Global Cell Surface Market

Market Size in USD Billion

CAGR :

%

USD

6.70 Billion

USD

16.94 Billion

2025

2033

USD

6.70 Billion

USD

16.94 Billion

2025

2033

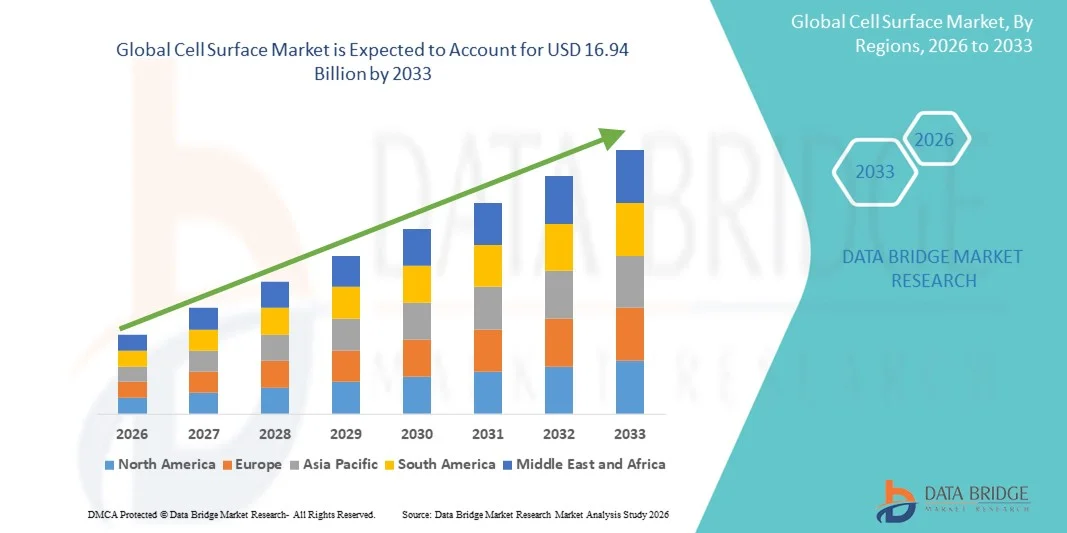

| 2026 –2033 | |

| USD 6.70 Billion | |

| USD 16.94 Billion | |

|

|

|

|

Cell Surface Market Size

- The global cell surface market size was valued at USD 6.70 billion in 2025 and is expected to reach USD 16.94 billion by 2033, at a CAGR of 12.3% during the forecast period

- The market growth is primarily driven by the increasing focus on cell-based research, advanced diagnostics, and therapeutic development, which are expanding the applications of cell surface analysis in life sciences and biotechnology

- In addition, rising demand for personalized medicine, targeted therapies, and improved disease detection techniques is positioning cell surface technologies as critical tools in research and clinical settings. These combined factors are accelerating the adoption of cell surface solutions, thereby significantly propelling the industry's growth

Cell Surface Market Analysis

- Cell surface technologies, encompassing tools and assays for analyzing cell membranes, receptors, and surface markers, are becoming increasingly essential in biomedical research, drug development, and diagnostics due to their critical role in understanding cellular interactions, disease mechanisms, and therapeutic targeting

- The rising demand for advanced cell-based assays and targeted therapies is primarily driving the adoption of cell surface solutions, alongside growing investments in biotechnology, immunology, and personalized medicine research

- North America dominated the cell surface market with the largest revenue share of 39.2% in 2025, supported by a robust life sciences infrastructure, high R&D expenditure, and a strong presence of key market players, with the U.S. leading in innovations for flow cytometry, hematology analyzers, and advanced reagent kits

- Asia-Pacific is expected to be the fastest-growing region in the cell surface market during the forecast period, fueled by increasing biotech investments, expanding research infrastructure, and rising focus on advanced diagnostics and therapeutic development

- Flow cytometry segment dominated the cell surface market with a market share of 43.9% in 2025, driven by its widespread application in research and clinical settings for analyzing T cell, B cell, NK cell, and monocyte surface markers efficiently

Report Scope and Cell Surface Market Segmentation

|

Attributes |

Cell Surface Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cell Surface Market Trends

Advancements in Multiplexed and High-Throughput Analysis

- A significant and accelerating trend in the global cell surface market is the increasing adoption of multiplexed and high-throughput platforms, enabling simultaneous analysis of multiple cell surface markers with higher accuracy and efficiency

- For instance, flow cytometry platforms now allow simultaneous profiling of T cell, B cell, NK cell, and monocyte markers, reducing time and reagent consumption while improving experimental throughput

- Integration with automated sample processing and advanced software analytics enhances data interpretation, allowing researchers to derive actionable insights from complex cellular datasets

- These technological advancements are facilitating faster discovery in immunology, oncology, and personalized medicine, driving demand for sophisticated cell surface analysis solutions

- This trend towards more efficient, scalable, and automated platforms is fundamentally reshaping laboratory workflows and user expectations, encouraging companies such as BD Biosciences and Bio-Rad to develop next-generation high-throughput cytometry instruments

- The demand for cell surface technologies with multiplexing capabilities is growing rapidly across both academic and clinical research sectors, as scientists prioritize precision, scalability, and reproducibility in their studies

- Growing adoption of AI and machine learning in cell surface data analysis allows predictive modeling and pattern recognition, improving the accuracy of biomarker identification and therapeutic targeting

Cell Surface Market Dynamics

Driver

Increasing Demand for Targeted Therapies and Personalized Medicine

- The rising focus on targeted therapies and personalized medicine is a key driver of demand for cell surface analysis technologies, as these tools enable precise identification of cell types and biomarkers critical for therapeutic development

- For instance, researchers utilize antibody-based profiling and PCR arrays to study cell surface markers that guide immunotherapy design, leading to more effective treatments for cancer and autoimmune diseases

- Growing investment in biotechnology and pharmaceutical R&D further fuels adoption, as advanced cell surface assays are integral for drug discovery, receptor profiling, and biomarker validation

- The increasing prevalence of chronic diseases and the need for early diagnosis and treatment monitoring are further encouraging the integration of cell surface technologies in clinical workflows

- Rising collaborations between academic institutions, hospitals, and biotech companies are accelerating the development of novel assays and reagents tailored for specific cell types, expanding market opportunities. Increasing regulatory approvals for cell-based diagnostics and companion diagnostic tools are driving adoption in clinical settings, enhancing the credibility and applicability of cell surface analysis

- The combination of scientific innovation and rising healthcare awareness is making cell surface analysis an indispensable component of both research and clinical applications

Restraint/Challenge

High Costs and Technical Complexity

- The high costs of advanced instruments, reagents, and kits, along with the technical expertise required to operate and interpret complex cell surface assays, pose significant challenges to market expansion

- For instance, setting up flow cytometry platforms with multiplexing capability requires substantial investment in hardware, software, and trained personnel, limiting accessibility for smaller laboratories

- In addition, variability in assay protocols and potential for technical errors can affect reproducibility and reliability, leading some institutions to delay adoption of advanced systems

- Companies such as Thermo Fisher Scientific and Miltenyi Biotec emphasize user-friendly kits and automated workflows to mitigate complexity, but initial setup costs remain a barrier in emerging regions

- Limited availability of standardized reagents and validated protocols across diverse cell types can hinder consistency and widespread adoption, particularly in multi-center studies

- Challenges in data management and interpretation due to the large volume of complex datasets generated by high-throughput cell surface analyses can overwhelm existing laboratory infrastructure

- Overcoming these challenges through cost-effective instruments, simplified protocols, and enhanced training programs is essential for broader adoption and sustained growth of the global cell surface market

Cell Surface Market Scope

The market is segmented on the basis of product, source, cell type, application, end user, and instruments & reagents.

- By Product

On the basis of product, the cell surface market is segmented into antibody and PCR array. The Antibody segment dominated the market with the largest market revenue share in 2025, driven by its extensive use in flow cytometry, immunophenotyping, and receptor profiling. Antibodies are highly specific, allowing researchers to accurately detect and quantify surface markers on T cells, B cells, NK cells, and monocytes. The segment benefits from a wide range of commercially available monoclonal and polyclonal antibodies, facilitating research in immunology, oncology, and stem cell studies. Increasing adoption in both academic and clinical laboratories for high-throughput experiments and diagnostic applications further strengthens its dominance. In addition, antibody-based kits and reagents are widely compatible with existing cytometry instruments, making them a preferred choice for routine analysis and reproducible results.

The PCR Array segment is anticipated to witness the fastest growth from 2026 to 2033 due to the rising demand for gene expression profiling and cell surface marker identification at the molecular level. PCR arrays allow simultaneous detection of multiple genes, supporting studies in personalized medicine, cancer research, and immunotherapy. Advances in multiplex PCR technologies, combined with decreasing costs and automation, are making PCR arrays more accessible to research institutions and clinical laboratories. Furthermore, the increasing use of PCR arrays for biomarker discovery and targeted therapeutic development is expected to drive substantial adoption over the forecast period.

- By Source

On the basis of source, the market is segmented into mice, rats, and other sources. The Mice segment dominated the market in 2025 due to their extensive use in preclinical research, immunology studies, and therapeutic testing. Mice offer well-characterized immune systems, making them ideal models for studying T cell, B cell, and NK cell surface markers. The availability of transgenic and knockout strains further enhances their utility in receptor profiling and disease modeling. Mice-derived antibodies and reagents are widely adopted in both academic research and pharmaceutical R&D, supporting their dominance. The high reproducibility and reliability of results from mice-based studies contribute to their preference in laboratory settings.

The Other Sources segment is expected to witness the fastest growth during the forecast period, driven by the rising adoption of humanized models, primates, and alternative sources for translational research. These sources allow closer approximation to human biology, enhancing the relevance of cell surface studies in clinical research. The growing demand for advanced models in oncology, hematology, and immunotherapy is accelerating adoption, supported by improvements in ethical sourcing and high-quality reagent availability.

- By Cell Type

On the basis of cell type, the market is segmented into T Cell Surface Markers, B Cell Surface Markers, NK Cell Surface Markers, Monocyte Cell Surface Markers, and Other Cell Types. The T Cell Surface Markers segment dominated the market in 2025, attributed to the central role of T cells in immunology research, cancer immunotherapy, and infectious disease studies. T cell profiling enables identification of activation, differentiation, and exhaustion markers, which are critical for designing targeted therapies. The availability of well-validated antibodies and flow cytometry panels supports high adoption in both academic and clinical laboratories. The increasing focus on CAR-T therapy and checkpoint inhibitor research further strengthens the demand for T cell surface analysis.

The NK Cell Surface Markers segment is expected to witness the fastest growth from 2026 to 2033 due to rising interest in NK cell-based immunotherapies and antiviral research. NK cells are being explored for cancer and infectious disease treatments, driving demand for accurate surface marker characterization. Technological advancements in high-throughput cytometry and multiplexed assays make NK cell studies more accessible. Increasing collaborations between biotech companies and research institutions to develop NK cell-targeted therapies are further accelerating growth.

- By Application

On the basis of application, the market is segmented into research and clinical. The Research segment dominated the market in 2025, supported by high demand for cell surface profiling in stem cell studies, immunology research, and drug discovery. Academic institutions and pharmaceutical companies rely on surface marker analysis to understand cell differentiation, immune responses, and receptor-ligand interactions. Technological advancements in flow cytometry, PCR arrays, and multiplexed assays are expanding research capabilities. Funding support from government and private organizations for fundamental research continues to drive growth.

The Clinical segment is expected to witness the fastest growth during the forecast period due to the rising adoption of cell surface analysis in oncology and hematology diagnostics. Cell surface markers are critical for early disease detection, monitoring treatment response, and guiding personalized therapy decisions. Increasing regulatory approvals for companion diagnostic tools and advanced laboratory infrastructure in hospitals are supporting rapid growth. Furthermore, growing awareness of precision medicine among clinicians is accelerating integration of cell surface technologies in clinical workflows.

- By End User

On the basis of end user, the market is segmented into academic and research institutes, hospitals & clinical testing laboratories, and pharmaceutical & biotechnology companies. The Academic and Research Institutes segment dominated the market in 2025, driven by high research activity in immunology, stem cell studies, and drug discovery. These institutes have access to advanced flow cytometry platforms, reagents, and kits, making them primary users of cell surface analysis technologies. Government grants and funding programs further support adoption. The segment benefits from collaborations with biotech and pharmaceutical companies for translational research.

The Pharmaceutical & Biotechnology Companies segment is expected to witness the fastest growth from 2026 to 2033, due to increasing R&D in targeted therapies, immunotherapies, and biomarker discovery. These companies invest heavily in high-throughput instruments and multiplexed assays for drug development. Integration of AI and machine learning for data analysis further accelerates adoption. Growing partnerships with academic institutions and clinical labs also support the rapid expansion of this end-user segment.

- By Instruments and Reagents

On the basis of instruments and reagents, the market is segmented into flow cytometry, hematology analyzers, and reagents and kits. The Flow Cytometry segment dominated the market in 2025 with a market share of 43.9%, owing to its ability to perform high-throughput and multiparameter analysis of cell surface markers with high accuracy. It is widely adopted in both research and clinical settings for immunophenotyping, stem cell characterization, and cancer studies. Flow cytometry platforms are compatible with a broad range of antibodies and reagents, enhancing their utility. Technological advancements, such as spectral cytometry and automated sample processing, are strengthening this segment’s dominance.

The Reagents and Kits segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for standardized, ready-to-use solutions for cell surface analysis. Reagents and kits simplify workflows for academic, clinical, and industrial laboratories, reducing variability and enhancing reproducibility. Advances in multiplexed reagent panels, AI-assisted kits, and automation-friendly formulations are further accelerating adoption. Rising demand for cell-type-specific kits for T cells, B cells, NK cells, and monocytes supports sustained growth.

Cell Surface Market Regional Analysis

- North America dominated the cell surface market with the largest revenue share of 39.2% in 2025, supported by a robust life sciences infrastructure, high R&D expenditure, and a strong presence of key market players, with the U.S. leading in innovations for flow cytometry, hematology analyzers, and advanced reagent kits

- Researchers and institutions in the region prioritize precision and reliability in cell surface analysis, leveraging advanced flow cytometry, PCR arrays, and reagent kits for applications in immunology, oncology, and stem cell research

- The widespread adoption is further supported by robust government and private funding for life sciences research, a technologically skilled workforce, and extensive collaborations between academic, clinical, and pharmaceutical organizations, establishing North America as the leading hub for cell surface technologies in both research and clinical settings

U.S. Cell Surface Market Insight

The U.S. cell surface market captured the largest revenue share in 2025 within North America, driven by extensive investments in life sciences research, advanced laboratory infrastructure, and the presence of key market players. Researchers and pharmaceutical companies are increasingly prioritizing high-throughput flow cytometry, PCR arrays, and multiplexed assays for applications in immunology, oncology, and stem cell research. The growing emphasis on personalized medicine and targeted therapies further accelerates adoption. In addition, strong government and private funding, alongside collaborations between academic institutions and biotech firms, is significantly contributing to market growth.

Europe Cell Surface Market Insight

The Europe cell surface market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in biotechnology and the rising demand for advanced diagnostic tools. Stringent regulatory frameworks for clinical research and growing adoption of high-precision instruments such as flow cytometers and hematology analyzers are fostering market growth. European researchers are leveraging cell surface technologies for cancer research, immunotherapy, and stem cell studies. Moreover, the expansion of research infrastructure and collaborations between hospitals, universities, and pharmaceutical companies is further supporting adoption across the region.

U.K. Cell Surface Market Insight

The U.K. cell surface market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing R&D in immunology and oncology and a focus on precision medicine. Rising investments in flow cytometry, PCR arrays, and standardized reagent kits are encouraging adoption across academic, clinical, and pharmaceutical settings. In addition, collaborations between universities, hospitals, and biotech companies are expanding research capabilities. The U.K.’s strong regulatory environment and technological expertise in laboratory sciences are expected to continue driving market growth.

Germany Cell Surface Market Insight

The Germany cell surface market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong emphasis on innovation, advanced research infrastructure, and high adoption of laboratory automation. Germany’s robust pharmaceutical and biotechnology sector, coupled with increasing clinical research activities in oncology and hematology, supports the growth of cell surface technologies. Integration of high-throughput flow cytometry and multiplexed assays into routine research workflows is becoming increasingly prevalent. The market is further driven by government and private funding for translational research and personalized medicine initiatives.

Asia-Pacific Cell Surface Market Insight

The Asia-Pacific cell surface market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by rising investments in biotechnology, expanding research infrastructure, and increasing government initiatives supporting life sciences innovation in countries such as China, Japan, and India. The region is witnessing growing adoption of high-throughput instruments and multiplexed assays in both research and clinical applications. In addition, increasing collaborations with global pharmaceutical companies and rising focus on personalized medicine are contributing to market expansion.

Japan Cell Surface Market Insight

The Japan cell surface market is gaining momentum due to the country’s advanced research ecosystem, technological expertise, and focus on precision medicine. Japanese researchers are leveraging flow cytometry, PCR arrays, and reagent kits for applications in oncology, immunology, and hematology. The integration of high-throughput analysis and AI-assisted data interpretation is driving efficiency and accuracy in cell surface studies. Moreover, Japan’s strong government support for biotech innovation and clinical research is boosting the adoption of cell surface technologies across academic, clinical, and industrial laboratories.

India Cell Surface Market Insight

The India cell surface market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to growing investments in biotechnology, increasing research activities in immunology and oncology, and expanding laboratory infrastructure. India is emerging as a key hub for clinical research and pharmaceutical R&D, fueling demand for flow cytometry, PCR arrays, and reagent kits. Government initiatives promoting life sciences research, combined with a growing skilled workforce and affordable instrumentation, are key factors propelling market growth. In addition, collaborations with global pharmaceutical and biotech companies are further driving adoption across the country.

Cell Surface Market Share

The Cell Surface industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Danaher (U.S.)

- Agilent Technologies Inc. (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Sysmex Corporation (Japan)

- Cytek Biosciences (U.S.)

- Sony Biotechnology Inc. (U.S.)

- Miltenyi Biotec (Germany)

- Standard BioTools (U.S.)

- Apogee Flow Systems Ltd. (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Abcam plc (U.K.)

- Luminex Corporation (U.S.)

- F. Hoffmann-La Roche Ltd (Germany)

- Fluidigm Corporation (U.S.)

- Illumina, Inc. (U.S.)

- Sartorius AG (Germany)

What are the Recent Developments in Global Cell Surface Market?

- In May 2024, Cell Surface Bio (CSB) emerged from stealth mode and launched its VeRSaMAb™ research antibodies a catalogue of recombinant, fully validated monoclonal antibodies designed for difficult cell‑surface protein targets. The company emphasised high specificity, reproducible batches and direct relevance for flow cytometry, immunofluorescence, and surface‑omics applications

- In March 2024, Bio‑Rad Laboratories, Inc. announced the launch of “Celselect Slides” validated antibodies for rare cell and circulating tumour cell (CTC) enumeration. The antibodies are designed for the company’s Genesis Cell Isolation System and are optimized for sensitive and specific immunostaining of captured CTCs to support tumour heterogeneity and disease progression studies

- In November 2023, CD Bioparticles, Inc. announced the launch of new flow cytometry alignment and size‑standard particles for calibration and method development in flow cytometry. These particles support experiments involving cell surface marker analysis by enabling more accurate setup, standardisation and size control in cytometry assays

- In May 2023, Becton, Dickinson and Company (BD) launched the world’s first spectral cell sorter with high‑speed cell imaging capabilities. The new system combines BD’s CellView™ image‑technology (allowing real‑time visual inspection of individual cells) and SpectralFX™ full‑spectrum cell sorting, enabling high‑parameter experiments that were previously difficult or not possible with standard flow cytometry workflows

- In May 2023, Sysmex Corporation launched its Clinical Flow Cytometry System in Japan (also to be expanded to North America, Europe and Asia‑Pacific). The system includes the Flow Cytometer XF‑1600, a sample preparation system PS‑10, and accompanying antibody reagents aiming to automate the full flow cytometry testing process from sample prep to result reporting

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.