Global Cell Sorting Market

Market Size in USD Million\

CAGR :

%

USD

466.53 Million\

USD

705.19 Million\

2024

2032

USD

466.53 Million\

USD

705.19 Million\

2024

2032

| 2025 –2032 | |

| USD 466.53 Million\ | |

| USD 705.19 Million\ | |

|

|

|

|

Cell Sorting Market Size

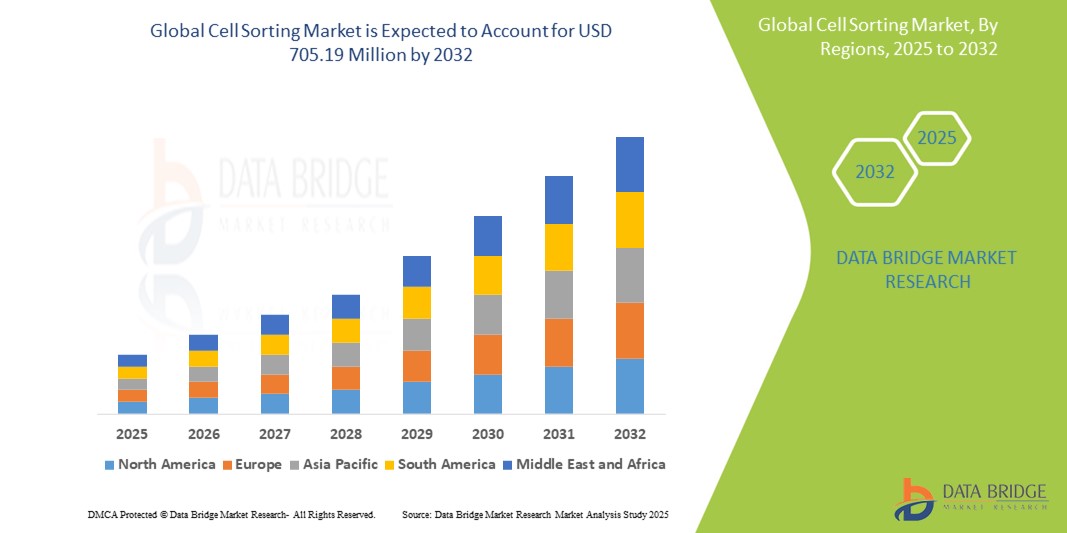

- The global cell sorting market size was valued at USD 466.53 million in 2024 and is expected to reach USD 705.19 million by 2032, at a CAGR of 5.3% during the forecast period

- The market growth is largely driven by increasing demand for cell-based research in cancer, immunology, and stem cell studies, along with the rise in the development of advanced cell sorting instruments with improved accuracy and speed

- Furthermore, growing investments in biotechnology and pharmaceutical R&D, combined with the expanding adoption of personalized medicine, are reinforcing the importance of high-throughput and precise cell separation technologies. These converging dynamics are propelling the uptake of cell sorting solutions, significantly driving the market's expansion

Cell Sorting Market Analysis

- Cell sorting, a key technology in separating specific cells from a heterogeneous cell population based on defined properties, plays a crucial role in biomedical research, clinical diagnostics, and therapeutic development due to its precision, speed, and ability to maintain cell viability

- The rising demand for advanced cell-based assays in oncology, stem cell research, and immunology, alongside the expanding focus on single-cell analysis and precision medicine, is significantly fueling the growth of the global cell sorting market

- North America dominated the cell sorting market with the largest revenue share of 40.2% in 2024, characterized by robust research funding, the presence of major biotechnology and pharmaceutical companies, and a high concentration of academic institutions actively engaged in cell-based studies

- Asia-Pacific is expected to be the fastest growing region in the cell sorting market during the forecast period due to increasing investments in life sciences, growing healthcare infrastructure, and government support for biotechnology innovation

- Fluorescence- based droplet cell sorting segment dominated the cell sorting market with a market share of 41.9% in 2024, driven by its high accuracy, rapid processing, and suitability for complex multicolor sorting in research and clinical applications

Report Scope and Cell Sorting Market Segmentation

|

Attributes |

Cell Sorting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cell Sorting Market Trends

“Technological Advancements in High-Throughput and Single-Cell Analysis”

- A significant and accelerating trend in the global cell sorting market is the rapid evolution of high-throughput technologies and their integration with single-cell analysis platforms, which is enabling unprecedented precision and scalability in cellular research and diagnostics

- For instance, the BD FACSymphony S6 Cell Sorter allows researchers to sort up to six populations simultaneously, supporting complex, multicolor flow cytometry applications. Similarly, Sony’s SH800S cell sorter offers full automation and high-speed sorting for single-cell genomics and transcriptomics studies

- Advancements in microfluidics and chip-based cell sorting are further enhancing efficiency and reducing sample contamination, with platforms such as On-chip Sort leveraging gentle sorting mechanisms suitable for fragile cells. These technologies also improve cell viability and purity, critical for downstream applications such as CRISPR screening and stem cell therapy

- The integration of artificial intelligence and machine learning into cell sorting workflows is beginning to optimize gating strategies, pattern recognition, and decision-making in real-time, reducing user dependency and increasing reproducibility

- This trend toward automated, intelligent, and high-resolution sorting systems is driving demand across both academic and clinical research settings, where precision and throughput are crucial. Researchers can now more easily isolate rare cell populations such as circulating tumor cells (CTCs) or antigen-specific T cells for diagnostics or immunotherapy development

- Consequently, companies such as Miltenyi Biotec, Bio-Rad, and Thermo Fisher Scientific are innovating next-generation cell sorters that combine high-performance optics, automation, and AI-driven software interfaces to meet the growing demand for scalable and reproducible cell sorting workflows across diverse applications in life sciences and healthcare

Cell Sorting Market Dynamics

Driver

“Rising Demand for Precision Medicine and Cell-Based Research”

- The growing emphasis on precision medicine, targeted therapies, and advanced cell-based research is a significant driver propelling the demand for sophisticated cell sorting technologies across the global life sciences industry

- For instance, in March 2024, Thermo Fisher Scientific expanded its cell sorting portfolio with the launch of a next-generation flow cytometry platform designed for high-speed, high-purity cell sorting in translational research and clinical applications. Such developments are expected to accelerate market growth over the forecast period

- As research institutions and biopharmaceutical companies increasingly focus on understanding cellular heterogeneity and developing cell-specific therapeutics, the need for accurate and efficient separation of distinct cell populations has surged

- Cell sorting systems provide critical capabilities such as isolating rare cells, enriching stem cell populations, and analyzing immune cell subsets—making them essential tools in oncology, regenerative medicine, and immunotherapy development

- Furthermore, the rise in single-cell omics technologies and the need for high-quality input samples for genomic and proteomic studies are reinforcing the role of cell sorting in ensuring analytical precision. The demand is particularly strong in translational research and clinical labs aiming to link cell phenotypes with disease outcomes

- The increasing availability of automated, user-friendly, and scalable cell sorters tailored for both research and clinical environments is further supporting adoption, as institutions seek reliable and reproducible tools to accelerate discovery and development efforts

Restraint/Challenge

“High Cost and Technical Complexity of Advanced Cell Sorters”

- The high acquisition and operational costs associated with advanced cell sorting instruments pose a significant barrier to widespread adoption, particularly among smaller research institutions, diagnostic laboratories, and healthcare facilities with limited budgets

- For instance, high-end flow cytometry-based cell sorters used in immunophenotyping and single-cell analysis can cost hundreds of thousands of dollars, not including ongoing expenses for maintenance, reagents, and skilled personnel. This makes cost-efficiency a major concern for broader deployment, especially in developing regions

- Moreover, the technical complexity of operating sophisticated cell sorting systems—such as multicolor flow cytometers or droplet-based sorters—requires highly trained staff, rigorous calibration, and specialized knowledge, which can limit their usability and scalability

- Addressing these limitations through simplified interfaces, increased automation, and affordable benchtop models is becoming essential for vendors looking to penetrate new markets and support a wider range of users

- Companies such as Bio-Rad and Beckman Coulter have introduced user-friendly systems designed for medium-throughput applications, but the trade-off between cost, functionality, and flexibility remains a challenge. In addition, stringent regulatory compliance, especially for clinical applications, demands extensive validation and quality control, further adding to the implementation hurdles

- Reducing operational complexity, expanding training programs, and offering scalable solutions tailored to varying user needs will be critical for overcoming these challenges and supporting the continued growth of the cell sorting market

Cell Sorting Market Scope

The market is segmented on the basis of product and services, technology, application, end user, and distribution channel.

- By Product And Services

On the basis of product and services, the cell sorting market is segmented into cell sorters, reagents and kits, consumables, and cell sorting services. The reagents and consumables segment dominated the market with a revenue share of 61.3% in 2024. This dominance is attributed to the continuous demand for specialized and high-quality materials essential for accurate and efficient cell sorting processes across various research and clinical applications.

The cell sorting services segment is expected to register the fastest CAGR of 9.3% during the forecast period. This growth is fueled by the increasing need for technical support, training, and outsourced cell sorting procedures as the technology becomes more complex and sophisticated, and as research centers and laboratories seek specialized expertise.

- By Technology

On the basis of technology, the cell sorting market is segmented into fluorescence-based droplet cell sorting, magnetic-activated cell sorting (MACS), micro-electromechanical systems (MEMS)–microfluidics, gradient centrifugation, immunodensity cell separation, sedimentation, cell markers-based, buoyancy-activated cell sorting (SACS), and others. Fluorescence-based droplet cell sorting (FACS) technology accounted for the largest revenue share of 41.4% in 2024. This is due to its high accuracy, efficiency, and versatility in utilizing fluorescent tags to identify and sort various cell types for research and clinical applications, including immune cells and stem cells.

Magnetic-activated cell sorting (MACS) technology is expected to register the fastest CAGR during the forecast period. This growth is driven by its simplicity, high efficiency, and ability to isolate specific cell types without the need for complex instrumentation, utilizing magnetic beads coated with antibodies to target specific cells, ensuring high selectivity and minimal contamination.

- By Application

On the basis of application, the cell sorting market is segmented into research and clinical. Research applications held the largest share of 62.6% in 2024. This dominance is attributed to significant investments in biomedical research by various organizations and governments, along with the growing need for accurate cell isolation in fields such as immunology, cancer research, stem cell studies, and drug discovery.

Clinical applications are expected to register significant growth with a CAGR over the forecast period. This growth is driven by the increasing prevalence of chronic diseases and the rising demand for advanced diagnostic and therapeutic solutions, particularly in personalized medicine and cancer treatment, which require precise cell sorting technologies.

- By End User

On the basis of end user, the cell sorting market is segmented into research institutes, pharmaceutical and biotechnology companies, medical and academic institutions, hospitals and clinical testing laboratories, diagnostic laboratories, and others. Research institutions led the market with a revenue share of 39.0% in 2024. This can be linked to the increasing expenditure in scientific research and the rising need for accurate cell isolation in various research fields such as immunology, cancer research, and stem cell studies.

The medical schools and academic institutions segment is expected to register the fastest CAGR during the forecast period. This is due to the increasing adoption of cell sorting technologies in academic research, growing awareness about cell-based therapies, and increasing collaborations between academic institutions and industry players.

- By Distribution Channel

On the basis of distribution channel, the cell sorting market is segmented into direct tender and retail sales. The direct tender segment held the largest market revenue share in 2024. This is primarily driven by the high unit cost and complexity of cell sorter instruments, which are typically procured by large research institutions, pharmaceutical companies, and major hospitals through formalized tender processes and direct negotiations with manufacturers.

The retail sales segment is anticipated to witness the fastest growth rate during forecast period. This growth is fueled by increasing accessibility and demand for by a broader base of smaller laboratories, diagnostic centers, and individual research groups.

Cell Sorting Market Regional Analysis

- North America dominated the cell sorting market with the largest revenue share of 40.2% in 2024, driven by robust research funding, the presence of major biotechnology and pharmaceutical companies, and a high concentration of academic institutions actively engaged in cell-based studies

- Consumers and research institutions in the region highly value the innovations in cell sorting technologies, the rapidly expanding healthcare infrastructure, and the rising awareness and adoption of sophisticated solutions

- This widespread adoption is further supported by the increasing incidence of chronic diseases, significant governmental funding for biotechnology and pharmaceutical research, and the presence of emerging economies such as China and India, establishing Asia Pacific as a favored region for market expansion.

U.S. Cell Sorting Market Insight

The U.S. cell sorting market captured the largest revenue share of 83% in 2024 within North America, driven by the growing focus on precision medicine, advanced healthcare infrastructure, and increased funding in biomedical research. The demand is further fueled by the widespread use of flow cytometry in cancer, immunology, and stem cell studies. The presence of key players and rising applications in clinical diagnostics and drug discovery are accelerating the adoption of cell sorting technologies, particularly high-throughput and fluorescence-based systems

Europe Cell Sorting Market Insight

The Europe cell sorting market is projected to witness significant CAGR throughout the forecast period, propelled by advancements in cell-based therapies and rising R&D investments. Stringent regulatory standards and a well-established biotechnology sector are encouraging the development of highly accurate sorting technologies. Moreover, growing demand for regenerative medicine and increasing collaborations between academic institutions and biotech companies are boosting market growth across key countries including Germany, France, and the U.K.

U.K. Cell Sorting Market Insight

The U.K. cell sorting market is anticipated to grow at a notable CAGR during the forecast period, supported by strong government funding in life sciences and the rapid expansion of biotechnology startups. Research efforts in immunotherapy, oncology, and infectious disease diagnostics are amplifying demand for sophisticated cell analysis tools. In addition, the presence of globally recognized research institutions and clinical laboratories is fostering market penetration and technological advancements in cell sorting applications.

Germany Cell Sorting Market Insight

The Germany cell sorting market is expected to grow at a considerable CAGR over the forecast period, backed by robust healthcare spending and a thriving biopharma sector. Germany’s commitment to medical innovation and its focus on expanding translational research are contributing to the increasing adoption of flow-based and magnetic-activated sorting systems. The country's emphasis on precision diagnostics and automation in laboratory workflows is also accelerating the uptake of advanced sorting platforms.

Asia-Pacific Cell Sorting Market Insight

The Asia-Pacific cell sorting market is poised to register the fastest CAGR between 2025 and 2032, driven by increasing investments in healthcare infrastructure, rising biotechnology activities, and growing clinical research in China, India, and Japan. Government support for genomics and cell-based therapies, along with the rising burden of chronic diseases, is encouraging the adoption of cell sorting in academic and clinical settings. The expansion of manufacturing facilities for biopharmaceuticals is also boosting regional growth.

Japan Cell Sorting Market Insight

The Japan cell sorting market is expanding steadily due to the country's advanced biomedical research ecosystem and strong focus on precision diagnostics. The use of high-speed cell sorting in oncology and immunotherapy research is growing, supported by collaborative efforts between academia and the private sector. With aging demographics and a high incidence of chronic diseases, demand is rising for technologies that enable personalized treatment approaches through effective cellular analysis.

India Cell Sorting Market Insight

The India cell sorting market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid growth in clinical research, increasing government support for biotechnology, and the emergence of domestic biopharma firms. Rising awareness of stem cell therapy and cancer diagnostics, along with improving laboratory infrastructure, is fostering demand for cost-effective and scalable sorting technologies. Furthermore, international collaborations and clinical trial activity are enhancing market development across the region.

Cell Sorting Market Share

The cell sorting industry is primarily led by well-established companies, including:

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Miltenyi Biotec (Germany)

- Beckman Coulter, Inc. (U.S.)

- Sony Biotechnology Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cytek Biosciences (U.S.)

- NanoCellect Biomedical, Inc. (U.S.)

- Cytonome/ST, LLC (U.S.)

- Sysmex Corporation (Japan)

- STEMCELL Technologies Inc. (Canada)

- Merck KGaA (Germany)

- On-Chip Biotechnologies Co., Ltd. (Japan)

- Union Biometrica, Inc. (U.S.)

- Namocell Inc. (U.S.)

- Akadeum Life Sciences (U.S.)

- Cell Microsystems Inc. (U.S.)

- Molecular Devices LLC (U.S.)

- Sartorius AG (Germany)

- Terumo BCT, Inc. (U.S.)

What are the Recent Developments in Global Cell Sorting Market?

- In April 2023, Becton, Dickinson and Company (BD) launched its BD FACSDiscover S8 Cell Sorter, the first cell sorter to integrate spectral flow cytometry with real-time imaging. This next-generation instrument empowers researchers with deeper insights into cellular behavior, significantly enhancing applications in immunology, oncology, and cell therapy development. The innovation demonstrates BD’s ongoing commitment to advancing precision tools for high-throughput cell sorting

- In March 2023, Thermo Fisher Scientific expanded its cell analysis portfolio by acquiring MarqMetrix, a company known for its Raman spectroscopy solutions. The integration of Raman technology aims to support label-free, non-invasive cellular analysis, further boosting Thermo Fisher’s capabilities in providing advanced cell sorting and characterization tools for research and clinical applications

- In March 2023, Sony Biotechnology Inc. introduced an upgraded version of its SH800S Cell Sorter, now featuring improved microfluidics and real-time quality control mechanisms. The innovation targets increased demand for user-friendly, high-accuracy sorting platforms in academic and pharmaceutical research, strengthening Sony’s position in the competitive cytometry market

- In February 2023, Miltenyi Biotec announced the launch of its MACSQuant Tyto Cartridge Starter Set, optimized for gentle and sterile cell sorting in clinical and translational research. The fully closed system, designed to minimize contamination and preserve cell viability, is being rapidly adopted in stem cell and immunotherapy labs, reflecting the rising importance of regulatory-compliant technologies in biomedical research

- In January 2023, Bio-Rad Laboratories, Inc. unveiled enhancements to its S3e Cell Sorter, including automation-friendly features and upgraded software for multiplexed cell analysis. These advancements are aimed at improving efficiency in life science laboratories and supporting complex workflows in genomics, proteomics, and drug discovery, reaffirming Bio-Rad’s role in driving innovation in cellular research tools

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CELL SORTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CELL SORTING MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CELL SORTING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 EPIDEMIOLOGY

6 PREMIUM INSIGHTS

6.1 PESTAL ANALYSIS

6.2 PORTER’S ANALYSIS

6.3 KEY STRATEGIC INITIAVES

6.4 TECHNOLOGICAL INOVATIONS

6.5 REVIEW FROM END USER

7 INDUSTRY INSIGHTS

7.1 MICRO AND MACRO ECONOMIC FACTORS

7.2 PENETRATION AND GROWTH PROSPECT MAPPING

7.3 KEY PRICING STRATEGIES

7.4 INTERVIEWS WITH SPECIALIST

7.5 ANALYIS AND RECOMMENDATION

8 INTELLECTUAL PROPERTY (IP) PORTFOLIO

8.1 PATENT QUALITY AND STRENGTH

8.2 PATENT FAMILIES

8.3 LICENSING AND COLLABORATIONS

8.4 COMPETITIVE LANDSCAPE

8.5 IP STRATEGY AND MANAGEMENT

8.6 OTHER

9 COST ANALYSIS BREAKDOWN

10 TECHNONLOGY ROADMAP

11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

11.1.1 JOINT VENTURES

11.1.2 MERGERS AND ACQUISITIONS

11.1.3 LICENSING AND PARTNERSHIP

11.1.4 TECHNOLOGY COLLABORATIONS

11.1.5 STRATEGIC DIVESTMENTS

11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

11.3 STAGE OF DEVELOPMENT

11.4 TIMELINES AND MILESTONES

11.5 INNOVATION STRATEGIES AND METHODOLOGIES

11.6 RISK ASSESSMENT AND MITIGATION

11.7 FUTURE OUTLOOK

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 REIMBURSEMENT FRAMEWORK

14 OPPUTUNITY MAP ANALYSIS

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL CELL SORTING MARKET, BY CELL TYPE

17.1 OVERVIEW

17.2 HUMAN CELL

17.2.1 BY SORTING TYPE

17.2.1.1. 4-WAY SORTING

17.2.1.2. MULTI-WAY SORTING

17.2.1.3. STRAIGHT-DOWN SORTING

17.3 ANIMAL CELL

17.3.1 BY SORTING TYPE

17.3.1.1. 4-WAY SORTING

17.3.1.2. MULTI-WAY SORTING

17.3.1.3. STRAIGHT-DOWN SORTING

17.4 MICROBIAL CELL

17.4.1 BY SORTING TYPE

17.4.1.1. 4-WAY SORTING

17.4.1.2. MULTI-WAY SORTING

17.4.1.3. STRAIGHT-DOWN SORTING

18 GLOBAL CELL SORTING MARKET, BY PRODUCT AND SERVICE

18.1 OVERVIEW

18.2 PRODUCTS

18.2.1 CELL SORTER

18.2.1.1. BY MODALITY

18.2.1.1.1. BENCHTOP

18.2.1.1.2. PORTABLE

18.2.1.2. BY LASERS OPTION

18.2.1.2.1. UPTO 3

18.2.1.2.2. UPTO 4

18.2.1.2.3. UPTO 5

18.2.1.3. BY IMAGING DETECTOR

18.2.1.3.1. 0

18.2.1.3.2. 6

18.2.1.3.3. OTHERS (IF ANY)

18.2.2 CONSUMBABLES

18.2.2.1. MICROFLUIDIC CHIP

18.2.2.1.1. BY PACKAGING

18.2.2.1.1.1 10 CHIPS PER BOX

18.2.2.1.1.2 25 CHIPS PER BOX

18.2.2.1.1.3 OTHERS

18.2.2.1.2. BY USABILITY

18.2.2.1.2.1 DISPOSABLE

18.2.2.1.2.2 REUSABLE

18.2.2.2. CALIBRATION BEADS

18.2.2.3. OTHERS

18.2.3 REAGENTS AND KITS

18.2.3.1. CELL SEPARATION TYPE

18.2.3.1.1. POSITIVE CELL SEPARATION

18.2.3.1.2. NEGATIVE CELL SEPARATION

18.2.3.2. BEADS TYPE

18.2.3.2.1. S-PLURIBEAD

18.2.3.2.2. M-PLURIBEAD

18.2.3.3. BY SAMPLE TYPE

18.2.3.3.1. WHOLE BLOOD

18.2.3.3.2. BUFFY COAT

18.2.3.3.3. OTHERS

18.2.3.4. BY PRICE RANGE

18.2.3.4.1. BELOW 100 DOLLARS

18.2.3.4.2. 100-300 DOLLARS

18.2.3.4.3. ABOVE 300 DOLLARS

18.2.4 SPECTRAL CELL SORTER ACCESSORIES

18.3 SERVICES

19 GLOBAL CELL SORTING MARKET, BY SORTING TYPE

19.1 OVERVIEW

19.2 4-WAY SORTING

19.3 MULTI-WAY SORTING

19.4 STRAIGHT-DOWN SORTING

20 GLOBAL CELL SORTING MARKET, BY MODE OF OPERATION

20.1 OVERVIEW

20.2 AUTOMATED OPERATION

20.3 MANUAL OPERATION

21 GLOBAL CELL SORTING MARKET, BY TECHNIQUE

21.1 OVERVIEW

21.2 IMMUNODENSITY CELL SEPARATION

21.3 BUOYANCY-ACTIVATED CELL SORTING (SACS)

21.4 MAGNETIC-ACTIVATED CELL SORTING (MACS)

21.5 FLUORESCENCE- BASED DROPLET CELL SORTING

21.6 MICRO-ELECTROMECHANICAL SYSTEMS (MEMS)–MICROFLUIDICS

21.7 OTHERS

22 GLOBAL CELL SORTING MARKET, BY APPLICATION

22.1 OVERVIEW

22.2 RESEARCH APPLICATIONS

22.2.1 PHYSIOLOGICAL RESEARCH

22.2.2 PROTEIN ENGINEERING

22.2.3 CELL ENGINEERING

22.2.4 STEM CELL RESEARCH

22.3 CLINICAL APPLICATIONS

22.3.1 CANCER CELL SCREENING

22.3.2 INFECTIOUS DISEASES

22.3.3 OTHERS

22.4 OTHERS (IF ANY)

23 GLOBAL CELL SORTING MARKET, BY END USER

23.1 OVERVIEW

23.2 MEDICAL AND ACADEMIC INSTITUTIONS

23.3 RESEARCH INSTITUTIONS AND ACADEMIC INSTITUTIONS

23.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

23.4.1 SMALL

23.4.2 MEDIUM

23.4.3 LARGE

23.5 HOSPITALS AND CLINICAL TESTING LABORATORIES

23.5.1 PUBLIC

23.5.2 PRIVATE

23.6 DIAGNOSTIC LABORATORIES

23.7 OTHERS

24 GLOBAL CELL SORTING MARKET, BY DISTRIBUTION CHANNEL

24.1 OVERVIEW

24.2 DIRECT TENDER

24.3 RETAIL SALES

24.4 OTHERS

25 GLOBAL CELL SORTING MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL CELL SORTING MARKET, BY GEOGRAPHY

GLOBAL CELL SORTING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1 NORTH AMERICA

26.1.1 U.S.

26.1.2 CANADA

26.1.3 MEXICO

26.2 EUROPE

26.2.1 GERMANY

26.2.2 FRANCE

26.2.3 U.K.

26.2.4 HUNGARY

26.2.5 LITHUANIA

26.2.6 AUSTRIA

26.2.7 IRELAND

26.2.8 NORWAY

26.2.9 POLAND

26.2.10 ITALY

26.2.11 SPAIN

26.2.12 RUSSIA

26.2.13 TURKEY

26.2.14 NETHERLANDS

26.2.15 SWITZERLAND

26.2.16 REST OF EUROPE

26.3 ASIA-PACIFIC

26.3.1 JAPAN

26.3.2 CHINA

26.3.3 SOUTH KOREA

26.3.4 INDIA

26.3.5 SINGAPORE

26.3.6 THAILAND

26.3.7 INDONESIA

26.3.8 MALAYSIA

26.3.9 PHILIPPINE

26.3.10 AUSTRALIA

26.3.11 NEW ZEALAND

26.3.12 VIETNAM

26.3.13 TAIWAN

26.3.14 REST OF ASIA-PACIFIC

26.4 SOUTH AMERICA

26.4.1 BRAZIL

26.4.2 ARGENTINA

26.4.3 REST OF SOUTH AMERICA

26.5 MIDDLE EAST AND AFRICA

26.5.1 SOUTH AFRICA

26.5.2 SAUDI ARABIA

26.5.3 UAE

26.5.4 EGYPT

26.5.5 KUWAIT

26.5.6 ISRAEL

26.5.7 REST OF MIDDLE EAST AND AFRICA

26.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL CELL SORTING MARKET, SWOT AND DBMR ANALYSIS

28 GLOBAL CELL SORTING MARKET, COMPANY PROFILE

28.1 MOLECULAR MACHINES AND INDUSTRIES GMBH

28.1.1 COMPANY OVERVIEW

28.1.2 REVENUE ANALYSIS

28.1.3 GEOGRAPHIC PRESENCE

28.1.4 PRODUCT PORTFOLIO

28.1.5 RECENT DEVELOPMENTS

28.2 BIO-RAD LABORATORIES, INC.

28.2.1 COMPANY OVERVIEW

28.2.2 REVENUE ANALYSIS

28.2.3 GEOGRAPHIC PRESENCE

28.2.4 PRODUCT PORTFOLIO

28.2.5 RECENT DEVELOPMENTS

28.3 DANAHER CORPORATION

28.3.1 COMPANY OVERVIEW

28.3.2 REVENUE ANALYSIS

28.3.3 GEOGRAPHIC PRESENCE

28.3.4 PRODUCT PORTFOLIO

28.3.5 RECENT DEVELOPMENTS

28.4 MILTENYI BIOTEC AND/OR ITS AFFILIATES

28.4.1 COMPANY OVERVIEW

28.4.2 REVENUE ANALYSIS

28.4.3 GEOGRAPHIC PRESENCE

28.4.4 PRODUCT PORTFOLIO

28.4.5 RECENT DEVELOPMENTS

28.5 SONY BIOTECHNOLOGY INC

28.5.1 COMPANY OVERVIEW

28.5.2 REVENUE ANALYSIS

28.5.3 GEOGRAPHIC PRESENCE

28.5.4 PRODUCT PORTFOLIO

28.5.5 RECENT DEVELOPMENTS

28.6 UNION BIOMETRICA, INC.

28.6.1 COMPANY OVERVIEW

28.6.2 REVENUE ANALYSIS

28.6.3 GEOGRAPHIC PRESENCE

28.6.4 PRODUCT PORTFOLIO

28.6.5 RECENT DEVELOPMENTS

28.7 STEMCELL TECHNOLOGIES

28.7.1 COMPANY OVERVIEW

28.7.2 REVENUE ANALYSIS

28.7.3 GEOGRAPHIC PRESENCE

28.7.4 PRODUCT PORTFOLIO

28.7.5 RECENT DEVELOPMENTS

28.8 TERUMO BCT, INC.

28.8.1 COMPANY OVERVIEW

28.8.2 REVENUE ANALYSIS

28.8.3 GEOGRAPHIC PRESENCE

28.8.4 PRODUCT PORTFOLIO

28.8.5 RECENT DEVELOPMENTS

28.9 NANOCELLECT BIOMEDICAL

28.9.1 COMPANY OVERVIEW

28.9.2 REVENUE ANALYSIS

28.9.3 GEOGRAPHIC PRESENCE

28.9.4 PRODUCT PORTFOLIO

28.9.5 RECENT DEVELOPMENTS

28.1 ABGENEX PVT. LTD

28.10.1 COMPANY OVERVIEW

28.10.2 REVENUE ANALYSIS

28.10.3 GEOGRAPHIC PRESENCE

28.10.4 PRODUCT PORTFOLIO

28.10.5 RECENT DEVELOPMENTS

28.11 BD

28.11.1 COMPANY OVERVIEW

28.11.2 REVENUE ANALYSIS

28.11.3 GEOGRAPHIC PRESENCE

28.11.4 PRODUCT PORTFOLIO

28.11.5 RECENT DEVELOPMENTS

28.12 CYTONOME/ST, LLC

28.12.1 COMPANY OVERVIEW

28.12.2 REVENUE ANALYSIS

28.12.3 GEOGRAPHIC PRESENCE

28.12.4 PRODUCT PORTFOLIO

28.12.5 RECENT DEVELOPMENTS

28.13 ON-CHIP BIOTECHNOLOGIES CO., LTD.

28.13.1 COMPANY OVERVIEW

28.13.2 REVENUE ANALYSIS

28.13.3 GEOGRAPHIC PRESENCE

28.13.4 PRODUCT PORTFOLIO

28.13.5 RECENT DEVELOPMENTS

28.14 THERMO FISHER SCIENTIFIC INC.

28.14.1 COMPANY OVERVIEW

28.14.2 REVENUE ANALYSIS

28.14.3 GEOGRAPHIC PRESENCE

28.14.4 PRODUCT PORTFOLIO

28.14.5 RECENT DEVELOPMENTS

28.15 PLURISELECT LIFE SCIENCE UG (HAFTUNGSBESCHRÄNKT) & CO. KG

28.15.1 COMPANY OVERVIEW

28.15.2 REVENUE ANALYSIS

28.15.3 GEOGRAPHIC PRESENCE

28.15.4 PRODUCT PORTFOLIO

28.15.5 RECENT DEVELOPMENTS

28.16 CELLULAR HIGHWAYS LTD (A TTP PLC COMPANY)

28.16.1 COMPANY OVERVIEW

28.16.2 REVENUE ANALYSIS

28.16.3 GEOGRAPHIC PRESENCE

28.16.4 PRODUCT PORTFOLIO

28.16.5 RECENT DEVELOPMENTS

28.17 NAMOCELL

28.17.1 COMPANY OVERVIEW

28.17.2 REVENUE ANALYSIS

28.17.3 GEOGRAPHIC PRESENCE

28.17.4 PRODUCT PORTFOLIO

28.17.5 RECENT DEVELOPMENTS

28.18 SYSMEX EUROPE SE

28.18.1 COMPANY OVERVIEW

28.18.2 REVENUE ANALYSIS

28.18.3 GEOGRAPHIC PRESENCE

28.18.4 PRODUCT PORTFOLIO

28.18.5 RECENT DEVELOPMENTS

28.19 MOLECULAR DEVICES, LLC

28.19.1 COMPANY OVERVIEW

28.19.2 REVENUE ANALYSIS

28.19.3 GEOGRAPHIC PRESENCE

28.19.4 PRODUCT PORTFOLIO

28.19.5 RECENT DEVELOPMENTS

28.2 CELL MICROSYSTEMS

28.20.1 COMPANY OVERVIEW

28.20.2 REVENUE ANALYSIS

28.20.3 GEOGRAPHIC PRESENCE

28.20.4 PRODUCT PORTFOLIO

28.20.5 RECENT DEVELOPMENTS

28.21 XIAMEN WINACK BATTERY TECHNOLOGY CO., LTD

28.21.1 COMPANY OVERVIEW

28.21.2 REVENUE ANALYSIS

28.21.3 GEOGRAPHIC PRESENCE

28.21.4 PRODUCT PORTFOLIO

28.21.5 RECENT DEVELOPMENTS

28.22 SPHERE FLUIDICS.

28.22.1 COMPANY OVERVIEW

28.22.2 REVENUE ANALYSIS

28.22.3 GEOGRAPHIC PRESENCE

28.22.4 PRODUCT PORTFOLIO

28.22.5 RECENT DEVELOPMENTS

28.23 NEBULA ELECTRONIC CO. LTD.

28.23.1 COMPANY OVERVIEW

28.23.2 REVENUE ANALYSIS

28.23.3 GEOGRAPHIC PRESENCE

28.23.4 PRODUCT PORTFOLIO

28.23.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

29 RELATED REPORTS

30 CONCLUSION

31 QUESTIONNAIRE

32 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.