Global Cellulose Esters Market

Market Size in USD Billion

CAGR :

%

USD

2.93 Billion

USD

4.68 Billion

2024

2032

USD

2.93 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 2.93 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Cellulose Esters Market Size

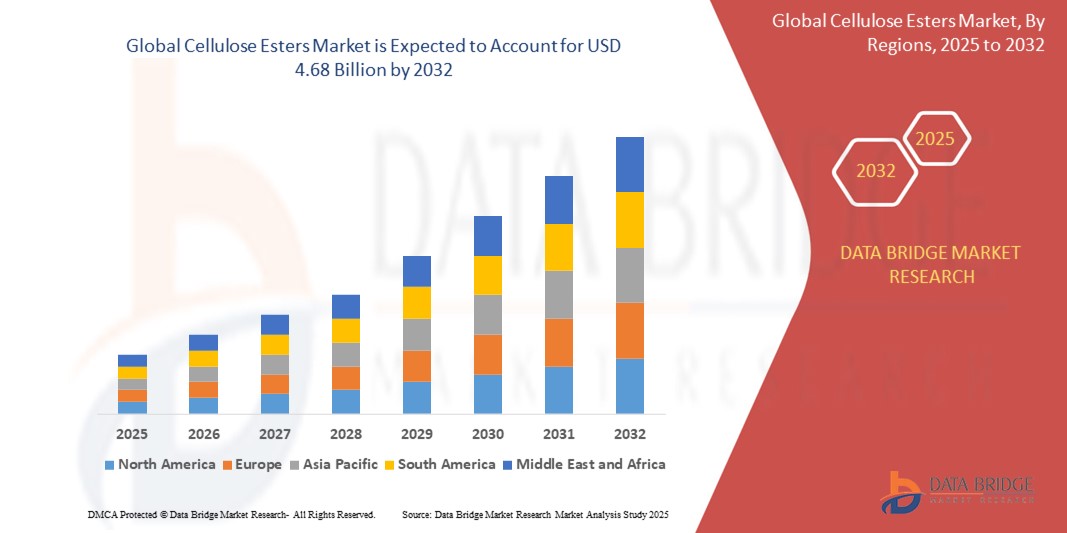

- The global cellulose esters market size was valued at USD 2.93 billion in 2024 and is expected to reach USD 4.68 billion by 2032, growing at a CAGR of 5.98% during the forecast period.

- The market’s growth is propelled by increasing demand from packaging, textiles, and coatings industries, along with the push toward sustainable, biodegradable materials in industrial and consumer applications.

Cellulose Esters Market Analysis

- Cellulose esters are bio-based polymers produced by the esterification of cellulose, offering excellent film-forming ability, compatibility with other materials, high clarity, and biodegradability. These properties make them ideal for use in coatings, packaging films, inks, and textile finishes.

- The market is steadily expanding due to rising environmental concerns, stricter regulations on single-use plastics, and growing preference for eco-friendly polymers in both industrial and consumer product applications.

- Asia-Pacific leads the cellulose esters market, holding a market share of 38.21%, owing to robust growth in textile manufacturing, automotive production, and flexible packaging in economies like China, India, and Southeast Asia.

- Europe is expected to witness the fastest growth during the forecast period, driven by stringent EU regulations on plastic use, growing adoption of biodegradable coatings and packaging, and increasing investments in green chemistry.

- By type, cellulose acetate dominates the market with a share of 42.17%, favored for its use in cigarette filters, photographic films, coatings, and textiles due to its superior clarity, toughness, and biodegradability.

Report Scope and Cellulose Esters Market Segmentation

|

Attributes |

Cellulose Esters Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

· Eastman Chemical Company (U.S.) · Celanese Corporation (U.S.) · Daicel Corporation (Japan) · Mitsubishi Chemical Group Corporation (Japan) · Sappi Limited (South Africa) · China National Tobacco Corporation (China) · Rayonier Advanced Materials Inc. (U.S.) · Ashok Alco-Chem Limited (India) · Chempro Group (China) · Acordis Cellulosic Fibers Limited (UK) · CP Kelco (J.M. Huber Corporation) (U.S.) · Shandong Henglian New Materials Co., Ltd. (China) · Nantong Cellulose Fibers Co., Ltd. (China) · BASF SE (Germany) · Diverchim (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cellulose Esters Market Trends

“Shift Toward Sustainable and Bio-Based Polymer Solutions”

- One prominent trend in the global cellulose esters market is the increasing shift toward sustainable, biodegradable, and bio-based polymer alternatives.

- This trend is being driven by growing environmental awareness, regulatory restrictions on synthetic plastics, and the increasing demand for renewable material sources in packaging, textiles, and coatings.

- For instance, companies like Eastman Chemical Company and Mitsubishi Chemical Group are actively developing cellulose-based plastics and coatings to replace petroleum-derived materials in consumer packaging and automotive interiors.

- Cellulose esters are derived from wood pulp and cotton linters, making them naturally biodegradable, thereby aligning well with circular economy and green material initiatives.

- As both manufacturers and end-users focus more on eco-friendly product development and reduced carbon footprints, the adoption of cellulose esters in sustainable product designs is expected to gain substantial momentum.

Cellulose Esters Market Dynamics

Driver

“Increasing Demand from Packaging and Coatings Industries”

- A major driver in the cellulose esters market is the surging demand from the packaging and coatings sectors, where these materials offer film-forming properties, clarity, flexibility, and biodegradability.

- With growing pressure to reduce the use of single-use plastics and comply with global sustainability mandates, industries are shifting toward cellulose-based materials for packaging films, barrier coatings, and inks.

- For instance, Eastman’s cellulose esters are widely used in sustainable food packaging films, while Mitsubishi’s products are incorporated in biodegradable coatings used across consumer goods.

- Cellulose esters are also used in automotive and textile coatings for their ability to enhance surface durability and visual appeal without compromising biodegradability.

- As demand for environmentally conscious yet functional materials continues to rise, cellulose esters are becoming a preferred option, supporting market expansion across multiple end-use industries.

Restraint/Challenge

“Fluctuations in Raw Material Supply and Processing Costs”

- One of the key challenges in the cellulose esters market is the volatility in raw material supply—primarily wood pulp and cotton linters—and the associated high processing costs.

- The production of cellulose esters involves complex esterification processes and the use of various chemical reagents, increasing manufacturing costs, especially for high-purity or specialty-grade esters.

- For instance, the growing global demand for paper and textile fibers affects the availability and price of cellulose feedstock, leading to supply chain constraints and input cost inflation.

- This challenge is particularly significant in cost-sensitive industries like textiles and consumer packaging, where price competitiveness is a key decision factor.

- Moreover, adopting green chemistry practices and meeting stringent environmental standards often require additional investments, which may hinder adoption in developing regions.

- The combination of raw material price fluctuations and cost-intensive processing may restrict broader market penetration, especially among small-to-medium manufacturers seeking cost-effective alternatives to synthetic polymers.

Cellulose Esters Market Scope

The market is segmented on the basis of type, application, and end-use industry.

- By Type

On the basis of type, the Cellulose Esters Market is segmented into Cellulose Acetate, Cellulose Acetate Butyrate (CAB), Cellulose Acetate Propionate (CAP), and Others. The Cellulose Acetate segment is expected to dominate the market with the largest revenue share of 39.7% in 2025, owing to its widespread application in film coatings, textiles, and cigarette filters, as well as its biodegradable nature, which aligns with the global push toward sustainable materials.

However, the Cellulose Acetate Butyrate (CAB) segment is projected to register the highest CAGR of 6.84% during the forecast period of 2025–2032. This growth is primarily driven by increasing demand in automotive coatings, graphic arts, and packaging, where CAB’s excellent weatherability, clarity, and adhesion properties are particularly valued. CAB’s compatibility with various solvents and resins also makes it suitable for high-performance coatings.

- By Application

On the basis of application, the Cellulose Esters Market is segmented into Coatings, Films & Tapes, Inks, Plastics, Textiles, and Others. The Coatings segment held the largest market share of 25.6% in 2025, driven by its extensive use in automotive refinishes, wood coatings, and printing inks. The ability of cellulose esters to improve flow, leveling, and film formation makes them a preferred additive in coating formulations.

During the forecast period, the Films & Tapes segment is expected to witness the highest CAGR of 7.03%, supported by rising demand for biodegradable and transparent films in packaging and electronics. Cellulose ester films are increasingly being adopted as sustainable alternatives to conventional petroleum-based plastics due to their excellent clarity, printability, and environmental compatibility.

- By End-Use Industry

On the basis of end-use industry, the Cellulose Esters Market is segmented into Packaging, Automotive, Textile, Paints & Coatings, Consumer Goods, and Others. The Packaging segment accounted for the largest market share of 28.4% in 2025, owing to increasing adoption of biodegradable cellulose-based films in food packaging and labeling. The growing focus on sustainability and plastic reduction mandates from both regulators and consumers is significantly driving this segment.

Meanwhile, the Automotive segment is projected to record the fastest CAGR of 6.91% during 2025–2032, fueled by the need for high-performance coatings and interior components that offer both aesthetic appeal and environmental compliance. Cellulose esters are used in automotive paints and trim coatings due to their scratch resistance, fast drying time, and gloss retention, making them ideal for next-generation automotive applications.

Global Cellulose Esters Market Regional Analysis

North America Cellulose Esters Market Insight

North America holds a prominent position in the global cellulose esters market, accounting for a significant revenue share in 2024. The region's advanced packaging, coatings, and pharmaceutical industries drive strong demand for cellulose esters due to their biodegradability, clarity, and film-forming properties. The shift toward sustainable packaging materials and low-VOC coatings is accelerating adoption across end-use sectors. Furthermore, well-established R&D infrastructure and government support for eco-friendly product development bolster regional market growth.

- U.S. Cellulose Esters Market Insight

The U.S. market dominates the North American region in 2025, largely driven by the packaging and coatings industries, which are rapidly adopting bio-based polymers. The country’s focus on sustainable manufacturing practices, combined with demand from pharmaceutical capsule production and tobacco filters, continues to fuel growth. Additionally, key players are investing in cellulose acetate and CAB capacity expansions to meet the rising demand for specialty films and coatings.

- Canada Cellulose Esters Market Insight

The Canadian cellulose esters market is projected to grow steadily during the forecast period, supported by increasing investments in renewable packaging and green construction materials. Rising consumer demand for biodegradable films and coatings in food and industrial applications, coupled with favorable regulatory policies, is expected to spur market development. The Canadian government’s emphasis on reducing single-use plastic consumption is further driving demand for cellulose-based alternatives.

Europe Cellulose Esters Market Insight

The European cellulose esters market is expected to register notable growth through 2032, driven by stringent environmental regulations, circular economy initiatives, and innovation in bio-based polymers. Demand is particularly strong in coatings, textiles, and consumer goods, where performance and environmental safety are key. The EU’s Green Deal and plastic ban directives are also playing a major role in shifting demand toward cellulose-based materials.

- Germany Cellulose Esters Market Insight

Germany leads the European cellulose esters market, thanks to its strong industrial base and environmental leadership. The country’s automotive coatings, electronics, and packaging industries are increasingly adopting cellulose esters due to their transparency, thermal stability, and environmental compliance. The push for VOC-free coatings and sustainable product design is further accelerating market penetration, particularly for CAB and CAP derivatives.

- France Cellulose Esters Market Insight

The French market is poised for considerable growth, backed by rising demand for biodegradable films and sustainable inks in the packaging and printing sectors. France’s efforts to reduce plastic waste and increase recyclability in consumer goods packaging are fueling interest in cellulose esters. Moreover, government-led green building initiatives and a shift toward eco-friendly consumer products are reinforcing demand for low-impact coating and plasticizing solutions.

Asia-Pacific Cellulose Esters Market Insight

The Asia-Pacific region is expected to witness the fastest CAGR of over 21% in 2025, fueled by rapid industrialization, urbanization, and rising environmental awareness across emerging economies. The demand for biodegradable films, high-performance coatings, and safe plasticizers is expanding across packaging, textiles, and electronics sectors. Supportive government policies for green manufacturing and investments in domestic cellulose ester production are further driving growth.

- China Cellulose Esters Market Insight

China commands the largest market share in the Asia-Pacific cellulose esters market, driven by high consumption in packaging films, textiles, and cigarette filters. The country’s large-scale manufacturing capabilities, combined with a growing emphasis on environmental sustainability and plastic alternatives, are boosting the use of cellulose acetate and related derivatives. Investments in pharmaceutical and food-grade cellulose esters are also contributing to demand.

- India Cellulose Esters Market Insight

India’s cellulose esters market is projected to grow at an impressive CAGR during the forecast period, driven by expansion in food packaging, personal care, and construction sectors. Rising awareness of sustainable and recyclable materials, along with increasing pressure to replace traditional plastics, is fostering demand for cellulose-based products. Furthermore, government initiatives supporting bio-based polymers and the emergence of local cellulose ester producers are expected to enhance market growth prospects.

Cellulose Esters Market Share

The Cellulose Esters industry is primarily led by well-established companies, including:

- Eastman Chemical Company (U.S.)

- Celanese Corporation (U.S.)

- Daicel Corporation (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- Sappi Limited (South Africa)

- China National Tobacco Corporation (China)

- Rayonier Advanced Materials Inc. (U.S.)

- Ashok Alco-Chem Limited (India)

- Chempro Group (China)

- Acordis Cellulosic Fibers Limited (UK)

- CP Kelco (J.M. Huber Corporation) (U.S.)

- Shandong Henglian New Materials Co., Ltd. (China)

- Nantong Cellulose Fibers Co., Ltd. (China)

- BASF SE (Germany)

- Diverchim (France)

Latest Developments in Global Cellulose Esters Market

- In February 2025, Eastman Chemical Company launched a new grade of cellulose acetate specifically designed for sustainable packaging applications. This new bio-based formulation offers improved transparency, gloss, and printability while maintaining compostability and biodegradability, reinforcing Eastman’s commitment to circular economy principles and expanding its foothold in eco-friendly materials.

- In October 2024, Daicel Corporation announced the expansion of its cellulose acetate production facility in Arai, Japan, aimed at meeting the rising global demand from the pharmaceuticals and optical films sectors. This strategic move is expected to boost supply chain resilience and reinforce Daicel’s position in high-purity cellulose derivatives for specialized applications.

- In June 2024, Celanese Corporation introduced a high-performance cellulose acetate propionate (CAP) grade optimized for automotive interior applications. The product offers superior UV resistance, dimensional stability, and low VOC emissions, aligning with the industry shift toward sustainable, high-specification interior materials and expanding Celanese’s reach into value-added esters for the mobility sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cellulose Esters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cellulose Esters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cellulose Esters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.