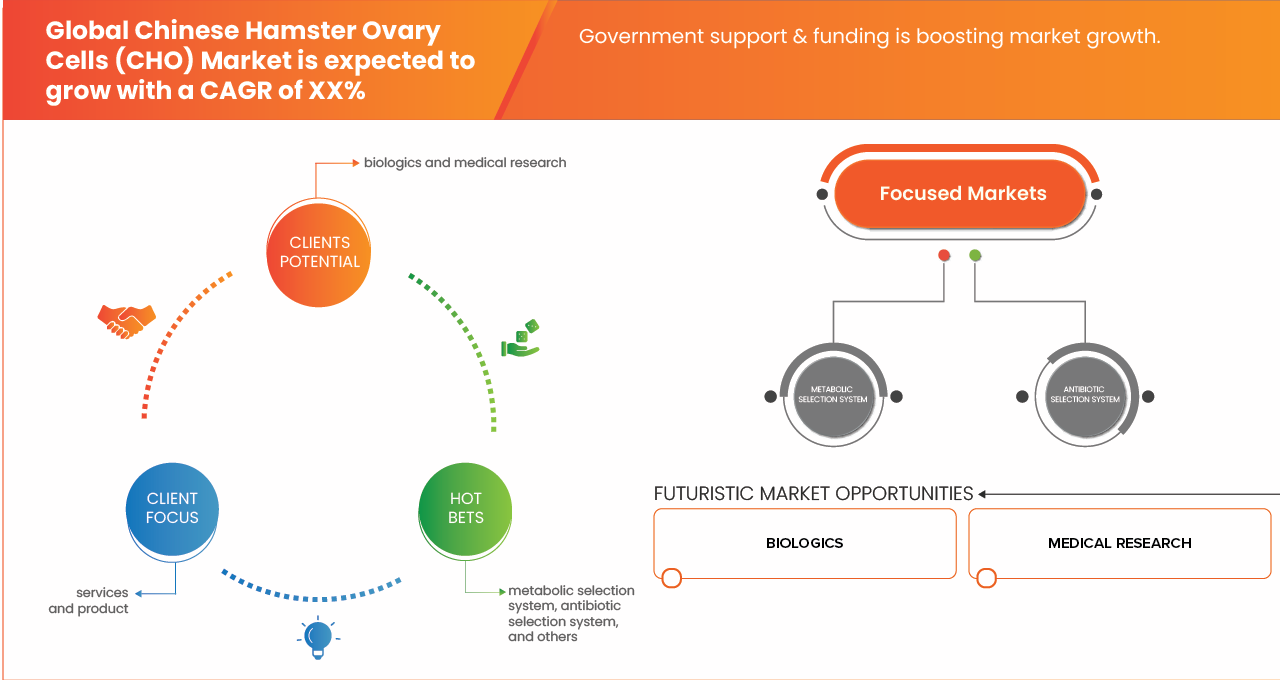

By Type

- On the basis of type, the market is segmented into services, products and others, In 2025, the services segment is expected to dominate the market with 66.56%, and expected to be fastest growing segment with 8.7% CAGR. This growth can be attributed to the increasing reliance on contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) for specialized cell line development, process optimization, and large-scale biomanufacturing. Additionally, the rising complexity of biologics production, high costs associated with in-house facilities, and growing demand for customized solutions are encouraging pharmaceutical and biotechnology companies to outsource more services. These factors collectively drive the expansion of the services segment, enhancing its market share and growth potential over the forecast period.

By System

- On the basis of system, the market is segmented into Metabolic Selection System, Antibiotic Selection System, and Others, In 2025, the Metabolic Selection System segment is expected to dominate the market with 59.45%, and expected to be fastest growing segment with 8.8% CAGR, This growth is primarily driven by the increasing adoption of metabolic selection systems for stable and high-yield recombinant protein production, as they eliminate the need for antibiotic resistance markers, reduce regulatory concerns, and enhance culture efficiency. Moreover, the growing preference for safer, cost-effective, and scalable cell line development techniques in biologics and biosimilar manufacturing further supports the expansion of this segment.

By Application

- On the basis of application, the market is segmented into Biologics, and Medical Research, In 2025, the Biologics segment is expected to dominate the market with 72.35%, and expected to be fastest growing segment with 8.6% CAGR, This growth is mainly attributed to the increasing demand for therapeutic proteins, monoclonal antibodies, and vaccines, coupled with the rising prevalence of chronic and autoimmune diseases. Additionally, advancements in bioprocessing technologies, expanding biopharmaceutical R&D investments, and the growing adoption of Chinese Hamster Ovary (CHO) cells for high-quality and scalable biologics production further propel the dominance and rapid expansion of the Biologics segment in the market.

By End User

- On the basis of end user, the market is segmented into Biopharmaceutical Companies, Biotechnology Companies, Clinical Development and Manufacturing Organizations, Clinical Research Organizations, Academic Institutes and Research Organizations, and Others, In 2025, the Biopharmaceutical Companies segment is expected to dominate the market with 44.84%, This dominance is driven by the increasing focus of biopharmaceutical companies on developing biologics, monoclonal antibodies, and gene therapies, which heavily rely on advanced cell lines like CHO cells for high-yield and high-quality protein production. Additionally, rising R&D investments, the expansion of biologics pipelines, and the need for scalable and cost-effective production processes further reinforce the leading position of biopharmaceutical companies in the market.

By Distribution Channel

On the basis of Distribution Channel, the market is segmented into Direct Tenders, Retail Sales, and Others, In 2025, the Direct Tenders segment is expected to dominate the market with 56.84%, and Retail Sales expected to be fastest growing segment with 8.6% CAGR. The dominance of direct tenders is driven by bulk procurement by large biopharmaceutical and research organizations seeking cost efficiency, reliable supply, and long-term contracts. Meanwhile, the rapid growth of retail sales is fueled by increasing accessibility of research products to smaller laboratories and academic institutes, rising demand for ready-to-use kits, and the expansion of e-commerce platforms for scientific supplies, making products more readily available across diverse end users.

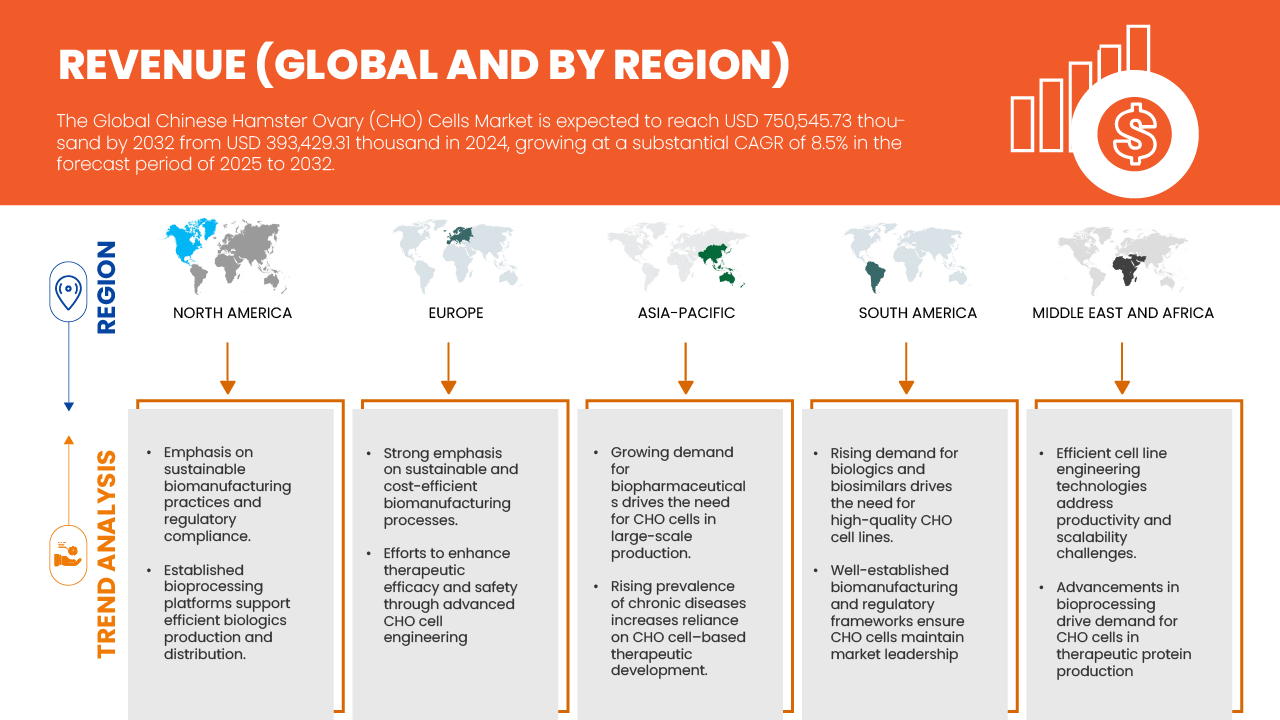

Chinese Hamster Ovary (CHO) Cells Market Regional Analysis

- North America holds the share of 40.21% in the global CHO cells market, driven by a well-established biopharmaceutical industry, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical and biotechnology companies.

- The United States, in particular, contributes significantly to regional dominance due to high R&D spending, increasing demand for biologics, and extensive use of CHO cells in the production of therapeutic proteins such as monoclonal antibodies.

- Government support for biologics development, coupled with robust regulatory frameworks and favorable reimbursement policies, further accelerates market growth. Moreover, strategic collaborations, technological advancements in cell line development, and an increase in FDA approvals for CHO cell-derived products continue to boost market expansion across the region.

U.S. CHO cells Market Insight

- The U.S. CHO cells market accounted for the largest market revenue share in the North American CHO cells market in 2025, attributed to the country’s well-established biopharmaceutical industry, significant R&D investments, presence of major biotechnology and pharmaceutical companies, advanced biologics manufacturing infrastructure, and strong government support for innovation in cell line development and biologics production.

Canada CHO cells Market Insight

- The Canada CHO cells market is expected to register a significant CAGR in North America from 2025 to 2032, driven by growing investments in biopharmaceutical research, increasing adoption of advanced cell line technologies, expansion of biologics and biosimilar production facilities, and supportive government initiatives promoting biotechnology and life sciences innovation.

Europe CHO cells Market Insight

- The Europe CHO cells market accounted for a substantial market share in 2025, driven by the presence of leading biopharmaceutical and biotechnology companies, increasing focus on biologics and monoclonal antibody production, advancements in cell line development technologies, and strong regulatory support for research and innovation in the life sciences sector.

Germany CHO cells Market Insight

- The Germany CHO cells market held the largest revenue share within Europe in 2025, fueled by a well-established biopharmaceutical industry, significant R&D investments in biologics and monoclonal antibodies, advanced manufacturing infrastructure, and strong government support for biotechnology and life sciences innovation.

U.K. CHO cells Market Insight

- The U.K. CHO cells market is growing steadily, supported by increasing investments in biopharmaceutical research, expansion of biologics and biosimilar production facilities, strong presence of biotechnology companies, and government initiatives promoting innovation and advanced cell line technologies in the life sciences sector.

Asia-Pacific CHO cells Market Insight

- The Asia-Pacific CHO cells market captured the largest share of the global CHO cells market in 2025, accounting for 22.66% of total revenue and projected to grow at the fastest CAGR of 10.1%. This growth is driven by rapid expansion of biopharmaceutical manufacturing, increasing adoption of advanced cell line technologies, rising investments in biologics and biosimilars, growing R&D activities, and supportive government policies across countries like China, India, and Japan.

China CHO cells Market Insight

- The China CHO cells market led the Asia-Pacific market in 2025, attributed to rapid growth in the biopharmaceutical industry, increasing biologics and monoclonal antibody production, substantial R&D investments, expansion of contract development and manufacturing organizations (CDMOs), and strong government support for biotechnology and advanced cell line research.

India CHO cells Market Insight

- The India CHO cells market is witnessing significant growth in the market due to rising investments in biopharmaceutical research and development, increasing focus on biologics and biosimilar production, the expansion of contract research and manufacturing organizations (CRDMOs), and supportive government initiatives promoting biotechnology and advanced cell line technologies.

Chinese Hamster Ovary (CHO) Cells Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- AcceGen (U.S.)

- RayBiotech Life, Inc. (U.S.)

- Cytion (Germany)

- BPS Bioscience, Inc. (U.S.)

- GenTarget Inc. (U.S.)

- Merck KGaA (Germany)

- Promega Corporation (U.S.)

- Abeomics (U.S.)

- Applied Biological Materials Inc. (abm) (Canada)

- ATCC (American Type Culture Collection) (U.S.)

- Sartorius AG (Germany)

- Lonza (Switzerland)

- Revvity Discovery Limited. (U.K.)

- Cytiva (U.S.)

- GTP Bioways (France)

- Curia Global, Inc. (U.S.)

Latest Developments in Global Chinese Hamster Ovary (CHO) Cells

- In February 2022, Sartorius acquired business from Novasep, added a complementary offering to its chromatography portfolio. The acquired portfolio includes chromatography systems primarily suited for small biomolecules such as oligonucleotides, peptides, and insulin, and innovative systems for the continuous production of biopharmaceuticals.

- In July 2023, Lonza launched TheraPRO CHO Media System, a new cell culture medium that simplifies processes and optimizes productivity and protein quality when using GS-CHO cell lines. The start-up supports pharmaceutical and biotech companies producing therapeutic proteins to further improve product quality. The TheraPRO CHO Media System provides efficient performance, achieving high concentrations of viable cells and protein titers above 5 g/L over a 15-day culture period. This represents more than double the protein titer that can be produced with commercially available solutions. This launch has helped the company to expand its product portfolio in the market.

- In October 2022, Thermo Fisher Scientific Inc. collaborated with ProBioGen to develop better platform the Gibco Freedom ExpiCHO-S Cell Line Development Kit. This kit allows users to generate cell lines suitable for clinical development without their own original cells, vectors, or previous experience in the field. ProBioGen significantly contributed to the performance of the Freedom ExpiCHO-S kit by leveraging its strong expertise in cell line and process development. The new series utilizes Thermo Fisher's ExpiCHO-S cell line expanding the company's product portfolio for the CHO cell line development series.

- In July 2023, Merck announced that it is expanding its facility in Lenexa, Kansas, U.S., adding 9,100 square meters of laboratory space and production capacity for the production of cell culture media. This expansion makes Lenexa the company's largest dry powder cell culture facility and a center of excellence in North America. The investment in the region reflects the company's strategy to expand and diversify its supply chain to meet current and future demand for cell culture platforms.

- In November 2022, ATCC, the world's leading regulatory and standards organization for biological materials, announced a new line of CAR-T Target luciferase reporter cell lines to support immuno-oncology (IO) discovery and the development of new immunotherapies. These models have a high endogenous expression of relevant chimeric antigen receptor (CAR) T target antigens such as HER2, CD19, and CD20. These new IO tools consist of both hematologic cancers and solid tumor cell lines expressing a luciferase reporter. This helped the company to expand its product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER'S FIVE FORCES ANALYSIS

4.3 PATENT ANALYSIS – GLOBAL CHO CELLS MARKET

4.3.1 PATENT QUALITY AND STRENGTH

4.3.2 PATENT FAMILIES

4.3.3 LICENSING AND COLLABORATIONS

4.3.4 COMPETITIVE LANDSCAPE

4.3.5 IP STRATEGY AND MANAGEMENT

4.3.6 OTHER OBSERVATIONS

4.4 INDUSTRY INSIGHTS

4.4.1 MICRO AND MACRO ECONOMIC FACTORS

4.4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.4.3 KEY PRICING STRATEGIES

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.1.1 JOINT VENTURES

4.5.1.2 MERGERS AND ACQUISITIONS

4.5.1.3 LICENSING AND PARTNERSHIP

4.5.1.4 TECHNOLOGY COLLABORATIONS

4.5.1.5 STRATEGIC DIVESTMENTS

4.5.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.5.3 STAGE OF DEVELOPMENT

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.6 OPPORTUNITY MAP

4.7 PRICING ANALYSIS – GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET

4.8 RAW MATERIAL COVERAGE

4.9 VALUE CHAIN ANALYSIS

4.1 CONSUMER BUYING BEHAVIOUR

4.11 TECHNOLOGICAL ADVANCEMENTS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE

5.2 OUTLOOK — LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE AND LOCAL PARTNERSHIPS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATORY FRAMEWORK – GLOBAL CHO CELLS MARKET

6.1 NORTH AMERICA

6.2 EUROPE

6.3 ASIA-PACIFIC

6.4 SOUTH AMERICA

6.5 MIDDLE EAST & AFRICA

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 RISING USE OF CHO CELLS IN THE GENETIC STUDY

7.1.2 GROWING DEMAND FOR BIOPHARMACEUTICALS

7.1.3 RISING INVESTMENTS IN BIOTECHNOLOGY R&D

7.1.4 RISING DEMAND FOR MONOCLONAL ANTIBODIES

7.2 RESTRAINT

7.2.1 HIGH COST OF CHO CELL–BASED PRODUCTION AS A MARKET RESTRAINT

7.2.2 STRICT REGULATORY REQUIREMENTS FOR CHO CELL-BASED PRODUCTION

7.3 OPPORTUNITY

7.3.1 CONTINUOUS DEVELOPMENT OF CELL-CULTURE TECHNOLOGIES

7.3.2 RISING NUMBER OF APPLICATIONS OF CHO CELLS

7.3.3 ADVANCES IN CELL-LINE ENGINEERING & SYNTHETIC BIOLOGY

7.4 CHALLENGES

7.4.1 TIME-CONSUMING AND INCONSISTENCY IN CHO CELL LINE DEVELOPMENT PROCESS

7.4.2 CONTAMINATION RISK OF CHO CELL CULTURES

8 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SERVICES

8.3 PRODUCT

8.3.1 CHO-K1

8.3.1.1 CHO-K1 ATCC

8.3.1.2 CHO-K1 ECACC

8.3.1.3 OTHERS

8.3.2 CHO-DG44

8.3.3 CHO-S

8.3.4 CHO-DXB11

8.3.5 OTHERS

9 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM

9.1 OVERVIEW

9.2 METABOLIC SELECTION SYSTEM

9.3 ANTIBIOTIC SELECTION SYSTEM

9.4 OTHERS

10 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BIOLOGICS

10.2.1 MONOCLONAL ANTIBODIES

10.2.2 FC-FUSION PROTIEN

10.2.3 ENZYMES

10.2.4 HORMONES

10.2.5 CYTOKINES

10.2.6 CLOTTING FACTORS

10.2.7 OTHERS

10.3 MEDICAL RESEARCH

11 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER

11.1 OVERVIEW

11.2 BIOPHARMACEUTICAL COMPANIES

11.2.1 MEDIUM

11.2.2 SMALL

11.3 CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS

11.3.1 MEDIUM

11.3.2 SMALL

11.4 BIOTECHNOLOGY COMPANIES

11.4.1 MEDIUM

11.4.2 SMALL

11.5 ACADEMIC INSTITUTES AND RESEARCH ORGANIZATIONS

11.6 CLINICAL RESEARCH ORGANIZATIONS

11.6.1 MEDIUM

11.6.2 SMALL

11.7 OTHERS

12 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 RETAIL SALES

12.4 OTHERS

13 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 FRANCE

13.3.4 ITALY

13.3.5 SPAIN

13.3.6 SWITZERLAND

13.3.7 NETHERLANDS

13.3.8 BELGIUM

13.3.9 SWEDEN

13.3.10 DENMARK

13.3.11 RUSSIA

13.3.12 TURKEY

13.3.13 NORWAY

13.3.14 FINLAND

13.3.15 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 AUSTRALIA

13.4.6 TAIWAN

13.4.7 SINGAPORE

13.4.8 HONG KONG

13.4.9 THAILAND

13.4.10 MALAYSIA

13.4.11 INDONESIA

13.4.12 PHILIPPINES

13.4.13 NEW ZEALAND

13.4.14 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 COLOMBIA

13.5.4 CHILE

13.5.5 PERU

13.5.6 ECUADOR

13.5.7 URUGUAY

13.5.8 VENEZUELA

13.5.9 BOLIVIA

13.5.10 PARAGUAY

13.5.11 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SAUDI ARABIA

13.6.2 U.A.E

13.6.3 SOUTH AFRICA

13.6.4 EGYPT

13.6.5 ISRAEL

13.6.6 QATAR

13.6.7 KUWAIT

13.6.8 OMAN

13.6.9 BAHRAIN

13.6.10 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SARTORIUS AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LONZA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 THERMO FISHER SCIENTIFIC INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 CYTIVA

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MERCK KGAA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ABEOMICS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ACCEGEN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 APPLIED BIOLOGICAL MATERIALS INC. (ABM)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ATCC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BPS BIOSCIENCE, INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CYTION

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 CURIA GLOBAL, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 GENTARGET INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GTP BIOWAYS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 PROMEGA CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 RAYBIOTECH LIFE, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 REVVITY DISCOVERY LIMITED.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL SERVICES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL METABOLIC SELECTION SYSTEM IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL ANTIBIOTIC SELECTION SYSTEM IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL OTHERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL MEDICAL RESEARCH IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL CHINESE HAMSTER OVARY CELLS CHO MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL ACADEMIC INSTITUTES AND RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL OTHERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL DIRECT TENDERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL RETAIL SALES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL OTHERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 U.K. CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 108 U.K. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 U.K. BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.K. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 U.K. BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 U.K. CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.K. BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.K. CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 U.K. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 116 FRANCE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 FRANCE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 ITALY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 ITALY CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 ITALY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 132 ITALY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 133 ITALY BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 ITALY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 135 ITALY BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 ITALY CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 ITALY BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 ITALY CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 ITALY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 140 SPAIN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SPAIN PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SPAIN CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SPAIN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 144 SPAIN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 SPAIN BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SPAIN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 147 SPAIN BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SPAIN CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SPAIN BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SPAIN CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SPAIN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SWITZERLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 SWITZERLAND BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SWITZERLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 159 SWITZERLAND BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 SWITZERLAND CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SWITZERLAND BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SWITZERLAND CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SWITZERLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 164 NETHERLANDS CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 NETHERLANDS PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 NETHERLANDS CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 NETHERLANDS CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 168 NETHERLANDS CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 NETHERLANDS BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NETHERLANDS CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 NETHERLANDS BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NETHERLANDS CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NETHERLANDS BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NETHERLANDS CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NETHERLANDS CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 176 BELGIUM CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 BELGIUM PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 BELGIUM CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 BELGIUM CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 180 BELGIUM CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 181 BELGIUM BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 BELGIUM CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 183 BELGIUM BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 BELGIUM CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 BELGIUM BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 BELGIUM CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BELGIUM CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 188 SWEDEN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SWEDEN PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SWEDEN CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SWEDEN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 192 SWEDEN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 SWEDEN BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SWEDEN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 195 SWEDEN BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SWEDEN CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SWEDEN BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SWEDEN CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SWEDEN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 200 DENMARK CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 DENMARK PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 DENMARK CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 DENMARK CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 204 DENMARK CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 DENMARK BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 DENMARK CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 207 DENMARK BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 DENMARK CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 DENMARK BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 DENMARK CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 DENMARK CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 212 RUSSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 RUSSIA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 RUSSIA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 RUSSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 216 RUSSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 217 RUSSIA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RUSSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 219 RUSSIA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RUSSIA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RUSSIA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 RUSSIA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RUSSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 TURKEY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 TURKEY PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 TURKEY CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 TURKEY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 228 TURKEY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 229 TURKEY BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 TURKEY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 231 TURKEY BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 TURKEY CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 TURKEY BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 TURKEY CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 TURKEY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 236 NORWAY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NORWAY PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NORWAY CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NORWAY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 240 NORWAY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 241 NORWAY BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NORWAY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 243 NORWAY BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 NORWAY CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 NORWAY BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 NORWAY CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 NORWAY CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 FINLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 FINLAND PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 FINLAND CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 FINLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 252 FINLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 253 FINLAND BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 FINLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 255 FINLAND BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 FINLAND CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 FINLAND BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 FINLAND CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 FINLAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 260 REST OF EUROPE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 ASIA-PACIFIC CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 262 ASIA-PACIFIC CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 ASIA-PACIFIC PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 ASIA-PACIFIC CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 ASIA-PACIFIC CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 266 ASIA-PACIFIC CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 ASIA-PACIFIC BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 ASIA-PACIFIC CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 269 ASIA-PACIFIC BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 ASIA-PACIFIC CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 ASIA-PACIFIC BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 ASIA-PACIFIC CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 ASIA-PACIFIC CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 CHINA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 CHINA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 CHINA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 CHINA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 278 CHINA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 279 CHINA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 CHINA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 281 CHINA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 CHINA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 CHINA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 CHINA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 CHINA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 286 JAPAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 JAPAN PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 JAPAN CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 JAPAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 290 JAPAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 291 JAPAN BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 JAPAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 293 JAPAN BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 JAPAN CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 JAPAN BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 JAPAN CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 JAPAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 298 SOUTH KOREA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SOUTH KOREA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SOUTH KOREA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SOUTH KOREA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 302 SOUTH KOREA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 303 SOUTH KOREA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SOUTH KOREA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 305 SOUTH KOREA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SOUTH KOREA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SOUTH KOREA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 SOUTH KOREA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 SOUTH KOREA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 INDIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 INDIA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 INDIA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 INDIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 314 INDIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 INDIA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 INDIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 317 INDIA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 INDIA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 INDIA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 INDIA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 INDIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 322 AUSTRALIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 AUSTRALIA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 AUSTRALIA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 AUSTRALIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 326 AUSTRALIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 327 AUSTRALIA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 AUSTRALIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 329 AUSTRALIA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 AUSTRALIA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 AUSTRALIA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 AUSTRALIA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 AUSTRALIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 334 TAIWAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 TAIWAN PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 TAIWAN CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 TAIWAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 338 TAIWAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 339 TAIWAN BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 TAIWAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 341 TAIWAN BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 TAIWAN CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 TAIWAN BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 TAIWAN CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 TAIWAN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 346 SINGAPORE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 SINGAPORE PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 SINGAPORE CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 SINGAPORE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 350 SINGAPORE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 351 SINGAPORE BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SINGAPORE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 353 SINGAPORE BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 SINGAPORE CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 SINGAPORE BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SINGAPORE CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 SINGAPORE CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 358 HONG KONG CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 HONG KONG PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 HONG KONG CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 HONG KONG CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 362 HONG KONG CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 363 HONG KONG BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 HONG KONG CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 365 HONG KONG BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 HONG KONG CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 HONG KONG BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 HONG KONG CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 HONG KONG CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 370 THAILAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 THAILAND PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 THAILAND CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 THAILAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 374 THAILAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 375 THAILAND BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 THAILAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 377 THAILAND BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 THAILAND CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 THAILAND BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 THAILAND CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 THAILAND CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 382 MALAYSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 MALAYSIA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 MALAYSIA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 MALAYSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 386 MALAYSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 387 MALAYSIA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 MALAYSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 389 MALAYSIA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 MALAYSIA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 MALAYSIA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 MALAYSIA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 MALAYSIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 394 INDONESIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 INDONESIA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 INDONESIA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 INDONESIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 398 INDONESIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 399 INDONESIA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 INDONESIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 401 INDONESIA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 INDONESIA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 INDONESIA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 INDONESIA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 INDONESIA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 406 PHILIPPINES CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)