Global Cbd Patch Market

Market Size in USD Billion

CAGR :

%

USD

352.61 Billion

USD

677.22 Billion

2024

2032

USD

352.61 Billion

USD

677.22 Billion

2024

2032

| 2025 –2032 | |

| USD 352.61 Billion | |

| USD 677.22 Billion | |

|

|

|

|

CBD Patch Market Size

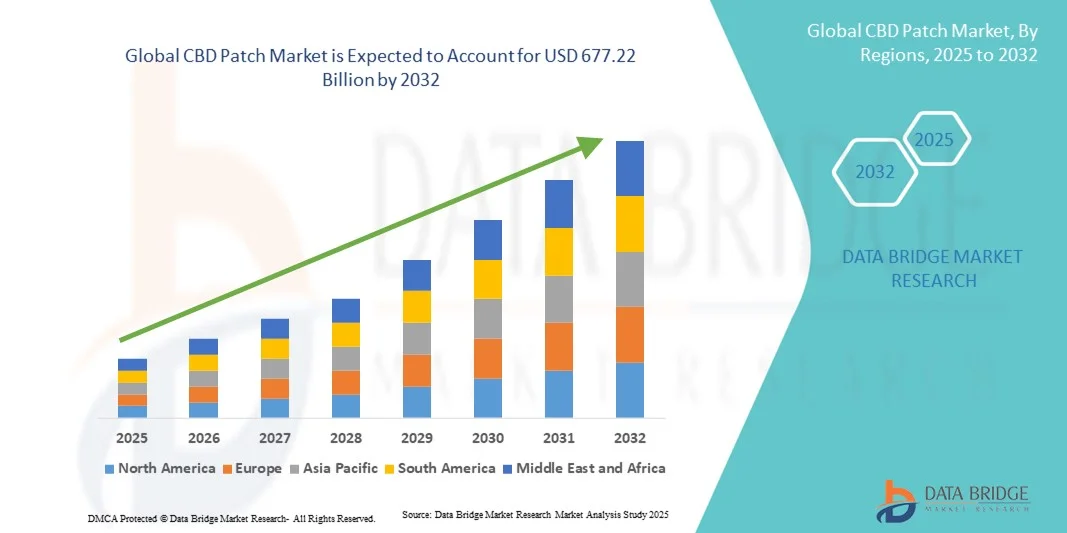

- The global CBD patch market size was valued at USD 352.61 billion in 2024 and is expected to reach USD 677.22 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is primarily driven by the increasing acceptance of cannabidiol (CBD)-based products for pain management, anxiety relief, and wellness applications, along with growing legalization trends across various region

- Moreover, rising consumer preference for convenient, non-invasive, and long-lasting drug delivery systems is positioning CBD patches as a preferred alternative to traditional CBD formats. These combined factors are propelling the adoption of CBD patch solutions, thereby fueling the industry's expansion

CBD Patch Market Analysis

- CBD patches, offering transdermal delivery of cannabidiol for therapeutic benefits, are emerging as an effective alternative to oral and inhalable CBD products due to their ability to provide controlled, long-lasting, and discreet administration for both medical and wellness purposes

- The rising demand for CBD patches is primarily driven by increasing consumer awareness of CBD’s potential in pain relief, anxiety reduction, and sleep management, coupled with a growing preference for non-invasive and convenient drug delivery systems

- North America dominated the CBD patch market with the largest revenue share of 41.8% in 2024, supported by favorable legalization trends, strong consumer acceptance of CBD-based wellness products, and the presence of established cannabinoid product manufacturers, particularly in the U.S., which continues to see innovation in premium and targeted patch formulations

- Asia-Pacific is expected to be the fastest growing region in the CBD patch market during the forecast period, fueled by rising awareness of natural therapies, expanding wellness industries, and gradual regulatory relaxation in select countries

- The Matrix segment dominated the CBD patch market with a market share of 45.3% in 2024, attributed to its cost-effectiveness, design simplicity, and efficient drug delivery mechanism, making it widely preferred by both manufacturers and consumers

Report Scope and CBD Patch Market Segmentation

|

Attributes |

CBD Patch Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

CBD Patch Market Trends

Rising Popularity of Targeted and Long-Acting Transdermal Delivery

- A significant and accelerating trend in the global CBD patch market is the increasing adoption of transdermal patches that provide controlled, long-lasting release of cannabidiol, enabling consistent therapeutic effects and discreet use in daily routines

- For instance, PainRelief CBD Patch delivers a steady dosage over 8–12 hours, allowing consumers to manage chronic discomfort without frequent reapplication. Similarly, CalmPatch integrates both CBD and natural terpenes for enhanced relaxation effects

- Advanced patch technologies now enable features such as micro-needle delivery and matrix systems that improve absorption and efficacy, while also allowing users to select formulations tailored to their specific needs, such as sleep support or pain management

- The seamless integration of CBD patches into wellness routines and their compatibility with wearable health monitoring devices is fostering a more personalized and data-driven approach to alternative therapies. Users can now track effects, optimize dosing, and combine patches with other wellness interventions

- This trend towards more precise, convenient, and long-acting transdermal CBD delivery is reshaping consumer expectations for alternative wellness products. Consequently, companies such as NeuroPatch are developing patches with customizable dosages and extended-release profiles to meet evolving demand

- The demand for CBD patches with targeted, long-acting, and convenient delivery is growing rapidly across both healthcare and wellness sectors, as consumers increasingly prioritize non-invasive, reliable, and user-friendly alternatives to oral or inhalable CBD formats

CBD Patch Market Dynamics

Driver

Rising Demand Due to Increasing Wellness Awareness and Pain Management Needs

- The growing awareness of CBD’s potential therapeutic benefits, coupled with rising prevalence of chronic pain, anxiety, and sleep disorders, is a significant driver for the heightened demand for CBD patches

- For instance, in March 2024, MediPatch launched a new transdermal patch for chronic arthritis pain, emphasizing sustained release and ease of application. Such initiatives by key companies are expected to drive market growth during the forecast period

- As consumers seek safer, non-invasive alternatives to conventional medications, CBD patches offer targeted delivery, consistent dosage, and discreet usage, providing a compelling option over oral capsules or tinctures

- Furthermore, the increasing adoption of natural and alternative wellness products is making CBD patches an integral part of daily health routines, offering seamless integration with other supplements and therapies

- Convenience of long-lasting effects, ease of application, and the ability to manage personal wellness discreetly are key factors propelling adoption in both homecare and clinical settings. The trend toward ready-to-use, user-friendly patches further contributes to market expansion

Restraint/Challenge

Skin Irritation Issues and Regulatory Compliance Hurdle

- Concerns regarding skin irritation or allergic reactions from transdermal adhesives pose a significant challenge to broader market adoption. Some consumers may experience redness or discomfort, limiting repeat usage and affecting perception of CBD patches

- For instance, reports of mild dermatitis from extended patch wear have made some consumers cautious about prolonged use in sensitive areas

- Addressing these concerns through hypoallergenic materials, patch design optimization, and clear usage guidelines is crucial for building consumer trust. Companies such as PureRelief and CBDistillery highlight patch safety and dermatologically tested adhesives in their product information to reassure buyers. In addition, differing regulatory frameworks across countries for CBD products can restrict market access and complicate global expansion

- While product prices are gradually becoming more competitive, premium formulations with advanced delivery systems or higher CBD concentrations still carry a higher cost, which may limit adoption among price-sensitive consumers

- Overcoming these challenges through improved patch formulations, clear labeling, education on safe use, and harmonized regulations will be vital for sustained growth in the global CBD patch market

CBD Patch Market Scope

The market is segmented on the basis of product, species, packaging, dosage, derivatives, application, source type, end user, and distribution channel.

- By Product

On the basis of product, the CBD patch market is segmented into reservoir, matrix, and layer drug-in-adhesive. The matrix segment dominated the market with a revenue share of 45.3% in 2024, driven by its simple design, cost-effectiveness, and consistent drug delivery. Matrix patches are widely preferred by manufacturers due to ease of production and by consumers for reliable, sustained therapeutic effects. They are compatible with multiple CBD concentrations and suitable for homecare and clinical applications. Strong consumer trust arises from proven efficacy in pain management and wellness routines. In addition, marketing strategies and distribution networks reinforce the segment’s dominance. Matrix patches continue to benefit from established supply chains and brand recognition globally.

The layer drug-in-adhesive segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by technological advancements that enable precise layering for controlled release and faster absorption. These patches are increasingly used for specialized applications, including anxiety reduction and neurological pain. Layered patches allow customizable dosing and enhanced therapeutic outcomes, appealing to consumers seeking targeted solutions. Growing research on innovative adhesive technologies accelerates adoption across both medical and wellness markets. High-efficacy product demand supports rapid growth in this segment. Companies are investing heavily in R&D to optimize performance and ensure consistency in results.

- By Species

On the basis of species, the CBD patch market is segmented into cannabis indica, hybrid, and sativa. The Hybrid segment dominated the market with a 42.1% revenue share in 2024, owing to its balanced cannabinoid profile that delivers both relaxation and mild stimulation. Hybrid-based patches are widely used for chronic pain relief, mood elevation, and general wellness. They are versatile, appealing to both medical and recreational users. Consumer preference for flexible effects drives consistent adoption in multiple regions. Hybrid patches are increasingly recommended by healthcare and wellness professionals. Their adaptability to various formulations reinforces their leadership in both homecare and clinical settings. Established brands continue to promote hybrids as effective daily-use products.

The Sativa segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for energy-enhancing and mood-lifting effects. Sativa patches are preferred for daytime usage, focus, and productivity-related wellness applications. Younger, wellness-conscious consumers are the key adopters in this category. Marketing campaigns highlighting mood elevation and alertness support rapid market penetration. Innovation in Sativa-infused patches is creating multiple new product variants. Regulatory relaxations in specific regions are enabling wider adoption and growth of this segment.

- By Packaging

On the basis of packaging, the CBD patch market is segmented into two to five patches, single patch, and more than five patches. The two to five patches segment dominated the market with a revenue share of 46.3% in 2024, owing to its convenience for short-term usage and trial purposes. This format appeals to new users seeking moderate dosing while balancing affordability and usability. It encourages repeat purchases and brand loyalty over time. Retailers prefer this format for simplified inventory management and consumer retention. Consumer trust in branded two-to-five patch packs enhances adoption rates. The segment is widely used in both homecare and personal wellness routines, sustaining steady market demand.

The more than five patches segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for long-term pain management and chronic wellness applications. Bulk packaging supports continuous usage without frequent repurchase. It appeals to frequent users, hospitals, and medical facilities. Subscription-based e-commerce models further accelerate adoption. Consumers perceive more value in multi-patch packs, which drives repeat purchases. Long-term clinical and wellness applications are key growth drivers globally. Expansion of bulk-pack distribution networks strengthens the segment’s market presence.

- By Dosage

On the basis of dosage, the CBD patch market is segmented into below 30 mg, 30-40 mg, 40-50 mg, and above 50 mg. The 30-40 mg segment dominated the market with a 43.7% share in 2024, providing balanced therapeutic effects suitable for most wellness and pain management applications. This dosage is considered safe for daily use without psychoactive effects. It is widely adopted in homecare and clinical routines. Consumer familiarity and standardization reinforce preference. Manufacturers focus on this range for consistent efficacy across products. Marketing emphasizes reliability, non-invasiveness, and repeatable therapeutic outcomes.

The above 50 mg segment is expected to witness the fastest growth during 2025–2032, driven by demand for high-potency formulations targeting chronic pain, arthritis, and neurological conditions. Higher dosages are increasingly preferred in hospitals and clinical environments. Awareness of stronger therapeutic doses is rising globally, supported by clinical research. Consumers seek faster and longer-lasting relief from high-potency patches. Product innovation emphasizes safe administration of potent doses. Regulatory compliance and clinical validation accelerate adoption in professional care settings.

- By Derivatives

On the basis of derivatives, the CBD patch market is segmented into cannabidiol (CBD), tetrahydrocannabinol (THC), and others. The CBD segment dominated the market with a 51.2% revenue share in 2024, driven by its non-psychoactive nature and broad therapeutic applications. CBD patches are legally accepted in most major markets. They are widely used for pain relief, anxiety reduction, and overall wellness. Strong consumer trust supports broad adoption. CBD-based patches are integrated into homecare and clinical treatments globally. Marketing emphasizes safety, efficacy, and reliability in daily use. Established brands maintain dominance through consistent quality and supply chain control.

The THC segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing legalization in medical and recreational markets. THC patches are increasingly used for targeted pain relief, appetite stimulation, and specialized therapeutic applications. Clinical and hospital usage supports adoption. Consumer awareness of THC’s benefits is rising steadily. Regulatory relaxations in key regions enable faster market growth. Innovation in THC patch formulations enhances effectiveness and safety. Expansion of professional guidance and educational campaigns drives adoption in clinical and homecare environments.

- By Application

On the basis of application, the CBD patch market is segmented into chronic pain, anxiety, arthritis, elevate mood, neurological pain, and others. The chronic pain segment dominated the market with a 45.7% revenue share in 2024, driven by rising prevalence of musculoskeletal disorders globally. CBD patches provide long-lasting and discreet relief. They are widely adopted in both homecare and clinical settings. Consumer preference for non-invasive therapies fuels market demand. Market leaders focus on chronic pain solutions with enhanced efficacy. Marketing emphasizes convenience, safety, and therapeutic reliability. Chronic pain remains a primary driver of sustained adoption in all regions.

The neurological pain segment is expected to witness the fastest CAGR from 2025 to 2032, driven by awareness of alternative therapies for neuropathy, fibromyalgia, and post-surgical pain. CBD patches are increasingly recommended by clinicians and wellness professionals. Clinical trials supporting efficacy boost adoption rates. Hospitals, rehab centers, and specialty clinics are key consumers. Consumer interest in targeted therapies is rising. Innovation in patch design and formulation enhances outcomes. Education on nerve-pain management drives further adoption and market growth.

- By Source Type

On the basis of source type, the CBD patch market is segmented into natural and synthetic. The natural segment dominated the market with a 52.5% revenue share in 2024, driven by consumer preference for plant-derived, organic products. Natural CBD patches are perceived as safer and more effective. Consumer trust supports adoption in both homecare and clinical settings. Marketing emphasizes sustainability, authenticity, and natural origins. Regulatory acceptance reinforces dominance globally. Demand for clean-label products strengthens market growth. Sustainability trends continue to drive the natural source segment’s expansion.

The synthetic segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by adoption of lab-synthesized cannabinoids that ensure consistent potency and purity. Synthetic patches are widely used in clinical trials and hospitals. Consistency, safety, and reliability drive adoption. Research-backed formulations boost credibility. Regulatory compliance is easier in certain regions. Innovation in synthetic cannabinoids enhances market growth and supports premium product offerings. Expansion of high-tech production facilities accelerates segment adoption worldwide.

- By End User

On the basis of end user, the CBD patch market is segmented into homecare setting, research and development centers, hospitals, clinics, rehab centers, and others. The homecare setting segment dominated the market with a 48.9% revenue share in 2024, as consumers prefer self-administered, convenient, non-invasive solutions. Homecare usage is driven by chronic pain, wellness routines, and general health maintenance. Consumer trust in branded patches reinforces adoption. Marketing emphasizes ease of use, reliability, and accessibility. Online availability further supports growth in this segment. Homecare remains a key segment driving consistent global sales.

The hospitals and clinics segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by controlled pain management, post-operative recovery, and neurological therapies. Clinical adoption increases credibility and trust. Institutional purchases support volume growth. Integration into hospital wellness and rehabilitation protocols enhances demand. Regulatory approval in medical settings accelerates adoption. Innovation for clinical efficacy drives further expansion and adoption of CBD patches in professional care environments.

- By Distribution Channel

On the basis of distribution channel, the CBD patch market is segmented into dispensaries & pharmacies, online, and conventional stores. The online segment dominated the market with a 50.3% revenue share in 2024, driven by convenience, product variety, and access to remote regions. Subscription models boost repeat purchases. Direct-to-consumer platforms enhance reach and brand awareness. Online marketing campaigns support sales growth and adoption. Consumer preference for home delivery accelerates penetration. Digital awareness drives online segment dominance across all regions globally.

The dispensaries & pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by legalization, professional recommendations, and regulatory compliance. Physical stores provide verified sourcing and credibility. Personalized guidance enhances adoption rates. Hospitals, clinics, and homecare users increasingly rely on dispensaries. Trust and authenticity attract consumers. Expansion of dispensary networks drives market growth and strengthens regional market presence, supporting long-term sustainability

CBD Patch Market Regional Analysis

- North America dominated the CBD patch market with the largest revenue share of 41.8% in 2024, supported by favorable legalization trends, strong consumer acceptance of CBD-based wellness products, and the presence of established cannabinoid product manufacturers, particularly in the U.S., which continues to see innovation in premium and targeted patch formulations

- Consumers in the region highly value convenience, consistent dosing, and the non-invasive nature of CBD patches, which can be integrated into daily wellness and pain management routines

- This widespread adoption is further supported by a strong presence of established manufacturers, growing research and clinical evidence supporting efficacy, and rising consumer preference for homecare solutions, establishing CBD patches as a favored option for both medical and wellness applications

U.S. CBD Patch Market Insight

The U.S. CBD patch market captured the largest revenue share of 79% in 2024 within North America, fueled by rising consumer awareness of alternative therapies and growing adoption of wellness products. Consumers are increasingly prioritizing non-invasive, consistent dosing solutions for pain management, anxiety, and chronic wellness. The expanding trend of homecare and self-administered therapies, combined with strong demand for high-quality, clinically validated CBD patches, further propels the market. Moreover, the growing legalization of CBD-based products and integration with health and wellness routines is significantly contributing to market expansion. Leading manufacturers are also introducing innovative formulations and patch designs to cater to diverse consumer needs. The U.S. market remains a key hub for R&D, product launches, and premium segment growth.

Europe CBD Patch Market Insight

The Europe CBD patch market is projected to expand at a substantial CAGR during the forecast period, driven by rising interest in natural and plant-based therapies and increasing adoption of alternative medicine. The increase in urbanization, coupled with a growing preference for homecare solutions, is fostering CBD patch adoption. European consumers value consistent dosing, convenience, and safety provided by CBD patches. Regulatory advancements and awareness campaigns supporting the benefits of CBD are further boosting market penetration. The region is witnessing growth across homecare, clinical, and wellness applications, with CBD patches being incorporated into both preventive and therapeutic routines. Manufacturers are also targeting multi-country distribution networks to strengthen their presence.

U.K. CBD Patch Market Insight

The U.K. CBD patch market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer interest in non-invasive pain relief and wellness products. Rising concerns regarding chronic pain, stress, and anxiety are encouraging both consumers and healthcare practitioners to adopt CBD patches. The U.K.’s well-established retail and e-commerce infrastructure supports easy access and product variety. Consumers are increasingly drawn to homecare and self-administered treatments, valuing reliability and safety. The availability of clinically validated and standardized CBD patches is further stimulating market growth. Growing awareness campaigns and collaborations with healthcare professionals are also expected to drive adoption.

Germany CBD Patch Market Insight

The Germany CBD patch market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of natural therapies and growing interest in pain management, anxiety, and wellness applications. Germany’s emphasis on sustainability, clinical validation, and high-quality healthcare products promotes adoption. CBD patches integrated into homecare and clinical routines are gaining popularity. Strong regulatory frameworks and support for alternative medicine enhance consumer trust. Manufacturers are introducing innovative, eco-friendly, and effective patches to meet local expectations. Germany’s robust healthcare infrastructure and distribution channels further support market growth.

Asia-Pacific CBD Patch Market Insight

The Asia-Pacific CBD patch market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising awareness of alternative therapies and growing adoption of self-administered wellness solutions in countries such as China, Japan, and India. Increasing disposable incomes, rapid urbanization, and technological advancements are fueling demand. Government initiatives promoting health, wellness, and innovation are also supporting adoption. The region’s expanding e-commerce penetration makes CBD patches more accessible to a wider consumer base. In addition, the growing number of wellness-focused retailers and manufacturers is enhancing market visibility. APAC is emerging as a key manufacturing hub for high-quality CBD patch formulations, boosting affordability and availability.

Japan CBD Patch Market Insight

The Japan CBD patch market is gaining momentum due to high consumer awareness of wellness and non-invasive pain management solutions. Rapid urbanization, aging population, and technological adoption are driving demand for convenient, safe, and effective CBD patches. Japanese consumers prioritize clinically validated products and integrated wellness routines. Integration with homecare practices and healthcare recommendations fuels growth. The focus on quality, safety, and regulatory compliance supports strong adoption in both homecare and clinical segments. Moreover, manufacturers are innovating with advanced patch formulations to cater to the unique needs of the Japanese market.

India CBD Patch Market Insight

The India CBD patch market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to growing health and wellness awareness, rapid urbanization, and rising disposable incomes. India is witnessing increasing adoption of alternative therapies and self-administered solutions for pain, stress, and wellness. The push towards smart healthcare, homecare adoption, and availability of affordable CBD patch options are key factors propelling the market. Strong presence of domestic and international manufacturers further accelerates growth. Consumer preference for natural and non-invasive treatments supports sustained demand. Expansion of e-commerce platforms and retail channels enhances accessibility and market penetration across urban and semi-urban regions.

CBD Patch Market Share

The CBD Patch industry is primarily led by well-established companies, including:

- CBD Living (U.S.)

- Mary's Medicinals (U.S.)

- Medterra (U.S.)

- Transdermal Therapeutics (U.S.)

- Green Roads (U.S.)

- HempFusion (U.S.)

- CBD One Ltd. (U.K.)

- The Good Patch (U.S.)

- Panacea Life Sciences (U.S.)

- 4P Therapeutics (U.S.)

- NUTRIBAND (U.S.)

- Meditech Innovations Ltd - (U.S.)

- Casco Bay Hemp (U.S.)

- Palcom Comunicazione (U.K.)

- Papa & Barkley (U.S.)

- Pure Ratios (U.S.)

- Charlotte's Web, Inc. (U.S.)

- Natural Healthy (U.S.)

- GoGreen Hemp (U.S.)

- Healist Naturals (U.K.)

What are the Recent Developments in Global CBD Patch Market?

- In June 2024, NOW Solutions, a leading natural products manufacturer, expanded its product line to include three new CBD topical body care products: a CBD Joint & Muscle Cream, CBD Balm, and CBD Massage Oil. These products are formulated with broad-spectrum hemp extract and a range of botanical ingredients to support muscles, joints, and skin

- In April 2024, CS MEDICA entered a strategic partnership with a leading German over-the-counter (OTC) company specializing in chronic pain management. This collaboration aims to introduce the CANNASEN Pain Patch to the German market, with the launch scheduled for the third quarter of 2024. The partnership leverages both companies' expertise to expand the reach of CBD-based pain relief solutions in Europe

- In March 2024, Yon-Ka Paris, a renowned wellness brand, launched an innovative CBD serum and treatment line. Among its offerings is the Serum CBD, a night serum specifically formulated to combat stress-induced skin damage, accompanied by a calming massage intended to alleviate tension and enhance deep, restorative sleep

- In July 2023, celebrity trainer Isaac Boots, known for working with clients such as Gwyneth Paltrow and Kelly Ripa, launched a new line of wellness products, including energy gummies and CBD patches. This expansion into CBD products reflects the growing trend of fitness professionals integrating wellness solutions into their offerings

- In May 2023, CS MEDICA's CANNASEN Pain Patch became the first-ever over-the-counter (OTC) CBD product approved by Israel's Ministry of Health. This milestone marks a significant regulatory achievement, paving the way for broader acceptance and distribution of CBD-based therapeutic products in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.