Global Cardiac Ablation System Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

3.33 Billion

2024

2032

USD

1.32 Billion

USD

3.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 3.33 Billion | |

|

|

|

|

Cardiac Ablation System Market Size

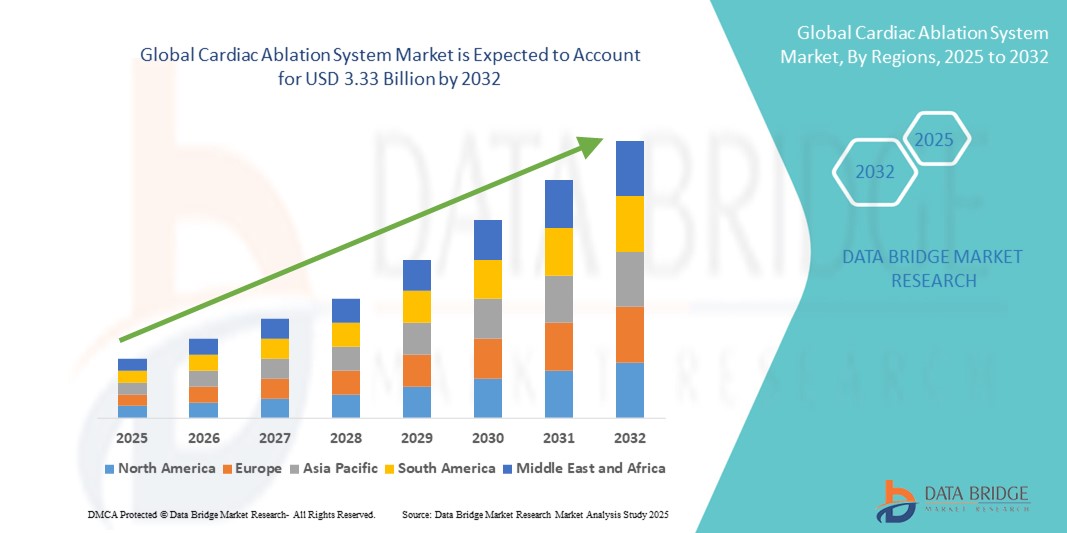

- The global cardiac ablation system market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 3.33 billion by 2032, at a CAGR of 12.22% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiac arrhythmias, especially atrial fibrillation, along with the rising geriatric population globally, which has led to a greater demand for minimally invasive procedures

- Furthermore, advancements in ablation technologies, including radiofrequency and cryoablation systems, along with growing healthcare expenditures and supportive reimbursement scenarios, are propelling the adoption of cardiac ablation systems across hospitals and specialty clinics, thereby significantly enhancing the market’s expansion trajectory

Cardiac Ablation System Market Analysis

- Cardiac ablation systems, which use energy to create scars in heart tissue to block abnormal electrical signals, are increasingly essential tools in managing arrhythmias such as atrial fibrillation and supraventricular tachycardia, particularly in hospital and cardiac care settings due to their effectiveness, precision, and minimally invasive nature

- The growing demand for cardiac ablation systems is primarily driven by the rising global incidence of cardiovascular diseases, increased awareness about catheter-based treatments, and a strong shift toward less invasive cardiac interventions

- North America dominated the cardiac ablation system market with the largest revenue share of 40% in 2024, supported by a high burden of arrhythmia cases, advanced healthcare infrastructure, favorable reimbursement policies, and the presence of leading medical device manufacturers actively investing in ablation innovations and clinical research

- Asia-Pacific is expected to be the fastest growing region in the cardiac ablation system market during the forecast period due to expanding healthcare access, a rapidly aging population, and increasing government investments in cardiovascular care

- The radiofrequency ablators segment dominated the cardiac ablation system market with a market share of 46.1% in 2024, attributed to its clinical efficacy, well-established safety profile, and widespread adoption as the standard first-line ablation modality

Report Scope and Cardiac Ablation System Market Segmentation

|

Attributes |

Cardiac Ablation System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cardiac Ablation System Market Trends

“Technological Advancements Driving Precision and Patient Outcomes”

- A major and accelerating trend in the global cardiac ablation system market is the continuous technological advancement in energy delivery modalities, catheter designs, and real-time imaging techniques, which are significantly enhancing the precision, safety, and efficacy of ablation procedures

- For instance, companies such as Boston Scientific and Biosense Webster have introduced advanced mapping systems such as Rhythmia and CARTO, which enable detailed 3D mapping of cardiac tissue, allowing electrophysiologists to more accurately target abnormal pathways during ablation

- Emerging technologies such as pulsed field ablation (PFA), a non-thermal energy modality, are showing promising results in minimizing collateral tissue damage while maintaining procedural efficacy. Farapulse, a leading developer of PFA, has been actively trialing its system in various clinical studies with encouraging outcomes

- Integration with artificial intelligence and machine learning is also being explored to assist in real-time decision-making during ablation procedures, potentially reducing procedure times and improving success rates. In addition, robotic-assisted ablation is gaining attention for its potential to enhance catheter stability and reduce radiation exposure to both patients and clinicians

- These advancements are reshaping procedural workflows in electrophysiology labs and contributing to higher success rates in treating complex arrhythmias, thus expanding the candidate pool for catheter ablation. As a result, hospitals and specialty cardiac centers are increasingly adopting these next-generation systems to remain at the forefront of arrhythmia care

- The growing emphasis on improving patient outcomes through precision medicine and minimally invasive approaches is expected to drive continued innovation and adoption of cutting-edge cardiac ablation systems globally

Cardiac Ablation System Market Dynamics

Driver

“Rising Prevalence of Arrhythmias and Demand for Minimally Invasive Solutions”

- The increasing global burden of cardiac arrhythmias, particularly atrial fibrillation (AF), which affects millions worldwide, is a key driver fueling demand for cardiac ablation systems. The preference for minimally invasive, catheter-based treatments over traditional open-heart surgeries is further accelerating market growth

- For instance, the Centers for Disease Control and Prevention (CDC) estimates that AF affects over 12 million Americans, with similar upward trends in Europe and Asia. This growing patient pool, along with physician preference for minimally invasive interventions, is strengthening adoption of ablation systems

- Moreover, government initiatives and awareness campaigns around cardiovascular health are encouraging early diagnosis and treatment of arrhythmias, while favorable reimbursement scenarios in developed markets are reducing the financial burden on patients

- Technological advancements that have made ablation procedures safer, faster, and more accessible are also facilitating broader adoption across medium- and large-scale healthcare facilities. The demand for effective long-term rhythm control, reduced medication dependency, and improved quality of life is leading to increased procedural volumes worldwide

Restraint/Challenge

“High Cost and Accessibility Constraints in Emerging Markets”

- Despite its clinical efficacy, the high cost associated with cardiac ablation procedures and systems poses a significant barrier to market expansion, especially in cost-sensitive and low-income regions

- Advanced mapping systems, disposable catheters, and energy generators often represent substantial capital and operational expenditure for hospitals, limiting widespread access in resource-constrained settings

- In addition, the procedures require highly skilled electrophysiologists and specialized infrastructure, which are not uniformly available across healthcare systems in emerging economies. As a result, delayed diagnosis and underutilization of ablation therapies persist in many parts of Asia, Africa, and Latin America

- Regulatory and reimbursement challenges further impede access in several countries where cardiac ablation is not uniformly covered by public or private insurance schemes

- To overcome these limitations, key industry players are focusing on cost-optimization strategies, local manufacturing, and partnerships with regional distributors to increase affordability and access. Increasing training programs and telemedicine support may also help bridge the expertise gap and promote greater global adoption of cardiac ablation systems

Cardiac Ablation System Market Scope

The market is segmented on the basis of product, application, and end use.

- By Product

On the basis of product, the cardiac ablation system market is segmented into Radiofrequency (RF) ablators, electrical ablators, cryoablation devices, ultrasound ablators, and others. The radiofrequency (RF) ablators segment dominated the market with the largest market revenue share of 46.1% in 2024, owing to its clinical reliability, long-standing usage in arrhythmia treatment, and broad adoption across electrophysiology labs. RF ablation systems are well-established in managing atrial fibrillation and other supraventricular tachycardias, driven by favorable clinical outcomes and procedural familiarity among healthcare providers.

The cryoablation devices segment is anticipated to witness the fastest growth rate from 2025 to 2032, spurred by growing recognition of its benefits in minimizing damage to surrounding tissues, especially in pulmonary vein isolation procedures. Cryoablation is gaining traction as a safer alternative in specific patient populations, supported by the increasing availability of balloon-based systems and expanding clinical data validating its efficacy in treating paroxysmal atrial fibrillation.

- By Application

On the basis of application, the cardiac ablation system market is segmented into cardiac rhythm management, open surgery, and others. The cardiac rhythm management segment held the largest market share in 2024, driven by the high global prevalence of arrhythmias and the increasing preference for minimally invasive catheter-based treatments over pharmacological therapies. Cardiac rhythm management applications include atrial fibrillation, atrial flutter, and ventricular tachycardia, where ablation systems are used to restore normal electrical activity and improve quality of life. Rising procedural volumes and improvements in ablation efficacy are supporting the growth of this segment.

The open surgery segment is projected to grow steadily during forecast period, due to the integration of ablation tools in surgical interventions for structural heart diseases, although its share remains lower compared to catheter-based rhythm management due to longer recovery times and invasiveness.

- By End Use

On the basis of end use, the cardiac ablation system market is segmented into hospitals, ambulatory surgical centres, cardiac centres, and others. The hospitals segment dominated the market in 2024 with the highest revenue share, attributed to their comprehensive infrastructure, availability of skilled electrophysiologists, and access to advanced cardiac care technologies. High patient volumes, favorable insurance coverage, and increased investments in cardiovascular care units make hospitals the primary setting for cardiac ablation procedures.

The ambulatory surgical centres segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the shift toward outpatient procedures, reduced treatment costs, and improved efficiency. As ablation technologies become more streamlined and minimally invasive, these centers are increasingly equipped to handle less complex arrhythmia cases with same-day discharge capabilities.

Cardiac Ablation System Market Regional Analysis

- North America dominated the cardiac ablation system market with the largest revenue share of 40% in 2024, supported by a high burden of arrhythmia cases, advanced healthcare infrastructure, favorable reimbursement policies, and the presence of leading medical device manufacturers actively investing in ablation innovations and clinical research

- Patients and providers in the region increasingly favor minimally invasive ablation procedures due to their clinical effectiveness and shorter recovery times compared to traditional surgical approaches

- This widespread adoption is further supported by favorable reimbursement policies, the presence of leading medical device manufacturers, and a strong focus on innovation and clinical research, positioning cardiac ablation systems as a preferred treatment solution across hospitals and cardiac care centers

U.S. Cardiac Ablation System Market Insight

The U.S. cardiac ablation system market captured the largest revenue share of 82.3% in 2024 within North America, driven by the country’s high burden of atrial fibrillation and wide availability of advanced electrophysiology services. The swift adoption of catheter-based ablation therapies, supported by favorable reimbursement policies and a robust network of specialized cardiac centers, is accelerating market growth. Moreover, continuous technological innovation, including the integration of 3D mapping systems and robotic-assisted ablation, along with growing physician expertise, is solidifying the U.S. as a leader in the global cardiac ablation landscape.

Europe Cardiac Ablation System Market Insight

The Europe cardiac ablation system market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing cardiovascular disease prevalence, aging populations, and rising demand for minimally invasive procedures. Countries across the region are seeing expanded use of catheter ablation as first-line therapy for arrhythmias, particularly atrial fibrillation. Growing investment in cardiac care infrastructure and the adoption of advanced technologies such as cryoablation and pulsed field ablation are contributing to steady market development, especially in urban healthcare centers.

U.K. Cardiac Ablation System Market Insight

The U.K. cardiac ablation system market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising awareness of atrial fibrillation and strong clinical emphasis on rhythm control strategies. The expansion of NHS-funded electrophysiology programs and increased access to specialized cardiac centers are enabling more patients to receive timely ablation therapies. Further, the introduction of newer ablation technologies and improved patient referral pathways are contributing to the growing demand for efficient and minimally invasive cardiac rhythm management.

Germany Cardiac Ablation System Market Insight

The Germany cardiac ablation system market is expected to expand at a considerable CAGR during the forecast period, bolstered by its highly advanced healthcare infrastructure and strong emphasis on precision medicine. Germany's leadership in clinical research and adoption of cutting-edge ablation systems—such as contact force-sensing catheters and high-definition mapping platforms—support growing procedural volumes. In addition, proactive screening and diagnostic programs for cardiovascular disorders are enabling earlier detection of arrhythmias, contributing to increased ablation procedure rates.

Asia-Pacific Cardiac Ablation System Market Insight

The Asia-Pacific cardiac ablation system market is poised to grow at the fastest CAGR of 25.4% during the forecast period of 2025 to 2032, driven by increasing healthcare investments, rapid urbanization, and the rising prevalence of cardiac arrhythmias across the region. Growing access to electrophysiology services in countries such as China, India, and Japan, supported by government-led health initiatives and expanded private healthcare infrastructure, is accelerating adoption. Furthermore, rising medical tourism, the emergence of cost-effective ablation technologies, and increased clinical training are broadening access to cardiac ablation procedures.

Japan Cardiac Ablation System Market Insight

The Japan cardiac ablation system market is gaining momentum due to a rapidly aging population and a strong national emphasis on early intervention for cardiovascular diseases. Japan’s advanced medical infrastructure, coupled with a well-established electrophysiology community, supports the growing use of sophisticated ablation technologies. Integration of robotics, real-time mapping, and AI-driven clinical decision support tools in cardiac procedures is enhancing outcomes and attracting institutional investments, particularly in high-volume cardiac centers.

India Cardiac Ablation System Market Insight

The India cardiac ablation system market accounted for the largest market revenue share in Asia Pacific in 2024, driven by a rising incidence of arrhythmias, increasing healthcare awareness, and expanding access to specialized cardiac services. The country's growing middle class, expanding hospital network, and increasing number of electrophysiologists are contributing to market growth. Public-private partnerships, affordable catheter-based technologies, and supportive government health schemes are further propelling the use of cardiac ablation systems across urban and semi-urban centers.

Cardiac Ablation System Market Share

The cardiac ablation system industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Sanofi (France)

- Bristol-Myers Squibb Company (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Medtronic (Ireland)

- Teva Pharmaceuticals USA, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Viatris Inc. (U.S.)

- Lupin (India)

- Abbott (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Penumbra, Inc. (U.S.)

- Oxford Laboratories Pvt. Ltd. (India)

- Sandoz Group AG (Switzerland)

- GLENMARK PHARMACEUTICALS LTD. (India)

- Fresenius SE & Co. KGaA (Germany)

- Amneal Pharmaceuticals LLC (U.S.)

What are the Recent Developments in Global Cardiac Ablation System Market?

- In May 2024, Boston Scientific Corporation announced the completion of its acquisition of Farapulse, Inc., a pioneer in pulsed field ablation (PFA) technology. This strategic move is aimed at expanding Boston Scientific’s electrophysiology portfolio and accelerating the global commercialization of the Farapulse PFA System. With this addition, the company strengthens its position in the cardiac ablation market by offering a novel, non-thermal ablation modality that minimizes damage to surrounding tissue while effectively treating atrial fibrillation

- In March 2024, Medtronic plc received CE Mark approval for its Affera Mapping and Ablation System, which includes the Sphere-9 Catheter capable of delivering pulsed field and radiofrequency energy. This system allows physicians to perform high-precision, real-time mapping and ablation in a single catheter, reducing procedure complexity. The approval represents a significant milestone in the advancement of integrated ablation therapies for complex arrhythmias and reinforces Medtronic’s leadership in innovation for cardiac rhythm management

- In February 2024, Abbott Laboratories announced the launch of its TactiFlex Ablation Catheter in select international markets following regulatory approvals. Designed with contact force sensing and improved tip flexibility, the TactiFlex catheter enhances procedural control and efficiency in treating atrial arrhythmias. This development reflects Abbott's commitment to precision electrophysiology and improving long-term outcomes for patients with cardiac rhythm disorders

- In January 2024, Biosense Webster, a Johnson & Johnson MedTech company, initiated its global clinical trial program for the investigational VARIPULSE Pulsed Field Ablation Platform. The trials aim to evaluate the safety and efficacy of PFA technology in treating atrial fibrillation. By investing in large-scale clinical validation, Biosense Webster demonstrates its strategic focus on next-generation, tissue-selective ablation techniques with the potential to reshape standard practices in cardiac electrophysiology

- In December 2023, APT Medical Inc., a China-based electrophysiology solutions provider, expanded its international footprint by introducing its RF ablation and mapping systems in the European market. With CE certification and growing interest in cost-effective EP technologies, APT Medical’s expansion underscores the increasing competition and global diversification of cardiac ablation system providers. This development highlights the emergence of new players in delivering accessible, advanced cardiac care solutions across varied healthcare settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.