Global Cast Elastomers Market

Market Size in USD Billion

CAGR :

%

USD

1.49 Billion

USD

2.55 Billion

2024

2032

USD

1.49 Billion

USD

2.55 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 2.55 Billion | |

|

|

|

|

Cast Elastomers Market Size

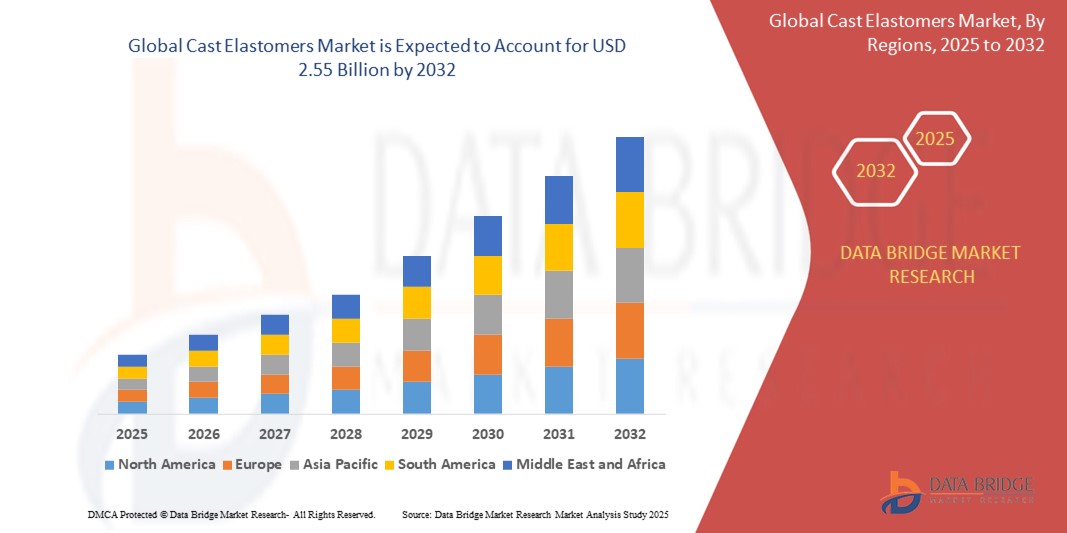

- The global cast elastomers market size was valued at USD 1.49 billion in 2024 and is expected to reach USD 2.55 billion by 2032, at a CAGR of 6.90% during the forecast period

- This growth is driven by factors such as the increasing demand for durable and high-performance materials across industries such as automotive, mining, and oil & gas, advancements in manufacturing technologies, and the expanding use of cast elastomers in industrial applications due to their excellent abrasion resistance and mechanical properties

Cast Elastomers Market Analysis

- The cast elastomers market is gaining strong momentum due to its rising use in industrial machinery components. These materials are chosen for their ability to endure tough environments and repetitive mechanical stress without rapid degradation

- Their application in parts such as rollers, gears, and seals is helping industries lower maintenance needs and boost efficiency

- Asia-pacific is expected to dominate the cast elastomers market due to advanced healthcare infrastructure and increasing demand for eye surgeries

- North America is expected to be the fastest growing region in the cast elastomers market during the forecast period due to rising awareness about eye health

- The industrial segment is expected to dominate the cast elastomers market with the largest share of 64.05% in 2025 due to its extensive use in machinery parts, rollers, and components that demand high abrasion resistance and durability. Industries such as mining, oil and gas, and material handling rely heavily on cast elastomers for equipment exposed to harsh operating environments. Their ability to withstand extreme temperatures, chemicals, and repetitive mechanical stress makes them ideal for industrial settings

Report Scope and Cast Elastomers Market Segmentation

|

Attributes |

Cast Elastomers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cast Elastomers Market Trends

“Rising Demand for Sustainable Cast Elastomer Solutions”

- The current cast elastomers market is witnessing a strong shift towards sustainable and eco-friendly alternatives as manufacturers increasingly adopt bio-based raw materials in response to growing environmental awareness and regulatory pressure

- This rising trend of sustainability is encouraging companies to replace conventional petroleum-derived components with plant-based or recycled feedstocks, aiming to reduce their carbon footprint and align with green manufacturing practices

- For instance, several producers are launching cast elastomers formulated with renewable polyols derived from sources such as soybean oil, which offer similar performance while being more environmentally responsible

- The demand for sustainable cast elastomers is also supported by end-use industries such as automotive, construction, and industrial machinery, which are under growing pressure to meet sustainability targets across their value chains

- In conclusion, as this trend strengthens, research and development efforts are intensifying to improve the mechanical strength, durability, and processing capabilities of eco-friendly cast elastomers to match or exceed the performance of traditional variants

Cast Elastomers Market Dynamics

Driver

“Growing Demand from the Automotive Sector”

- Cast elastomers are extensively used in automotive components such as suspension bushings, seals, and gaskets due to their abrasion resistance and ability to withstand extreme conditions

- There is growing adoption in electric vehicles for components involved in thermal management and insulation, as seen in Tesla’s use of advanced polymer systems for battery module protection

- The shift toward lightweight vehicle manufacturing is driving demand for materials with a high strength-to-weight ratio, with companies such as BMW exploring elastomer-based parts to reduce overall vehicle mass

- OEMs and suppliers are actively investing in durable elastomer solutions to meet performance goals, such as Continental AG’s development of high-end polyurethane parts for suspension systems

- For instance, emerging markets such as India and Brazil are seeing a rise in vehicle production, increasing the demand for reliable and long-lasting materials such as cast elastomers across both commercial and passenger segments

- The integration of cast elastomers in automotive manufacturing continues to grow steadily due to their role in improving vehicle durability and reducing maintenance frequency

Opportunity

“Increasing Use in Industrial Robotics and Automation”

- Cast elastomers are increasingly used in robotic systems due to their ability to endure repetitive motion and mechanical stress, making them suitable for high-performance industrial automation environments

- In smart factories, elastomers are found in critical components such as grippers, wheels, and gears, as seen in Fanuc’s and ABB’s robotic arms that operate under continuous load and harsh conditions

- The adaptability of cast elastomers to oils, chemicals, and varying temperatures makes them valuable in industries such as food processing and electronics where clean and consistent performance is essential

- Collaborative robots or cobots use softer elastomer materials for enhanced safety during human interaction, with Universal Robots integrating flexible materials to meet workplace safety standards

- For instance, demand for tailored elastomer parts is rising as companies look to optimize robotics for efficiency, with players such as Schunk and Zimmer Group investing in advanced polymer solutions for end-effectors

- In conclusion, as automation continues to scale across industries, cast elastomers are poised to play a critical role in improving operational precision and equipment lifespan

Restraint/Challenge

“High Production Costs and Price Sensitivity”

- Cast elastomers involve high production costs due to the need for specialized raw materials, precision processing, and advanced curing agents, unsuch as cheaper alternatives such as standard rubber or thermoplastics

- In industries such as construction and consumer goods, cost sensitivity limits adoption, as companies prioritize affordability over long-term durability, making elastomers less appealing despite their advantages

- Price volatility of petrochemical-derived inputs adds financial uncertainty, as seen when polyurethane prices surged due to global supply chain disruptions during 2021–2022, affecting budgeting and contracts

- Small and medium enterprises often hesitate to invest in elastomer-based solutions due to expensive tooling and the need for trained labor, which increases operational complexity and initial capital requirements

- For instance, the requirement for dedicated molding and manufacturing equipment limits scalability for many producers, especially those not equipped to handle the technical demands of elastomer production

- In conclusion, these economic and operational barriers slow widespread adoption, challenging producers to innovate more cost-efficient solutions while maintaining performance standards

Cast Elastomers Market Scope

The market is segmented on the basis of type, and end use industry.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End Use Industry |

|

In 2025, the industrial segment is projected to dominate the market with a largest share in End Use Industry segment

The industrial segment is expected to dominate the Cast Elastomers market with the largest share of 64.05% in 2025 due to its extensive use in machinery parts, rollers, and components that demand high abrasion resistance and durability. Industries such as mining, oil and gas, and material handling rely heavily on cast elastomers for equipment exposed to harsh operating environments. Their ability to withstand extreme temperatures, chemicals, and repetitive mechanical stress makes them ideal for industrial settings

The oil and gas segment is expected to account for the largest share during the forecast period in cast elastomers segment

In 2025, the oil and gas segment is expected to dominate the market with the largest market share due to the increasing demand for high-performance materials that can withstand harsh environmental conditions. Cast elastomers offer excellent abrasion resistance, durability, and chemical stability, making them ideal for use in seals, linings, and coatings within oil and gas exploration and production. The rising number of offshore and onshore drilling projects, particularly in regions such as the Middle East, North America, and parts of Europe, further fuels the demand.

Cast Elastomers Market Regional Analysis

“Asia Pacific the Largest Share in the Cast Elastomers Market”

- The Asia-Pacific region leads the global cast elastomer market, driven by rapid industrialization and urbanization in countries like China and India

- Significant investments in infrastructure and manufacturing sectors have increased demand for cast elastomers in automotive, construction, and industrial applications

- Major market players in the region have spurred innovation and expanded production capacities, strengthening the market presence

- The region's substantial manufacturing base and growing industrial activities act as key drivers for market growth

- Lower labor costs, abundant raw materials, and supportive government policies make Asia-Pacific an attractive hub for global manufacturers

“North America is Projected to Register the Highest CAGR in the Cast Elastomers Market”

- North America has a strong industrial base with key sectors like automotive, oil & gas, and manufacturing driving consistent demand for cast elastomers

- Ongoing technological advancements support the development of high-performance elastomer products across various applications

- Strict quality and safety regulations increase the need for durable, reliable materials in industrial and commercial sectors

- Presence of leading manufacturers enhances product availability, innovation, and regional competitiveness

- Increasing focus on sustainable and eco-friendly materials aligns with evolving environmental standards and consumer expectations

Cast Elastomers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE (Germany)v

- Covestro AG (Germany)

- Dow (U.S.)

- Huntsman International LLC (U.S.)

- Era Polymers Pty Ltd (Australia)

- Tosoh Corporation (Japan)

- Mitsui Chemicals, Inc. (Japan)

- LANXESS (Germany)

- Coim Group (Italy)

- Wanhua (China)

- Manali Petrochemical Limited (India)

- Polytek Development Corp. (U.S.)

- Synthesia Technology (Spain)

- SAPICI S.p.A. (Italy)

- Makro Chemical (Turkey)

- Taiwan PU Corporation (Taiwan)

- VCM Polyurethanes Pvt. Ltd. (India)

- CARLISLE POLYURETHANE SYSTEMS (U.S.)

- Polycoat Products (U.S.)

- CHEMLINE INDIA LIMITED (India)

Latest Developments in Global Cast Elastomers Market

- In July 2023, the global cast elastomer market was valued at USD 1.4 billion and is projected to reach USD 1.8 billion by 2028, growing at a 5.0% CAGR. This growth is driven by increasing demand from industries such as mining, automotive, and oil & gas, where cast elastomers are valued for their high load-bearing capacity, abrasion resistance, and versatility in molding complex shapes

- In April 2025, the global cast elastomer market is experiencing a significant shift towards sustainability, with bio-based elastomers emerging as a key trend. These materials, derived from renewable sources, offer reduced volatile organic compound (VOC) emissions compared to traditional petroleum-based elastomers, aligning with the growing demand for environmentally friendly alternatives

- In March 2025, Huntsman collaborated with RÄDER-VOGEL to develop a new generation of anti-static wheels using Huntsman's TECNOTHANE® hot cast elastomers. These polyurethane-based PEVOTEC® wheels are designed for industrial applications where trolleys, carts, pulleys, and automated guided vehicles (AGVs) are essential

- In August 2023, Covestro inaugurated a new elastomer plant in Shanghai, China, as part of its strategy to enhance its presence in the Asia-Pacific region. This facility is designed to meet the growing demand for high-performance polyurethane elastomers, particularly in renewable energy applications such as offshore wind energy and photovoltaic panel manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cast Elastomers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cast Elastomers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cast Elastomers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.