Global Catheter Coatings Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

2.19 Billion

2025

2033

USD

1.37 Billion

USD

2.19 Billion

2025

2033

| 2026 –2033 | |

| USD 1.37 Billion | |

| USD 2.19 Billion | |

|

|

|

|

Catheter Coatings Market Size

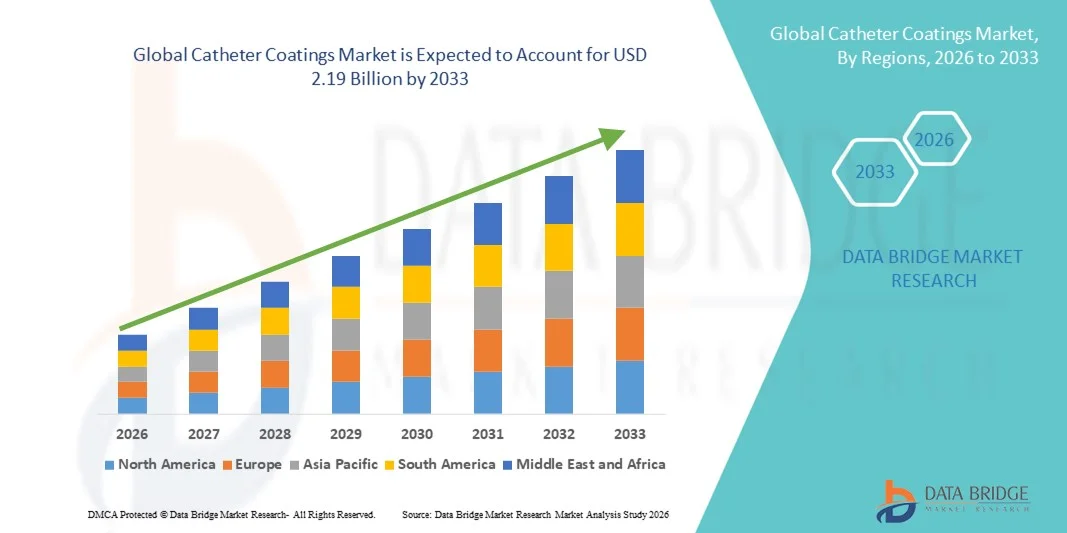

- The global catheter coatings market size was valued at USD 1.37 billion in 2025 and is expected to reach USD 2.19 billion by 2033, at a CAGR of 6.09% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced catheter technologies, rising awareness about catheter-associated infections, and growing demand for patient-friendly, safer urinary and vascular devices in both hospital and clinical settings

- The escalating demand for catheter coatings is primarily driven by innovations in hydrophilic and antimicrobial coatings, increasing prevalence of urinary tract infections and catheter-related bloodstream infections, and rising investments in healthcare infrastructure globally

Catheter Coatings Market Analysis

- Catheter coatings, which enhance surface properties of urinary and vascular catheters by improving lubricity, biocompatibility, and antimicrobial resistance, are increasingly vital components of modern medical device solutions in both hospital and clinical settings due to their role in reducing patient discomfort, minimizing infection risks, and improving procedural efficiency

- The escalating demand for catheter coatings is primarily fueled by the rising prevalence of catheter-associated infections, growing adoption of minimally invasive procedures, increasing focus on patient safety and comfort, and continuous advancements in hydrophilic and antimicrobial coating technologies across global healthcare systems

- North America dominated the catheter coatings market with the largest revenue share of approximately 38.7% in 2025, supported by advanced hospital infrastructure, high healthcare expenditure, and the presence of leading medical device companies. The U.S. accounts for the majority of regional revenue due to widespread adoption of hydrophilic and antimicrobial coated catheters and ongoing technological innovations.

- Asia-Pacific is expected to be the fastest-growing region in the catheter coatings market during the forecast period, registering a CAGR of around 12.9%, driven by improving healthcare infrastructure, rising catheter usage, increasing awareness of infection prevention, and growing adoption of advanced coated catheter technologies in countries such as China, India, and Japan

- The medical segment accounted for the largest market revenue share of 78.6% in 2025, as catheters are extensively used in hospitals, clinics, and outpatient care for urinary, cardiovascular, and vascular procedures

Report Scope and Catheter Coatings Market Segmentation

|

Attributes |

Catheter Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Catheter Coatings Market Trends

Enhanced Convenience Through Advanced Catheter Coating Technologies

- A significant and accelerating trend in the global catheter coatings market is the development of advanced coatings that improve biocompatibility, reduce friction, and prevent infections. These coatings enhance patient safety, improve procedural efficiency, and reduce complications associated with catheter use

- For instance, in March 2024, Terumo Corporation launched its next-generation hydrophilic catheter coating, designed to reduce urethral trauma and minimize patient discomfort during urological procedures. Similarly, Becton Dickinson (BD) introduced antimicrobial-coated catheters to prevent catheter-associated urinary tract infections (CAUTIs), offering hospitals a safer option for long-term catheterization

- The integration of antimicrobial, hydrophilic, and drug-eluting coatings enables catheters to resist bacterial colonization, improve insertion ease, and decrease hospitalization duration. For example, some new-generation catheters incorporate silver-ion coatings combined with polymer matrices to deliver sustained antimicrobial activity

- Innovations in coating materials and surface technologies are facilitating broader adoption of single-use and minimally invasive catheters, allowing healthcare providers to optimize treatment outcomes and reduce procedural costs

- This trend towards safer, more efficient, and patient-friendly catheter coatings is fundamentally reshaping clinician and hospital expectations. Consequently, companies such as C.R. Bard, Teleflex, and Boston Scientific are investing in research for multifunctional coatings, combining lubricity, antimicrobial activity, and drug-eluting capabilities

- The demand for advanced catheter coatings is growing rapidly across urology, cardiology, and critical care applications, as hospitals and healthcare providers increasingly prioritize patient safety, procedure efficiency, and regulatory compliance

Catheter Coatings Market Dynamics

Driver

Growing Need for Infection Prevention and Patient Safety

- The increasing prevalence of catheter-associated infections, rising demand for minimally invasive procedures, and focus on patient safety are significant drivers for the catheter coatings market

- For instance, in June 2023, Becton Dickinson launched its latest antimicrobial urinary catheter, designed to significantly reduce the incidence of CAUTIs, supporting hospital infection-control programs. Such product innovations by key companies are expected to drive market growth in the forecast period

- Hospitals and clinics are increasingly adopting coated catheters that reduce infection risk, minimize tissue irritation, and improve patient outcomes

- The rising volume of urological, cardiovascular, and critical care procedures worldwide is driving demand for hydrophilic and antimicrobial coatings that enhance procedural success rates

- Regulatory emphasis on reducing hospital-acquired infections (HAIs) and government initiatives promoting infection prevention in healthcare facilities are further boosting the adoption of advanced catheter coatings

- Increasing awareness among patients and caregivers about the benefits of coated catheters, such as reduced discomfort and lower infection risk, is stimulating demand

- The expansion of home healthcare and outpatient care services is encouraging the use of single-use coated catheters, which combine convenience with safety, fueling market growth

- Strategic collaborations between catheter manufacturers and pharmaceutical or material science companies are driving rapid R&D and innovation, accelerating the launch of next-generation coatings

- Emerging markets with rising healthcare expenditure and improving healthcare infrastructure, especially in India, China, and Brazil, are contributing to higher adoption rates of advanced catheter technologies

- Technological advancements in polymer science and nanomaterials are enabling multifunctional coatings that combine antimicrobial, lubricious, and drug-eluting properties, meeting the growing clinical demand for safer and more effective catheters

Restraint/Challenge

High Cost of Advanced Coatings and Regulatory Hurdles

- The relatively high cost of advanced catheter coatings compared to standard catheters can limit adoption in price-sensitive markets, particularly in developing countries or smaller hospitals

- For instance, premium hydrophilic and drug-eluting catheters can cost up to 3–5 times more than conventional catheters, posing a barrier for low-resource healthcare settings

- Strict regulatory requirements for coated medical devices, including safety and efficacy validation by the FDA, EMA, and other authorities, can prolong product development timelines

- Manufacturing complexities, such as uniform coating deposition, ensuring sterility, and quality control for multifunctional coatings, add operational costs and challenge scalability

- Supply chain constraints for specialized polymers or antimicrobial agents can disrupt production, causing delays in availability and increased costs

- Adoption may be slow in regions with limited hospital budgets or where traditional catheters are still considered clinically sufficient

- Lack of clinician awareness or training on the benefits of advanced coatings can reduce utilization rates in routine procedures

- Inconsistent reimbursement policies for premium catheter products in some healthcare systems can hinder widespread adoption

- While prices are gradually decreasing with technological advancement, perceived value versus cost can remain a concern, especially for outpatient or home-use catheters

- Overcoming these challenges through cost-effective coating technologies, faster regulatory approvals, robust clinician education programs, and evidence-based clinical studies demonstrating benefits will be vital for sustained market growth

Catheter Coatings Market Scope

The market is segmented on the basis of type, coating type, and application.

- By Type

On the basis of type, the Catheter Coatings market is segmented into metal, polymer, latex rubber, plastic, and others. The polymer segment dominated the largest market revenue share of 42.5% in 2025, driven by its versatility, biocompatibility, and ease of coating for multiple catheter types. Polymers such as polyurethane and silicone offer flexibility, low thrombogenicity, and superior mechanical properties, making them highly preferred in both short-term and long-term catheter applications. The growing demand for minimally invasive procedures and the expansion of the cardiovascular and urology segments further bolster polymer-based catheter adoption. Moreover, polymers’ compatibility with advanced coating technologies, such as drug-eluting and antimicrobial coatings, enhances their market presence. Hospitals and clinical centers favor polymer catheters due to reduced complications, patient comfort, and regulatory compliance in major markets like the U.S., Europe, and Asia-Pacific. The segment also benefits from ongoing R&D in hydrophilic and antimicrobial coatings integrated with polymers to reduce infection risks.

The latex rubber segment is anticipated to witness the fastest growth with a CAGR of 20.8% from 2026 to 2033, supported by rising demand in developing regions and improvements in hypoallergenic formulations. Latex catheters are cost-effective, widely available, and compatible with various coating technologies. Innovations in latex processing have reduced allergenic proteins, making them safer for long-term use. Emerging markets in Asia-Pacific and Latin America are increasingly adopting latex catheters for urinary and vascular applications due to affordability, ease of production, and growing healthcare infrastructure investments. The rapid increase in outpatient procedures, urological diagnostics, and catheterization labs contributes to the growth of this segment. Latex catheters with advanced coatings are expected to bridge cost-effectiveness with safety and performance, accelerating adoption.

- By Coating Type

On the basis of coating type, the Catheter Coatings market is segmented into hydrophilic coatings, drug-eluting coatings, anti-microbial coatings, and others. The hydrophilic coatings segment held the largest market revenue share of 44.1% in 2025, owing to their superior lubricity, reduced friction, and patient comfort during catheter insertion. Hydrophilic coatings are widely used in urinary and vascular catheters, reducing trauma, urethral irritation, and infection risks. Hospitals, outpatient centers, and diagnostic clinics prefer hydrophilic-coated catheters for both adult and pediatric populations. Adoption is further supported by regulatory approvals and clinical evidence demonstrating fewer complications compared to uncoated or standard catheters. The segment also benefits from rising demand in minimally invasive procedures and continuous innovations in polymeric hydrophilic surfaces for improved safety.

The drug-eluting coatings segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, driven by the need for infection prevention and enhanced therapeutic delivery via catheters. Drug-eluting catheters, coated with antibiotics or antithrombotic agents, reduce hospital-acquired infections and improve patient outcomes. Growth is accelerated by increasing awareness of catheter-associated urinary tract infections (CAUTIs) and bloodstream infections (CLABSIs) globally. Research and development in controlled drug-release coatings is further fueling adoption in both developed and emerging markets. The segment sees strong uptake in cardiovascular, oncology, and urology applications due to the dual benefits of medical efficacy and patient safety.

- By Application

On the basis of application, the Catheter Coatings market is segmented into medical, research, and others. The medical segment accounted for the largest market revenue share of 78.6% in 2025, as catheters are extensively used in hospitals, clinics, and outpatient care for urinary, cardiovascular, and vascular procedures. The segment benefits from the growing prevalence of cardiovascular and urological disorders, aging populations, and the adoption of minimally invasive procedures. Advanced coatings improve safety, reduce infection risks, and enhance catheter performance, further increasing demand in healthcare settings. Regulatory approvals, reimbursement policies, and rising healthcare expenditure in developed countries contribute to the dominance of the medical application segment.

The research segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033, fueled by the rising use of catheters in preclinical studies, biomedical research, and pharmaceutical testing. Research applications often require specialized coatings for experimental drug delivery, antimicrobial testing, and biocompatibility studies. Academic institutes and biotech companies are investing in advanced catheter technologies for innovative studies, including tissue engineering and minimally invasive models. The increasing focus on R&D in catheter coatings and collaborations between universities and manufacturers accelerate growth in this segment.

Catheter Coatings Market Regional Analysis

- North America dominated the catheter coatings market with the largest revenue share of approximately 38.7% in 2025, supported by advanced hospital infrastructure, high healthcare expenditure, and the strong presence of leading medical device manufacturers

- Healthcare providers in the region place high importance on patient safety, infection prevention, and improved clinical outcomes, driving strong adoption of hydrophilic, antimicrobial, and drug-eluting catheter coatings

- This dominance is further reinforced by favorable reimbursement policies, high procedural volumes, and rapid adoption of technologically advanced coated catheters across hospitals, ambulatory surgical centers, and long-term care facilities

U.S. Catheter Coatings Market Insight

The U.S. catheter coatings market accounted for the majority share of North American revenue in 2025, driven by the high prevalence of chronic diseases, increasing catheterization procedures, and widespread adoption of advanced coated catheter technologies. Strong demand for hydrophilic and antimicrobial coatings to reduce catheter-associated infections, along with continuous product innovation by leading manufacturers, is significantly supporting market growth. Additionally, strict infection-control regulations and strong clinical awareness regarding hospital-acquired infections continue to boost the uptake of coated catheters across healthcare settings.

Europe Catheter Coatings Market Insight

The Europe catheter coatings market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulatory standards for medical device safety and growing emphasis on infection prevention. Increasing surgical volumes, an aging population, and rising incidence of urological and cardiovascular disorders are supporting demand for advanced catheter coatings. European healthcare systems are increasingly adopting antimicrobial and lubricious coatings to enhance patient comfort and reduce post-procedural complications across hospitals and specialty clinics.

U.K. Catheter Coatings Market Insight

The U.K. catheter coatings market is anticipated to grow at a noteworthy CAGR over the forecast period, supported by rising healthcare investments and growing awareness of catheter-associated urinary tract infections (CAUTIs). National health initiatives focused on reducing hospital-acquired infections and improving patient outcomes are encouraging the adoption of coated catheters. Increased use of minimally invasive procedures and expanding use of catheters in home healthcare settings are further contributing to market growth in the country.

Germany Catheter Coatings Market Insight

The Germany catheter coatings market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on medical innovation, patient safety, and advanced clinical practices. The country’s well-established healthcare infrastructure and emphasis on high-quality medical devices support the adoption of hydrophilic and antimicrobial catheter coatings. Growing demand from hospitals and specialty care centers for high-performance coated catheters is contributing to sustained market expansion.

Asia-Pacific Catheter Coatings Market Insight

The Asia-Pacific catheter coatings market is expected to be the fastest-growing region during the forecast period, registering a CAGR of around 12.9%, driven by improving healthcare infrastructure, rising catheter usage, and increasing awareness of infection prevention. Rapid growth in pharmaceutical and medical device manufacturing, combined with expanding access to healthcare services, is accelerating the adoption of advanced coated catheter technologies across the region. Government initiatives to strengthen healthcare systems are further supporting market growth.

Japan Catheter Coatings Market Insight

The Japan catheter coatings market is gaining steady momentum due to the country’s aging population, high prevalence of chronic diseases, and strong focus on patient safety. Increasing demand for long-term catheterization and minimally invasive procedures is driving adoption of hydrophilic and antimicrobial coatings. Japan’s emphasis on high-quality medical devices and infection-control practices continues to support the use of advanced catheter coatings in hospitals and home healthcare settings.

China Catheter Coatings Market Insight

The China catheter coatings market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid healthcare infrastructure development, rising hospitalization rates, and increasing adoption of advanced medical technologies. Growing awareness of infection prevention, expanding access to healthcare services, and strong domestic manufacturing capabilities are driving demand for coated catheters across hospitals and clinics. Continued investments in healthcare modernization and rising procedural volumes are expected to further propel market growth in China.

Catheter Coatings Market Share

The Catheter Coatings industry is primarily led by well-established companies, including:

- Surmodics, Inc. (U.S.)

- DSM Biomedical (Netherlands)

- Hydromer, Inc. (U.S.)

- AST Products, Inc. (U.S.)

- BioCoat Incorporated (U.S.)

- Precision Coating Company, Inc. (U.S.)

- Covalon Technologies Ltd. (Canada)

- Harland Medical Systems, Inc. (U.S.)

- Aculon, Inc. (U.S.)

- Advanced Surface Technology, Inc. (U.S.)

- Biocoat Ltd. (U.K.)

- KISCO Ltd. (Japan)

- Applied Medical Coatings (U.S.)

- Formacoat LLC (U.S.)

- Medicoat AG (Switzerland)

- Surface Solutions Group (U.S.)

- Parylene Coatings Services (U.S.)

- Hemoteq AG (Germany)

- Specialty Coating Systems (U.S.)

- Royal DSM (Netherlands)

Latest Developments in Global Catheter Coatings Market

- In July 2023, Biocoat, a leading medical polymer and coating specialist, completed the acquisition of Chempilots, a custom polymers and production services firm, thereby broadening its biomaterials platform for hydrophilic and specialty catheter coatings used by OEMs in minimally invasive devices. This acquisition strengthened capabilities for customized coating solutions tailored to catheter applications

- In September 2023, industry reports highlighted that the global catheter coatings market was projected to reach USD 1.52 billion by 2026, driven by increasing demand for antimicrobial, hydrophilic, and lubricious coatings that lower infection rates and improve catheter performance in cardiovascular and urology procedures. This forecast underscored market momentum and growth outlook through continuous innovation in catheter surface technologies

- In November 2024, Medeologix expanded its catheter manufacturing services by integrating hydrophilic coating capabilities through a strategic partnership with Biocoat Incorporated, enabling in-house advanced coating application and streamlined regulatory pathways for coated catheter products. This expanded service scope enhances manufacturing efficiency and supports accelerated product development timelines

- In November 2024, Boston Scientific announced a collaboration with Amsino International to jointly develop and validate next-generation antimicrobial-coated urinary catheters, aimed at improving coating durability and reducing catheter-associated infection rates in clinical settings. This initiative highlighted industry focus on infection prevention technologies

- In June 2025, Surface Solutions Group (SSG) expanded its coating production capacity by installing a new automated electrostatic robotic coating line, boosting its ability to meet rising demand for medical device coatings — including those used for catheter lubricity and anti-infection functions — across regional markets. This investment signifies increased manufacturing scale for catheter surface treatments

- In January 2025, Cook Medical unveiled a new silver-ion antimicrobial-coated urinary catheter designed to resist biofilm formation and extend functional lifespan, addressing persistent issues with catheter-associated infections. This product introduction reflects ongoing innovation in antimicrobial surface technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.