Global Ceramic Armor Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

5.01 Billion

2024

2032

USD

2.81 Billion

USD

5.01 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 5.01 Billion | |

|

|

|

|

Ceramic Armor Market Size

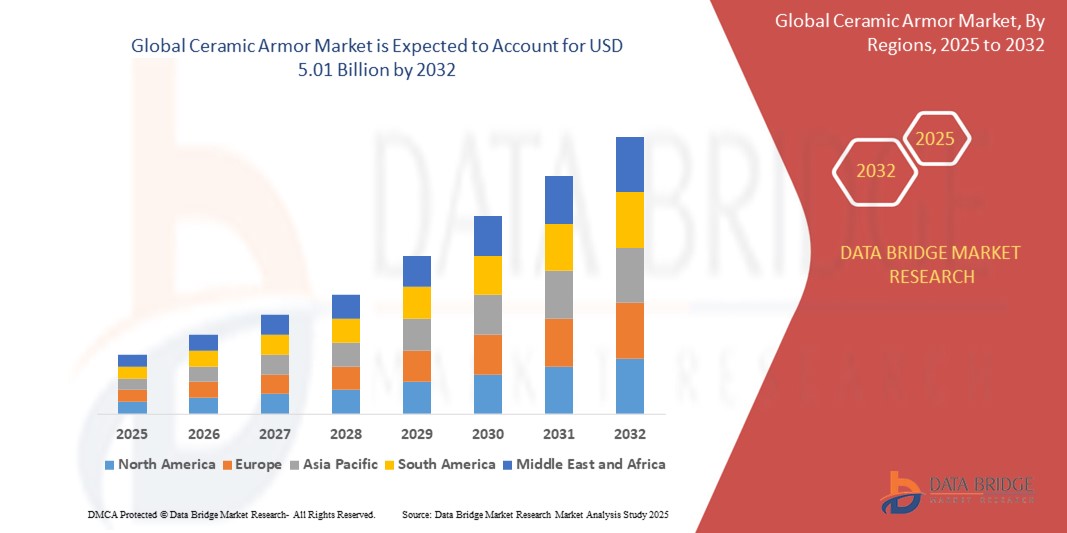

- The global ceramic armor market size was valued at USD 2.81 billion in 2024 and is expected to reach USD 5.01 billion by 2032, at a CAGR of 7.5% during the forecast period

- The market growth is largely fueled by increasing demand for lightweight, high-performance protective solutions across defense and security sectors, driven by the need for enhanced survivability and mobility in modern combat scenarios

- Furthermore, advancements in ceramic materials offering superior hardness, thermal resistance, and ballistic protection are encouraging their integration into body armor, vehicles, and aircraft, thereby significantly accelerating the adoption of ceramic armor systems and boosting overall market expansion

Ceramic Armor Market Analysis

- Ceramic armor, providing lightweight and highly durable ballistic protection, is becoming an essential component in modern defense and security applications across military, law enforcement, and homeland security platforms due to its superior hardness, impact resistance, and reduced weight compared to traditional metal armor

- The escalating demand for ceramic armor is primarily driven by increased defense spending, rising global security concerns, and the growing emphasis on enhancing soldier survivability and vehicle protection through advanced material technologies

- North America dominated the ceramic armor market with a share of 32.7% in 2024 due to significant defense spending, ongoing military modernization programs, and rising demand for lightweight protective solutions

- Asia-Pacific is expected to be the fastest growing region in the ceramic armor market during the forecast period due to escalating geopolitical tensions, increasing defense budgets, and domestic production initiatives in key nations such as China, India, and Japan

- Defense segment dominated the market with a market share of 63.1% in 2024 due to continuous procurement of advanced protective systems for military operations

Report Scope and Ceramic Armor Market Segmentation

|

Attributes |

Ceramic Armor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ceramic Armor Market Trends

“Rising Advancements in Lightweight Materials”

- A significant and accelerating trend in the global ceramic armor market is the continuous advancement in lightweight material technologies, enabling enhanced mobility, protection, and operational efficiency for defense and security personnel. These innovations are focused on improving the strength-to-weight ratio of ceramic composites while maintaining high ballistic resistance

- For instance, Morgan Advanced Materials has developed advanced alumina and silicon carbide ceramic armor solutions that deliver superior protection with reduced weight, making them ideal for both body armor and vehicle armor applications. Similarly, CeramTec is leveraging its expertise in technical ceramics to create high-performance armor plates tailored for modern military needs

- The push toward lightweight ceramic armor has also led to the development of hybrid and composite systems that combine ceramics with backing materials such as aramid fibers or UHMWPE, enhancing flexibility without compromising safety. Companies such as CoorsTek are at the forefront of this trend, offering multi-material armor systems designed for next-generation soldier protection and armored vehicle platforms

- Furthermore, advancements in manufacturing processes—such as hot pressing and pressure-assisted sintering—are enabling precise engineering of lighter ceramic armor components, improving durability and resistance under dynamic battlefield conditions

- This trend toward lighter and more durable ceramic armor solutions is transforming the defense landscape, as global military forces seek to equip personnel with gear that enhances maneuverability and endurance. Consequently, leading manufacturers are intensifying R&D efforts to meet the growing demand for high-performance, low-weight armor systems across land, air, and marine applications

- The demand for advanced lightweight ceramic armor is rapidly increasing across defense and homeland security sectors, driven by the need to optimize protection while minimizing load-bearing fatigue in increasingly mobile and high-threat operational environments

Ceramic Armor Market Dynamics

Driver

“Increasing Military Expenditures”

- The growing allocation of national budgets toward defense modernization and security enhancement is a significant driver for the rising demand in the ceramic armor market. As global tensions persist and governments prioritize troop protection and tactical advantage, investment in advanced armor technologies continues to surge

- For instance, in 2024, CoorsTek announced the expansion of its armor ceramics production capacity to support increased defense procurement contracts, particularly from U.S. and NATO-aligned forces. This move aligns with the growing defense budgets seen in countries such as the U.S., India, and China, which are actively upgrading their personnel protection and armored vehicle systems

- As military operations become more mobile and complex, ceramic armor is preferred for its lightweight yet highly durable properties, offering effective protection against high-velocity threats while enabling improved maneuverability for soldiers and vehicles

- Furthermore, companies such as Morgan Advanced Materials and CeramTec are working closely with defense ministries to deliver innovative armor solutions tailored to evolving battlefield requirements, including enhanced multi-hit capabilities and compatibility with advanced combat gear

- The rising military expenditures across both developed and emerging economies are expected to sustain long-term demand for ceramic armor systems, positioning industry leaders to capitalize on growing procurement needs and modernization initiatives globally

Restraint/Challenge

“High Production Costs”

- The high production costs associated with ceramic armor manufacturing pose a significant challenge to broader market scalability. The complex fabrication processes, such as hot pressing and pressure-assisted sintering, combined with the high cost of raw materials such as boron carbide and silicon carbide, contribute to elevated unit prices, limiting affordability for some end-users

- For instance, companies such as CeramTec and CoorsTek face substantial costs in maintaining advanced production facilities and ensuring consistent material quality to meet strict defense-grade specifications. These costs are further compounded by the need for rigorous testing and certification standards demanded by military and security agencies

- Addressing these cost challenges requires innovation in materials engineering and process efficiency. Leading firms are investing in R&D to explore cost-effective composite solutions and scalable production techniques. For example, Morgan Advanced Materials is actively working on integrating new ceramic matrix composites that offer a balance between cost and performance for broader market adoption

- Nevertheless, the high upfront investment remains a barrier, particularly for smaller defense contractors and security forces in budget-constrained regions. While long-term lifecycle benefits such as lower weight and extended durability are clear, the initial capital outlay continues to deter wider deployment across all defense and security sectors

- Overcoming this challenge will depend on further material innovations, economies of scale, and potential public-private collaborations to subsidize procurement, ensuring ceramic armor solutions become more accessible to a broader range of applications and markets

Ceramic Armor Market Scope

The market is segmented on the basis of material type, application, and platform.

- By Material Type

On the basis of material type, the ceramic armor market is segmented into Alumina, Boron Carbide, Silicon Carbide, Ceramic Matrix Composite, Titanium Boride, and Aluminium Nitride. The Alumina segment held the largest market revenue share of 34.7% in 2024, attributed to its cost-effectiveness, good ballistic performance, and widespread availability, making it a preferred choice for lightweight armor solutions across military and security applications.

The Silicon Carbide segment is projected to register the fastest growth rate from 2025 to 2032, driven by increasing demand for high-performance armor systems and advancements in manufacturing technologies enhancing its ballistic efficiency.

- By Application

On the basis of application, the market is categorized into Body Armor, Aircraft Armor, Marine Armor, and Vehicle Armor. The Body Armor segment dominated the market with the largest revenue share in 2024, supported by rising defense budgets and growing demand for lightweight protection for military personnel.

The Aircraft Armor segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing use of advanced ceramic composites in military aircraft for enhanced survivability and weight reduction.

- By Platform

On the basis of platform, the market is segmented into Defense, Homeland Security, and Civilians. The Defense segment accounted for the largest revenue share 0f 63.1% in 2024, owing to continuous procurement of advanced protective systems for military operations.

The Homeland Security segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by growing concerns over terrorism, border security threats, and increasing investments in protective equipment for law enforcement agencies.

Ceramic Armor Market Regional Analysis

- North America dominated the ceramic armor market with the largest revenue share of 32.7% in 2024, driven by significant defense spending, ongoing military modernization programs, and rising demand for lightweight protective solutions

- The region's focus on soldier survivability and advanced vehicle armor systems underpins the demand for high-performance ceramic materials such as boron carbide and silicon carbide

- Growing adoption in homeland security and law enforcement agencies, along with collaborations between defense contractors and research institutions, further strengthens North America’s leadership in the ceramic armor space

U.S. Ceramic Armor Market Insight

The U.S. ceramic armor market captured the largest revenue share of 89.4% in 2024 within North America, fueled by continued investment in next-generation armor technologies for military and tactical applications. The Department of Defense’s emphasis on upgrading personal protective equipment and armored vehicles is driving procurement of ceramic-based solutions. In addition, innovations in material science, combined with strong domestic production capabilities and partnerships with defense manufacturers, are bolstering market growth.

Europe Ceramic Armor Market Insight

The Europe ceramic armor market is projected to expand at a steady CAGR throughout the forecast period, supported by heightened concerns over national security, rising military budgets, and cross-border defense collaborations. Demand for lightweight, high-strength armor materials is rising across both NATO-aligned forces and domestic security units. The adoption of ceramic armor in both vehicle and aircraft platforms is increasing, particularly in countries such as France, Germany, and the U.K., which are focusing on modernizing defense fleets and enhancing personnel protection systems.

Germany Ceramic Armor Market Insight

The Germany ceramic armor market is expected to grow considerably, driven by government efforts to reinforce defense readiness and enhance the protective capabilities of armed forces. Germany's commitment to NATO defense targets and domestic initiatives for equipping military and security personnel with advanced armor solutions are contributing to increased demand. Furthermore, Germany’s advanced manufacturing infrastructure and R&D in advanced ceramics support local production and innovation in armor applications.

U.K. Ceramic Armor Market Insight

The U.K. ceramic armor market is anticipated to grow at a moderate CAGR during the forecast period, supported by rising investments in defense modernization and counterterrorism operations. With a focus on enhancing mobility and protection for both infantry and vehicle platforms, the U.K. is deploying ceramic armor in a wide range of military and law enforcement equipment. The country’s robust defense sector, combined with partnerships in NATO joint development projects, continues to foster market expansion.

Asia-Pacific Ceramic Armor Market Insight

The Asia-Pacific ceramic armor market is projected to grow at the fastest CAGR of 9.5% from 2025 to 2032, driven by escalating geopolitical tensions, increasing defense budgets, and domestic production initiatives in key nations such as China, India, and Japan. Growing focus on modernizing armed forces, particularly through indigenized armor manufacturing programs, is boosting adoption across land, naval, and airborne platforms. The availability of raw materials and advancements in ceramic processing technologies are enhancing regional competitiveness.

China Ceramic Armor Market Insight

The China ceramic armor market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country's aggressive military modernization strategy and increased focus on domestic manufacturing of defense-grade materials. China is rapidly advancing its ceramic armor capabilities through government-backed R&D and public-private partnerships. The adoption of ceramic armor is expanding beyond military into internal security and law enforcement, driven by urbanization, strategic infrastructure protection, and the growing need for riot control and anti-terrorism equipment.

Japan Ceramic Armor Market Insight

The Japan ceramic armor market is gaining traction due to the country’s rising defense awareness and investment in advanced protective systems for its Self-Defense Forces. Emphasis on developing lightweight, durable armor for rapid deployment and homeland security applications is fueling demand for high-performance ceramics. In addition, Japan’s strong materials science capabilities and focus on innovation are encouraging the integration of ceramic armor in aerospace and naval applications for both defensive and peacekeeping missions.

Ceramic Armor Market Share

The ceramic armor industry is primarily led by well-established companies, including:

- Saint-Gobain (France)

- CoorsTek Inc (U.S.)

- Koninklijke Ten Cate bv (Netherlands)

- 3M (U.S.)

- ArmorWorks (U.S.)

- CeramTec Group (Germany)

- BAE Systems (U.K.)

- Morgan Advanced Materials (U.K.)

- Seyntex (Belgium)

- Safariland, LLC (U.S.)

- Hard Shell UK Ltd. (U.K.)

- FMS Enterprises Migun LTD (Israel)

- Concept East Ltd (U.K.)

- Schunk GmbH (Germany)

- SM Group (Finland)

- CerCo Corporation (U.S.)

- Point Blank Enterprises, Inc. (U.S.)

- ArmorStruxx.com (U.S.)

- Saab AB (Sweden)

- II-VI Incorporated (U.S.)

- KDH Defense Systems, Inc. (U.S.)

- Sarkar Tactical (U.K.)

Latest Developments in Global Ceramic Armor Market

- In July 2023, Elbit Systems Ltd. (NASDAQ: ELST) acquired Applied Ceramics Inc. (ACI), a key manufacturer of advanced ceramic armor, for approximately USD 145 million. This strategic acquisition bolsters Elbit’s foothold in the body armor sector while expanding its product portfolio to include lightweight, high-performance ceramic plates. The move enhances Elbit's capability to meet growing global demand for protective armor solutions in military and law enforcement applications

- In June 2023, Honeywell Aerospace (NYSE: HON) introduced Spectra Shield X, a cutting-edge boron carbide-based ceramic armor material. This innovative solution is 20% lighter than traditional boron carbide armor while maintaining the same high level of ballistic protection. The development underscores Honeywell’s commitment to advancing protective technology for military, law enforcement, and civilian uses, offering enhanced safety without sacrificing mobility

- In May 2023, Ceradyne, Inc. (OTC: CRDY) was awarded a USD 34 million contract from the US Department of Defense to supply advanced composite armor inserts for the Improved Outer Tactical Vest (IOTV) program. The contract reflects the DoD's continued investment in upgrading protective equipment for military personnel, with Ceradyne's composite materials playing a critical role in enhancing the durability and ballistic resistance of the IOTV system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ceramic Armor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ceramic Armor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ceramic Armor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.