Global Cheese Market

Market Size in USD Million

CAGR :

%

USD

208.16 Million

USD

356.86 Million

2024

2032

USD

208.16 Million

USD

356.86 Million

2024

2032

| 2025 –2032 | |

| USD 208.16 Million | |

| USD 356.86 Million | |

|

|

|

|

Cheese Market Size

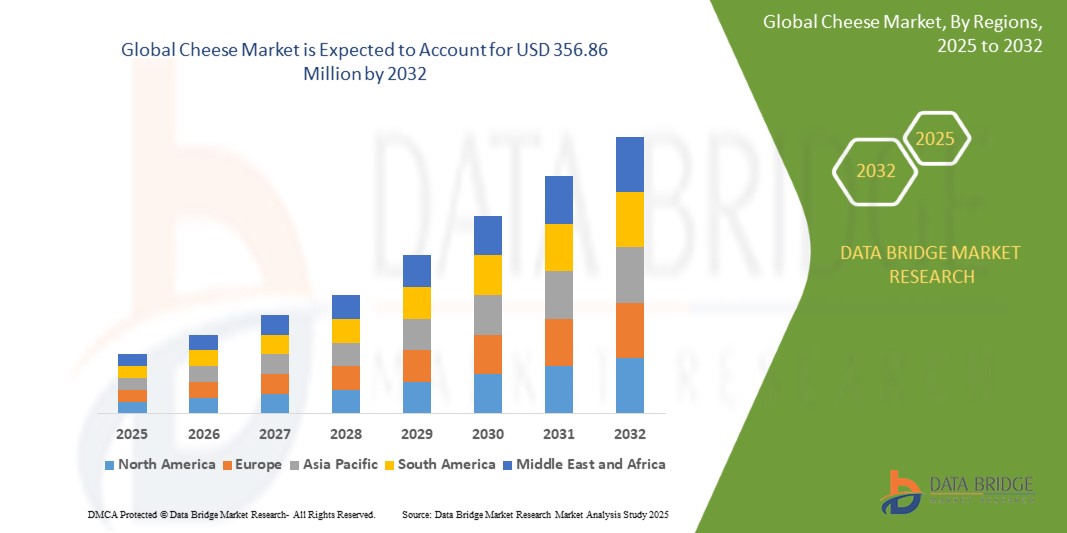

- The global Cheese market was valued at USD 208.16 million in 2024 and is expected to reach USD 356.86 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.97% primarily driven by the increasing consumer demand and rising consumption of dairy products

- This growth is driven by factors such as growing urbanization, rising disposable income, expanding fast-food industry, increasing health consciousness leading to demand for premium and organic cheese, and advancements in cheese production and packaging technologies

Cheese Market Analysis

- The global cheese market is witnessing steady growth, driven by increasing consumer demand for diverse cheese varieties and the rising popularity of cheese-infused dishes in various cuisines

- For instance, in the U.S., per capita cheese consumption has been on the rise, with individuals consuming approximately 40.2 pounds in 2020, up from previous years. Cheddar and mozzarella remain the most popular varieties, reflecting consumers' expanding palates and interest in different cheese types

- Health-conscious consumers are seeking cheeses with reduced sodium and fat content, leading manufacturers to innovate and offer healthier options without compromising on taste. This trend is evident in the growing popularity of artisanal and functional cheese varieties that cater to nutritional preferences while delivering unique flavors.

- The surge in plant-based diets has prompted the development of dairy-free cheese alternatives made from ingredients such as nuts and soy, catering to vegan and lactose-intolerant consumers. This shift is reflected in the increasing demand for plant-based cheeses, which has surged by 12.5% annually, mirroring the broader movement toward vegan and vegetarian diets.

- E-commerce platforms have become significant distribution channels for cheese products, providing consumers with convenient access to a wide range of options, including specialty and international cheeses. The growth of direct-to-consumer models has boosted online sales, with online shopping offering convenience and accessibility, particularly appealing to consumers who may not have access to specialty cheese retailers in their local area.

- The influence of Western cuisine has led to increased cheese consumption in regions where it was previously less prevalent.

- For instance, in the Middle East, changing dietary habits and the increasing acceptance of cheese as part of local cuisine have resulted in higher consumption. Key players in this market have responded by diversifying their product portfolios to include cheeses such as labneh and halloumi, alongside more familiar varieties such as mozzarella and cheddar

Report Scope and Cheese Market Segmentation

|

Attributes |

Cheese Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cheese Market Trends

“Increasing Consumption of Plant-Based Cheese Alternatives”

- The rise of plant-based cheese alternatives is driven by the increasing number of people adopting vegan, vegetarian, and lactose-free diets, with brands such as Daiya and Violife gaining significant market share, particularly in North America and Europe, where plant-based products are increasingly popular

- Plant-based cheese is made from various ingredients such as almonds, cashews, soy, and coconut, catering to a broader audience beyond vegans

- For instance, Miyoko’s Creamery offers cashew-based cheeses, while Cocoon focuses on coconut-based options, expanding the diversity in the market

- The trend is fueled by growing environmental awareness, as plant-based products have a lower carbon footprint compared to traditional dairy cheese. Research shows that producing plant-based cheese results in fewer greenhouse gas emissions, making products such as Follow Your Heart and Chao highly appealing to eco-conscious consumers

- Large dairy companies are responding to this shift by expanding their plant-based offerings. Kraft launched a plant-based line under the “Cracker Barrel” brand, while grocery chains such as Whole Foods and Walmart now carry plant-based cheeses from brands such as Violife, reflecting how quickly these alternatives have entered the mainstream market

- As taste and texture improve, plant-based cheese is becoming more mainstream, with innovations such as plant-based mozzarella being used on pizzas at well-known chains such as Pizza Hut and Domino’s. These major players are increasingly offering plant-based cheese as part of their menu to cater to the growing demand for dairy-free options

Cheese Market Dynamics

Driver

“Increasing Demand for Convenience Foods”

- Increasing demand for convenience foods is driving the global cheese market, as consumers seek quick and easy meal options without sacrificing taste or nutrition

- For instance, McDonald's uses cheese in popular menu items such as the McChicken and Cheeseburger, while Subway offers cheese in a variety of subs such as the Italian B.M.T. and Turkey Breast sandwiches

- Cheese’s versatility makes it a staple in ready-to-eat meals, snacks, and fast-food products. Domino's Pizza incorporates cheese in multiple menu items, including its Cheese Stuffed Crust Pizza and Cheesy Breadsticks, which are customer favorites, further highlighting cheese’s role in fast food offerings

- Pre-sliced, grated, and shredded cheese products are becoming increasingly popular for consumers looking to save time in meal preparation

- For instance, Kraft offers Pre-shredded Cheddar Cheese, while Sargento provides a range of pre-sliced cheese options, making it easier for consumers to quickly prepare sandwiches, salads, or snacks

- The rise of meal delivery services such as Uber Eats and DoorDash has fueled the demand for cheese in ready-to-serve dishes. Many restaurants such as Papa John’s and Pizza Hut now offer cheese-laden pizza options through these platforms, catering to the growing demand for convenient meals delivered directly to consumers

- Cheese's role as a quick, flavorful, and nutritious ingredient extends to home-cooked meals.

- For instance, Pre-grated Mozzarella from brands such as Galbani and Pre-sliced Cheddar from Land O'Lakes are commonly used in everyday recipes such as lasagna, sandwiches, and tacos in busy households across the U.S. and U.K.

Opportunity

“Rise of Plant-Based Diets and Veganism”

- The rise of plant-based diets and veganism presents a significant opportunity for the cheese market, as more consumers opt for dairy-free and lactose-free alternatives. Violife, known for its coconut-based cheese, and Miyoko’s Creamery, which offers cashew-based cheeses, are two key players leading this plant-based cheese revolution

- Companies are developing plant-based cheese options made from ingredients such as nuts, soy, coconut, and oats to cater not only to vegans but also to those with lactose intolerance and people reducing animal product consumption

- For instance, Daiya offers a variety of dairy-free cheese made from tapioca starch and coconut, while Miyoko’s has expanded with nut-based cheeses such as their Vegan Aged English Farmhouse Cheddar

- One of the notable opportunities is the increasing popularity of plant-based cheese among mainstream consumers. Once considered niche, the demand for dairy-free alternatives has skyrocketed, with major retailers such as Whole Foods, Walmart, and Target now stocking plant-based cheese options from brands such as Treeline (cashew-based) and Follow Your Heart (soy-based), which are gaining widespread appeal

- Fast-food chains such as Pizza Hut and Dominos have introduced plant-based pizza options to cater to the growing market, offering Daiya’s dairy-free cheese on their pizzas in several countries, including the U.S., the UK, and Canada, making it easier for customers to enjoy their favorite comfort food without animal-based products

- As plant-based cheese products improve in taste and texture, and as sustainability concerns drive consumer choices, the market for these products is expected to continue its rapid growth. Brands such as So Delicious and Earth Balance are innovating with more flavor options and environmentally friendly packaging to meet the increasing demand for both quality and sustainability in the plant-based cheese sector.

Restraint/Challenge

“Rising Cost of Raw Materials and Production”

- One of the significant challenges facing the cheese market is the rising cost of raw materials and production. The prices of milk, which is the core ingredient in traditional cheese, have been rising steadily

- For instance, in the U.S., dairy farmers have experienced volatile milk prices due to factors such as fluctuating feed costs and climate change affecting milk production, which has led to higher cheese prices for consumers, such as the price hike in cheddar cheese witnessed in 2021 due to supply chain disruptions

- The dairy industry also faces strict regulations regarding animal welfare, food safety, and environmental standards, which add to production costs. Manufacturers are being increasingly pressured to meet sustainability goals, requiring investments in new technologies, packaging solutions, and production methods.

- For instance, Nestlé has committed to reducing carbon emissions by investing in eco-friendly packaging and sustainable farming practices, raising production costs in the process

- Plant-based cheese alternatives also face production challenges due to the high cost of ingredients such as cashews, almonds, and coconut, which are key to producing creamy, flavorful substitutes. Companies such as Miyoko's Creamery use expensive cashew nuts for their cheeses, and while demand is growing, the higher production costs can make these products more expensive compared to traditional dairy cheese

- The complexities of manufacturing plant-based cheese alternatives, which require specialized processing methods to mimic dairy's taste and texture, also contribute to higher costs. Brands such as Daiya have improved their processes but still face challenges in scaling production efficiently, making it difficult to compete on price with traditional cheese, particularly in price-sensitive markets

- These increasing production costs, whether in dairy or plant-based cheese, present a challenge to the affordability of cheese products, particularly in regions where consumers are more price-conscious. In countries such as India or parts of Southeast Asia, where dairy and plant-based cheese options are still considered premium products, affordability remains a significant challenge

Cheese Market Scope

The market is segmented on the basis of source, type, format, product, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Format |

|

|

By Product |

|

|

By Distribution Channel |

|

Cheese Market Regional Analysis

“Europe is the Dominant Region in the Cheese Market”

- Europe dominates the global cheese market due to its deep-rooted cheese-making tradition and cultural significance, with countries such as France, Italy, and the U.K. being known for their rich history of producing internationally recognized cheeses

- The region offers a wide variety of cheese styles, including soft, hard, and semi-soft varieties, which cater to a broad spectrum of consumer preferences, both within Europe and globally

- Europe is home to renowned dairy cooperatives and producers that contribute to the continuous growth of the cheese market, supported by the European Union’s agricultural policies that promote high-quality standards in cheese production

- The production of artisanal and specialty cheeses in local dairies further strengthens Europe’s market position, as consumers increasingly seek unique, high-quality cheese products that reflect regional traditions

- Cheese in Europe extends beyond traditional forms and is widely incorporated into gourmet dishes, fast food, and ready-to-eat meals, ensuring its role as a key ingredient in various food sectors, reinforcing Europe’s leadership in the global cheese market

“North America is Projected to Register the Highest Growth Rate”

- North America is emerging as the fastest-growing region in the global cheese market, driven by the growing integration of cheese into fast food and quick-service restaurant menus, with cheese being a central ingredient in items such as burgers, sandwiches, and pizzas offered by global brands such as McDonald's, Subway, and Domino's

- The demand for processed cheese products such as shredded and sliced cheese is increasing as these forms are quick and easy to incorporate into high-volume food offerings, catering to the fast-paced nature of the food service industry in North America

- As consumers focus more on protein-rich diets, cheese has gained popularity as a nutritious snack and meal option, with products such as cheese sticks, cheese dips, and crackers gaining traction, particularly in the U.S. and Canada, where snacking culture is on the rise

- The plant-based cheese market in North America is expanding rapidly due to the growing shift toward plant-based diets for ethical, health, and environmental reasons, with companies offering alternatives made from almonds, cashews, and coconut, helping to cater to the increasing demand for dairy-free options

- The improvement in taste, texture, and variety of plant-based cheese products is further boosting their acceptance, ensuring that North America remains a key player in the global cheese market, with a strong potential for continued growth in both dairy and plant-based cheese segments

Cheese Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Kite Hill (U.S.)

- Nush Foods (U.S.)

- Follow Your Heart (U.S.)

- Field Roast (U.S.)

- Miyoko's Creamery (U.S.)

- GOOD PLANeT Foods (U.S.)

- Brownstoner LLC (U.S.)

- Tofutti Brands, Inc. (U.S.)

- Bute Island Foods Ltd. (U.K.)

- Kinda Co. (U.K.)

- Reine, LLC. (U.S.)

- Uhrenholt A/S (Denmark)

- Kalpavriksha Foundation (India)

- Parmela Creamery (U.S.)

- Daiya Foods (Canada)

Latest Developments in Global Cheese Market

- In November 2021, Nush Foods announced the relaunch of its dairy-free cream cheese in recyclable cups. This development aims to enhance sustainability by offering eco-friendly packaging for their plant-based cream cheese. The move is expected to reduce plastic waste and appeal to environmentally-conscious consumers. In addition, it supports Nush Foods' commitment to providing healthier, plant-based alternatives while maintaining product quality. This relaunch is likely to strengthen Nush Foods' position in the growing dairy-free market, aligning with current consumer demand for both sustainable and vegan-friendly products. The impact on the market will be significant as it not only caters to the increasing preference for plant-based options but also sets a trend for eco-conscious packaging in the food industry

- In March 2021, DalterFood Group launched its new cheese matchsticks. This product innovation is designed to offer a convenient, snack-sized cheese option that appeals to busy consumers looking for easy-to-consume, portion-controlled products. The cheese matchsticks are expected to tap into the growing demand for on-the-go snacks, offering a healthier alternative to traditional snack foods. The product is likely to have a positive impact on the market by catering to the increasing popularity of convenient and portion-controlled cheese options, further expanding DalterFood Group’s presence in the snacking segment and meeting the preferences of modern consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHEESE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CHEESE MARKET MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CHEESE MARKET MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 IMPORT-EXPORT SCENARIO

5.3 PRIVATE LABEL VS BRAND ANALYSIS

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TELEVISION ADVERTISEMENT

5.4.4.2. ONLINE ADVERTISEMENT

5.4.4.3. IN-STORE ADVERTISEMENT

5.4.4.4. OUTDOOR ADVERTISEMENT

5.5 PROMOTIONAL ACTIVITIES

5.6 NEW PRODUCT LAUNCH STRATEGY

5.6.1 NUMBER OF NEW PRODUCT LAUNCH

5.6.1.1. LINE EXTENSTION

5.6.1.2. NEW PACKAGING

5.6.1.3. RE-LAUNCHED

5.6.1.4. NEW FORMULATION

5.6.2 DIFFERNTIAL PRODUCT OFFERING

5.6.3 MEETING CONSUMER REQUIREMENT

5.6.4 PACKAGE DESIGNING

5.6.5 PRICING ANALYSIS

5.6.6 PRODUCT POSITIONING

5.7 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.8 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 NEW PRODUCT LAUNCHES

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 GLOBAL CHEESE MARKET, BY CHEESE TYPE, 2018-2032, (USD MILLION) (KILO TONS)

(ASP, VALUE AND VOLUME WILL BE GIVEN FOR ALL THE SEGMENTS)

13.1 OVERVIEW

13.2 FRESH

13.2.1 COTTAGE CHEESE

13.2.2 CREAM CHEESE

13.2.3 RICOTTA

13.2.4 BOCCONCINI

13.2.5 BURRATA

13.2.6 CHEESE CURDS

13.2.7 FRESH MOZZARELLA

13.2.8 MASCARPONE

13.2.9 PANEER

13.2.10 OTHERS

13.3 HARD

13.3.1 CHEDDAR

13.3.2 EDAM CHEESE

13.3.3 PARMESAN

13.3.4 MOZZARELLA

13.3.5 PECORINO

13.3.6 EMMETNTAL CHEESE

13.3.7 GOUDA

13.3.8 HAVARTI

13.3.9 ASIAGO

13.3.10 COLBI

13.3.11 COLBI-JACK

13.3.12 COTIJA

13.3.13 EMMENTAL

13.3.14 PEPPER JACK

13.3.15 GORGONZOLA

13.3.16 GRUYERE

13.3.17 HALLOUMI

13.3.18 PROVOLONE

13.3.19 ROMANO

13.3.20 SWISS

13.3.21 OTHERS

13.4 SOFT

13.4.1 BRIE

13.4.2 FETA

13.4.3 CAMEMBERT

13.4.4 CANBOZOLA

13.4.5 BLUE CHEESE

13.4.6 AMERICAN CHEESE

13.4.7 COLD PACK

13.4.8 HAVARTI

13.4.9 JARLSBERG

13.4.10 MONTEREY JACK

13.4.11 MUENSTER

13.4.12 NEUFCHÂTEL

13.4.13 STRING CHEESE

13.4.14 OTHERS

14 GLOBAL CHEESE MARKET, BY SOURCE, 2018-2032, (USD MILLION)

14.1 OVERVIEW

14.2 PLANT BASED

14.2.1 BY TYPE

14.2.1.1. SOY MILK

14.2.1.2. ALMOND MILK

14.2.1.3. OAT MILK

14.2.1.4. COCONUT MILK

14.2.1.5. CASHEW MILK

14.2.1.6. OTHERS

14.3 ANIMAL BASED

14.3.1 BY TYPE

14.3.1.1. GOAT MILK

14.3.1.2. COW MILK

14.3.1.3. SHEEP MILK

14.3.1.4. BUFFALO MILK

14.3.1.5. CAMEL MILK

14.3.1.6. OTHERS

15 GLOBAL CHEESE MARKET, BY NATURE, 2018-2032, (USD MILLION)

15.1 OVERVIEW

15.2 ORGANIC

15.3 CONVENTIONAL

16 GLOBAL CHEESE MARKET, BY FORM, 2018-2032, (USD MILLION)

16.1 OVERVIEW

16.2 SHREDDED

16.3 WHEELS

16.4 BLOCKS & WEDGES

16.5 GRATED

16.6 SLICES

16.7 CUBES

16.8 SPREAD

16.9 POWDER

16.1 OTHERS

17 GLOBAL CHEESE MARKET, BY CATEGORY, 2018-2032, (USD MILLION)

17.1 OVERVIEW

17.2 NATURAL/UNPROCESSED

17.3 PROCESSED

18 GLOBAL CHEESE MARKET, BY FLAVOUR, 2018-2032, (USD MILLION)

18.1 OVERVIEW

18.2 REGULAR/UNFLAVOURED

18.3 FLAVORED

18.3.1 CHIVE

18.3.2 ONION

18.3.3 GARLIC

18.3.4 TOMATO&BASIL

18.3.5 BELL PEPPER

18.3.6 HOT PEPPER

18.3.7 GINGER

18.3.8 JALPENO

18.3.9 MIX HERB

18.3.10 CREAMY

18.3.11 CHILLI

18.3.12 AGED

18.3.13 BARNYYARDY

18.3.14 BUTTERY

18.3.15 BROTHY

18.3.16 BUTYRIC

18.3.17 EARTHY

18.3.18 FLORAL

18.3.19 GRASSY

18.3.20 NUTTY

18.3.21 SALTY

18.3.22 SMOKEY

18.3.23 SOUR

18.3.24 TANGY

18.3.25 YEASTY

18.3.26 OTHERS

19 GLOBAL CHEESE MARKET, BY PREPARATION METHOD, 2018-2032, (USD MILLION)

19.1 OVERVIEW

19.2 BACTERIA-RIPENED

19.3 MOULD-REPENED

19.4 UN-RIPENED

20 GLOBAL CHEESE MARKET, BY BRAND CATEGORY, 2018-2032, (USD MILLION)

20.1 OVERVIEW

20.2 BRANDED

20.3 PRIVATE LABEL

21 GLOBAL CHEESE MARKET, BY PRICE RANGE, 2018-2032, (USD MILLION)

21.1 OVERVIEW

21.2 MASS

21.3 PREMIUM

21.4 LUXURY

22 GLOBAL CHEESE MARKET, BY CLAIM 2018-2032, (USD MILLION)

22.1 OVERVIEW

22.2 LOW-FAT CHEESE

22.3 REDUCED-SODIUM CHEESE

22.4 HIGH-PROTEIN CHEESE

22.5 LOW-CALORIE CHEESE

22.6 SUGAR-FREE CHEESE

22.7 LACTOSE-FREE CHEESE

22.8 GLUTEN-FREE CHEESE

22.9 KETO-FRIENDLY CHEESE

22.1 PROBIOTIC/LIVE CULTURES CHEESE

22.11 NON-GMO CHEESE

22.12 GRASS-FED CHEESE

22.13 CRUELTY-FREE CHEESE

22.14 SUSTAINABLY SOURCED CHEESE

22.15 PLANT-BASED/VEGAN CHEESE

22.16 ARTISANAL/CRAFT CHEESE

22.17 HALAL-CERTIFIED CHEESE

22.18 KOSHER-CERTIFIED CHEESE

22.19 ARTIFICIAL ADDITIVES-FREE CHEES

22.2 PRESERVATIVE-FREE CHEESE

22.21 MULTIPLE CLAIMS

22.22 WITHOUT CLAIMS

22.23 OTHERS

23 GLOBAL CHEESE MARKET, BY PACKAGING TYPE, 2018-2032, (USD MILLION)

23.1 OVERVIEW

23.2 POUCHES

23.3 BOXES

23.4 CUPS

23.5 WRAPPERS

23.6 TUBS

23.7 BOTTLES

23.8 JARS AND CONTAINERS

23.9 OTHERS

24 GLOBAL CHEESE MARKET, BY PACKAGING SIZE, 2018-2032, (USD MILLION)

24.1 OVERVIEW

24.2 LESS THAN 100 GRAMS

24.3 100 TO 250 GRAMS

24.4 250 TO 500 GRAMS

24.5 500 TO 750 GRAMS

24.6 750 TO 1000 GRAMS

24.7 MORE THAN 1000 GRAMS

25 GLOBAL CHEESE MARKET, BY PACKAGING QUANTITY, 2018-2032, (USD MILLION)

25.1 OVERVIEW

25.2 SINGLE PACK

25.3 MULTI-PACKS

26 GLOBAL CHEESE MARKET, BY END USE, 2018-2032, (USD MILLION)

26.1 OVERVIEW

26.2 HOUSEHOLD / RETAIL

26.3 FOOD SERVICE SECTOR

26.3.1 FOOD SERVICE SECTOR, BY CATEGORY

26.3.1.1. HOTELS

26.3.1.2. RESTAURANTS

26.3.1.3. CHAIN RESTAURANT

26.3.1.4. INDEPENDENT RESTAURANT

26.3.1.5. CAFÉ

26.3.1.6. BARS AND CLUBS

26.3.1.7. CETERING

26.3.1.8. OTHERS

26.4 OTHERS

27 GLOBAL CHEESE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032, (USD MILLION)

27.1 OVERVIEW

27.2 STORE BASED RETAILERS

27.2.1 MODERN GROCERY RETAILERS

27.2.2 CONVENIENCE STORES

27.2.3 DISCOUNTERS STORES

27.2.4 FORECOURT RETAILERS

27.2.5 HYPERMARKETS/ SUPERMARKETS

27.2.6 TRADITIONAL GROCERY STORES

27.2.7 INDEPENDENT SMALL GROCERS’ STORES

27.2.8 OTHERS

27.3 NON-STORE RETAILERS

27.3.1 E-COMMERCE WEBSITES

27.3.2 COMPANY OWNED WEBSITE

28 GLOBAL CHEESE MARKET, BY GEOGRAPHY, 2018-2032, (USD MILLION) (KILO TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

28.1 NORTH AMERICA

28.1.1 U.S.

28.1.2 CANADA

28.1.3 MEXICO

28.2 EUROPE

28.2.1 GERMANY

28.2.2 U.K.

28.2.3 ITALY

28.2.4 FRANCE

28.2.5 SPAIN

28.2.6 RUSSIA

28.2.7 SWITZERLAND

28.2.8 TURKEY

28.2.9 BELGIUM

28.2.10 NETHERLANDS

28.2.11 DENMARK

28.2.12 SWEDEN

28.2.13 POLAND

28.2.14 NORWAY

28.2.15 FINLAND

28.2.16 REST OF EUROPE

28.3 ASIA-PACIFIC

28.3.1 JAPAN

28.3.2 CHINA

28.3.3 SOUTH KOREA

28.3.4 INDIA

28.3.5 SINGAPORE

28.3.6 THAILAND

28.3.7 INDONESIA

28.3.8 MALAYSIA

28.3.9 PHILIPPINES

28.3.10 AUSTRALIA

28.3.11 NEW ZEALAND

28.3.12 VIETNAM

28.3.13 TAIWAN

28.3.14 REST OF ASIA-PACIFIC

28.4 SOUTH AMERICA

28.4.1 BRAZIL

28.4.2 ARGENTINA

28.4.3 REST OF SOUTH AMERICA

28.5 MIDDLE EAST AND AFRICA

28.5.1 SOUTH AFRICA

28.5.2 EGYPT

28.5.3 BAHRAIN

28.5.4 UNITED ARAB EMIRATES

28.5.5 KUWAIT

28.5.6 OMAN

28.5.7 QATAR

28.5.8 SAUDI ARABIA

28.5.9 REST OF MEA

29 GLOBAL CHEESE MARKET, COMPANY LANDSCAPE

29.1 COMPANY SHARE ANALYSIS: GLOBAL

29.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

29.3 COMPANY SHARE ANALYSIS: EUROPE

29.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

29.5 MERGERS & ACQUISITIONS

29.6 NEW PRODUCT DEVELOPMENT & APPROVALS

29.7 EXPANSIONS & PARTNERSHIP

29.8 REGULATORY CHANGES

30 GLOBAL CHEESE MARKET, SWOT & DBMR ANALYSIS

31 GLOBAL CHEESE MARKET, COMPANY PROFILES

31.1 ARLA FOODS AMBA

31.1.1 COMPANY OVERVIEW

31.1.2 REVENUE ANALYSIS

31.1.3 PRODUCT PORTFOLIO

31.1.4 RECENT DEVELOPMENTS

31.2 FONTERRA CO-OPERATIVE GROUP LIMITED

31.2.1 COMPANY OVERVIEW

31.2.2 REVENUE ANALYSIS

31.2.3 PRODUCT PORTFOLIO

31.2.4 RECENT DEVELOPMENTS

31.3 THE KRAFT HEINZ COMPANY

31.3.1 COMPANY OVERVIEW

31.3.2 REVENUE ANALYSIS

31.3.3 PRODUCT PORTFOLIO

31.3.4 RECENT DEVELOPMENTS

31.4 FRIESLANDCAMPINA

31.4.1 COMPANY OVERVIEW

31.4.2 REVENUE ANALYSIS

31.4.3 PRODUCT PORTFOLIO

31.4.4 RECENT DEVELOPMENTS

31.5 WENSLEYDALE CREAMERY

31.5.1 COMPANY OVERVIEW

31.5.2 REVENUE ANALYSIS

31.5.3 PRODUCT PORTFOLIO

31.5.4 RECENT DEVELOPMENTS

31.6 DAIRY FARMERS OF AMERICA, INC.

31.6.1 COMPANY OVERVIEW

31.6.2 REVENUE ANALYSIS

31.6.3 PRODUCT PORTFOLIO

31.6.4 RECENT DEVELOPMENTS

31.7 NORSELAND LTD

31.7.1 COMPANY OVERVIEW

31.7.2 REVENUE ANALYSIS

31.7.3 PRODUCT PORTFOLIO

31.7.4 RECENT DEVELOPMENTS

31.8 GRUPO VAI

31.8.1 COMPANY OVERVIEW

31.8.2 REVENUE ANALYSIS

31.8.3 PRODUCT PORTFOLIO

31.8.4 RECENT DEVELOPMENTS

31.9 LACTALIS INTERNATIONAL

31.9.1 COMPANY OVERVIEW

31.9.2 REVENUE ANALYSIS

31.9.3 PRODUCT PORTFOLIO

31.9.4 RECENT DEVELOPMENTS

31.1 SAPUTO INC.

31.10.1 COMPANY OVERVIEW

31.10.2 REVENUE ANALYSIS

31.10.3 PRODUCT PORTFOLIO

31.10.4 RECENT DEVELOPMENTS

31.11 HENNING'S WISCONSIN CHEESE

31.11.1 COMPANY OVERVIEW

31.11.2 REVENUE ANALYSIS

31.11.3 PRODUCT PORTFOLIO

31.11.4 RECENT DEVELOPMENTS

31.12 CASEIFICO F.LLI OIOLI

31.12.1 COMPANY OVERVIEW

31.12.2 REVENUE ANALYSIS

31.12.3 PRODUCT PORTFOLIO

31.12.4 RECENT DEVELOPMENTS

31.13 SAVENCIA SA.

31.13.1 COMPANY OVERVIEW

31.13.2 REVENUE ANALYSIS

31.13.3 PRODUCT PORTFOLIO

31.13.4 RECENT DEVELOPMENTS

31.14 MONDARELLA

31.14.1 COMPANY OVERVIEW

31.14.2 REVENUE ANALYSIS

31.14.3 PRODUCT PORTFOLIO

31.14.4 RECENT DEVELOPMENTS

31.15 DR. MANNAHS

31.15.1 COMPANY OVERVIEW

31.15.2 REVENUE ANALYSIS

31.15.3 PRODUCT PORTFOLIO

31.15.4 RECENT DEVELOPMENTS

31.16 NEW ROOTS

31.16.1 COMPANY OVERVIEW

31.16.2 REVENUE ANALYSIS

31.16.3 PRODUCT PORTFOLIO

31.16.4 RECENT DEVELOPMENTS

31.17 ALMARAI COMPANY

31.17.1 COMPANY OVERVIEW

31.17.2 REVENUE ANALYSIS

31.17.3 PRODUCT PORTFOLIO

31.17.4 RECENT DEVELOPMENTS

31.18 LAND O'LAKES, INC.

31.18.1 COMPANY OVERVIEW

31.18.2 REVENUE ANALYSIS

31.18.3 PRODUCT PORTFOLIO

31.18.4 RECENT DEVELOPMENTS

31.19 GCMMF (AMUL)

31.19.1 COMPANY OVERVIEW

31.19.2 REVENUE ANALYSIS

31.19.3 PRODUCT PORTFOLIO

31.19.4 RECENT DEVELOPMENTS

31.2 ASSOCIATED MILK PRODUCERS INC.

31.20.1 COMPANY OVERVIEW

31.20.2 REVENUE ANALYSIS

31.20.3 PRODUCT PORTFOLIO

31.20.4 RECENT DEVELOPMENTS

31.21 BRITANNIA INDUSTRIES LIMITED

31.21.1 COMPANY OVERVIEW

31.21.2 REVENUE ANALYSIS

31.21.3 PRODUCT PORTFOLIO

31.21.4 RECENT DEVELOPMENTS

31.22 THE BEL GROUP

31.22.1 COMPANY OVERVIEW

31.22.2 REVENUE ANALYSIS

31.22.3 PRODUCT PORTFOLIO

31.22.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

32 RELATED REPORTS

33 CONCLUSION

34 QUESTIONNAIRE

35 ABOUT DATA BRIDGE MARKET RESEARCH

Global Cheese Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cheese Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cheese Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.